Key Takeaways

- Pre-profit startups are tightening up their spending heading into 2023.

- Considering where to make spending cuts isn’t a one-size-fits-all scenario.

- It can pay to get creative with staffing, spending, and office space solutions.

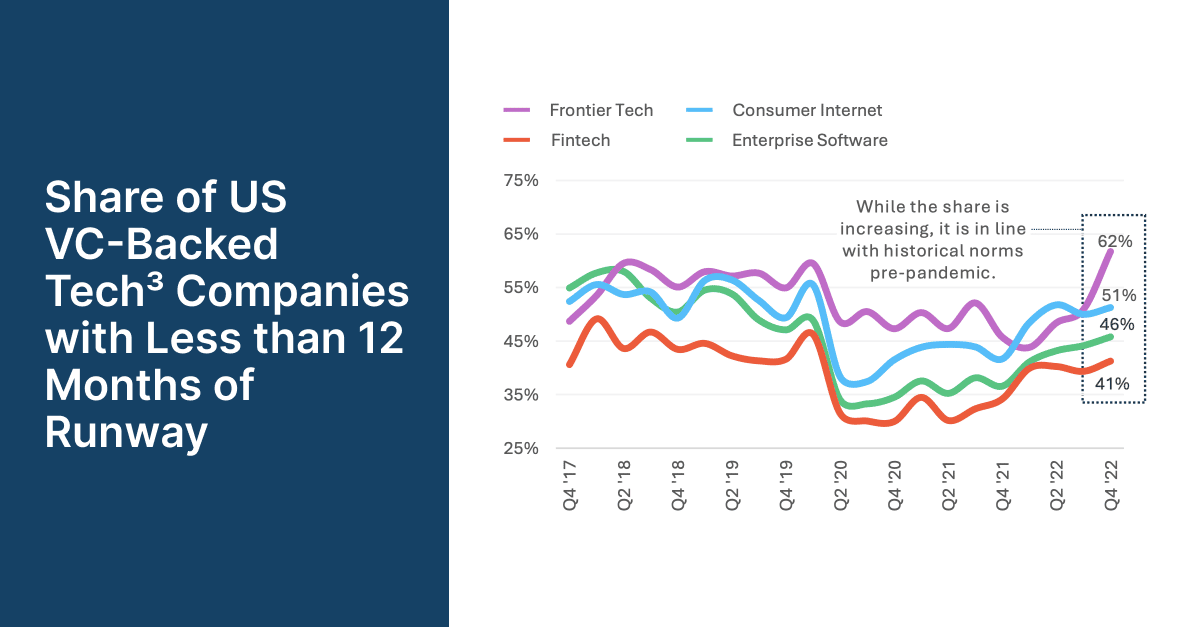

It’s become clear that the heady days and high valuations of the post-pandemic period are over. Cash runway lengths are getting shorter, with certain verticals, like hardware-intensive frontier tech, feeling the pinch more than others (see chart below.) The median cash runway is down from sixteen months in the fourth quarter of 2021 to just over twelve months in the fourth quarter of 2022, according to our State of the Markets H1 2023 report.

Note: Tech defined using SVB taxonomy.

Source: SVB proprietary data and SVB analysis.

As founders seek to make their runway last, they are looking much closer at one figure in particular: burn rate. If you need a refresher, burn rate is the amount of money a company loses each month before operating at a profit. See Understanding what your startup’s burn rate really means for a more in-depth look at the figure.

In the midst of a tough fundraising climate, startups are tightening up their spending. Nearly 40% of all pre-profit US tech companies have reduced net burn, according to our figures. After spending by early-stage startups peaked in the second quarter of last year, it has been declining ever since.

Given those stats, it’s clear that the conversation around burn rate (and how to reduce it) is a hot topic. In talking to clients in our portfolio, we’re hearing about several ways startup founders are making moves to reduce it. Here are five of them:

1. They’re rethinking the need for office space.

For years, the “cool office” has been the cornerstone of startup culture. But we’re seeing more and more early-stage founders re-evaluate their plan to have a centralized office space, let alone a glamorous one.

Though there are certainly benefits to your team collaborating out of a home base, the costs can be immense. Aside from the main expense — rent — the additional costs add up quickly: utilities, supplies, and cleaning — not to mention the single-origin coffee bean delivery. But perhaps even more importantly, signing a long-term lease can limit your young company’s flexibility. You may find yourself hamstrung by a space that doesn’t suit your evolving needs, especially if the uncertain economy slows your company’s ability to raise funds or grow as quickly as you’d like.

In the current climate, investors are less likely to be wowed by a sleek workspace than they are by a founder with their budgetary fundamentals in check.

2. They’re getting flexible with staffing.

According to one estimate, losing an employee can cost a company between fifty percent and two times their annual salary.1 Once you factor in the amount of time it takes to recruit, hire, train and get an employee up to speed, hiring full-time employees can be expensive. That’s especially likely if circumstances aren’t ideal. It’s not easy to be forced to reduce headcount four months after making hires because a funding round didn’t happen as soon as expected.

As an alternative, some founders are finding help through services such as Bolster, which enables companies to hire executive-level talent on a part-time basis. We’ve also heard from a growing number of founders who are getting creative with their contractor dollars by hiring remote developers in South America, where time zones aren’t far off from those in the US.

3. They’re finding alternative sources of funding.

While you can reduce your burn rate via cutting costs, you can also reduce it by increasing the amount of cash you have on hand. As we cover in 5 tips for fundraising during a downturn for startups, more and more founders are looking for alternative and non-dilutive sources of funding. These pools of funding can come from grants, philanthropic projects, government initiatives that provide access to capital or loans, and more.

If your startup focuses on a product or industry with myriad government grant opportunities — such as climate tech — now could be a great time to scale up your grant writing capacity. An outside expert with deep request-for-proposal writing experience might increase your hit rate and yield a worthwhile return-on-investment if you manage to land more grants. This also frees up bandwidth for you to focus on your product, your go to market strategy, and your other fundraising priorities.

4. They’re reconsidering their ad spend.

One of the bigger cuts we’ve seen founders make is in their advertising spend, slowing or stopping their ads on services like Facebook, Google and Twitter. This seems like an obvious call when a company’s ads are delivering few new clicks or customers.

However, shutting off the marketing spigot shouldn’t be a knee-jerk reaction. In 2023, venture capitalists (VCs) are looking to invest in businesses that are showing traction metrics like revenue, customer retention, and expected lifetime value. Back-of-napkin ideas, or even companies that have amazing technologies but are pre-revenue, most likely aren’t going to cut it. Therefore, if your ad spend is showing a return on investment — even if it’s a small number of new customers — consider continuing it. A small return on investment is still valuable because it shows some traction, and it’s showing a figure you can scale from.

5. They’re pushing for an MVP sooner rather than later.

A year or two ago, a founder might have expected to spend around three months fundraising. Now we’re hearing that for many, that expectation has become six to nine months.

Instead of hitting the fundraising trail, some founders are cutting their expenses to the bone and trying to bootstrap their way to a minimum viable product as soon as possible — even better if it’s monetizable. With the “growth at all costs, figure out monetization later” mindset now a distant memory, it may be easier to raise funds by pitching a product that is already making some money — even if it’s a modest amount.

As always, getting to an ideal burn rate depends on the unique circumstances within your business, and it's worthwhile to invest the time to carefully evaluate which cost-cutting or runway-boosting methods will be most effective. It's particularly important during economic slowdowns to have a bank and financial partner that's seen peaks and troughs before. With forty years of experience in the innovation economy, at Silicon Valley Bank, we're here to help you focus on managing expenses and building your company in a smart, durable way.

Running a startup is hard. Visit our Startup Insights for more on what you need to know at different stages of your startup’s early life. And, for the latest trends in the innovation economy, check out our State of the Markets report.

1 source: Retaining Talent: A Guide to Analyzing and Managing Employee Turnover, Society for Human Resource Management