- With a backdrop of major geopolitical challenges, US private investors in 2023 continued their risk-off strategy of focusing on established markets, like the UK and Europe.

- Companies and investors are feeling the brunt of the global downturn in private markets, with small, highly connected countries particularly affected.

- Despite the challenges, the industry's resiliency and firm foundation of global technical innovation provide confidence in the long-term prospects of international private markets.

Long-term trends in geopolitics are driving investment decisions more than ever before. Armed conflict, competing trade policies, onshoring/nearshoring, consequential elections and general geopolitical uncertainty are all forcing investors to think critically about their international strategies. With these macro issues in the background, investors in 2023 continued the risk-off strategy started in 2022 which led many to focus on more established markets, like the US, the UK and Europe. There was a general pullback from less developed private markets as investors licked their wounds from losses suffered during a period of inflated valuations and limited exit opportunities globally.

What the FDI ranking says

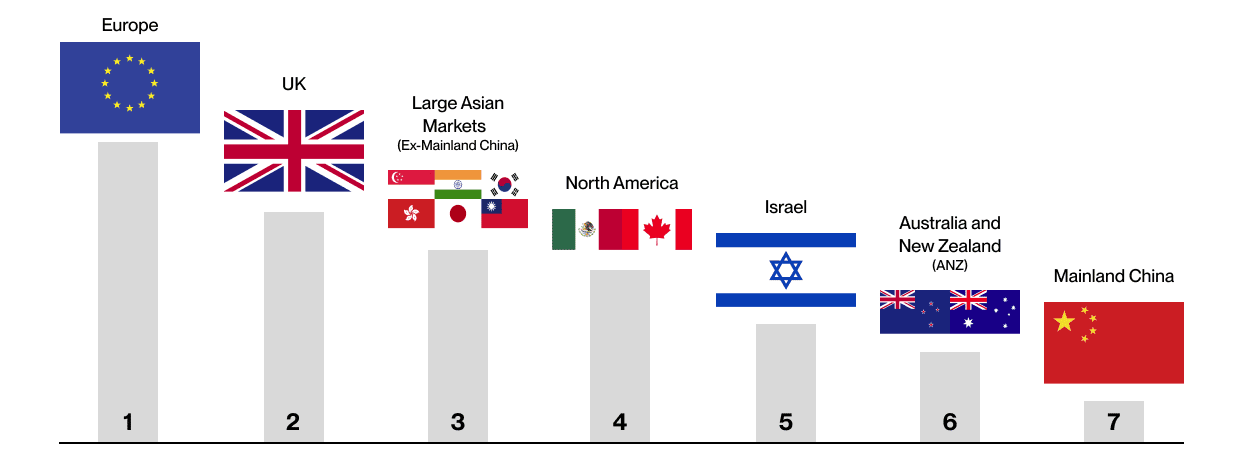

Evidence of these factors and their influence on international investment decisions appears in the 2024 SVB private foreign direct investment (FDI) ranking. The ranking shows where US private equity (PE) and venture capital (VC) investors have placed their bets to pick the most promising companies across the globe. Using data on US private funds’ international wires and foreign exchange transactions throughout the prior year, the ranking below identifies the top seven regions that are attracting the most interest from US private investors.

The 2024 private FDI ranking

In 2024, Europe and the UK took the top spots. US VCs are generally focusing more on Europe than in the pre-COVID-19 era, as geographic proximity remains less of a priority. Per Paul Strachman, Venture Partner at French VC ISAI, “Today, many US firms have teams dedicated to investing in European companies, sometimes with established outposts in Europe. This has increased the funding from US VCs into Europe.”

"Europe’s investment in standout innovation sectors, such as AI and sustainability/climate tech, is strengthened by its deep pool of talent from successful unicorns and world-class education and research institutions."

- Sara Rona, Managing Director and Head of UK/Europe, MENA & ANZ, SVB

US investment destinations

US investors are drawn to Europe’s rapidly developing innovation hubs — such as London, Berlin, Amsterdam and Paris — thanks at least in part to government programs that encourage innovation. France, for instance, has several government programs to encourage investment and innovation in the country, and year-end numbers show French VCs successfully bucking the global trend by raising more in 2023 than in 2022.1 Per Sara Rona, Managing Director and Head of Europe, MENA & ANZ in SVB's Global Gateway practice, “Europe’s investment in standout innovation sectors, such as artificial intelligence (AI) and sustainability/climate tech, is strengthened by its deep pool of talent from successful unicorns and world-class education and research institutions. This talent is consistently recycled into the ecosystem and positions the continent well to be a key destination for companies that have global ambitions from the outset.” These advantages, coupled with business cultures and legal systems not too dissimilar from those in the US, suggest that Europe’s status as a top destination for US investment is likely to endure.

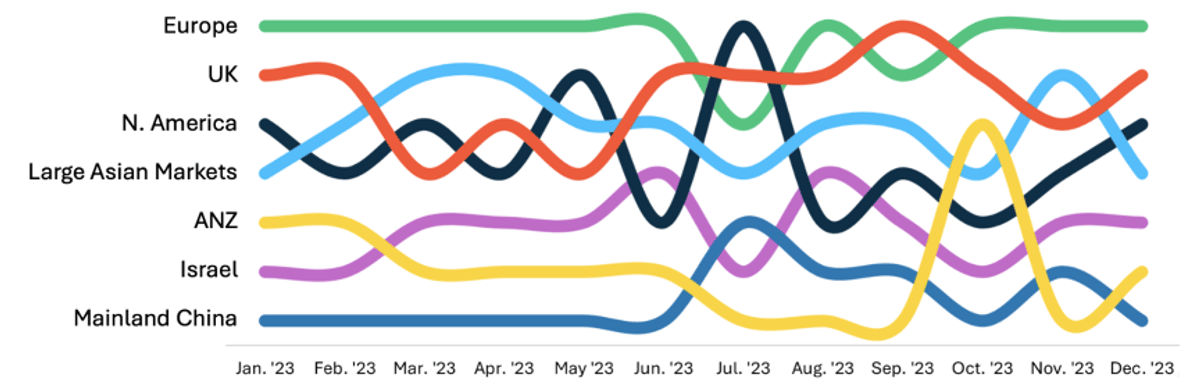

Still, annual rankings tell only part of the story. The dynamism of the international investment landscape in 2023 is reflected in the month-to-month movements of the rankings. While Europe and the UK kept their places near the top throughout most of the year, other regions showed big swings often due to large, one-off deals.

Destination of international investments by US PE/VC funds, ranked monthly

Among the lower-ranked areas throughout 2023 were Israel and China, both of which have been affected heavily by the global downturn in private market investment. Each of the two countries, however, face their own respective headwinds going into 2024.

Foreign market challenges and optimisms

To start, Israeli private markets are intensely global. Per Ella Adhanan, Senior Vice President and Head of India and Israel in SVB's Global Gateway practice, “The high sensitivity of Israeli private markets to global economic downturns in PE and VC funding is due to the small size of the country's market. The country’s reliance on foreign investment capital makes Israel more vulnerable to rapid and significant decreases in investments during global crises compared to other countries.”

"Amidst challenges, Israel's tech scene stands strong. The nation's dynamic startup culture, top-tier talent, and global market focus anchor its economic foundation, positioning it to rebound and continue pioneer cutting-edge technologies globally, especially in fields like cybersecurity."

- Ella Adhanan, Senior Vice President and Head of India and Israel, SVB

In addition to the global downturn, Israeli private markets have faced two other primary challenges over the past year. The first, judicial reform in early 2023, triggered significant political protests and led investors to reassess their short-term investment objectives. Although this issue has mostly subsided, international investors are now considering the potential impact of war on private markets. While the war has not resulted in a decline in private investment into the country since October, an extended conflict could dampen foreign investor interest. These issues, along with the global decline in PE and VC investment over the past year, have compounded the challenges faced by Israeli markets.

Even with its current challenges, Israel's strong economy, substantial government support and a strategy aimed at global markets are key factors contributing to its successful innovation landscape. Tech also remains at the center of the country’s economy, representing over 15% of GDP and 50% of exports.2 Hence, while investment levels are expected to remain below previous high points in the near-term, the long-term sentiment towards Israeli technology and innovation remains positive.

Chinese private markets, meanwhile, face their own set of headwinds. Perhaps most notably, ongoing trade tensions with the US have dampened direct investment from US private fund managers. With a tough stance on China being one of the few areas of bipartisan overlap in the US, this issue is likely to persist and weaken US investor enthusiasm for the country. A difficult exit market has compounded the issue and has led to PE funds facing discounts of 30-60% when looking to offload assets in the secondaries market.3

However, there are still signs of optimism. The country is transitioning to a consumer-driven economy with the number of upper-middle- and high-income households set to increase 75% between 2022 and 2030.4 Further, the sheer size of China’s economy alone attracts foreign businesses and investors. While these factors together could bolster international investment over the medium- to long-term, trade tensions and the difficult exit environment will likely continue to depress US PE/VC interest in the region for some time.

Looking forward

Over the past two years, the innovation economy has faced the biggest contraction since the dot-com bubble, and the impacts of this pullback have been felt globally. Today, companies are feeling the brunt of this downturn with decreasing runway and the most difficult fundraising environment in at least a decade. Despite this, founders remain resilient as they navigate through these uncharted waters. This resiliency and the firm foundation of technical innovation globally, including AI, provide confidence that the long-term prospects of the international private markets are strong, and that world-class companies can be built anywhere.

Technical notes

Proprietary data on international wires and FX transactions was gathered for US-based private funds. Based on an analysis of a representative sample of the data, 98% of these flows represents investments into portfolio companies (i.e., FDI). Geographies were ranked based on the amount of FDI received. This analysis focuses on the top seven regions. Rankings were calculated on both a monthly and an annual basis using data from January through December 2023. The group “Large Asian Markets” includes the largest six destinations in the region excluding mainland China: Hong Kong, India, Japan, Singapore, South Korea and Taiwan.

Acknowledgement

Thank you to David Song and Ben Johnston for their support in gathering data for this article. Thank you as well to Sara Rona, Ella Adhanan and Li Song, CFA for sharing their expertise and providing helpful background.

SVB Global Gateway is a dedicated international business development team that provides the right mix of products, services and strategic advice to venture capital (VC) firms, VC-backed startups and growth stage companies expanding into the US from innovation centers around the world. The Global Gateway team has worked with international clients for more than a decade across all stages and has years of experience helping clients navigate the challenges and complexities that arise in their expansions to the US. The team’s mission is to empower visionary companies like yours by providing comprehensive banking solutions tailored to your unique needs, while ensuring a seamless banking experience.