- Equity is a slice of company ownership that founders exchange for investor funding or offer as an employee benefit.

- It is critical that founders share ownership equitably based on their role and commitment to the business.

- Keep in mind that equity is finite, so spend it carefully.

What is equity in a startup?

Startup equity describes ownership of a company, typically expressed as a percentage of shares of stock. How does owning equity in a startup work? On day one, founders own 100%. As the company grows, equity is often exchanged for funding or used to attract employees, leading to shared ownership. If you have more than one founder, you can choose how you want to share ownership: 50/50, 60/40, 40/40/20, etc.

Equity share in your startup will depend on how many founders you have and their contribution to the success of your company. However, to build your business, you will likely need to exchange equity for fundraising and to lure new talent.

How much equity should a founder get in a startup? Early on, founders need to give up a significant percentage of equity to match the risk investors are taking by funding your startup. The specific amount can vary greatly depending on the startup’s needs and the level of investment required. But as you grow and demonstrate greater success, your startup equity increases in value and investors are typically willing to pay more — or inversely accept less equity in exchange for their funding.

When VCs invest capital in exchange for equity in your company, you are forming a business relationship. If your company turns a profit, investors make returns proportionate to the percentage of equity they have in your startup. On the other hand, if your startup fails, the investors lose their money. However, VCs are willing to take this risk because owning a percentage of a successful startup can be very profitable — and keeps the ecosystem moving when they use the proceeds to make investments in the next generation of startups.

What is the difference between stock, shares and equity?

Stocks and equity are often used interchangeably to describe ownership interest in a company. However, stock is a general term for the ownership certificates of any company, while equity refers to the value of the shares issued by a company. Shares, on the other hand, are how your company’s stock is divided.

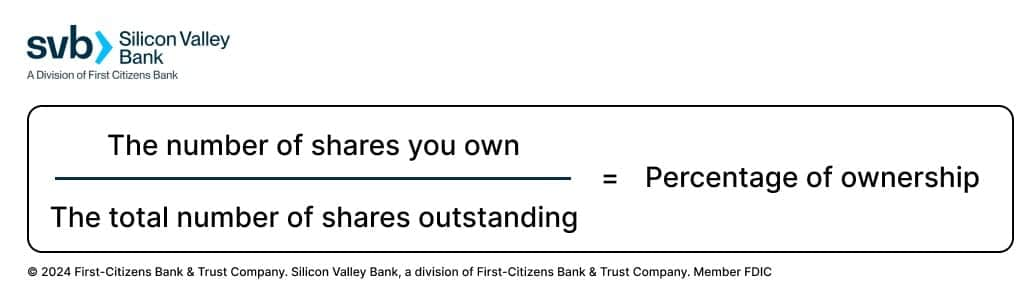

How is equity calculated in a startup?

To calculate equity in a startup, your percentage of ownership is equal to the number of shares you own divided by the total number of shares available. This calculation helps founders and investors understand their stake in the company and the value of their investment as the company grows.

How is startup equity distributed among employees?

Startup equity is distributed among employees as a form of compensation to attract and retain talent, and the amount allocated often varies based on the company's stage, the employee's role and the potential growth of the startup. After founders divide the initial ownership among themselves and investors, early-stage employees typically receive a larger share due to the higher risk they take on, while later-stage employees might receive less as the company stabilizes.

Is 1% equity in a startup good? Whether 1% equity is good depends on the stage of the company, the employee's role and the potential growth of the startup. These equity offers not only compensate for potential salary cuts and long hours but also provide the prospect of a big payday when the company exits through a buyout or Initial Public Offering (IPO).

But how much equity should you offer? And what are the terms? There are general rules, but essentially the younger and smaller your company, the more startup equity you’ll need to offer.

How do you structure equity in a startup?

There’s no correct answer for deciding the equity split among founders. Often, they default to a 50/50 split or another equal distribution to avoid an uncomfortable conversation. It’s an issue that can lead to big problems in a company’s future if not properly aired.

Sometimes a 50/50 split simply doesn’t make sense. Founders have different skills and commitment to the business. People can be in different stages in their personal lives, and founders play different roles.

“Generally, the CEO gets more,” says Peter Pham, a serial entrepreneur, angel investor, startup advisor and Co-Founder of Science, an incubator in Santa Monica, California. Pham cites a team that came into Science assuming they’d split their company 50/50. “We had to tell them, ‘Look, it can’t be 50/50. Because you’re the CEO and your partner is not, and the value of their role will diminish over time and yours will increase,’” Pham says. While the non-CEO founder deserved a large stake in the company, “the equity should be split based on value creation,” Pham adds.

How do you safely split equity in your company?

To safely split equity in your company, it is essential to have a serious conversation about ownership early on. Begin by having a frank discussion with your team to understand everyone's expectations, risk profile, commitment and personal circumstances. It is critical that founders “understand deeply each other’s interests and intentions,” says Roy Bahat, head of Bloomberg Beta, an early-stage venture firm backed by Bloomberg L.P.

How do you build an equity distribution program?

It will be necessary to offer startup equity to recruit board members, advisors and key employees, however sharing out equity is a challenge for first-time founders. How much equity should you give up in a startup? The amount of equity to give up depends on the funding needed, the stake investors are asking for and the strategic value they bring. It’s crucial to balance between retaining control and attracting necessary resources. Also, the stake an employee receives depends on a range of factors from skills to seniority as well as their original contribution when they were hired.

Serial entrepreneur Joe Beninato asks, “What’s the experience of the person coming over? You must look at each situation individually.”

Position and seniority play a big role in deciding whether to offer 1% or .05%. Online guides, like Index Ventures and Holloway Guide to Equity Compensation, provide compensation benchmarks to help founders decide the percentage of the company they give away when signing talent.

At a company’s earliest stages however, you can expect to give a senior engineer as much as 1% of a company. But an experienced business development employee would typically receive only a .35% cut. An engineer coming in at the mid-level can expect .45% versus .15% for a junior engineer, and so on. But Beninato says, “The percentages really vary dramatically. I don’t want to say it’s like a decaying exponential, but it’s something like that. The first people get more, and it goes down over time.”

Is equity compensation subject to vesting schedules?

Regardless of its form, equity compensation is always subject to vesting schedules. You need to reward your team for staying with your company, and startups have typically used a four-year benchmark with a one-year cliff — this means, no ownership percentage is granted until an employee has worked at least twelve months. However, longer vesting schedules are becoming more commonplace as startups take longer to exit.

But keep in mind that equity is finite, so spend it carefully.

How do you craft your startup’s exit strategy?

Crafting a successful exit strategy begins at the inception of your company and leadership team. Having the hard conversations early, and fairly assessing everyone’s value to the enterprise, are critical.

Noam Wasserman, founding director of USC’s Founder Central Initiative, studied more than 6,000 startups over 15 years. He reported that startups that chose an even-split by default, bypassing difficult but important discussions, were three times more likely to have unhappy founding team members.

Unhappiness can even ruin success. “I’ve been at big liquidity events where everyone should be celebrating,” according to Scott Dettmer, a Silicon Valley-based lawyer who has been advising startups since the mid-1990s. “But two of the three founders say, ‘The third is getting more than he deserves’.” Discuss equity splits early, fully and openly to avoid that situation.

Conclusion

Equity share in your startup will depend on many factors. Determining how you structure equity and building an equity distribution program that clearly defines percentages of equity can help you avoid painful conversations later. The amount of equity in your company is finite, so be sure you calculate how much you can give away to gain the skills and funds you need to be successful.