State of the US Wine Industry

2026

Key Takeaways

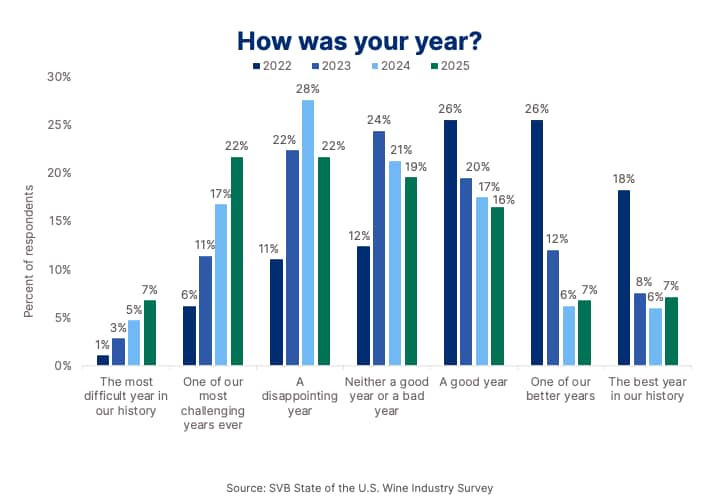

The US wine industry is navigating a challenging cycle, but not all wineries are experiencing it the same way. A clear divide has emerged between those evolving with the market and those struggling to keep up. These patterns offer a roadmap for navigating slower demand and building toward more resilient growth.

01 The passive growth era is over—performance hinges on behavior, not conditions

Wineries in the top quartile reported 8% sales growth and 11.9% operating income, while the bottom quartile saw a 10.2% sales decline and -10.5% operating margin. These results reflect fundamental differences in how they are repositioning in response to demand.

02 Stabilization is coming—but not for everyone

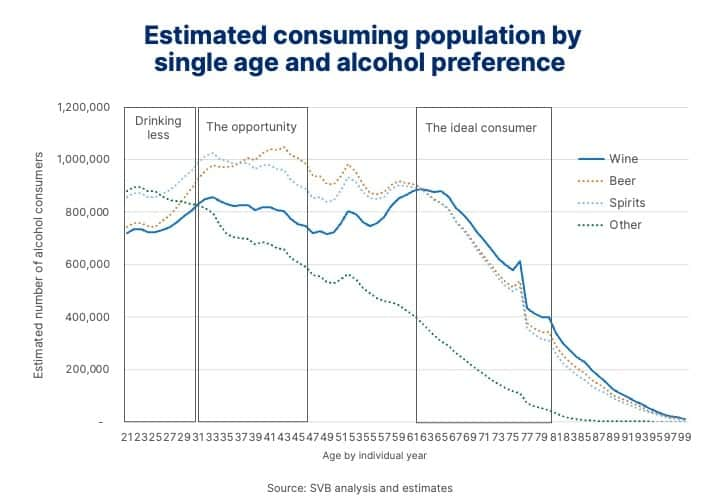

The older, wine-focused cohort is aging out, and younger adults aren’t replacing them at the same rate. Millennial and Gen Z drinkers are spread across more categories and drinking less overall, particularly under age 29.

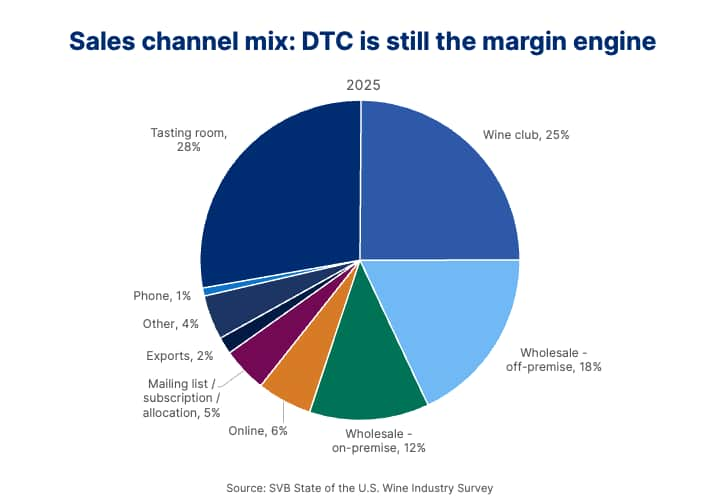

03 Top performers prioritize the customer and use digital tools to extend that edge

Leading wineries focus on customer alignment and brand clarity, treating direct-to-consumer (DTC) as a loyalty engine, not just a sales channel. Tasting rooms and wine clubs now account for 53% of the average winery’s sales, with some regions relying on DTC for as much as 78% of revenue.