Key Takeaways

- It’s important to consider where a currency trades relative to its historical mean when allocating capital overseas.

- Our machine learning model trained on 30 years of data demonstrates that a currency hedging strategy based on SVB’s proprietary signals could add significant IRR to overseas investments.

- The gravitational pull of mean reversion may take years to take hold, so this strategy is appropriate for private equity and growth investors with long-dated investment horizons.

View PDF version. Regarding the price volatility of its currency, the People’s Bank of China (PBoC) said in a statement1:

“... [It] is not our days that leave us, never to return, or a dam that will roll non-stop when the water floods in. It’s more like the water level in the reservoir, it rises and falls during different periods.” This elegant quote reminds us that FX does not trade like stocks do. Apple Inc. crossed the $1 billion, $10 billion, $100 billion, and $1 trillion market cap thresholds and, like “our days that leave us”, will likely never return. Most currencies, however, do revert to some pre-established mean. What’s unknown are the timing and the degree of the pullback.

Mean reversion with a twist

When tossing a coin or shooting field goals in basketball, mean reversion comes quickly. If you toss a coin 10 times, you may see seven heads. Toss a coin another 10 times, and repeat a few times, and it becomes increasingly unlikely that 70% of your flips will come up heads again. The more you toss, the closer you’ll approach the mean of 50%. Similarly, Lebron James may hit 10 shots in a row in the first quarter of a playoff game. However, as the game and the playoff series go on, his success percentage will fall and settle somewhere close to his lifetime field goal percentage of 50.4%.2

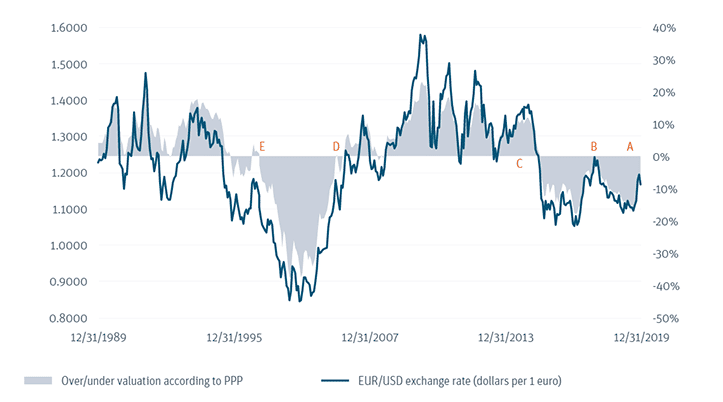

With currencies, mean reversion does not tend to come quickly. The long run mean for the EUR/USD exchange rate (number of dollars per euro), adjusted for inflation, was 1.293 as of Q1 2021. It has been close to three years since the EUR traded at its long-run mean (this time period is highlighted in the chart by points A and B), and six years since it traded above its long-run mean (highlighted by points A to C). Going back 30 years, periods in which the currency valuation has deviated from the mean have been as long as 7 years (highlighted by points D to E).

Source of data & PPP calculation: Bloomberg

Mean reversion can be used for cross-border decision-making

Mean reversion is such an inexorable force in currency markets that it can serve as an important data point to consider when allocating capital overseas. Specifically, knowing where exchange rates are relative to their long-term mean can help you improve your chances of avoiding erosion in your internal rate of return (IRR) due to exchange rate volatility. However, forecasting currency mean reversion is not an exact science. The timing, the degree of the deviation, and speed of the pullback are unknown.

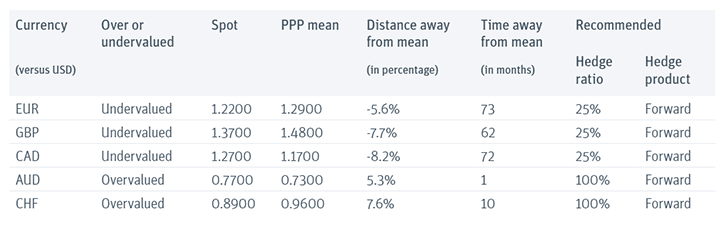

To extract the most value out of the mean reversion dynamic, we have analyzed decades of historical exchange rate data and developed a quantitative framework to assist with the currency hedging decision. At a high level, if a currency is trading above its mean when the foreign-denominated investment is made, it is likely to fall, and more hedging is recommended. Conversely, less hedging would be recommended when a currency trades below its mean, making it likely to rise. The model evaluates the exchange rate’s degree of deviation from the mean, as well as the time it has spent away from the mean, in order to assign a level of conviction to the view in support of the hedging action.

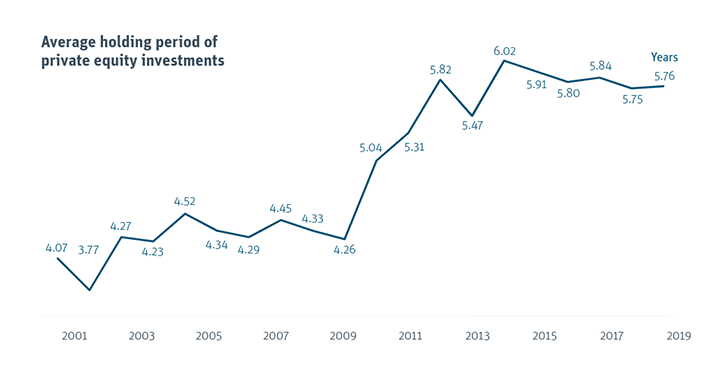

Since it can take years for mean reversion’s gravitational pull to take hold, using the mean reversion signal in cross-border decision-making is appropriate only for investors with long-dated investment horizons — namely private equity and growth funds. According to Pitchbook, the average holding period for funds that exited in 2019 was close to six years, almost 50% greater than it was a decade ago.

Source: Pitchbook, August 1, 2019

From signal to hedging action

We invite you to read our technical white paper for details on the computational construct behind our FX hedging signals, as well as empirical validation of the benefits of using them to inform hedging decisions. We will be publishing quarterly updates of these signals for the key currencies we trade on behalf of the funds we bank, along with the corresponding hedging recommendation. See our Q1 recommendations below.

About Silicon Valley Bank’s Global Fund Banking FX Team

SVB’s Global Fund Banking FX team focuses exclusively on fund banking and has FX professionals on the east and west coasts to support your international investments. We welcome you to use this resource, as you assess the value proposition of international investments and the associated currency risks. We are here to help at any stage of the process, from the pre-close analysis and due-diligence stage all the way through closing and beyond.

View full technical whitepaper PDF.

Contact us: If you’d like to discuss your specific situation to determine if incorporating our hedging signals into your decisioning is right for your fund, contact the authors directly, Ivan Oscar Asensio, Head of FX Risk Advisory, at iasensio@svb.com and David Song, FX Advisor, at dsong@svb.com

Learn more: SVB’s latest FX information and commentary: Foreign Exchange Advisory