- While the U.S. remains the global leader, China has propelled Asia to stand alongside Europe as the world’s second-largest AI market.

- Government-backed investment, deep talent pipelines and open-source tools are accelerating AI development across China’s core industries.

- Outside of China, U.S. tech giants are fueling AI infrastructure investment across emerging Asian innovation hubs.

As artificial intelligence (AI) reshapes the way we work and live, China has emerged as Asia’s undisputed leader, prioritizing AI as a core pillar of its long-term national interests. Despite U.S. export controls on advanced technologies like semi-conductors through its “small yard, high fence” strategy, these restrictions have done little to slow China’s progress. Instead, this approach has helped catalyze China to seed its own home-grown ecosystem.

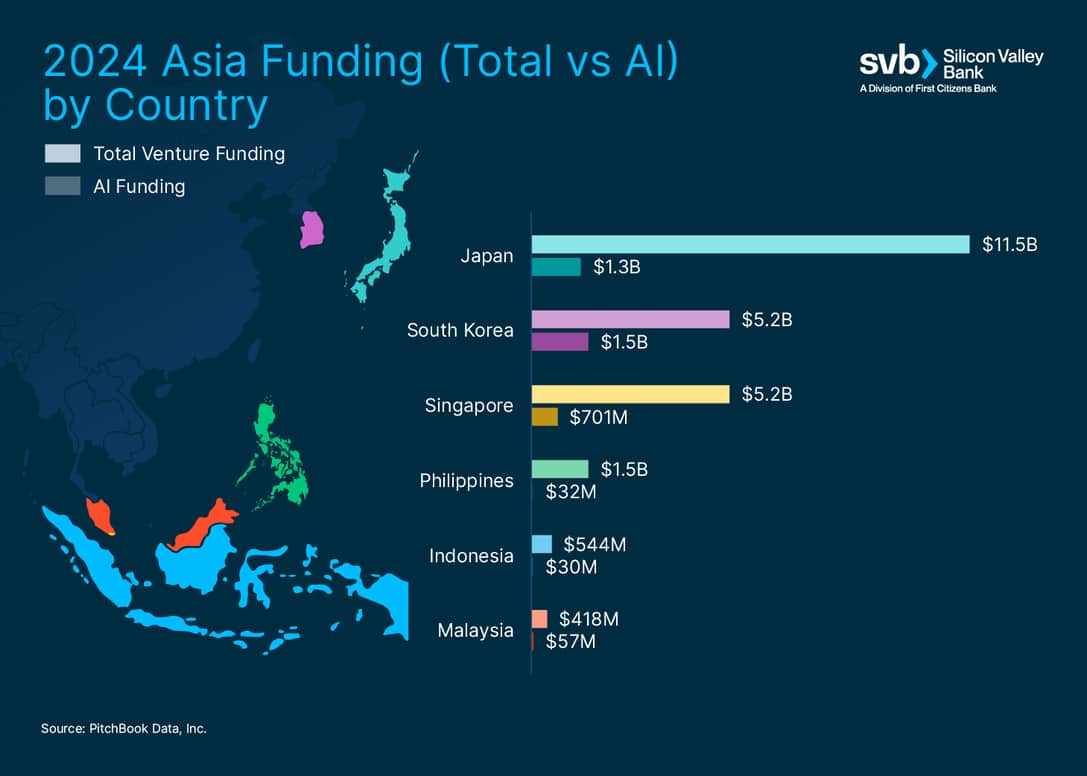

Despite a pullback of U.S. capital amidst ongoing geopolitical tensions in the region, Asia remains neck-and-neck with Europe behind the U.S. as the second-largest AI market globally – driven largely by China, which accounted for more than 70% of Asia’s $13B in AI investment in 2024.1 Today, state-backed funds play a central role in China’s funding landscape, setting investment priorities that guide private capital deployment. Notably, HonghShan (Sequoia China) and Matrix Partners – both spinoffs from U.S. funds that restructured – have become major players, alongside legacy tech giants like Alibaba, Tencent, and Bytedance.

Despite a downturn in total capital, China’s AI ecosystem remains strong, with 55 unicorns and a couple decacorns ($10B+). The emergence of DeepSeek in early 2025 underscores this strength – its breakthroughs in large language model (LLM) efficiency have closed the performance gap with top U.S. models at a fraction of the cost, positioning China as a true AI competitor.

China’s emergence as a major AI player can be attributed to a triad of competitive advantages: strong government support, a highly skilled talent force, foundational enablers (such as accessibility of data) and a robust open-source ecosystem.

Chinese government support for AI

Policy frameworks

The Chinese government’s commitment to AI development is underpinned by a series of policy frameworks and initiatives that align public and private sector efforts. China has overarching frameworks, such as New Generation Artificial Intelligence Development Plan, which provides a long-term roadmap for the industry. More targeted initiatives, such as the Artificial Intelligence Open Innovation Platforms, enlist existing private companies like Baidu (Autonomous Transportation), Alibaba (Smart Cities), Tencent (Medical Imaging) and iFlyTek (Natural Language Processing) to create incubation programs to incentivize industry-specific use cases of AI. By creating these platforms, startups gain access to critical AI infrastructure, public data resources and open-source tools.

Subsidies

China’s AI ecosystem is directly fueled by state-directed subsidies and financial incentives for chip manufacturers that reduce reliance on U.S. producers. For example, the China Integrated Circuit Industry Investment Fund has injected nearly $100B in capital towards the country’s largest chip producers, such as SMIC and SJ Semi. In March 2025, China announced a new $138B high-tech fund to grow AI and other emerging sectors. To further bolster the industry, the government also offers tax deductions on R&D expenses for AI and semiconductor firms. Local municipalities have followed suit. For instance, Shanghai offers computing vouchers to AI startups to subsidize the training cost of their LLMs. Subsidies, together with China’s favorable policy framework for AI development, position the country well to compete on the global stage.

AI talent pool in China

University systems

China’s next wave of AI startups is fueled by university spinouts and deep research roots. Tsinghua University, often referred to as the “MIT of China,” has played a key role in producing a new generation of AI companies focused on LLMs, open-source frameworks and multimodal reasoning tools.

Among the most closely followed companies are:

- Zhipu AI, creator of ChatGLM, one of China’s leading chatbots

- Baichuan AI, known for its open-source models and AI assistant Baixiaoying

- Moonshot AI, which recently launched a 1.5M context-length multimodal reasoning model

- MiniMax, the firm behind the consumer-facing chatbot Talkie and Hailuo AI platform

Universities are driving an unprecedented output of research and IP. According to the Organisation for Economic Co-operation and Development (OECD), China produced over 20% of the world’s AI research in 2023. It also holds six times more generative AI patents than the U.S. over the past decade, with China’s own Tencent, PingAn Insurance, Baidu and Chinese Academy of Sciences being the four largest holders.

Talent Pipeline

China’s talent pipeline for AI development is expanding rapidly, driven by the country’s large population and growing investment in education and training. The New York Times reports that since 2018, China has introduced over 2,000 undergraduate AI programs as part of its strategy to dominate the AI race. The country produced 47% of the world’s top-tier AI researchers in 2023, up from 29% in 2019. Additionally, there is less outflow of talent. Tsinghua University reported that the percentage of graduates moving to the U.S. dropped from 11% in 2018 to 3% in 2023.

Foundations for Scaling AI

Data enablement for training models

For AI to thrive, access to large and diverse datasets is critical for training and improving machine learning models. In China, flexible data-sharing norms allow both the government and private sector to harness vast data resources – laying a critical foundation for accelerating AI development and deployment.

China has strategically applied this advantage to key industries like smart cities and industrial automation. For example, Baidu’s autonomous vehicle program leverages data from smart-city traffic and surveillance networks to improve routes and safety. Alibaba’s ET City Brain integrates data from energy grids and emergency services to optimize urban planning and improve response times.

Open-source technology

China has embraced a growing culture of open source, a key enabler of its accessibility to AI tools and resources. By making foundational AI tools and frameworks freely accessible, open-source initiatives have significantly reduced development times and costs. Alibaba and Baidu, leaders in Internet and cloud computing, have collectively launched 100 open-source models, providing a strong foundation for startups to build upon. DeepSeek achieved major efficiency breakthroughs through open-source AI and later “open sourced” its own models, further reinforcing China’s technological knowledge sharing.

AI outside of China

Southeast Asia

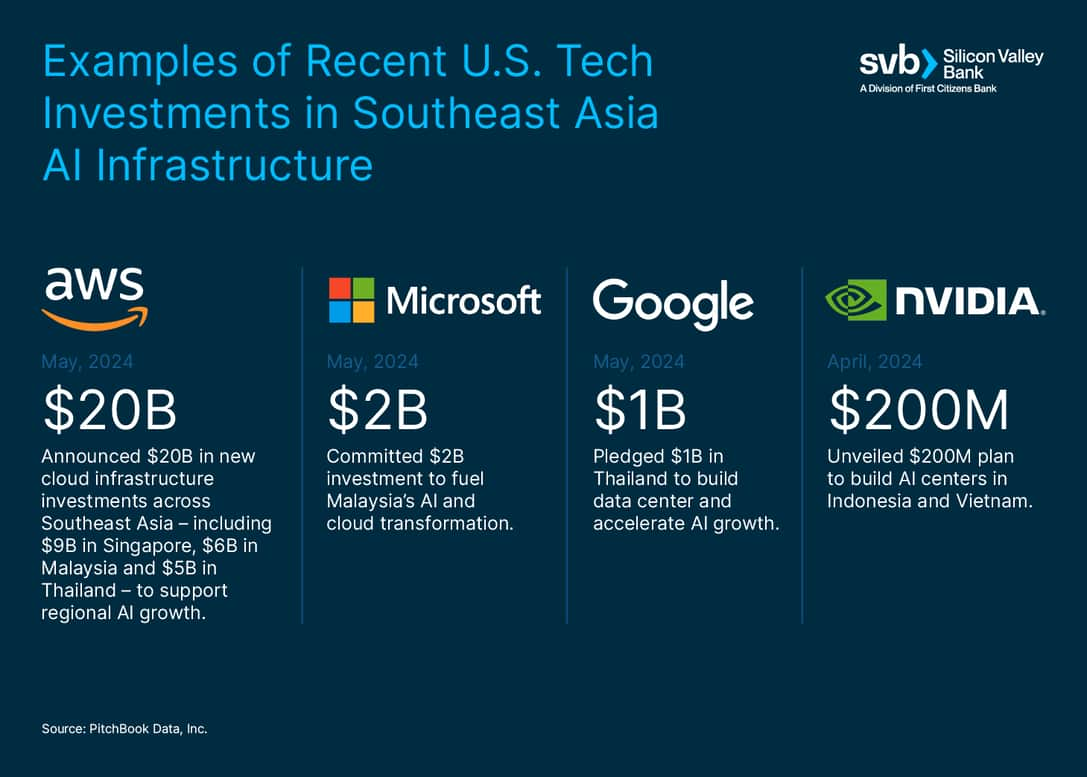

While China is the clear AI leader in Asia, Southeast Asian nations are limited by infrastructure barriers – particularly in compute and energy costs. As a result, investment in these countries is overwhelmingly driven by global technology companies like AWS, Microsoft, Google and Nvidia (see chart below). Together, these firms are set to inject $60B into Southeast Asia AI infrastructure over the next few years.

Japan and South Korea

Unlike China, Japan and South Korea have leaned on partnerships with U.S. technology leaders to drive local development. In early 2025, SoftBank signed a $3B joint venture with OpenAI to strengthen Japan's AI infrastructure, and Kakao, South Korea’s leading messaging platform, has partnered with OpenAI to co-develop AI-driven products for the Korean market. While these countries are actively building partnerships to accelerate the proliferation of AI, the sector still represents a relatively small share of total venture volume, suggesting untapped potential as national priorities increasingly shift toward AI-driven innovation.

Similar to Europe’s approach to responsible AI, both countries have also prioritized AI regulation. South Korea’s Basic Act on Artificial Intelligence, signed in early 2025, established development principles and oversight measures for high-impact AI systems. Likewise, Japan’s 2019 Social Principles of Human-Centered AI emphasize human rights, privacy, security and fostering innovation through international collaboration.

Final thoughts

The intensifying competition between global AI leaders is accelerating technological breakthroughs at an unprecedented pace. As rivaling nations push the boundaries of AI, each advancement fuels the next. Rather than a zero-sum game, this race is showing how competition itself can be a catalyst for innovation.

The AI race is not solely a sprint for who creates technical breakthroughs and who builds the best models – success will be based on who builds the conditions around governance, capital and talent for AI to thrive long term. China is demonstrating how national strategy can engineer global leading AI by cultivating local champions while reducing reliance on foreign technology and capital. The global race for AI leadership is fully engaged and accelerating.