Key Takeaways

- Venture debt is intended for early-stage businesses that have typically raised $5 million or more in a single round and is typically made available after an equity raise or within a few months of a round closing.

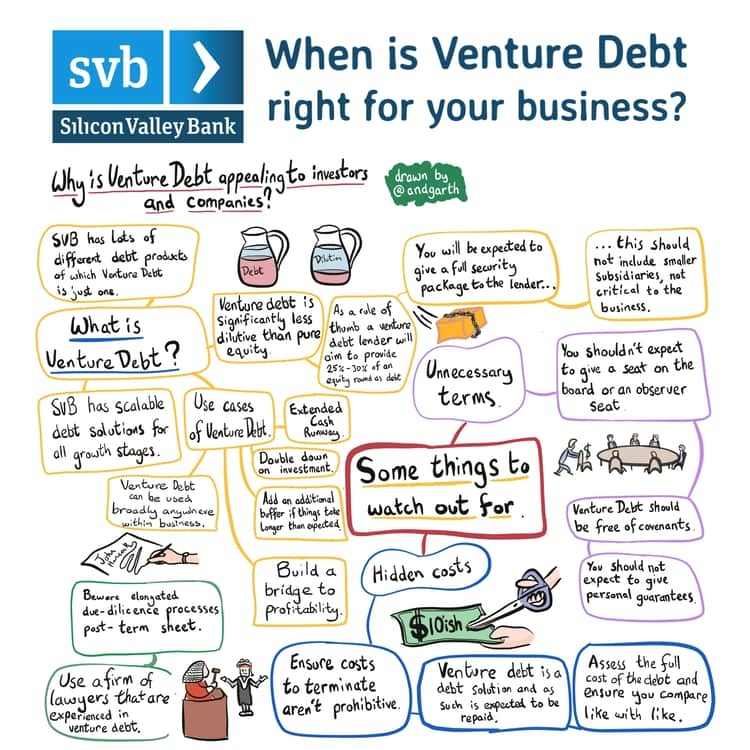

- Enabling companies to take on additional capital, venture debt can be used without the same level of dilution as an equity raise.

- Lenders structure venture debt in different ways. It's important to understand any dilutive components of warrants, and the impact they will have on the business if converted.

Venture debt can provide valuable options for early-stage businesses, helping to minimize dilution and enabling them to scale. In a webinar on demystifying venture debt, SVB’s Andrew Parker and Dominic Honmong discussed what businesses should consider when deciding if venture debt is right for them, including criteria for eligibility, when to use it, the benefits, and what to look out for.

In this article, we'll outline five key points discussed in the webinar.

1. Who should consider venture debt

Venture debt is intended for earlier-stage businesses, generally Series A onward, who have typically raised $5 million in a single round. They are generally fast growth, cashflow negative, and with financing provided to complete further rounds before realizing an exit. It is intended to be as equity-like as possible but without the dilution that occurs when external investors are brought in. The tradeoff is that it comes at the higher cost of capital.

Venture debt is intended for earlier-stage businesses.

Venture debt providers look closely at a company’s investors, since they work with investors they have built relationships with over time. These are typically well-known, top-tier VCs from the US, Europe or Asia with an LP/GP type structure, who hold reserves for follow-on investment. Lenders then know that if it takes longer to raise an additional equity round or there is a bump in the road, investors and the bank can work together to get the company through to the next external round.

2. When to take on venture debt

Venture debt is typically made available alongside an equity raise or within a few months of a round closing. It can be made available between rounds, but companies should have around 9-12 months of cash runway. The amount of financing targeted, equity or debt, should enable you to execute your business plan and get you through to the next stage. This can be done using pure equity with venture debt as a safety net or buffer, or the debt financing can be used to minimize the dilution of a round. At early stages, venture debt is complimentary to equity; it does not replace it. Venture debt should be as equity-like as possible, but it is a loan that needs to be repaid over a period of time or refinanced in later equity rounds. The exception is for later-stage companies looking at an exit or an IPO.

At early stages, venture debt is complementary to equity.

3. How venture debt is used

Venture debt enables companies to take on additional capital without the same level of dilution as from pure equity. It can be used:

- To extend cash runways

- As a safety net in case it takes longer than expected to reach the next round

- As an insurance policy in case of any bumps in the road

- To double down on plans, such as fueling sales and marketing

- To increase enterprise value so the next round can be raised at a higher valuation

Some companies at Series B or C stages also use venture debt as a bridge to profitability if they don’t intend to raise further equity rounds.

When deployed, venture debt is often used to:

- Fund engineering, sales, and marketing

- Expand further geographically

- Help with bolt-on acquisitions, where companies are cementing their position in the market or expanding offerings to their client base

4. What are the key terms

Venture debt is a term loan typically structured over a four-to-five-year amortization period, usually with a period of time to draw the loan down, such as 9-12 months. Interest-only periods of 3-12 months are common. Lenders will typically provide 25-35% of an equity round and are keen not to overburden businesses with large debt overhangs when they raise again in the future.

There are four key cost components:

- An upfront fee to arrange the facility

- Interest rates of 7-12% with repayment flexibility

- A back-end or final payment fee

- A warrant component

Warrants set venture debt providers apart from high-street banks, giving them the option to buy shares in the business at the point of exit. Some financial institutions offer their own version of venture debt and often include financial covenants. This removes flexibility and is not really venture debt.

Warrants set venture debt providers apart from high-street banks.

5. What to expect and watch out for

The entire venture debt approval process can be expected to last between six and eight weeks. Due diligence is undergone, followed by clarification of any questions that arise. Ordinarily, a credit approved term sheet will then be shared within around 10 days, and the debt provider will join investor calls to understand their investment thesis and strategic goals. The legal process then covers the wording of the loan agreement, the security agreement, and the warrant instrument.

Be sure to assess the full cost of the debt since lenders structure debt in different ways. Also, be sure to understand fully any dilutive components of warrants and the impact they will have on the business if converted. Lenders normally expect full charge over all business assets, including intellectual property, so there should be no personal guarantees. It is important to use a law firm familiar with these types of facilities to get the best deal from the negotiation process.

You can watch the full replay of the Venture Debt webinar here.

Running a startup is hard. Visit our Startup Insights for more on what you need to know at different stages of your startup’s early life. And, for the latest trends in the innovation economy, check out our State of the Markets report.