Data Insights - Currency

DATA INSIGHTS SHOW WHY HIGH-GROWTH FIRMS SHOULD MANAGE CURRENCY RISK

The game has changed for early-stage technology companies. For years, investors rewarded top-line growth above all else.

In 2019, investors’ preference shifted quickly and purposefully toward profitability, as is evidenced by the disparity in performance between the successful IPOs enjoyed by profitable firms such as Zoom and the struggles faced by several high-profile unprofitable companies. This shift means that high-growth and pre-IPO tech firms need to focus more intently on the bottom line. That includes improving their ability to understand, quantify and manage risks to earnings. Foreign exchange (FX) represents one key risk.

We conducted research by analyzing S1/F1 filings to determine the currency exposures of venture-backed US pre-IPO technology companies and to learn the extent to which they understand and manage them.

Pre-IPO tech firms' FX exposure

Technology companies are not only waiting longer to go public, but also approaching IPOs with larger and more mature businesses than before. In many cases, by the time these companies file they have substantial overseas revenues and correspondingly large currency exposures.

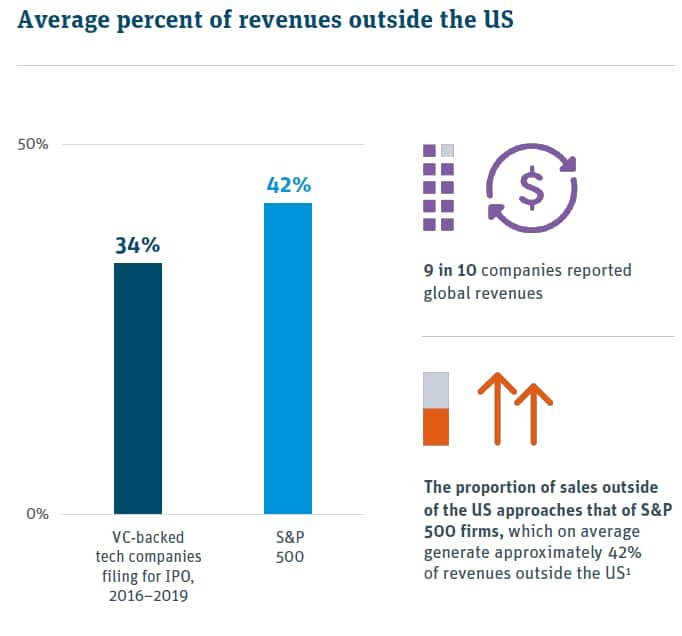

Nine in 10 of them reported global revenues. The companies under review generated 34% of revenues outside the United States, on

average — nearly as high as the average percentage of international revenues at S&P 500 companies.

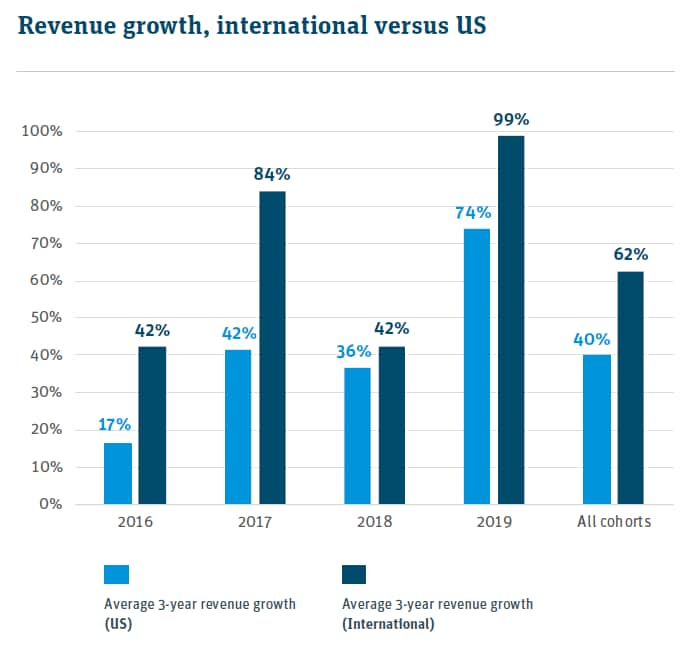

FX exposure growing fast

IPO filings consistently reported that pre-IPO tech firms' international revenues were growing much quicker than US revenues. Although international growth comes off a lower base and could slow in future years, tech firms' global currency exposure seems likely to increase in the years to come.

Little visibility into FX exposure

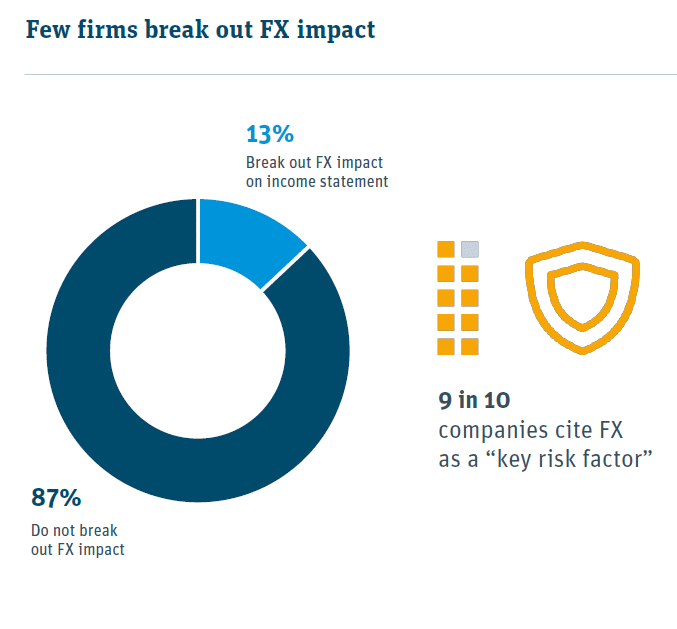

Generating substantial and increasing revenues outside the United States exposes these pre-IPO tech firms to considerable foreign currency risk. They know this: 90% of the firms reviewed identified FX as a risk factor in section 1A of their IPO filings.

But knowing the risk exists is not the same as understanding its impact on profits, which is the essential first step toward managing FX risk. To learn whether these firms had visibility into the ways currency risk affected their bottom line, we examined whether they broke out currency impact on their income statements. Very few did, suggesting that many pre-IPO tech firms have little visibility into an important risk that could affect profits.

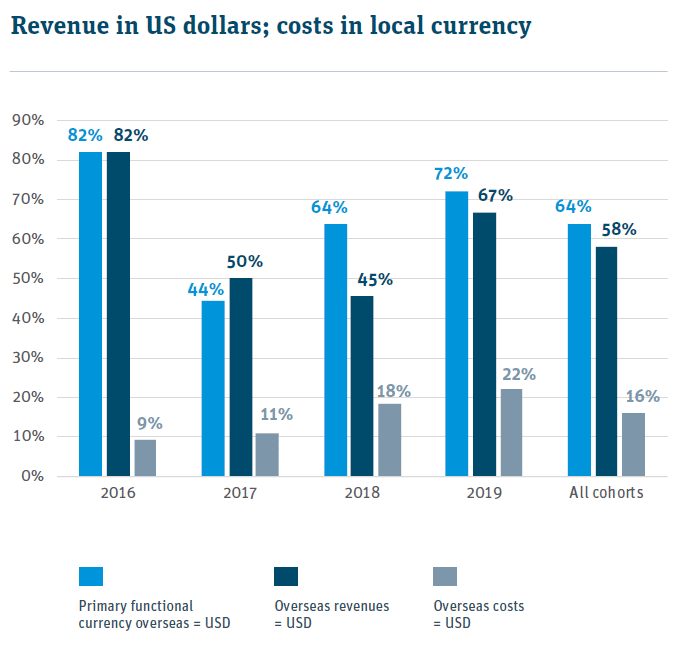

Revenues in USD, costs in foreign currency

We examined whether the firms under review were taking steps to manage their FX risk. We found that many firms price their overseas goods and services in US dollars. That practice serves as a natural hedge to the currency risk associated with those revenues, but it tends to become more difficult as companies scale. Moreover, the vast majority of costs (84%) came in local currencies.

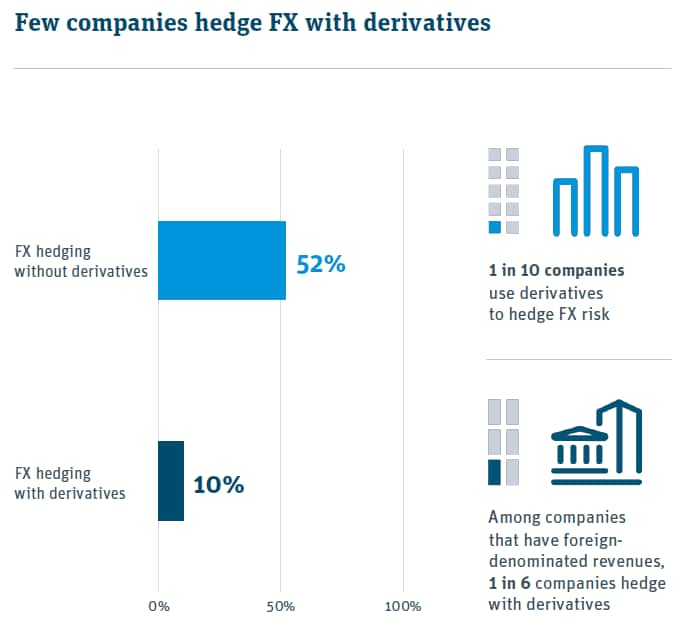

Most do not hedge with derivatives (yet)

Large firms commonly use derivatives2 to hedge currency risk. That practice was relatively rare among tech companies filing for IPOs between 2016 and 2019: One in 10 companies overall hedged FX risk using derivatives, including one in six among firms that reported non-US dollar revenues. About half hedged with other approaches, such as:- holding foreign currency through a subsidiary

- exploiting natural hedging alternatives

- billing and collecting in USD rather than foreign currency

Follow-up study: FX practices at the next stage of the business lifecycle

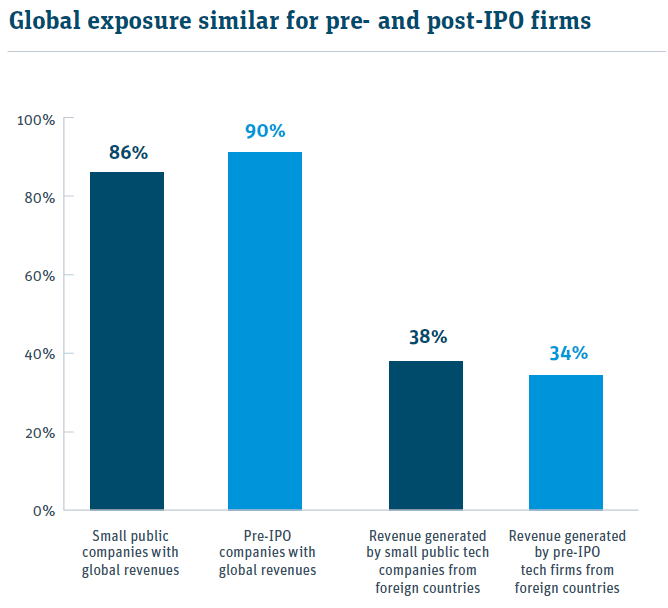

Should pre-IPO firms take a more intentional and active approach to their FX exposure? We sought insights that could help answer that question by examining tech companies at the next stage of the business lifecycle: publicly traded small-cap US technology firms, represented by the Dow Jones US Small-Capitalization Technology index (Bloomberg ticket: DJUSSTH).These companies' degree of FX exposure was strikingly similar to that of the pre-IPO firms we reviewed:

- 86% of these small public companies had global revenues, versus 90% at the pre-IPO companies reviewed

- small public tech companies generated 38% from foreign countries, on average, compared to 34% for pre-IPO tech firms

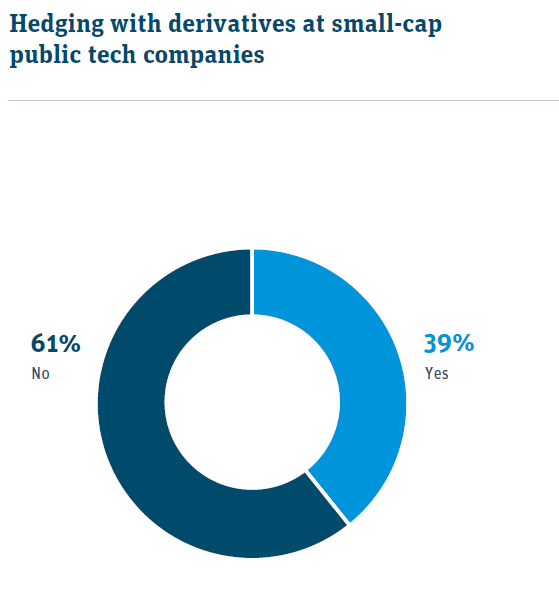

POST-IPO FIRMS 4X MORE LIKELY TO HEDGE WITH DERIVATIVES

We separated the companies in the small-cap tech index into two buckets: those that hedge FX using derivatives and those that do not. Nearly 40% of the companies in this small-cap technology index hedge using derivatives - four times the rate among the pre-IPO companies in our initial study.

Given that post-IPO firms do not have significantly more FX exposure that pre-IPO firms, their greater use of derivatives to hedge currency impacts may reflect not a response to the size of their exposure, but rather a step in the corporate maturation process.

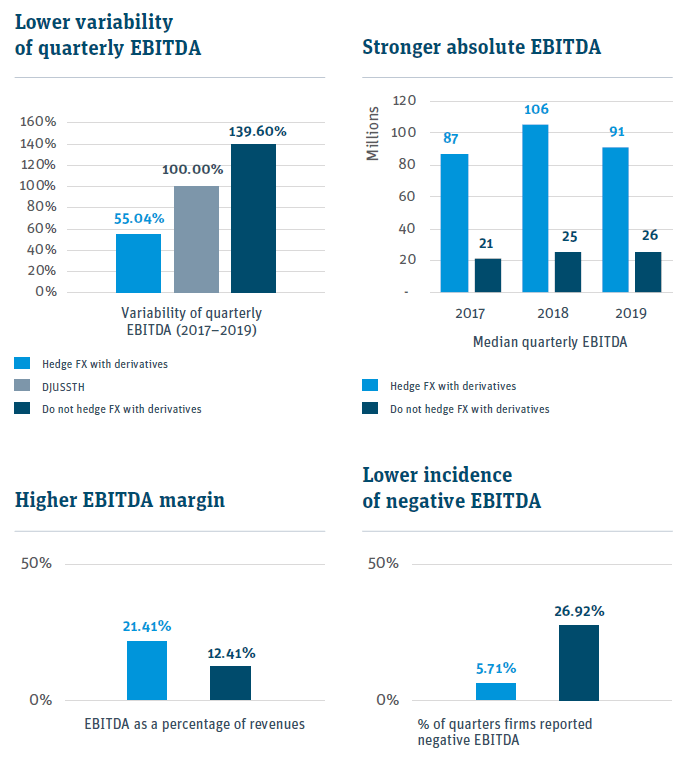

More profitable firms tend to hedge with derivatives

We compared the profitability of companies that hedge with derivatives with those that do not. Specifically, we examined several key metrics related to EBITDA (earnings before interest, taxes, depreciation and amortization), a useful tool for gauging core profitability. Companies that hedged currencies using derivatives performed significantly better on a variety of EBITDA measures.

The data do not show a casual relationship between hedging currency risk with derivatives and greater profitability. However, at a minimum, these findings suggest a link between hedging currencies with derivatives and greater, more reliable profitability for small cap technology companies.

An important note is that our statistical bias testing established that size alone does not fully explain why companies that hedge using derivatives are outperforming competitors.

Pre-IPO tech firms' FX exposure

Today, profits are paramount. As high-growth companies navigate the current environment and plan for the future, they might consider emulating the practices of the most successful and profitable companies at the next stage of the lifecycle. A conscious, intentional approach to understanding and managing FX risk is one of those practices.

A trusted partner can guide high-growth firms through a methodical process to gauge and address FX impact:

- Establishing a framework for identifying and quantifying the impact of FX movements on important business metrics.

- Determining how material the risk has been to financial results and how material it may be in the future.

- Employ natural hedging strategies.

- Where appropriate, mitigate currency impacts through the use of derivatives.

- Document frameworks, analyses and actions in an FX hedging policy.

- Adapt FX management over time.

If you’d like to discuss your specific situation or more details of this study, contact the author, Ivan Oscar Asensio, Head of FX Risk Advisory, at iasensio@svb.com or your SVB FX Advisor.

Data Insights - Currency Author

¹ Derivatives in the context of this paper refer mainly to forward contracts which are the primary tool firms use to manage FX risk.

An FX forward is a contractual obligation to exchange one currency for another at a pre-determined rate and date in the future.

2 Standard & Poor’s. https://us.spindices.com/indexology/djia-and-sp-500/sp-500-global-sales.

© SVB Financial Group. All rights reserved. Silicon Valley Bank is a member of the FDIC and of the Federal Reserve System. Silicon Valley Bank is the California bank subsidiary of SVB Financial Group (Nasdaq: SIVB). SVB, SVB FINANCIAL GROUP, SILICON VALLEY BANK, MAKE NEXT HAPPEN NOW and the chevron device are trademarks of SVB Financial Group, used under license.

This content is intended for US audiences only.

This material, including without limitation the statistical information herein, is provided for informational purposes only. The material is based in part upon information from third-party sources that we believe to be reliable, but which has not been independently verified by us and, as such, we do not represent that the information is accurate or complete.

The information should not be viewed as tax, investment, legal or other advice nor is it to be relied on in making an investment or other decisions. You should obtain relevant and specific professional advice before making any investment decision.

Nothing relating to the material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors, as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal and other advisors, and only make investment decisions on the basis of your own objectives, experience and resources.

The views expressed are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

Any non-SVB named companies cited or referenced herein for analysis and related purposes, are independent third parties, and are not affiliated with SVB Financial Group.

Comp ID# 20201703HTWUJ1TS