Grow your interest income

SVB Certificate of Deposit

Earn guaranteed income using Certificate of Deposit (CD).

Help optimize your company's cash management with extra income

Explore complementary SVB cash management products to grow your returns

Ready to talk with our team?

CD FAQs

A CD is a deposit product that allows you to earn a guaranteed fixed interest rate on the principal balance for a pre-defined term.

When you have excess cash available that you don’t need immediately, you can use a CD to lock in a rate to earn interest for 1-12 months.

CD interest rates are typically higher than savings/checking account rates, so you can earn extra income on cash that you have set aside for future needs. CDs will help you mitigate the risk of inflation if interest rates go down, because your rate is locked in.

With a CD, you deposit a cash balance to earn a fixed interest rate for a fixed period of time, during which you cannot access the money. SVB CDs give you the flexibility of terms as short as one month and up to 12 months. When the term ends at “maturity”, you can access the money. Or, take advantage of automated renewal and enable your CD to roll over until you need the funds.2 If you need to withdraw funds before the term ends, you can do so for a fee.3

Yes, a minimum of $2,500 is required to open and maintain an SVB CD account.

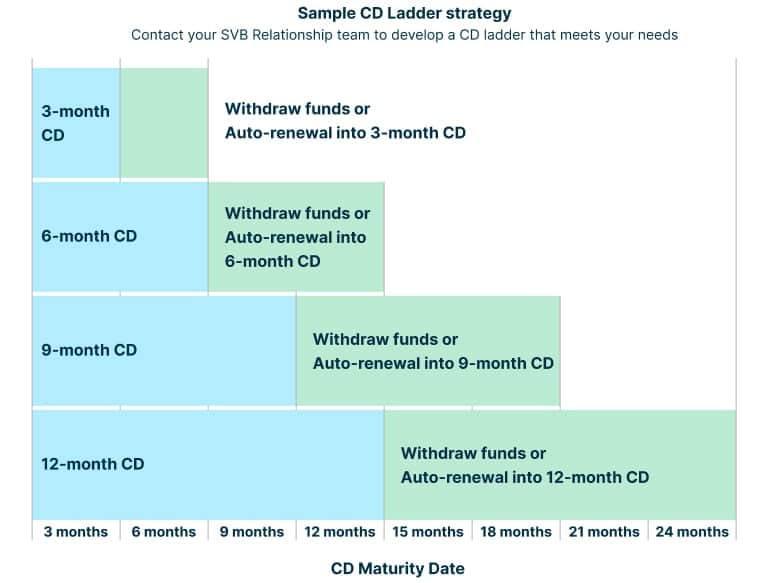

You may want to earn interest on all of your cash reserves, but need access to some of it at different times. Laddering is a strategy in which you open multiple CDs with different terms. For example, you might want one CD for just 2-3 months for funds intended for payroll, a second for a 6-month term in advance of a major purchase, and a third CD to earn interest on cash for up to a year before you’re ready to build out a new warehouse or lab space.

Please contact your SVB Relationship team for more product information and rate details.