- Asset-backed securities (ABS) are unique fixed income securities collateralized by underlying assets that generate income.

- ABS might offer an alternative, or supplement, to traditional corporate bonds and be a means to further diversify fixed income portfolios.

- Although ABS investing requires careful due diligence, it’s important to know there are investor-friendly provisions that can help manage risk and protect against loss.

Economic vista: ABS — The what, how and why

Christi Fletcher, Senior Portfolio Manager

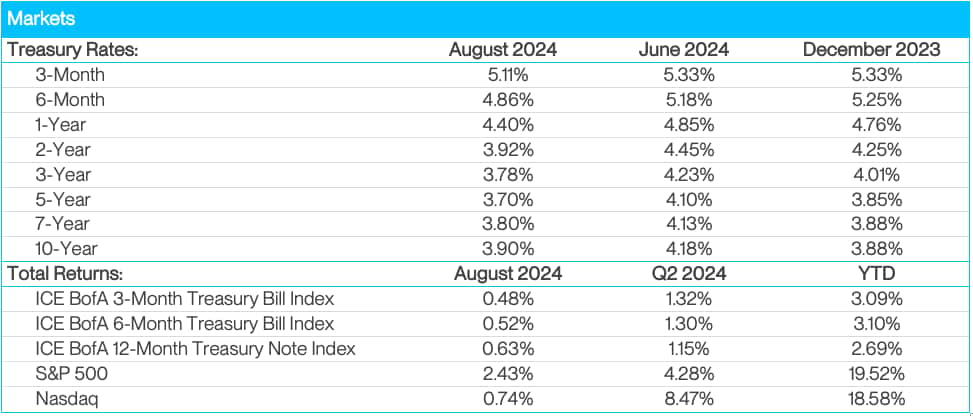

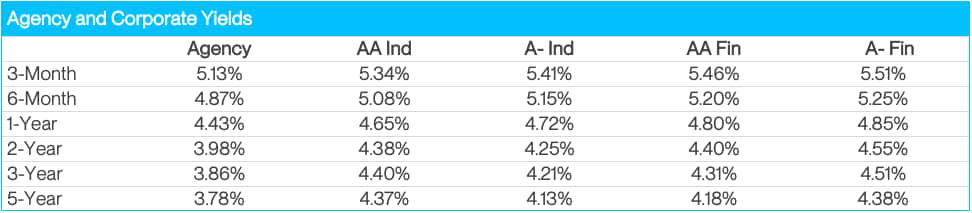

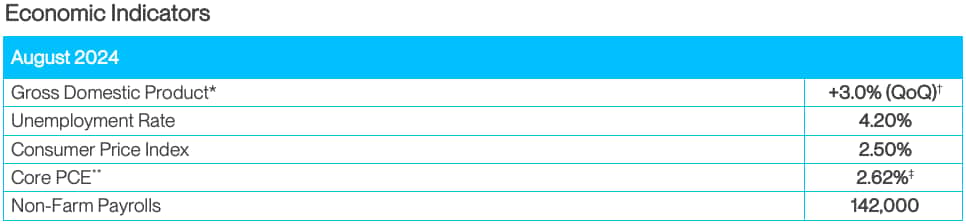

The silver lining of the recent “higher-for-longer” monetary policy era has been the attractive yields available to investors, especially at the short end of the curve. But now that the Federal Reserve is embarking on a new rate-cutting cycle, some investors may be wondering how this might affect their fixed income strategy going forward. For many, the inclusion of ABS may prove to be a worthy addition to portfolios.

What, exactly, are ABS? They are securities that are typically backed by a pool of income-generating assets or receivables, such as credit card receivables, home equity loans, student loans or auto loans. It’s a type of fixed income instrument, usually issued by banks or other lenders, but with different characteristics from conventional corporate bonds or US Treasuries. ABS are “secured” against a diversified pool of loans with similar characteristics, and they are backed by the assets of the borrowers, which can include accounts receivable, inventories or even royalties.

ABS have a unique creation process. In the simplest terms, a financial institution, typically a bank or lender, gathers a pool of assets — such as individual loans, leases or credit card debt — while also raising financing to issue ABS to investors. This is the process of securitization, and in effect it converts the underlying loans into an investible security. The ABS are backed by the future cash flows on the underlying assets. The yields on ABS will vary based on an array of factors, including the perceived risk or likelihood of collecting all future cash flows on the underlying assets. Many ABS have investor-friendly provisions that can help protect against loss — such as priority status of repayments or over-collateralization — making them suitable for a wide range of portfolios.

Guardrails for Investors

The individual loans that underlie ABS are typically illiquid and can’t be sold on their own. However, once pooled and securitized, they become liquid and are freely traded in the open market. Here, the ABS issuer (bank/finance company) will use a function called over-collateralization, which is used to offset the risk in the products, such as leases or credit card receivables. In this case, additional assets/loans are added to the security to cushion any potential capital losses due to defaults on the individual loans that are packaged in the security.

The purpose of over-collateralization is to increase the credit rating or the credit profile of the borrower collateralization — the bigger the cushion against any losses, the less risky the ABS security. Over-collateralization can come in many forms, though the most common are cash and accounts receivable/loans. The rule of thumb is 15%-20% of over-collateralization is needed to improve the credit profile, which in turn leads to higher credit ratings.

Why ABS?

The ABS sector represents about 5%-7% of the investment-grade market and has been around since the 1980s. This sector has been through several economic cycles, including the Great Financial Crisis (GFC) of 2008-2009, and remains a stable asset type that could offer multiple benefits to fixed income portfolios. It’s true that ABS are not like other bonds, and they require scrutiny and due diligence before inclusion in any portfolio. However, investing in ABS can provide access to different industries and sectors of the economy, and they can provide another way for investors to further diversify their fixed income portfolios. SVB Asset Management considers ABS in its portfolio strategies because the underlying assets collateralizing these securities offer another layer of protection compared to corporate bonds. There is not the same risk of an unexpected credit downgrade of ABS as there is with some corporate bonds.

It’s important to remember, however, that corporate bonds vs. ABS is not an either/or proposition. We see investing in ABS as an intriguing alternative (or supplement) to corporate bonds and a great way to further diversify your portfolio. ABS are a growing sector in the investment-grade universe, typically offering ample liquidity and high-quality issuers (such as John Deere, BMW, Mercedes-Benz, Toyota, Honda, J.P. Morgan, Bank of America, and Citi, to name a few). Finally, ABS can add insulation to a portfolio in times of increased market volatility as the security has a built-in cushion to protect the investor and enhance the average credit quality of the overall portfolio.

Credit vista: Safety in numbers

Tim Lee, CFA, Senior Credit Analyst

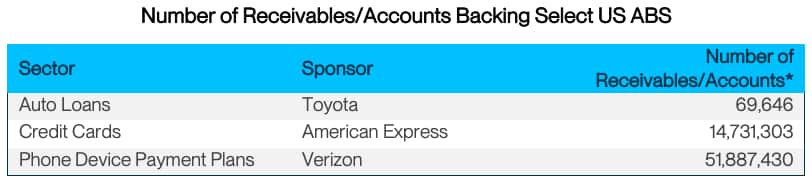

Short-term fixed income investors in US ABS have experienced very strong credit performance due, in part, to the diversification provided by the large pool of assets that back them. Compared to an investment in a standard corporate bond, which relies on repayment from a single source, ABS investors draw upon the financial power of tens of thousands — sometimes even millions — of individual obligors for repayment. Talk about diversifying risk!

This large number of obligations, when pooled together, generates a steadier stream of cash flow, and those that make payments as scheduled typically offset others who are late in paying or unable to pay. As a result, investors in highly rated US ABS can have a high degree of confidence that the credit risk in their investment is minimal.

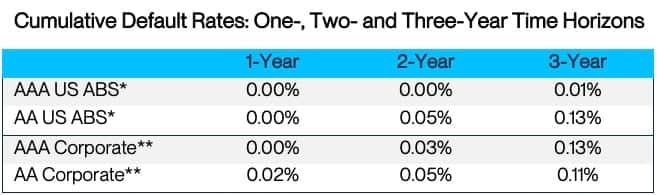

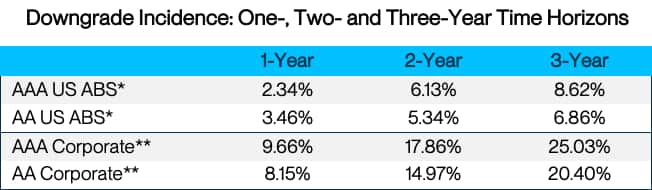

The proof is in the data. The above chart shows investments in AAA-rated US ABS have experienced a default rate of exactly zero over a one- and two-year time horizon and a paltry 0.01% default rate over a three-year time horizon. These results are from S&P data going back to 1983, which was near the time when ABS began appearing in US financial markets. Even ABS in the second-highest rating category, AA, faced zero defaults over a one-year period, while the default rate over a two-year period was 0.05% and just 0.13% over a three-year period. All this data suggests the relative safety of these investments.

In comparison, investors in AAA-rated corporate bonds also benefitted from zero defaults over a one-year period, though the default rate was 0.03% over a two-year period and 0.13% over a three-year period. This compares favorably to 0.00% and 0.01% for AAA-rated US ABS for the same time horizon. For AA-rated corporate bonds, the default rate was equivalent to AA-rated US ABS, with both averaging a default rate of 0.06% during a one-, two- and three-year horizon.

Ultimately, both highly rated ABS and corporate bonds have demonstrated admirable credit worthiness, but it is notable that credit volatility was substantially lower in ABS. The above chart shows that over a one-year period, over 96% of AAA- and AA-rated ABS did not experience a downgrade. Comparatively, the downgrade rate was four times higher for a AAA corporate at 9.66% vs. 2.34% for a AAA ABS during a one-year period. Over a two- and three-year period, the downgrade rate again favored ABS vs. corporates. Even at the lower AA-rating level, the downgrade rate was on average 2.7 times lower for ABS compared to corporates. This is not to say corporates are exceedingly risky, but rather to emphasize the rock-solid performance and credit profile of ABS.

Why do ABS investors enjoy such credit stability? No doubt it’s a reflection of the built-in credit enhancements inherent to the ABS asset class. The levels of subordination, excess spread, over-collateralization and other forms of credit protection have historically been many times higher than actual losses, leaving investors with large cushions against downgrades and defaults.

In the current economic environment that appears to be slowing, investors may be looking to diversify and lower the credit risk profiles of their fixed income portfolios. Looking ahead, we see the credit cushions among multiple ABS sectors as attractive features. Specifically, we highlight two principal sectors of the ABS world: credit cards and autos.

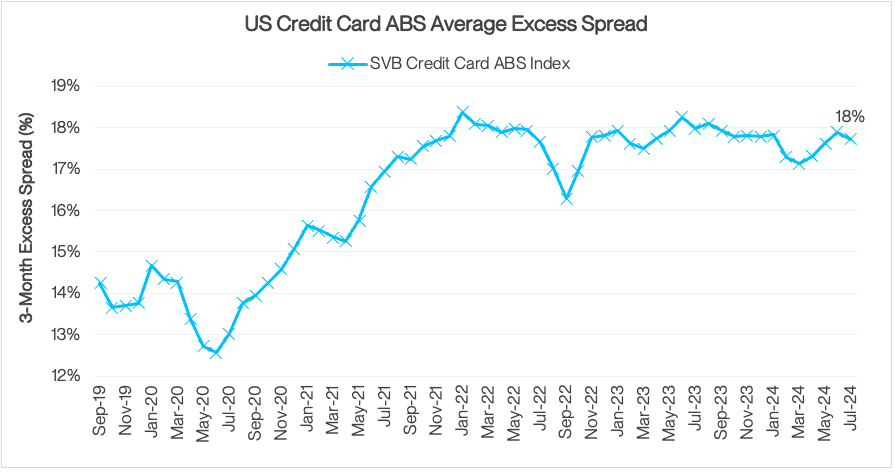

In US credit card ABS, excess spread, which is the amount of interest and fees collected after deducting for losses, remains healthy and above pre-pandemic levels. As of the July 2024 remittance month, the excess spread averaged 18%, based on SVB Asset Management’s US credit card ABS Index, which is composed of data from seven US credit card ABS trusts.

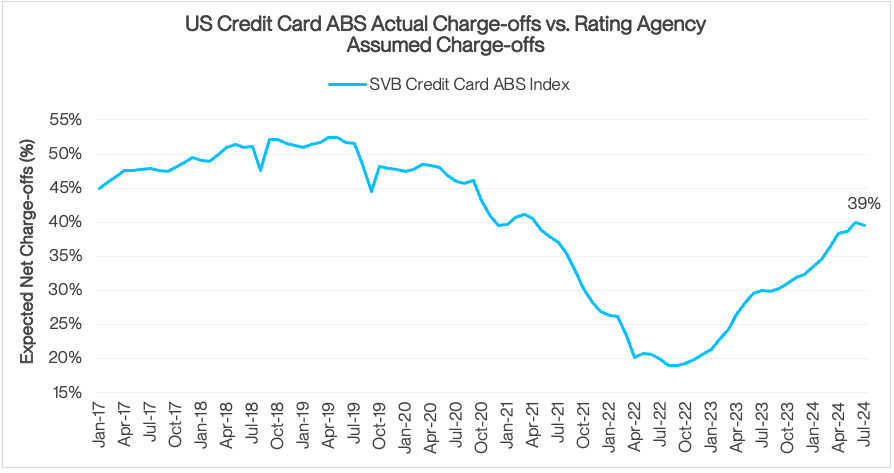

In part, credit health from elevated excess spread can be attributed to charge-offs that have averaged around half of assumed losses. As of July 2024, the average charge-off rate was 39% of the steady state charge-off rate expected by Fitch Ratings. Charge-off rates of US credit card ABS have been much lower than the Fed’s US charge-off rate for all bank credit cards, as US credit card ABS are generally backed by accounts that are more seasoned and have high FICO scores.

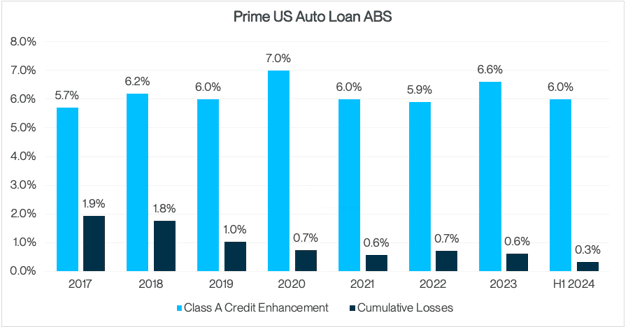

Actual losses for US auto loan ABS also have been well below the amount of credit protection provided to senior tranche investors. For US auto loan ABS transactions collateralized by prime loans that were issued from 2017 to 2021, cumulative losses averaged 1.2% compared to an average of 6.2% in loss protection provided. This simply means investors enjoyed a buffer of five times actual losses experienced.

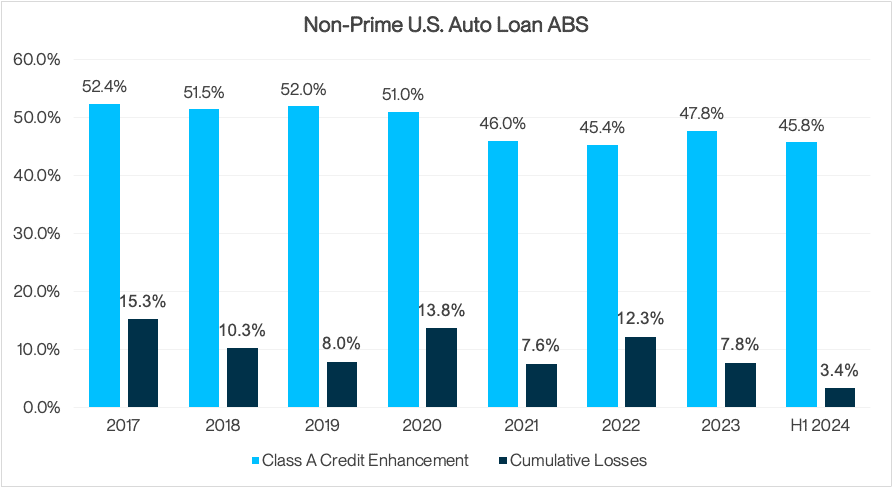

There was also a similar buffer of 4.6 times actual losses for US auto loan ABS transactions collateralized by non-prime loans that were issued from 2017 to 2021. These large buffers against losses have not only resulted in zero losses to investors in tranches of US auto loan ABS rated Aaa by Moody’s dating back to 2009, but also zero downgrades to those tranches by Moody’s. Investors in the second-highest Aa-rated tranches by Moody’s have also experienced zero losses, dating back to 2009, with 99.82% of those tranches having zero downgrades as well.

So what’s the key takeaway for us? The Fed has pivoted and now appears less worried about inflation and more concerned about the health of the economy. Thus, for investors concerned about the ability to continue capturing attractive yields in a declining rate environment while not taking on too much credit risk, ABS may be worth exploring. In fact, we expect US ABS will continue to be an attractive alternative for short-term investors, thanks largely to their unique and inherent diversification features. After all, there’s safety in numbers!