- Europe is home to a large population of top talent with tech backgrounds and education.

- While European VCs are actively backing early-stage AI startups, there’s a noticeable gap at the growth stage – one that’s increasingly being filled by US investors.

- The regulatory-first approach to AI in the U.K. and Europe sets them apart as they prioritize ethical standards, while global competitors focus on speed.

The race to lead in AI has become a defining part of global competition. Superpowers such as the U.S., Europe and China are accelerating development, investments and policy efforts to secure their place at the forefront of this transformation.

U.S. dominance in AI investment

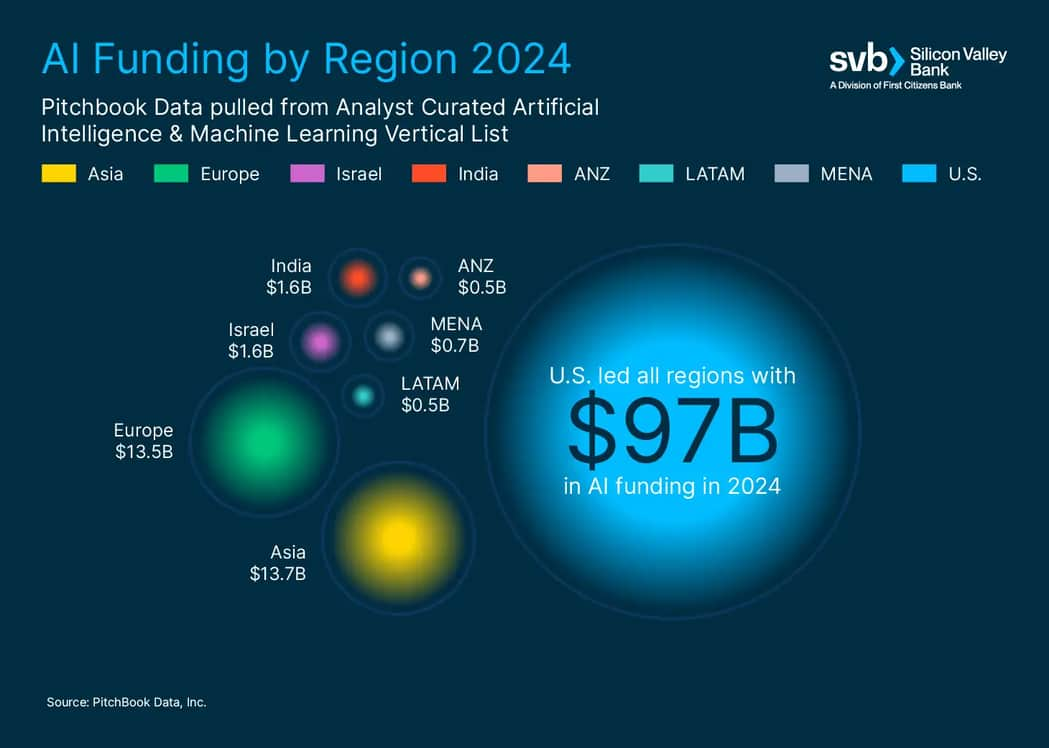

In early 2025, the U.S. unveiled Project Stargate, a $500B AI infrastructure initiative in partnership with Oracle, OpenAI, Softbank, Microsoft and Nvidia, to name a few. Intended to create thousands of jobs, this reinforces the U.S.’s determination to maintain its leadership in the AI race. To date, according to PitchBook, U.S.-based AI companies have attracted nearly $100B in funding – more than the rest of the world combined.

The U.S. has a first-mover advantage in AI, driven by a combination of world-leading private sector companies:

- Chipmakers and hyperscalers - Nvidia, Intel and AMD

- Cloud providers - AWS and Azure

- Data set providers - Google and Meta

Combined, these companies provide the infrastructure that enables AI training and deployment at scale.

However, while the U.S. is the front-runner, both Europe and Asia are carving out their own positions within the AI race. In early 2025, China’s Deepseek made global headlines for closing the large language model (LLM) gap at a fraction of the cost of the top U.S.-based AI players. At the same time, Europe is setting the global standard for ethical AI at the AI Action Summit in Paris in early 2025.

As shown in chart below, Europe and Asia accounted for more than 90% of total non-U.S. venture funding in 2024. Outside of the U.S., Europe (21) and Asia (15) rank as the second and third most prolific LLM producers, respectively. By capitalizing on their unique strengths, these two regions are shaping distinct paths to global AI leadership – through state-led innovation in China and ethics-driven governance in Europe.

AI investment landscape in Europe today

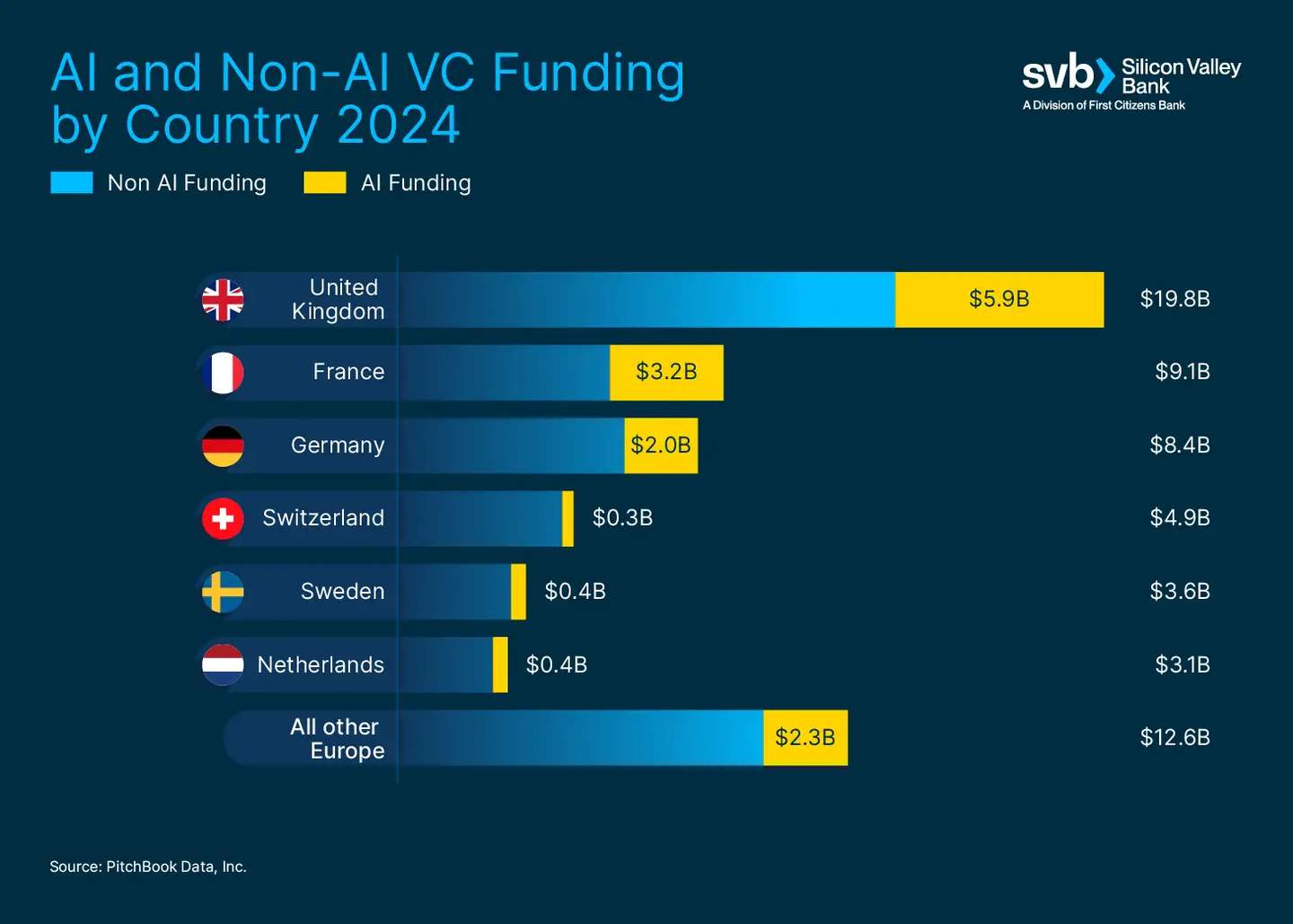

According to Pitchbook, European AI companies raised over $13B in 2024 – marking a 22% increase in capital invested, even as deal volume declined by 31% year-over-year. The increase in capital, despite the drop in deal volume, signals a consolidation of funding among established frontrunners across core LLMs, generative AI application layers, AI automation and deep tech. Some of the most active European investors fueling this growth include BPI France, LocalGlobe, Balderton, Index Ventures and Atomico. All have played a significant role in backing AI-driven startups across the region.

The U.K. remains a dominant AI hub, securing nearly $6B in AI funding in 2024—more than France and Germany combined (refer to chart below). However, France is rapidly catching up with Mistral AI emerging as the region’s leading LLM provider after raising over $1B within one year of its founding. Meanwhile, Germany’s AI sector remains deeply tied to its industrial roots, where advanced automation is transforming its automotive and manufacturing industries.

Across the U.K., France and Germany markets, large-scale AI funding rounds are led by U.S. investors who are filling the growth-stage capital gap for Europe’s most promising AI companies. A breakdown of the top funding rounds in 2024 across Europe* is detailed below.

Top European funding rounds in 2024

| Country | Company Name | Description | Recent Raise | Valuation | Notable Investors |

| United Kingdom | Wayve | Autonomous driving | $1.05B Series C (May 2024) | $2.8B | MSFT, Nvidia, Softbank, Uber |

| United Kingdom | Synthesia | Text to video GenAI | $180M Series D (Jan 2025) | $1.9B | Accel, Kleiner Perkins, GV, FirstMark |

| United Kingdom | Stability AI | Text to image GenAI | $102M Series B (June 2024) | N/A | Coatue Management, Lightspeed, Greycroft |

| France | Mistral AI | Large language model developer | $1B Series A (Feb 2024) & $650M Series B (June 2024) | $6.5B | A16z, Lightspeed, BPI France, General Catalyst, Nvidia |

| France | Poolside | GenAI software development | $500M Series B (Oct 2024) | $3.0B | Bain Capital, Citi Ventures, In-Q-Tel, Redpoint |

| France | H-Company | AI agent for automating tasks | $220M Seed (May 2024) | $370M | Accel, Samsung Next Ventures, Amazon, BPII France |

| Germany | Deep L | AI translator and writing tool | $320M Series C (May 2024) | $2B | Atomico, ICONIQ Growth, Index Ventures, Bessemer |

| Germany | Helsing | AI defense tech company | $484M Series C (July 2024) | $5.3B | Accel, General Catalyst, Lightspeed |

| Germany | Aleph Alpha | B2B Large language model | $459M Series B (Nov 2024) | N/A | SAP, Nvidia, Bosch Ventures, Intel |

| Luxembourg | Gcore | Cloud, edge computing, and AI infrastructure provider | $60M Series A | N/A | Constructor Capital, HRZ, Wargaming Group |

*According to PitchBook Data, Inc.

While U.K., France and Germany are the leading AI players, other European nations have also made significant contributions to the AI landscape. For example, according to Mattias Karén, a reporter and editor with Impact Loop, states that “A new report from byFounders – a Copenhagen based VC firm – shows that impact startups in the "New Nordics" surged to record levels of €650M in 2024 – a robust 25 percent increase from €520M in 2023 and outpacing investments in other sectors.”

Europe’s AI growth funding gap

While local VCs remain active at the early-stage, the table above indicates that U.S. investors dominate the growth stage for European AI companies. This large funding gap and a risk-averse investment culture have led many European scale-ups to struggle securing capital within UK/Europe. As a result, European startups often move to the U.S. to access larger funding pools, increase exit opportunities and tap into its vast consumer market.

The shift of looking to U.S. investors is evident in high-profile acquisitions like U.S.-based Thoma Bravo’s purchase of Darktrace. “As a U.K. publicly listed company, our operating and financial achievements were not being reflected commensurately with our global peers, as our shares were trading at a discount,” says Catherine Graham, CFO of Darktrace. “When we were approached by Thoma Bravo (U.S. PE firm) with an all-cash offer, our board recommended the transaction, and our shareholders overwhelmingly agreed.”

Ultimately, the appeal of U.S. investment extends beyond just funding; it can offer higher valuations, greater liquidity and more predictable exit pathways. Without a more robust late-stage ecosystem, Europe risks losing its top AI companies to markets with deeper capital reserves, damaging its long-term competitiveness.

Europe’s AI talent pool

Europe is home to a large population of top talent with tech backgrounds and education. According to a recent Sifted article on AI talent, the region has a large population of AI engineers and technical SMEs and is comparable to the U.S. in terms of per-capita concentration. This is particularly due to Europe having top engineering schools, like France’s École Polytechnique, which has produced a high number of AI founders (e.g. Hugging Face, InstaDeep, Dust, Mistral, etc,.) due to its strong emphasis on mathematics, engineering, computer science and a rooted entrepreneurial ethos. The University of Oxford, University of Cambridge, University College of London Imperial College London, University of Edinburgh, and a few others are also well-known for their cutting-edge research in AI and machine learning as well as deep industry collaborations (e.g. Alan Turing Institute, Google DeepMind).

Other top universities known for developing AI talent are Technical University of Munich (TUM) and Max Planck Institutes in Germany, ETH Zurich and Ecole Polytechnique Federale de Lausanne (EPFL) in Switzerland and Politecnico di Milano in Italy. Many of these engineering schools offer T&D tax rebates for public research and government-funded AI programs.

AI regulations: Balancing innovation and ethics

The regulatory-first approach in AI distinguishes the U.K. and Europe from other global competitors. Aimed at balancing innovation with responsible oversight, Europe has committed to leading the charge in ethical AI – a concept centered on fairness, transparency and accountability in AI frameworks.

To combat Europe’s fragmentation and countries operating with their own policies, the European Union has aimed to unify efforts through initiatives like the EU AI Act, with the first set of regulations now in effect as of early 2025. This comprehensive regulatory framework is intended to set a global standard, reducing policy inconsistencies or misinterpretation, promoting transparency, prioritizing home-grown AI advancement and sustainable growth. The initiatives, in addition to events like France’s AI Action Summit or U.K.’s AI Safety Summit, aim to create a cohesive European AI ecosystem and foster collaboration across countries.

As per Iain Armstrong, Regulatory Affairs Practice Lead from ComplyAdvantage, “Policymakers in the U.S., U.K. and European Union are all taking different approaches to AI regulation. There is no ‘one-size-fits-all’ framework, as a result, we adhere to all regulatory standards, including those that preceded the EU AI Act and AI Safety Summit, such as GDPR and NYDFS 504.”

Stringent data requirements – most notably GDPR – have established Europe as a global leader in privacy and regulatory oversight. However, according to some, these high standards can come with trade-offs. Complex compliance requirements can create challenges for cross-border data sharing and delay market entry.

As the region doubles down on regulation, the question remains whether this approach will limit competitiveness – or ultimately evolve into a distinct advantage that positions the region at the forefront of AI leadership.

Europe’s AI infrastructure challenge

While Europe challenges the U.S. and Asia on foundational models and AI applications, it has a low market share for AI semiconductor design and manufacturing, cloud infrastructure, and super computers. Training AI models requires high-performance GPUs, a market dominated by U.S. companies like Nvidia. These chips power data centers primarily owned by U.S. tech giants such as AWS and Microsoft, leaving Europe reliant of American cloud providers. However, concerns over regulatory compliance, cybersecurity and geopolitical risks are driving efforts to develop home grown infrastructure.

To reduce dependence on U.S. providers, the U.K. announced plans in January 2025 to build supercomputers and AI data centers to enhance domestic capabilities and ensure data sovereignty. GPU cloud provider NScale is also constructing a state-of-the-art data center. However, Social Market Foundation, a cross-party think tank, warns that high electricity costs, planning restrictions and grid connection delays pose challenges to U.K. AI leadership.

Similarly, Mistral, like most European AI firms, relies on AWS and Microsoft for model training. In February 2025 at the AI Action Summit, Mistral committed several billion euros to building an AI data center in Essonne, France with the aim to compete with OpenAI. The facility, set to open in 2025, will feature the latest GPUs and be powered entirely by decarbonized energy sources, thus offering a cheaper, sustainable alternative to nuclear power and reducing reliance on U.S. infrastructure.

Final thoughts on the AI industry in Europe

The AI ambitions of the Europe are clear, but the true test lies in how its ecosystem competes on the global stage. European AI companies continue to rely on U.S.-based investors to fund their growth. However, there’s ample evidence that Europe is positioning itself to be a key contender in the race for global technological supremacy in AI.

While Europe refines its regulatory frameworks and invest in their AI physical infrastructure, Asia’s AI sector is charting its own course and scaling at an unprecedented pace. Whether regulation or acceleration wins out, the AI race will largely dictate the future of global leadership.

Following this article, we’ll take a deep dive into the state of the AI industry in Asia. To learn more about the forces shaping AI VC investment, read our latest Global Private Market Trends report.

Acknowledgement

Thank you to Iain Armstrong and Will Robertson of ComplyAdvantage and Catherine Graham of Darktrace for sharing their expertise and providing helpful insights for this article.