Key Takeaways

- In a tough fundraising landscape, fiscal responsibility is key to survival.

- Founders need to adapt quickly and consider alternative sources of funding.

- Some of the best startup success stories have come out of challenging times.

It’s a confusing time for startup founders. We’re seeing a cloudy economic landscape, partly thanks to rising interest rates and market declines. Fundraising has slowed dramatically across all stages.

Yet, there are a few facts that should give early-stage founders hope: VCs hold a record amount of deployable capital on hand, and early-stage company valuations haven’t taken as big of a hit as later-stage startups. Investors are looking at early-stage companies as a buffer from the broader economic conditions.

But as you likely know, it’s still a tough environment for raising funds. Here are a few ways to think about your fundraising path forward. While you’re out on the trail, remember that some of the best success stories have come out of challenging times: companies like Airbnb, Docker and Uber. Corrections in the market often uplift the founders who can best adapt, coming out stronger on the other side.

1. Show a path to profitability.

The slowdown in deal volume is pronounced. Positive venture activity has decreased by record levels for both later stage and early-stage companies, according to our State of Early-Stage Venture & Startups report. Long story short: It’s not 2021 anymore.

Fiscal responsibility is key to survival — and not just to conserve operating expenses. It’s easier to access capital when you don’t need it.

Talk of “grow at all costs and figure out monetization later” is out; conversations around cash flow are in, including discussions about how to preserve and how to extend runway. VCs are asking startups to show plans for two years forward—or longer. Sequoia, Lightspeed, Y Combinator and Craft have all presented guidance suggesting that founders target a runway of 24 months or longer. A year ago, this wasn’t the case.

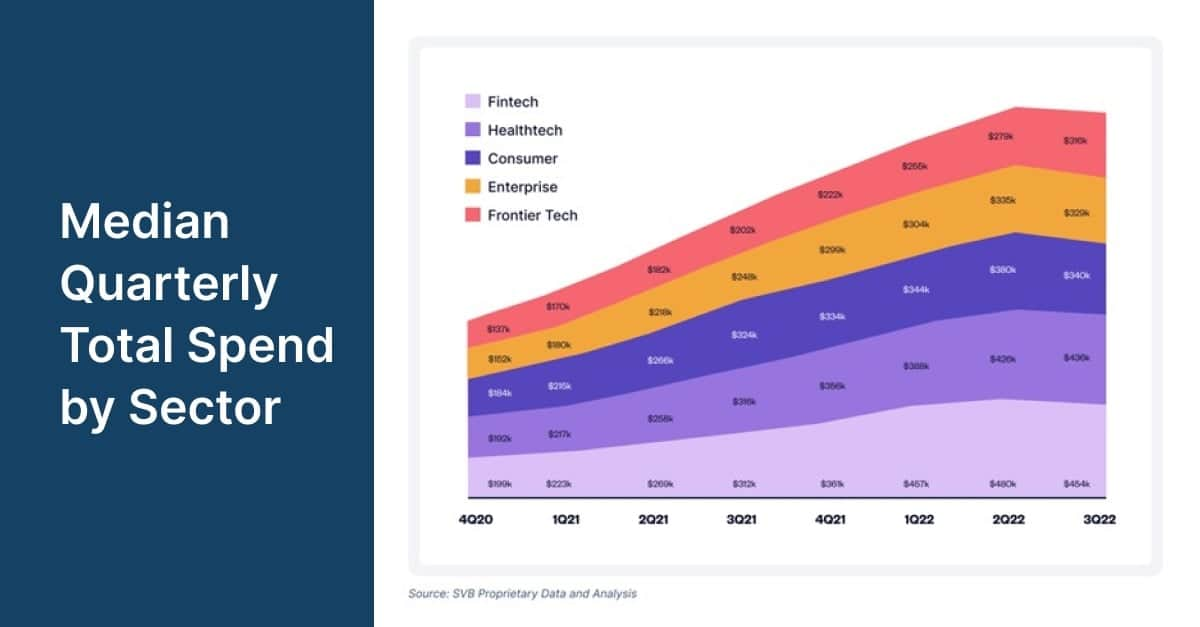

Our statistics show that founders are listening. Companies are heeding investors’ advice to conserve runway. We’re seeing high growth early-stage companies start to taper their spending, and payroll spend is tapering down, too, across all sectors (see chart below).

The takeaway: Fiscal responsibility is key to survival — and not just to conserve operating expenses. It’s easier to access capital when you don’t need it. When there is fear in the markets, investors tend to flee from companies that can’t control their cash flow.

2. Don’t be afraid of a down round if it means survival. But be cautious.

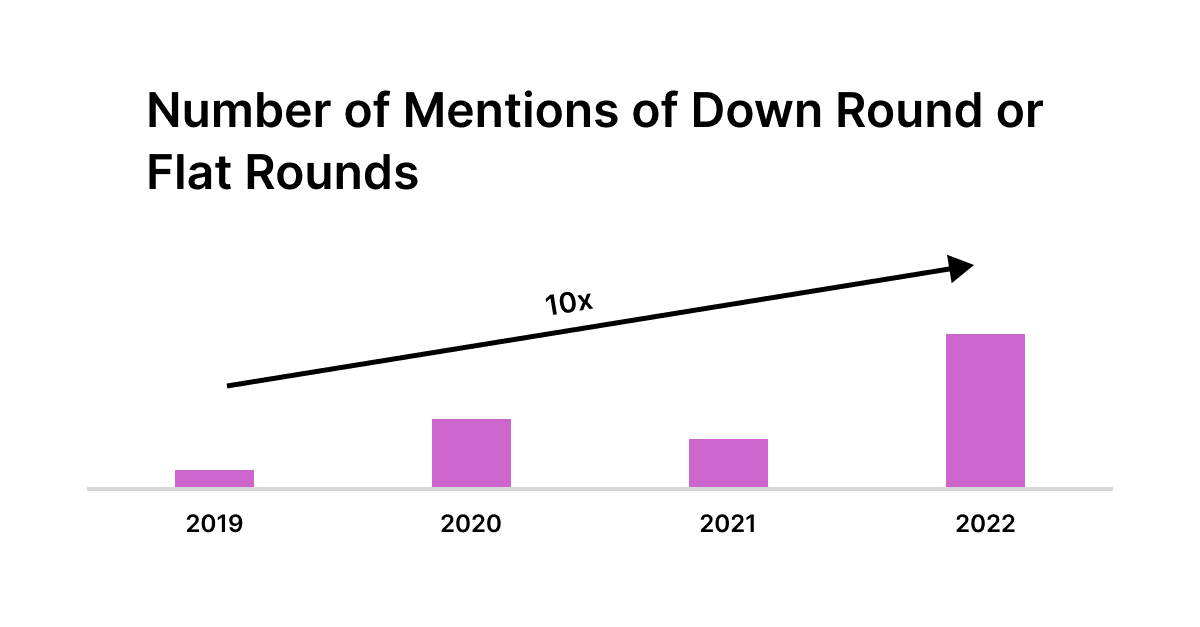

Down rounds — where companies sell additional shares for less than they were sold for in a prior financing round — are a clear signal of a slowdown. Yet we haven’t seen a meaningful uptick in them, according to our State of SaaS report. They are top of mind for many founders, though; our proprietary data shows a 10x increase in discussions around flat or down rounds from 2019 to 2022 (see chart below).

Source: SVB proprietary data and SVB analysis. Number of mentions calculated by analyzing proprietary internal call reports that included discussions around down or flat rounds.

Although down rounds are associated with dampening enthusiasm among employees and investors, the term “down round” may take on less of a stigma as investment continues to decelerate. Survival is paramount, after all, and along with controlling expenditures and considering debt facilities, a down round may serve as a critical bridge to get your company through an uncertain stretch.

There is a myriad of different kinds of down rounds, though, with different implications for your cap table — including “dirty cap table” options like structured preferred equity, where returns may be guaranteed, or convertible debt, where debt may become equity at a predetermined cap or valuation. Relying on these investor-friendly terms can even help you avoid a down round, but you may be giving up a lot of potential upside and future ownership. Beware of an “up round in name only.”

3. Prepare to encounter rapidly changing valuations.

If you raised money in 2021, you were raising at a historic high — an outlier of a year. With the economic slowdown, valuations are correcting, so don’t be surprised if your valuation isn’t quite where you would like it to be.

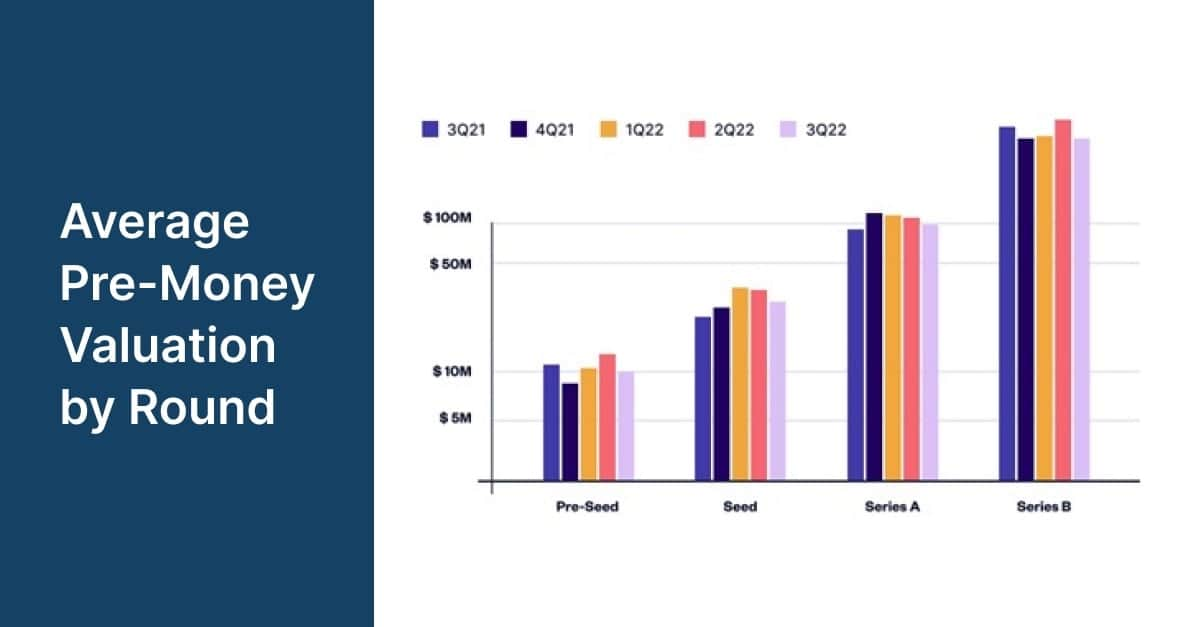

There is a bit of a silver lining for early-stage founders, though; we’re seeing early-stage companies take less of a hit (see chart below). Because later-stage companies are closer to the public markets, they are more likely to be impacted by changes in public markets. Earlier-stage companies are less impacted by market factors because have a longer time horizon to when they will be potentially going public. An early stage company may be 10-15 years from going public.

Source: AngelList Venture

4. Consider alternative sources of funding.

When fundraising gets tough, get creative about it. For some founders, this may mean looking outside of the traditional fundraising landscape into different pools of funding. This is especially true if you are in a space like climate tech, for which there are grants and philanthropic organizations interested in investing in projects that serve a common good.

Here is just a sampling of those outfits:

-

Schmidt Sciences, from Wendy and Eric Schmidt (the former CEO of Google), which aims to invest in visionary companies solving “hard problems in science and society”

-

The Chan Zuckerberg Initiative, from Facebook CEO Mark Zuckerberg, which deploys grants and venture investments in “impact-focused” companies

-

Footprint Coalition, founded by actor Robert Downey, Jr., which invests in new technologies for environmental restoration

-

Breakthrough Energy, started by Bill Gates, is aimed at solutions for a net-zero emission planet

You might also find some help courtesy of the State Small Business Credit Initiative (SSBCI), a federal initiative deploying $10 billion aimed at giving small businesses access to money via venture capital, loans, and other methods. Doled out by the states, the funds are intended to democratize access to capital for underserved communities. To find out if one of the initiative’s programs might apply to your business, try searching online for “SSBCI” along with your state name.

5. Leverage your existing investors.

In the current landscape, it pays to deliberately target the investors you are approaching. Have they worked in your sector? Are they appropriate for your company’s current stage? And even more importantly, do you know that they have capital to deploy?

You may end up with a subset of familiar names — they might have invested in your company already. Hitting up existing investors is key; raising an extension or follow-on round can be critical to your survival (not to mention, it could be easier than landing new investors). These folks may better understand how close you are to a certain milestone. Plus, they may already have a stake in your survival.

Your existing investors are familiar with you and your business, so avoid being vague with them. Consider giving them a roadmap to a specific milestone you are on track to achieving in the near future, such as “In x months this contract with a client is going to be signed;” “We have new features rolling out in x weeks;” or “Our new product launches on x date.” When you are raising money, you want to be able to say, “This money is going to these specific things, and we need to pay these people to help us accomplish them.” The days of ostentatious tech spending are over, at least for now. When investors are in a reluctant position, resourcefulness can help you minimize setbacks and keep your startup moving forward.

Running a startup is hard. Visit our Startup Insights for more on what you need to know at different stages of your startup’s early life. And, for the latest trends in the innovation economy, check out our State of the Markets report.