Venture's

Fourth Wave

INVESTMENT ENTERS ITS NEXT ERA

The past in perspective

- First wave (post-WWII – early 2000s): Startup costs are enormous and capital is scarce — which makes VCs all powerful.

- Second wave (mid-2000s – late 2000s): More available capital gives entrepreneurs more choices. Venture begins providing not only capital but added value.

- Third wave (early 2010s – late 2010s): Dramatically lower startup costs give birth to micro-VCs, leading to the democratization of venture capital.

VC HISTORY

1946

A Frenchman named Georges Doriot forms a publicly traded company to assess thousands of business proposals — and fund the best ones, inventing the modern practice of venture capitalism.

1969

The first mega-funds are created by attracting conservative institutional investors searching for improved returns, committing significantly larger sums of capital than ever to VC operations.

1978

The US Department of Labor relaxes certain restrictions of the Employee Retirement Income Security Act of 1974 (ERISA), allowing corporate pension funds to invest in the asset class.

1994

The dot-com bubble begins, as a record number of tech deals lead to a period of massive growth in the use and adoption of the internet.

2001

The dot-com bubble bursts, and investors shift from strongly performing technology stocks to poorly performing established stocks. More than half the dot-com companies do not survive.

2012

The Jumpstart Our Business Startups, or JOBS, Act opens the door for more seed investing, helping hundreds of companies access capital and go public.

2018

Total VC investment reaches a record high level: $137B. It’s the first time in over a decade that more than $100B is invested in venture.

Mega-funds — and opportunities

There’s ample reason for optimism. Capital is readily available, plus seed and early-stage costs are historically low. Even better, there are hundreds of emerging-manager (EM) funds to choose from, and larger firms with mega-funds stand ready to support later growth stages.- There’s been an explosion of firms funding seed stage — 665 VC firms in the US alone.2

- Multibillion-dollar funds are common, as capital has transitioned into a reliable commodity.

More diversity than ever

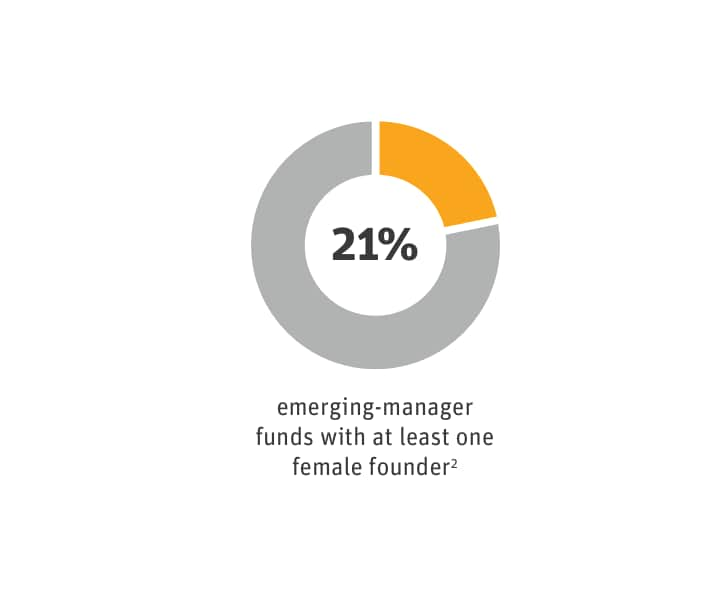

Research shows that homogeneous teams don’t perform so well. Fortunately, we’re entering a more inclusive era with more diverse investors who, in turn, are investing in new, more inclusive areas.- 21% of the emerging-manager (EM) funds tracked by SVB have one or more female founders.2

- Women still make up a small percentage of VCs overall but have made steady progress over the past few decades.

- 48% of all companies receiving venture dollars in 2019 are located outside the core technology geographies.2

Investment without geographic limits

There are inspired, ambitious founders everywhere who have the potential to transform science fiction into reality. No wonder EM firms are broadening their horizons to think, look and act globally.- In 2019, more than 14% of EM investments were outside the major tech hubs, with significantly lower-than-average seed-stage costs.2

- US tech communities have grown significantly in such places as Denver, Miami and Chicago along with Minneapolis, Seattle and Atlanta.2

73

years since the birth of the VC industry

48%

companies raising VC outside core tech geographies in 2019 (2)

54%

seed companies generating revenue at time of seed investment (3)

$7.6M

median premoney valuation for seed rounds - nearly doubled since 2010 (1)

Vision and real-world experience

Smart founders recognize the value of working with a VC partner who offers experience, insight and connections for their specific sectors. Going forward, differentiation by specialization will be an increasingly crucial component of success.- Now more than ever, firms want to play a role from seed through initial public offering.

- Specialization allows firms to add value to their investments.

- Data increasingly inform investment decisions at VC funds, as new technologies make way for more quantitative approaches to deal making.

Let SVB help you ride the fourth wave

1. Source: PitchBook and NVCA Venture Monitor

2. Source: Silicon Valley Bank

3. Source: WING Ventures 2019 V21 Analysis