- We believe that clients, small and large, deserve platinum level service. However, most asset managers are not able to meet the unique needs of companies in the innovation economy.

- Ambitious and innovative companies should seek an asset management partner with the experience to help guide them through various stages of their life cycle.

- We understand that liquidity and capital preservation should never be compromised for yield and incremental returns.

Economic vista: Service goes platinum

Travis Dugan, CFA, Managing Director, Portfolio Management

I will admit that I am a bit jealous of certain high-end platinum credit card holders. Granted, they may pay a hefty annual fee, but they also seem to get a lot of benefits. Card holders enjoy pre-sale access to sporting events and concert venues. At airports, they get priority boarding and occasional upgrades to business class. They also have access to airport lounges. I often wonder what it would be like to be part of that exclusive group, but until then I am stuck with the status quo.

At SVB Asset Management we aim to treat our clients to a platinum level of service. Whether you are a client who just completed an early round of funding or one who just celebrated a successful IPO, we strive to provide you with the very best service in the industry. For example, we provide direct access to the portfolio manager who invests your funds according to your specific investment policy. The portfolio manager also conducts regular portfolio reviews with clients and participates in webinars for broader client education. Beyond that, our clients are also supported by a Liquidity Account Management team, who assist with reporting needs, and by Liquidity Advisor and Relationship Management teams that can fulfill banking needs outside of asset management. Ultimately, we want clients to think of us as an extension of their finance team as we work together across the SVB organization to deliver the best advice and service to our clients.

Our technology and life science clients are all part of the innovation economy, and they have requirements unique to this sector. Our ability to serve this ecosystem is what sets us apart and the reason we develop such deep and embedded relationships with our clients. We know that change is constant. These innovators run the gamut from early-stage, high-growth, high-cash-burn companies, to more mature, public companies with stable cash. For most of our clients, capital preservation and liquidity are among their most important objectives. As such, our Portfolio Management team can manage liquidity in changing macro environments and within the context of each client’s specific objectives. I have worked at several other asset management firms, and I can say that none have been as willing or capable to provide customized separate account solutions to meet the needs of companies in the innovation economy. Importantly, our experience has taught us that yield/return are critical, but not at the expense of capital preservation and liquidity.

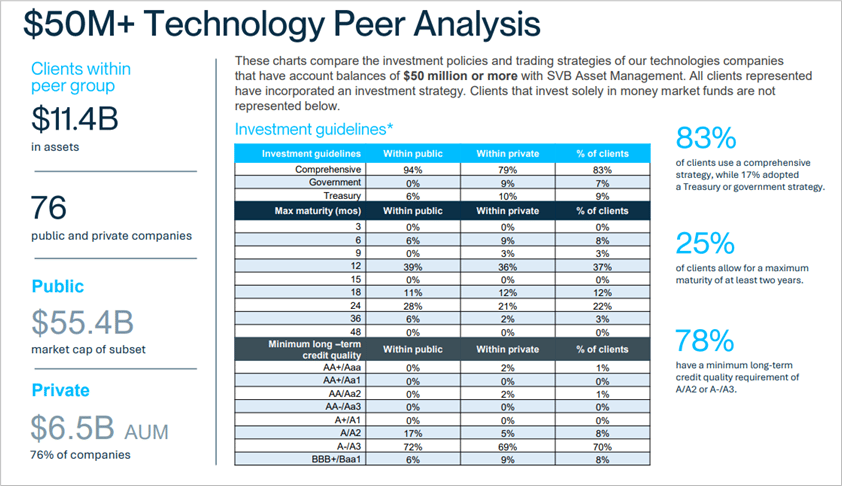

There is no substitute for real world experience. We live, breathe and thrive in the innovation economy. Because of our focus, we have additional resources to help support and educate our clients. Our clients frequently ask how their peers invest. At SVB Asset Management we conduct proprietary peer analysis that highlights the investment characteristics of our clients’ peer groups. This data is helpful to CFOs and CAOs in identifying how their investment policy aligns with that of others. We further help by educating clients on different asset classes that might enable them to better meet their investment objectives.

*Peer review chart based on 12/29/2023 data. Sources: U.S. Bank, Clearwater Analytics and SVB Asset Management. Due to rounding, values may not total 100 percent. The categories above and percentage of companies are not in alignment with our GIPS composites and do not represent performance. Companies may be excluded from GIPS composites for various reasons.

We believe clients small and large deserve platinum-level service. Smaller clients may require additional support services, especially if their finance team is lean, while larger clients may have the need for several portfolios, segmented by their objectives and cash uses. We thrive on being a long-term partner and adapting to clients’ changing needs as they grow through numerous rounds of funding. We genuinely appreciate our clients for trusting in us from their infancy and over the years as they grow and realize their potential.

Trading vista: Streamlined settlement

Jason Graveley, Senior Manager, Fixed Income Trading

More changes are coming to the standard corporate settlement for bond trades, and that’s a good thing. It may have taken a minute to get here, but ultimately the changes should help maintain or boost liquidity and likely even mitigate counterparty risk. That’s something all bond market participants should embrace.

What changes are we talking about? Corporate bond trades are finally transitioning to “T+1” trade settlement beginning on May 28th of this year. Under the new market-wide settlement cycle, corporate bond trades — along with stocks, municipal securities and exchange-traded funds — will now settle the day after their transaction date. This is the culmination of changes that have come in gradual steps, as the SEC has worked to standardize trade settlement and mitigate overall risks in the marketplace. The first trade settlement change for bonds took effect in 2017, when corporate bond settlement initially moved from “T+3” to “T+2”. This meant that the time between a security transaction date and when it actually settled into an account was reduced, which has certain benefits for firms and their clients. Before 2017, if you had purchased a corporate bond on Monday, it would not settle until Thursday. Now, starting at the end of this month, that process will move to the next day.

So what were the catalysts for the change and why did it take so long to realize and implement? Most of the call to action can be traced back to the financial crisis, where market participants saw first-hand the risks and costs associated with an extended settlement period. As the SEC noted in a previous statement to investors, “the need to better manage risks and minimize costs in the post-crisis environment has spurred the securities industry to action^,” thus allowing it to better address potential weaknesses in the system. And while the cracks appear to have been known, there was never a real impetus for change. Most of the market adopted an “if it ain’t broke, don’t fix it mentality” to extended settlement, putting a low priority on the need to change without a regulatory push. This is not surprising, as it is difficult to get investors with so many competing priorities to align on projects that require such a monumental change.

Although there will be an immediate change to how trading desks execute and price securities under the new framework, the change might also impact many other parts of a business operation, including securities lending, custody, margin and other corporate actions. This could create some near-term challenges; however, the potential benefits of streamlined settlement have been well documented and cannot be ignored. Moreover, the multi-step process to align corporate bonds to Treasury market and global settlement standards has been well-received by market participants. Deciding to make this move in steps, starting first in 2017, has further given banks and other settlement institutions time to examine their trade processes and establish a playbook for a seamless transition. Therefore, markets are not expecting any material disruption to the flow of business and clients will see no changes within their accounts. The shift is expected to facilitate more trading broadly, deepen market liquidity, lower margin requirements, and reduce overall counterparty risks. These are all welcome results as volatility remains high and volumes elevated.

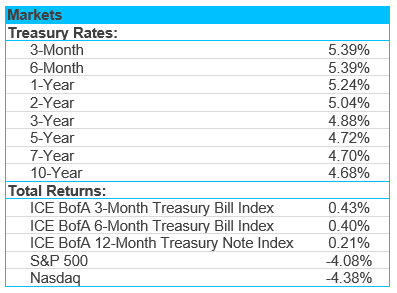

Source: Bloomberg and Silicon Valley Bank as of 04/30/2024.