Key Takeaways

- The new venture capital paradigm focuses on conserving cash and no longer rewards growth at all costs.

- A weaker dollar could shorten cash runways for global, pre-IPO companies, while a stronger dollar could erode their valuations. Given these risks, an active approach to assessing and addressing currency risk may be key to preparing for an IPO in the new paradigm.

- We recommend that companies going public convey in their S-1 filing a comprehensive understanding of potential FX impacts and a description of the risk mitigation strategy, where warranted.

View PDF version

Rising inflation has spurred a repricing of assets around the world in 2022. Bond markets are having their worst year on record. Equities, especially high-growth sectors, have sold off considerably from highs established during the COVID-19 recovery, with valuations falling 30% to 70% in many cases.1

Stressed market conditions have derailed IPO plans. In the first quarter of 2022, IPOs raised less than 10% of the amount they raised during the same period a year earlier, according to Dealogic.2

The IPO window does not remain closed forever, however. Many companies use this time to update prospectuses for their offerings to account for new realities. Venture-backed companies especially are recalibrating, shifting their emphasis from growth at all costs to cash preservation.

Currencies are a double-edged sword: A weaker USD can aggravate cash burn, while a stronger USD can hurt financial results and valuation multiples

Craft Ventures recently met with 165 portfolio companies to deliver the message that cash conservation should trump the pursuit of growth. In the words of Lightspeed Ventures,3 “In a capital-constrained environment, companies will necessarily focus on the input metrics of good unit economics as a matter of survival.”4

Currency management can help to rein in costs. For example, consider US-based high-growth companies that have not yet established overseas revenues. These companies typically fund foreign operations with US dollars (USDs) raised in pre-IPO rounds. Weakness in the USD makes foreign-denominated costs more expensive, aggravating the companies’ cash burn and shortening their cash runways. Past research using SVB’s proprietary data found that for one in four technology companies, a 25% adverse move in currencies could shorten runways by six months.5

A strong USD also can present challenges. Although a rising USD extends cash runways, it may cause revenues and profits denominated in foreign currencies to lose value in USD terms. In this scenario, valuations tied to revenue and profit multiples may be at risk. Currencies are a double-edged sword: A weaker USD can aggravate cash burn, while a stronger USD can hurt financial results and valuation multiples.

Currency volatility is inevitable, so companies must be prepared for impacts like these. IPO readiness is about enhancing business plans by sizing up potential adverse impacts and taking steps to mitigate them as warranted.

Venture-backed companies’ currency practices

To gain insight into the currency exposures and practices of high-growth venture-backed tech companies, Silicon Valley Bank (SVB) analyzed data from tech companies’ filings for US initial public offerings between 2016 and 2019.6 These filings include information about actions the firms had taken during the previous 18 to 24 months, offering a snapshot of the currency-related practices of private, high-growth companies during venture rounds of funding.

We identified considerable currency risks for these firms. Technology companies overwhelmingly recognized FX as a key risk factor. Yet relatively few actively managed their currency risk. One in six companies that reported non-US dollar revenues hedged FX risk using derivatives. About half deployed natural hedging alternatives such as pricing contracts or paying vendors in USD, pre-funding foreign currency accounts to meet future expenses, or exploring non-USD financing to reduce exposure to currency impacts on non-USD revenues.

Furthermore, S-1 filings suggest that firms preparing for IPOs had much less visibility into the materiality of their FX risk than they should have based on their size and global footprints. An overwhelming proportion of companies in the sample (87%) did not explicitly disclose FX gains and losses on their income statements, but instead presented currency impacts only as part of the broader line item “other income and expenses.”

We recommend that all companies going public convey in their S-1 filing a comprehensive understanding of potential FX impacts

These findings reflect attitudes and practices for pre-Covid-19 cohorts which operated under the ‘growth at all costs’ regime. We expect increased focus on currency management in the years ahead.

Having a Board-approved, fully executed FX hedging policy may be beyond the scope of some companies at the S-1 filing stage. The companies’ global footprints may not be large enough to merit such a policy, or the potential currency impact may not meet materiality thresholds. That said, we recommend that all companies going public convey in their S-1 filing a comprehensive understanding of potential FX impacts. Where warranted, the companies should describe their risk mitigation strategies, which may or may not involve derivatives.

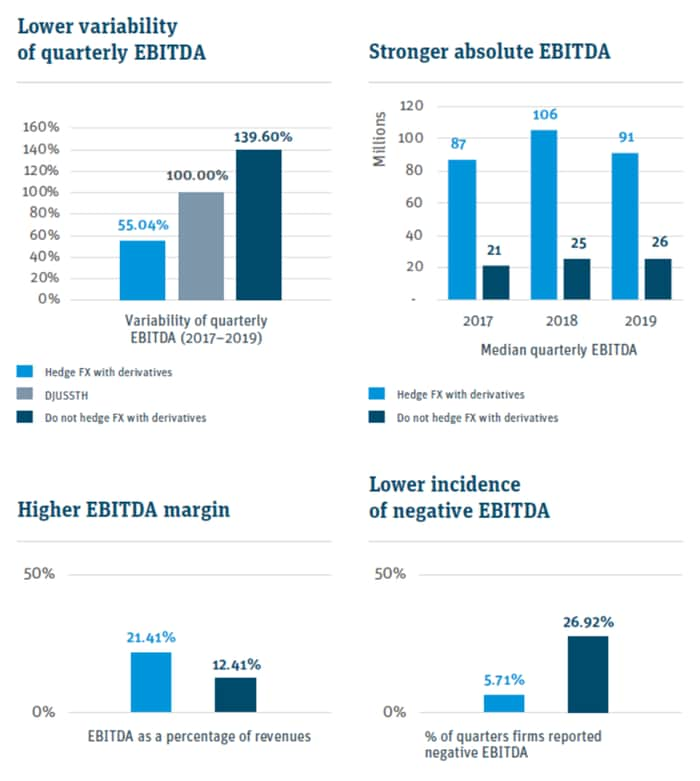

Hedging companies outperformed post-IPO

We also examined post-IPO companies. We found that, as a group, small-cap public US technology companies that hedged FX risk with derivatives outperformed on key profitability metrics.7 We are not attributing the hedging group’s superior performance to their FX hedging per se; rather, we believe better-run, more-profitable companies are more likely to employ strategies for hedging currency risk. Through statistical bias testing, we were able to establish that company size alone does not fully explain why companies that hedged using derivatives outperformed competitors.

IPO readiness includes currency management

We expect the new normal for venture-backed technology companies to include a shift in attitudes and practices regarding currency management. Outsized topline growth may no longer overshadow other performance metrics or mask performance gaps when determining IPO valuations. Companies going public must get their financial house in order, and currency management is key to that agenda.

The following checklist can help companies develop sound currency management practices prior to an IPO:

- Plan in multiple currencies, not just USDs, by embedding FX budget rates into the Financial Planning and Analysis (FP&A) process.8

- Establish a framework for quantifying the potential impact of FX movements on important business metrics and company valuation.

- Determine how material currency risk has been to past financial results and how material it may be in the future.9

- Employ natural hedging strategies, including pricing contracts or paying vendors in USD, pre-funding foreign currency accounts to meet future expenses, and exploring non-USD financing to reduce exposure to non-USD revenues.

- Where appropriate, mitigate currency impacts using derivatives.

- Document frameworks, analyses and actions in an FX hedging policy.

- Adapt FX management over time as the business evolves.

If you’d like to discuss your specific situation or for information regarding SVB’s tailored FX risk management services, reach out to your SVB FX contact or GroupFXRiskAdvisory@svb.com.