- The current environment is providing U.S.-based companies with a trifecta of cash management, investment, and foreign exchange (FX) opportunities—but action to lock-in benefits may be prudent.

- If the Federal Reserve begins cutting rates in September, money market rates may move lower quickly. Are you considering alternatives?

- It’s important not to neglect current trends and projections in currency markets, particularly those companies who are net sellers of U.S. dollars.

Economic vista: The stars have aligned

Travis Dugan, CFA, Managing Director, Portfolio Management

Ivan Oscar Asensio, PhD, Head of FX Risk Advisory

The stars have aligned for U.S.-based companies as it relates to the management of cash, investments, and foreign exchange (FX). All too often these areas have represented stiff headwinds for domestic corporations doing business abroad. But more recently, currency market trends, as well as a prevailing move away from extremely accommodative monetary policies have shifted the narrative and turned these headwinds into potential tailwinds. How long will these dynamics last, and what actions should forward-thinking organizations be considering?

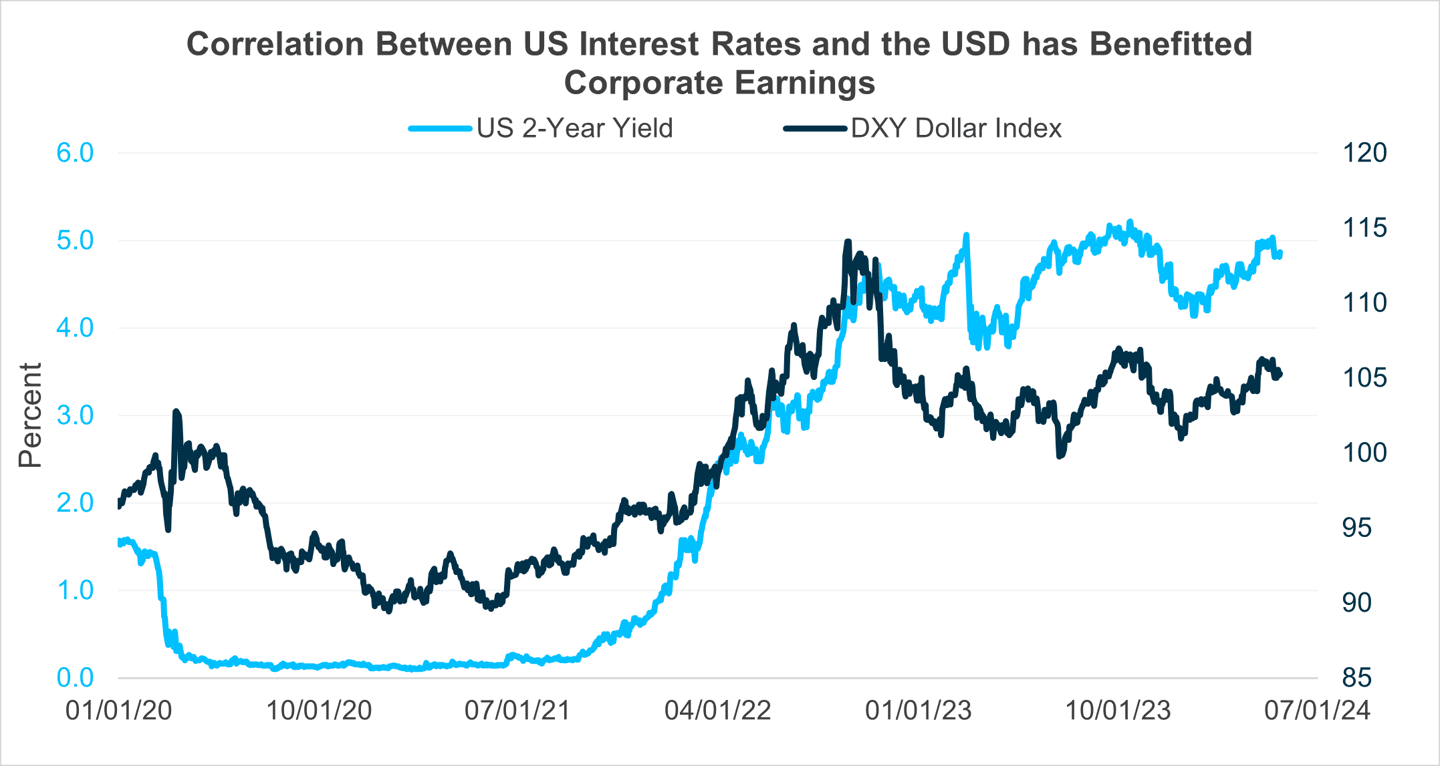

Perhaps at the heart of this shifting environment has been a positive correlation between US interest rates and the US dollar (USD), which has provided a dual win for many companies. The Federal Reserve has been working tirelessly to combat inflation, which has proven “stickier” than many had expected. The shift from extreme accommodation during the pandemic years to a much tighter policy has naturally ushered in a period of higher (if more normal) interest rates. In turn, this has allowed companies to generate material income streams for the first time in well over a decade. Meanwhile, a strong USD has benefitted companies that price goods and services in USD but have operating expenses in foreign currencies.

The windfall has been particularly beneficial for high-growth technology and life science companies, helping to ease their cash burn rates and offset the challenges presented by a tougher fundraising environment and higher cost of capital. According to Silicon Valley Bank (SVB) research, for example, enterprise software companies in the SVB client portfolio with a minimum of $50 million in revenues had a median 26 months of cash runway as of year-end 2023³. A 5% interest boost on that cash, compliments of an inflation-fighting Fed, coupled with a firmer USD, could extend the median runway by as much as one quarter if recent market trends were to repeat².

For global public companies, there have been unexpected FX risk management benefits. Revaluation of foreign assets and liabilities (aka remeasurement) may be destabilizing to earnings presentation if not addressed. Generally, the FX volatility created from such remeasurement activity can be remedied by implementing balance-sheet hedging programs, which deploy forward contracts to create synthetic offsets within current income. The new income streams from holding cash and short-term investments, which also run through current income, have worked to smooth earnings, serving as a natural hedge of FX remeasurement volatility.

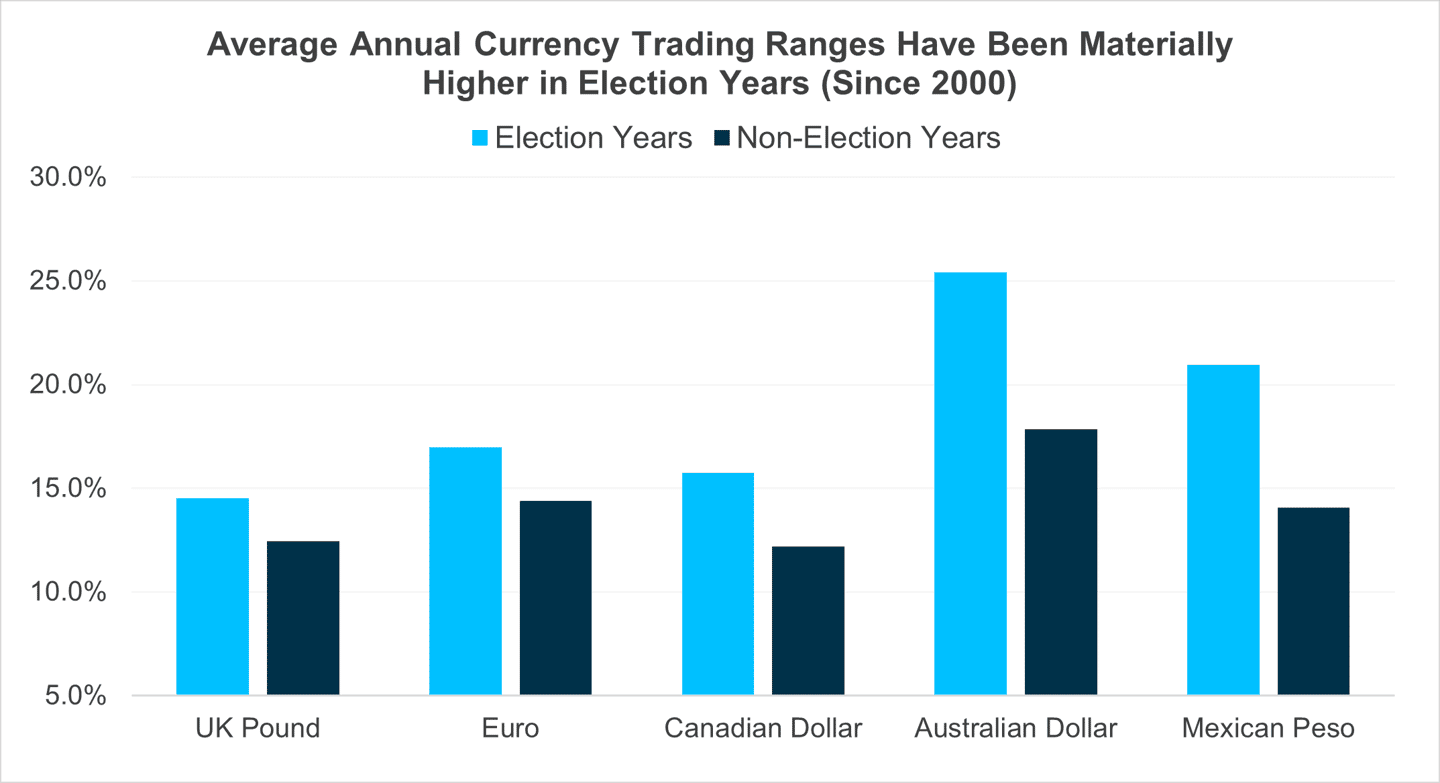

Time to Extend and Hedge?

Looking ahead, however, this dual windfall could be fleeting. There’s a good chance the correlation dynamics referenced above may be poised to change. After raising the federal funds interest rate 11 times during the most aggressive rate hike campaign on record in 2022/23, the Fed has been on hold in 2024. However, market pundits have been waiting for and predicting the start of a new easing cycle. Although rate cut expectations have been pushed out this year, the most recent cooler inflation data suggests that some accommodation is coming, perhaps as soon as September.³ Without the boost of higher interest rates and wider interest rate differentials, the USD will likely struggle to make new highs, in our opinion. Thus, any reversal of trends would erode the dual windfall enjoyed recently by domestic companies. Furthermore, looking ahead to a general election in the United States later this year, we can expect greater volatility and uncertainty, if history is our guide.

Develop an Action Plan

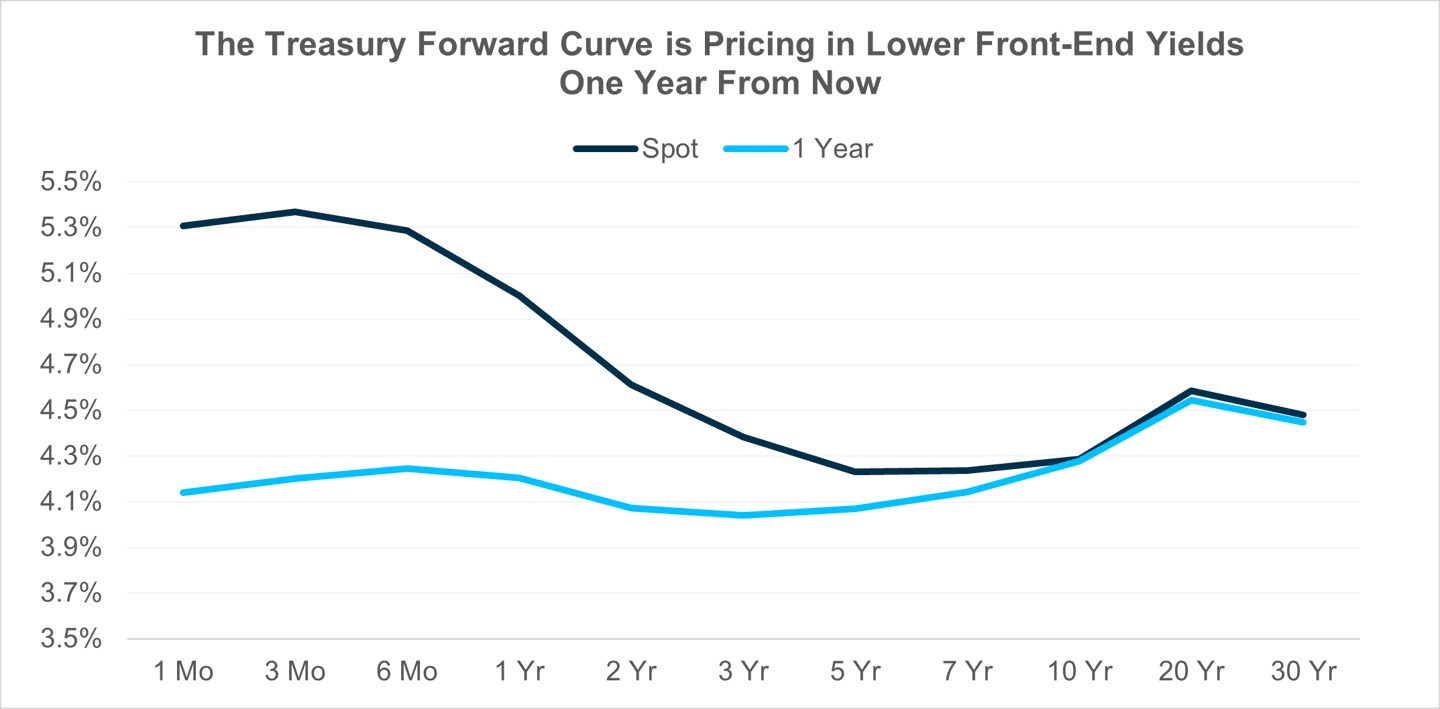

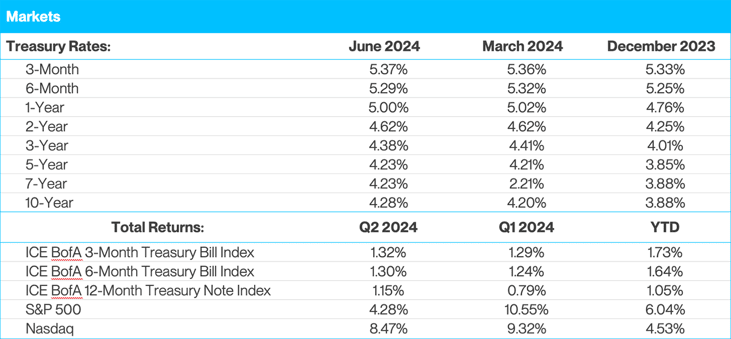

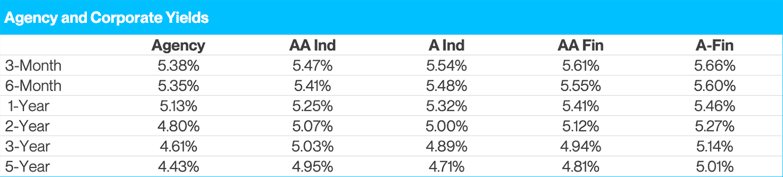

There’s no arguing that money market fund yields have been and remain attractive at rates above 5%. However, when the Federal Reserve reduces rates, money market fund yields will quickly adjust lower. These funds tend to be extremely sensitive to any movement in the federal funds rate. Investors may be able to preserve today’s attractive yields by extending duration in their portfolios. For example, 1-year Treasuries yield around 5% at present value if market expectations for Fed rate reductions are realized. In addition, investors may be able to capture additional yield by investing in commercial paper, corporate bonds, and/or asset-backed securities, which are trading at yield spreads above Treasuries as of early July.

An additional benefit of extending the duration in a portfolio is that it reduces the amount of income that needs to be forecasted. We’ve pointed out that money market fund yields are likely to adjust lower quickly once the Fed begins reducing the policy rate. The timing and extent of those rate cuts can only be estimated, and recent history illustrates that the futures market is not always an accurate predictor. In addition, inflation and labor data can change, and the Fed has repeatedly demonstrated that it is not afraid to be data dependent no matter what the market wants. On the other hand, 1-year Treasury and corporate bond yields are known at the time of purchase and thus can provide clarity and steady income until they mature.

Although every situation is different, in general we would also recommend taking an incremental approach to extending duration. For example, a barbell strategy can be used to maintain a buffer of cash to be invested in money market funds to meet near-term liquidity needs. Then, investors can redeploy the balance of the portfolio in 1- to 2-year bonds to lock-in yields for a longer duration. This strategy may preserve liquidity while also locking in attractive yields, and it represents one possible action plan to consider in the current environment.

Positioning for a Weaker USD

Interest rates are one area of focus, but for many companies it’s equally important not to neglect the currency markets. By a margin of 3 to 1, SVB clients are net USD sellers as foreign operations and growth are funded by USDs raised domestically. So, what does this mean?

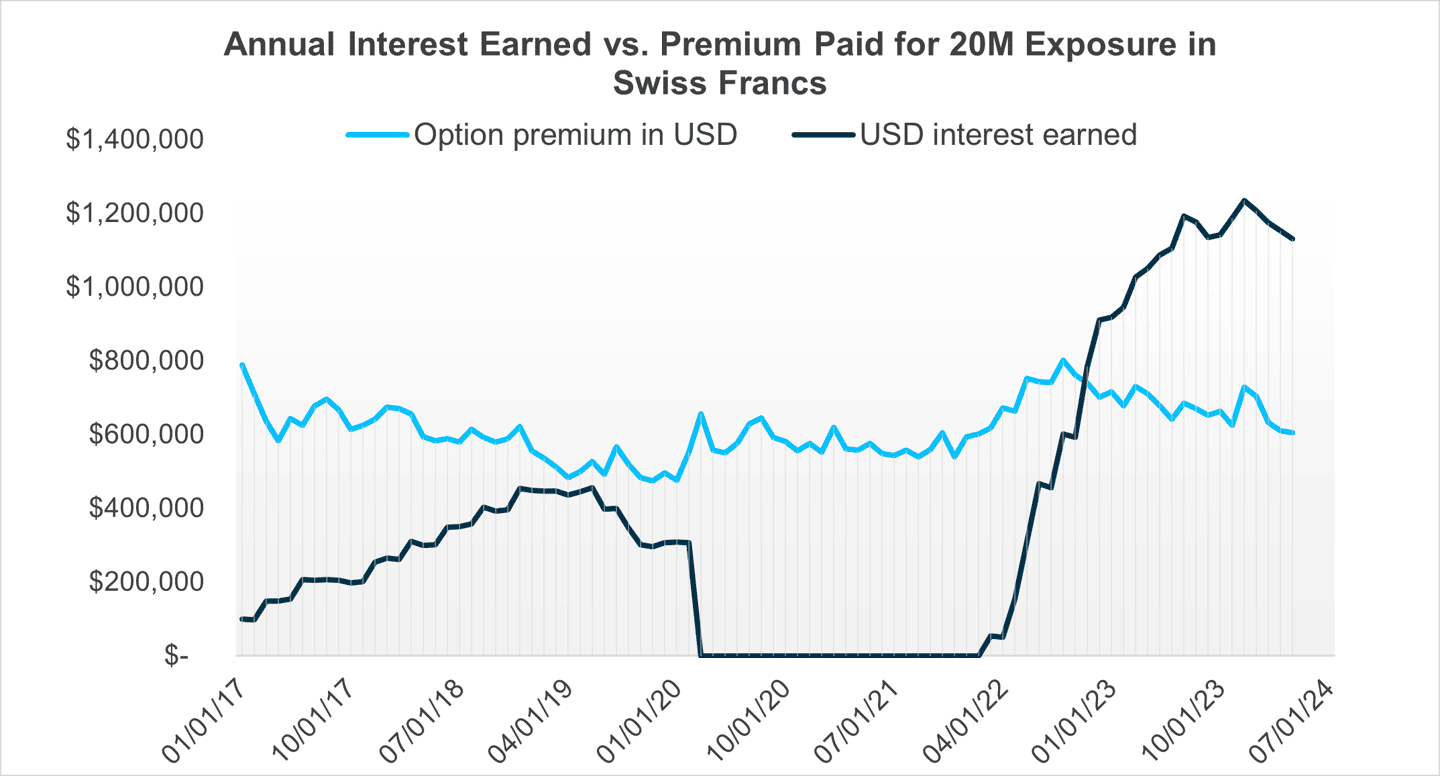

When interest rates were at the zero lower bound, most of these net sellers tended to deploy a strategy of pre-funding foreign currency accounts (e.g., buying currency on a spot basis) to protect against exchange rate volatility. This was a viable alternative to derivative hedging as the opportunity cost (of not holding USDs) was minimal. Today, however, deploying USDs to hedge currency risk forfeits the potential benefits of high yields earned in the U.S.

Locking in future currency prices via forward contracts delays the deployment of USDs, maximizing USD yields earned while insulating business results from currency volatility. Firms with more sophisticated risk management goals (e.g., rate flexibility, upside potential, asymmetric payouts) may find attractive valuations for FX option hedges. At the current level of interest rates and implied volatilities, the interest earned on one unit of cash is now more than the cost of an option that hedges one unit of exposure. This is illustrated in the example below.

Don’t Forgo the Tailwinds

Although the dual benefits of higher interest rates and a stronger USD has finally been providing benefits for U.S. companies, it’s important to remember that the environment is dynamic. Things can and do change, often unexpectedly. That’s why now may be an excellent time to consider the actions that can keep the interest rate and currency tailwinds in place.

Trading vista: The tide is turning

Jason Graveley, Senior Manager, Fixed Income Trading

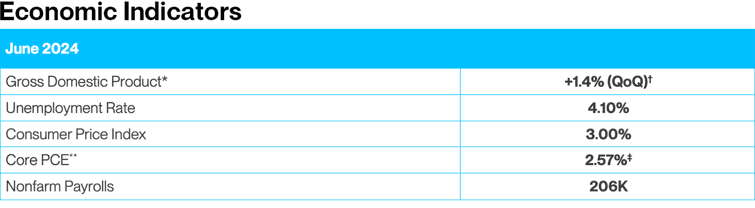

It doesn’t take much to turn the tide. In fact, just one encouraging inflation print in June has solidified expectations for the beginning of the market’s long-anticipated Federal Reserve rate-cut cycle. To be fair, that’s a bit simplistic as the market generally parses all economic indicators, along with various Fed commentaries; however, the monthly inflation and jobs data remain the two largest drivers of volatility in front-end rates. In a recent testimony before the Senate Banking Committee, Federal Reserve Chair Jerome Powell spoke to the modest progress on the inflation front, as well as the cooling labor market. Yet he was careful not to “send any signals about the timing of future actions.”

The Chairman’s testimony was perceived as well-balanced and set the stage ahead of the highly anticipated inflation reading. According to the Bureau of Labor Statistics, the consumer price index climbed 3% year-over-year in June, and top line numbers came in below economists’ expectations. This was interpreted as a confidence booster for the Federal Reserve, presumably paving the way for near-term rate cuts. The market had been projecting either September or November as the two most likely months to begin a more accommodative monetary policy, but the most recent inflation data, which was lower than consensus expectations, has market expectations firmly focused on September. Futures’ probabilities are currently expecting a September cut with an 85% probability, at the time of this writing.

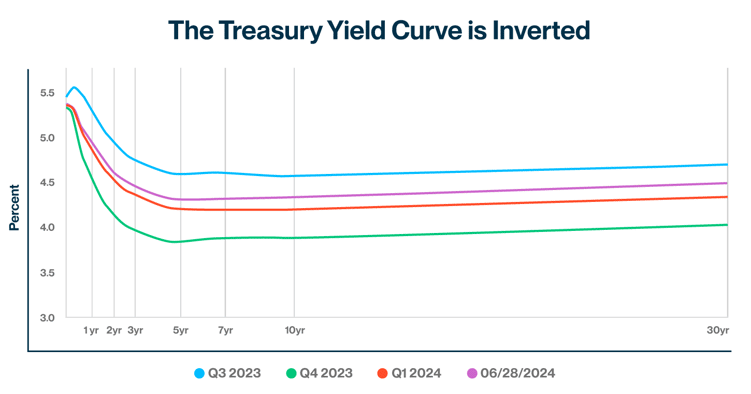

Meanwhile, yields have been trending lower over the last two months. After 2-year Treasuries briefly touched 5% at the end of May, markets have started to see rate cut expectations firm up in pricing. The 2-year yields were hovering around 4.50%, as of the second week of July, illustrating how quickly the rate tide can shift. Even looking at a Treasury forward curve, the 2-year Treasury note is expected to be under 4% in one year’s time frame. Simply put, the expectation is that cuts are coming soon and that yields will continue to go lower in the short-term.

So how are investors responding in turn? Generally, market commentary has suggested that investors started to term-out purchases and lock in duration as yields remained higher-for-longer than originally anticipated (markets were pricing in over five rate cuts to start the year and have course-corrected to just two cuts). Despite the inverted yield curve, investors have been willing to forego more income today to lock in a higher yield for a longer horizon. Even money market funds have been systematically pushing out their portfolio duration, with large government funds moving from weighted average maturities in the single digits to averages of more than 40 days. And while rates are lower than their peak, opportunities still exist to lock in yields of 5%. Although this level is below current money market fund yields, probabilities suggest it won’t be for too much longer.

¹ Silicon Valley Bank (2023). State of the Markets Report, H2 2023. Access at State of the Markets H2 2023 (svb.com).

² Analysis assumes USD rises by 10% and non-USD operating expenses are 50% of total.

³ According to Fed Fund futures, financial markets are pricing in 2 rate cuts by January 2025. Similarly, according to the latest Federal Reserve Summary of Economic Projections The Fed - June 12, 2024: FOMC Projections materials, accessible version (federalreserve.gov), typically known as the ‘dot plot’, Fed officials see 3 rate cuts over the same period.