To view the PDF version, click here.

Value proposition | Help stabilize your projected NAV (net asset value) or cost, mitigate the impact of currency fluctuations, while earning additional FX carry trade returns.

Situation

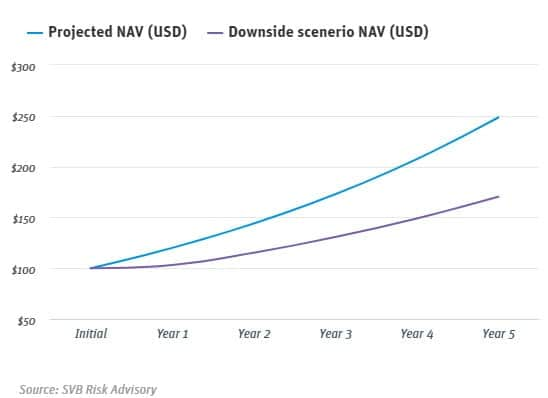

US-based private-equity fund holds euro-denominated assets with an anticipated holding period of 5 years. The projected internal rate of return (IRR) for the project, measured in US dollars (USD), is 20 percent per annum. No cash flows are anticipated prior to exit.

| Equity capital(USD) | $100.00 |

| Projected IRR | 20% |

| EURUSD spot | 1.20 |

| Projected NAV (EUR) |

Projected NAV (USD) |

Downside Projected NAV* (USD) |

|

| Initial | (€83.33) | ($100.00) | ($100.00) |

| Year 1 | €100.00 | $120.00 | $103.08 |

| Year 2 | €120.00 | $144.00 | $115.29 |

| Year 3 | €144.00 | $172.80 | $130.61 |

| Year 4 | €172.80 | $207.36 | $148.90 |

| Year 5 | €207.36 | $248.83 | $170.40 |

| IRR | 20% | 20% | 11% |

Risk quantification

A depreciation in the euro will adversely impact realized IRR. For instance, we can assign a 1 in 10 chance that the euro may depreciate over the 5-year investment period such that IRR will deteriorate from the projected 20 percent to 11 percent when the final cash flow is repatriated back to USD1.

Solution

An FX forward is a contractual obligation to exchange one currency for another at a pre-determined fixed rate and a specific date in the future. When used in risk management situations, FX forwards offer downside protection, IRR certainty, and in certain situations, favorable pricing over prevailing spot rates.

Trade details

- EUR/USD spot reference: 1.2000

- Direction: Sell EUR / Buy USD

- Notional: €207.36mio

- Contract rate: 1.3800

- Tenor: 5-year

Carry trade boost

The pricing of FX forward contracts is derived from three market factors: 1) spot exchange rates, 2) interbank interest rate differentials, and 3) cross-currency basis swap rates2. For EUR/USD forwards, because US interest rates are higher than EU interest rates (net of cross-currency basis), the hedger receives a better rate for selling euro in the forward market as opposed to the spot market. This carry trade boost for euro sellers improves with the trade tenor and, at over 3 percent per annum in early 2018, is at its highest point since the euro was launched in 1999. This phenomenon is primarily the result of divergent monetary policies between the Federal Reserve and the European Central Bank.

Hedged outcomes

Fund hedges 100 percent of projected NAV with an FX forward and locks in 23 percent IRR (assuming no date or notional mismatches between exposure cash flows and hedge).

| Equity capital(USD) | $100.00 |

| Projected IRR | 20% |

| EURUSD spot | 1.20 |

| FX forward hedge | $100.00 |

| Projected NAV (EUR) |

Projected NAV (USD) |

FX forward curve |

NAV with |

|

| Initial | (€83.33) | ($100.00) | 1.2000 | ($100.00) |

| Year 1 | €100.00 | $120.00 | 1.2360 | $126.60 |

| Year 2 | €120.00 | $144.00 | 1.2720 | $152.64 |

| Year 3 | €144.00 | $172.80 | 1.3080 | $188.35 |

| Year 4 | €172.80 | $207.36 | 1.3440 | $232.24 |

| Year 5 | €207.36 | $248.83 | 1.3800 | $286.16 |

| IRR | 20% | 20% | 23% |

Additional considerations

- Realized NAV may differ from initial projected NAV, potentially resulting in mismatches between exposure and hedge amounts. This may be addressed by keeping hedge ratios under 100%.

- A window may be incorporated into the forward to accommodate expiry date flexibility, helping avoid a cash event on the deal back-end. A cash event describes a situation where there is a mismatch between the expiry of the derivative and the timing of the underlying cash flow. This is undesirable, as it may result in a cash outlay needed to settle the forward which is not offset by the cash inflow from the real business venture.

- For unanticipated early exits, forwards may be unwound early. The investor would be exposed to movements in forward curves (i.e., from forward point claw-back).

- Forward hedges do not offer upside participation from euro strength. Deferred premium put options or put option spreads may be used if asymmetry is desired.

- FX credit lines are required to execute long dated forwards.

If you’d like to discuss your specific risk profile, contact Bobby Donnelly at bdonnelly@svb.com, West Coast/Central, or Ben Johnston at bjohnston@svb.com, East Coast. You can also contact the author, Ivan Oscar Asensio, Head of FX Risk Advisory, at iasensio@svb.com.

Read our other FX Risk Advisory

1Projected loss determined by IVT x SQRT(T) x Z(.90), where Implied Volatility assumption for EUR/USD exchange rate is 11%, T is years, and Z is from standard normal such that P(Z<z).

2Forward rate = Spot rate x [(1+rUSD x (d/360))/( 1+(rEUR +b) x (d/360))] where r represent the interbank interest rates, b is the basis between USD and EUR, and d is day count.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

CompID-012219