Improve cash flow & efficiency with virtual cards

Stay on budget with precise controls

Manage who, how, when and where virtual cards can be used to reduce over-spend, and unexpected or out of policy transactions.Extend working capital with cost-efficient strategies

Shift vendor payables and subscriptions to virtual cards that cost less than checks and wires and hold money longer with same-day payments.83% of financial specialists believe virtual cards enhance their financial position2 by increasing working capital.

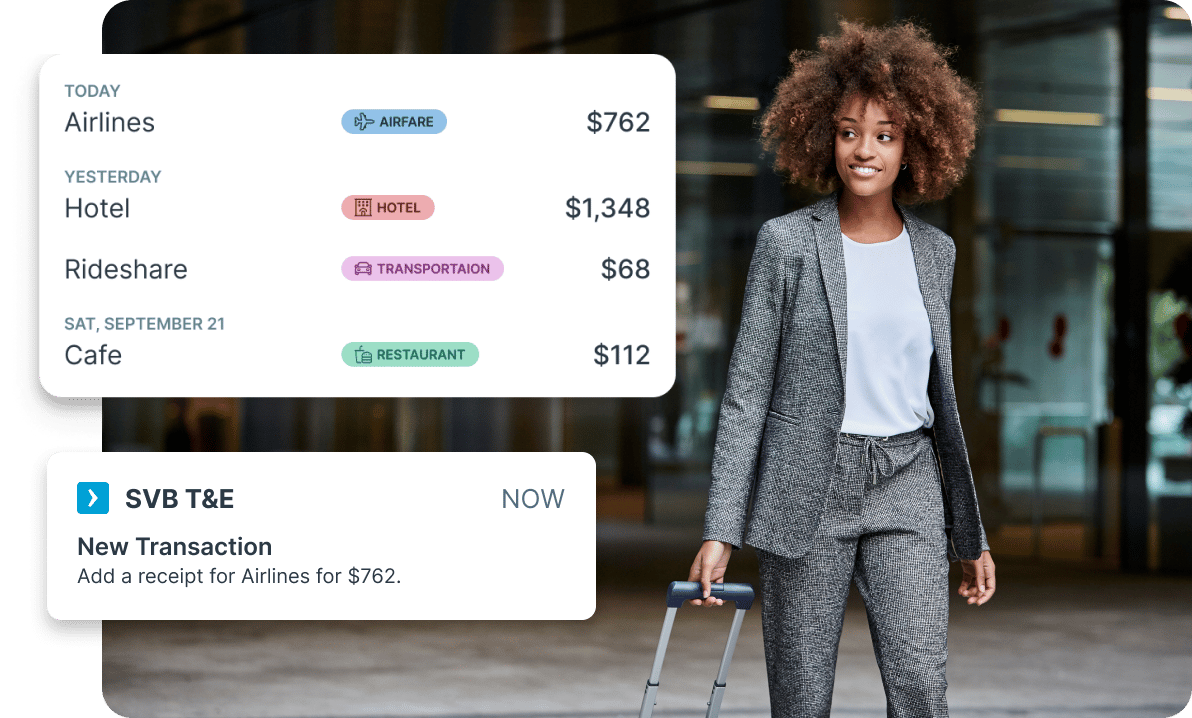

Streamline expense reporting

Replace manual expense reports and reimbursements with pre-approved virtual cards, and a mobile app for submitting expenses.Simplify reconciliation

Gain detailed, real-time reporting for faster, easier reconciliation, budgeting and audit trails.“We can issue a virtual card in under 60 seconds, so it’s very easy to enable our people on the fly to do what they do best.”

VP of Finance | Omnidian

Simplify virtual card management as you scale

Manage via web or mobile

Manage virtual cards via an intuitive web portal, ideal for on-demand purchasing, travel and payables.Automate A/P with batch files

Integrate with your ERP and automate reconciliation by linking invoices to virtual card payments.Scale up with reliable APIs

Access developer-friendly, highly configurable capabilities, ideal for high-volume needs.1 SVB virtual cards can earn 1x rewards points on all purchases, or revenue share at the rate determined by the client relationship.

2 RPMG Virtual Card Benchmark Survey, 2022

The term virtual card number (VCN) is synonymous with industry terminology such as virtual card, virtual account, v-card, single-use accounts, enterprise application platform (EAP), and e-payables.

For complete details about the SVB Innovator Card, including applicable fees and terms and conditions, see the SVB Innovator Card Agreement and Rewards Terms and Conditions. For full details about the SVB Corporate Card, see the SVB Corporate Card Agreement Terms and Conditions.

All credit products and loans are subject to underwriting, credit, and collateral approval. All information contained herein is for informational and reference purposes only and no guarantee is expressed or implied. Rates, terms, programs and underwriting policies subject to change without notice. This is not a commitment to lend. Certain terms, conditions, exclusions, and limitations apply, including a limit on cash advance capabilities.

Mastercard is a registered trademark of Mastercard International Incorporated and is an independent third party and not affiliated with Silicon Valley Bank, a division of First Citizens Bank & Trust Company.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC. EMVCo, LLC is an independent third party and not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

All non-SVB named companies listed throughout this document are independent third parties and are not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

Banking and lending products or services are offered by Silicon Valley Bank, a division of First-Citizens Bank & Trust Company. Accounts are subject to credit approval. Restrictions and limitations may apply.