SVB Go and ISO 20022

More efficient payments, richer reporting and more

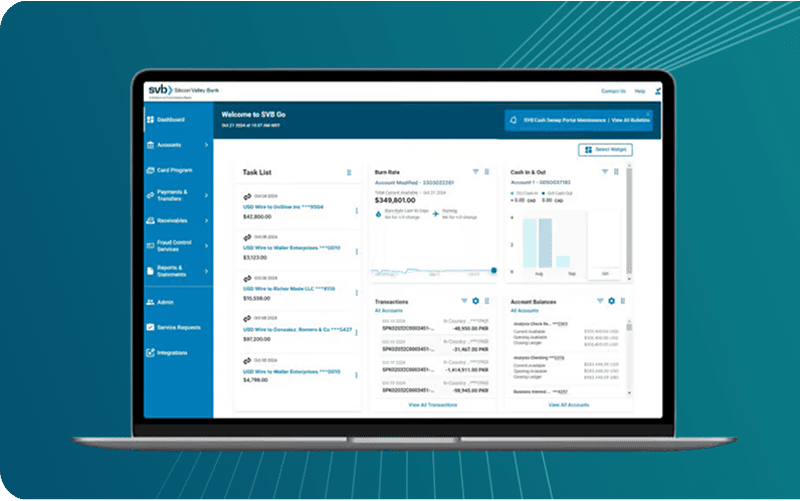

SVB’s transition to the ISO 20022 messaging standard enables faster payments and enhanced reporting through SVB Go.

Key benefits of ISO 20022 for SVB Go

Increase payments efficiency

- You may see faster processing of your payments as SVB Go transactions are formatted in the new ISO 20022 standard

- Standardization increases efficiency by eliminating the variances in messaging between banks so they can process payments more easily and with more detailed data

- Gain deeper insights with new data fields included in outgoing payments (e.g., purpose of payment and creditor) and receive more data about incoming payments

- Enhance remittance for outgoing payments including richer data supported by ISO 20022

Improve end-to-end tracking

Track domestic payments across their full lifecycle, including:

- Add your unique reference number in the end-to-end ID field that will be in the payment from start to finish

- You can give the ID to SVB and also provide it to the recipient, so they can easily find this information in a designated place within the message

- Available for cross-border payments in the first half of 2026

Enrich reporting

- Help streamline reconciliation with additional data when you send and receive payments

- Access more detailed remittance information, including Purpose of Payment and Related Remittance fields

- Save time and costs with richer data in reporting and payment tracking and tracing

Simplify tax payments by wire

- Clients no longer need to format wire for US tax payments themselves

- Simply provide your details to SVB and we will format the wire transfer for you

Learn more about SVB's migration to ISO 20022

All non-SVB named companies listed throughout this document are independent third parties and are not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.