- The Fed appears content with the current inflation trajectory and is poised to embark on its long-awaited rate cut cycle to help boost a slowing economy.

- Investors are wondering how to position in this new era and whether it’s too late to move further out the yield curve.

- With history as our guide, duration is an investment portfolio’s friend when the Fed is cutting rates.

Economic Vista: New Cycle, New Strategy

Jon Schwartz, Portfolio Manager

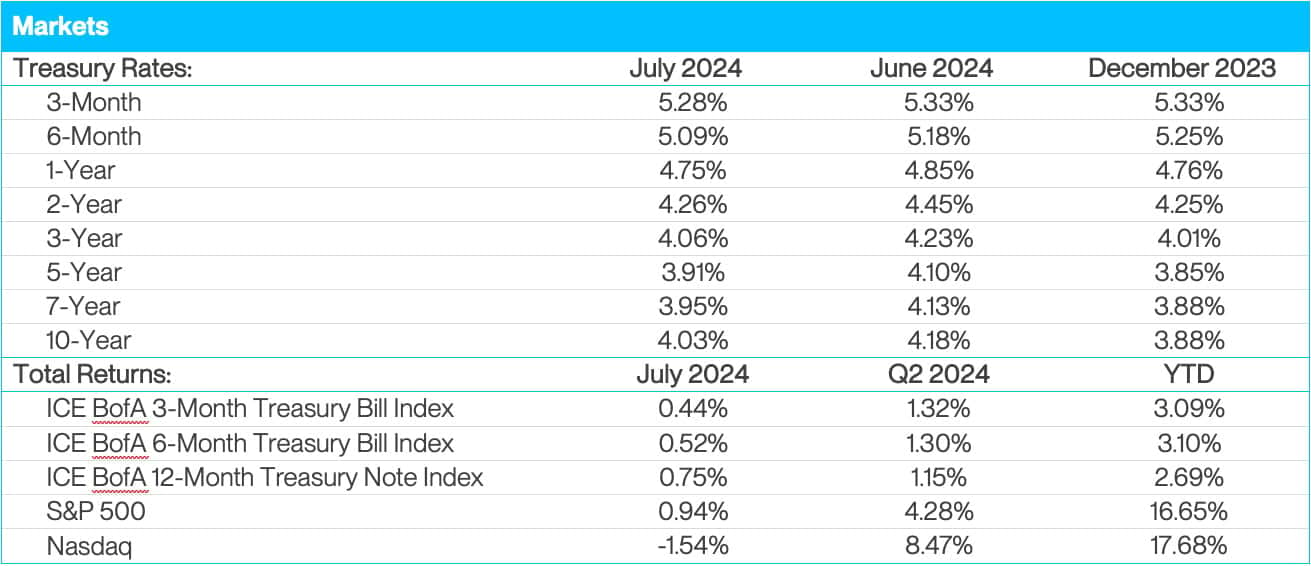

After scrutinizing endless reams of data and hotly debating the pros and cons of a more accommodative monetary policy, the Federal Reserve finally appears ready to end its higher-for-longer interest rate policy. A disappointing jobs report in July seemed to be the final straw, and as such it appears that the start of a new rate cut cycle is upon us. As the Fed readies its first fed funds rate cut since early 2020, we are often asked: What’s the best way forward to preserve and protect high-quality income for client investment portfolios?

For most, the subtext to this question is rather straightforward. Clients want to know if it’s too late to invest strategic cash further out along the yield curve. After all, the curve has already begun to price in up to five rate cuts for 2024 and an additional four more for 2025. Hasn’t the “get invested” ship already sailed? Although it’s true that short-term interest rates are well off their highs for the year, we might look at history to inform our views and answer that important question.

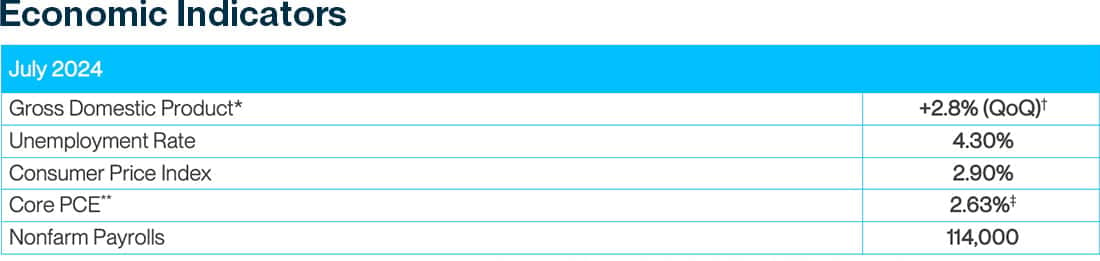

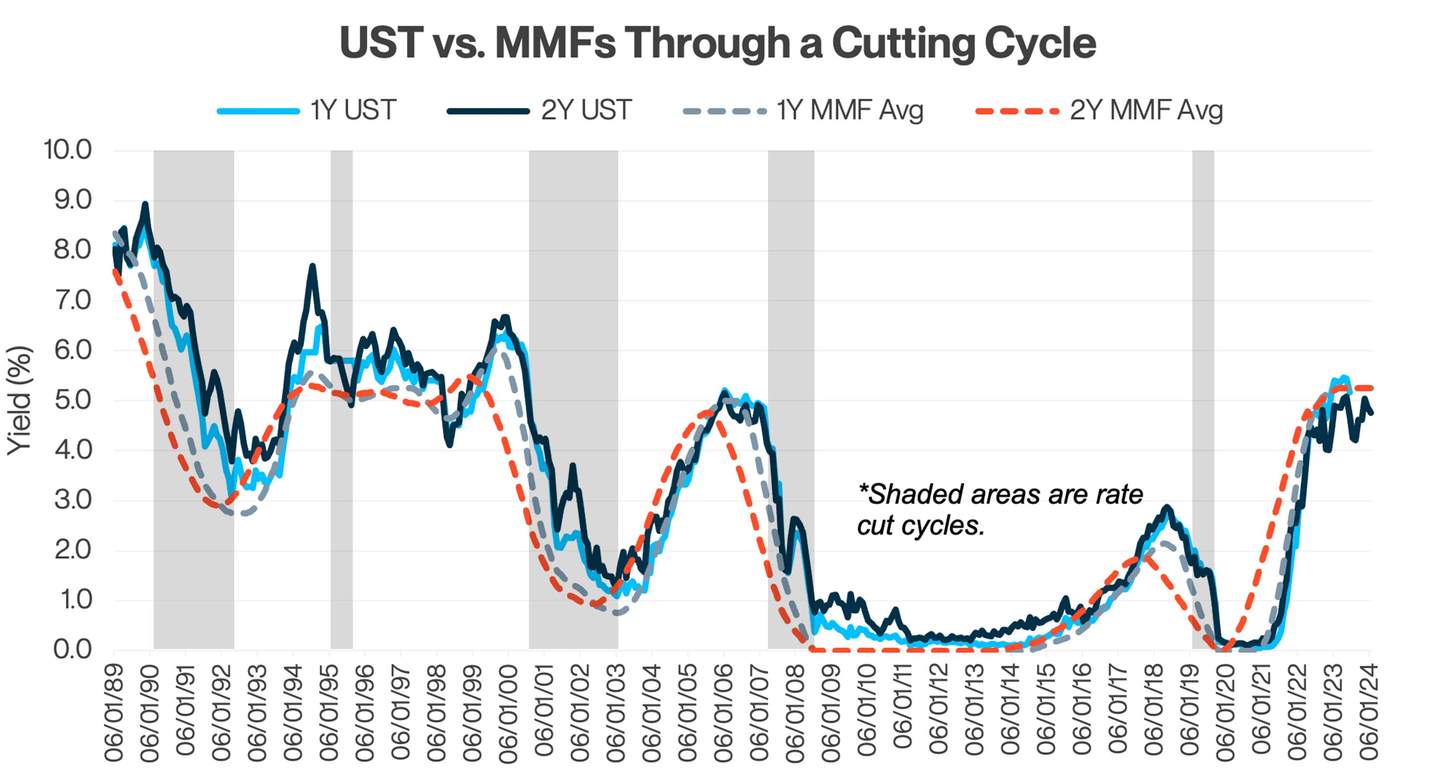

The graph below compares Treasuries to money market yields over the course of prior rate-cut cycles (the shaded areas) dating back to 1990. In each period, 1-year and 2-year US Treasury (UST) yields outperformed money market fund yields over the the next 12 and 24 month period.

Of course, nothing wins all the time, and the performance of money market funds during Fed tightening cycles bested many asset classes, including those with greater duration and increased sensitivity to rising interest rates. This was quite evident during the 2003 to 2006 hiking cycle, as well as the more recent 2020 to 2023 cycle. Cash (i.e., money market funds) was clearly the winner during these periods, which suggests the most optimized portfolio positioning would be to remain short on the yield curve. As rates rise, the yield earned by an investment portfolio would continue to grow. Now that we are getting an indication that the Fed may be cutting rates, duration extension helps preserve high income for investment portfolios as rates fall.

Positioning for the Future

The future path of monetary policy and the markets is uncertain—data dependent, as the Fed likes to say. That said, the recent messaging has been fairly clear. When Chairman Powell opined about the future path of the fed funds rate in December 2023, he stated that the FOMC had “done enough” and that “rate increases were not the base case anymore.”

Looking back, it’s clear that the market reacted to these comments at the beginning of 2024 by pricing in a significant number of rate cuts to be delivered in the first half of this year. But as we all know, those cuts did not materialize as many had hoped. There’s no doubt that the Fed wanted to be absolutely sure that the fight against inflation was won before pivoting their stance.

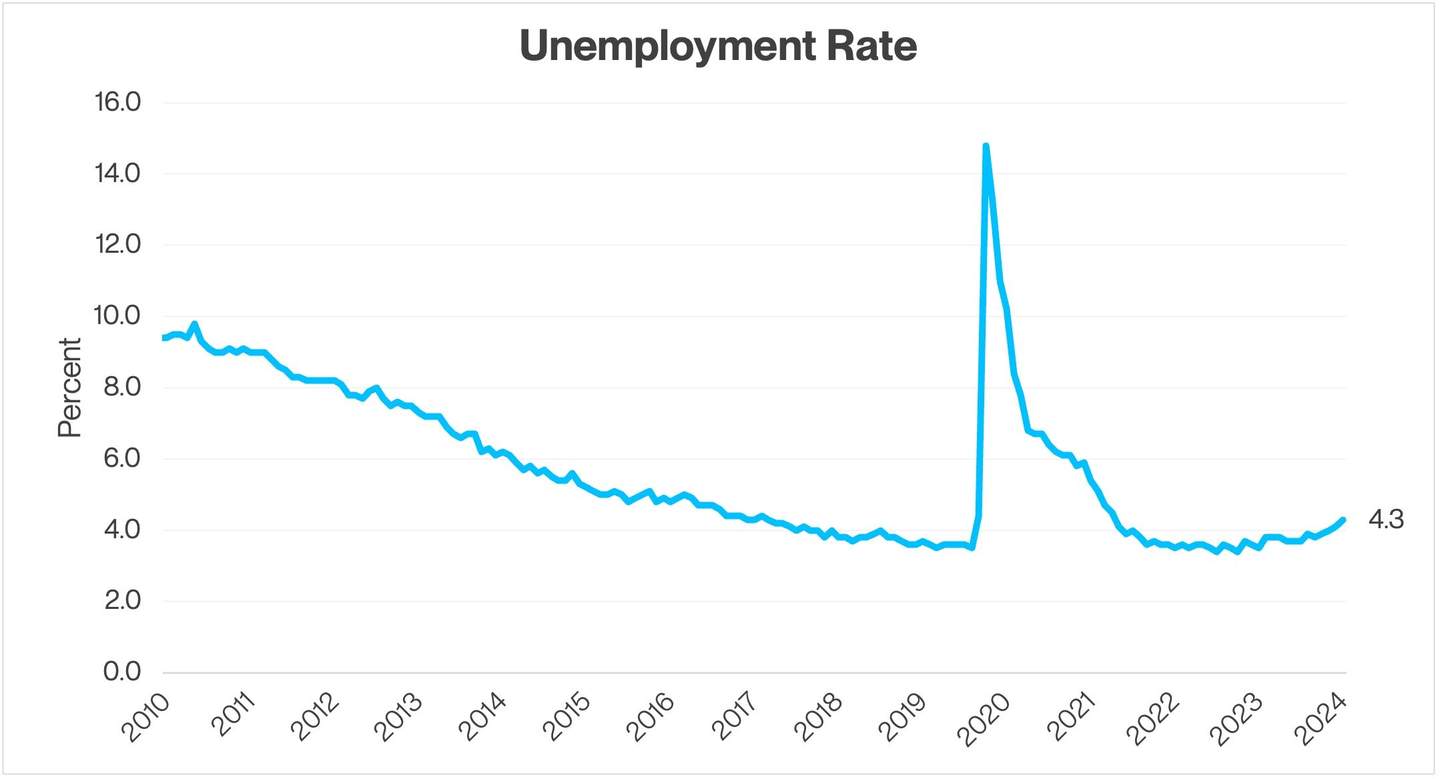

Fast forward to today—we’ve seen several good months of taming inflation, and the messaging from the Fed has aligned with the market’s view that September is likely an appropriate time for rate cuts. This was articulated by Chairman Powell on July 15 when he stated, “Now that inflation has come down and the labor market has indeed cooled off, we’re going to be looking at both mandates – they’re in much better balance.” As a result, the Fed can now point to both looser labor conditions and inflation trending towards the Fed’s 2% target as reasons to ease monetary policy. The unemployment rate has trended higher recently, any further deterioration could easily push the Fed to greater levels of accommodation than currently projected.

We can never operate with certainty on the path of interest rates in the future. The recent commentary of the Fed highlights that policy path should be gauged on improving inflation and a slowing employment outlook. This suggests the Fed’s next move is likely towards easier monetary policy. If you remotely believe this could be the case, studying history can shed light on the right strategic positioning for institutional investment portfolios. If a company’s liquidity needs can support adding duration, even if it’s very low risk 1- or 2-year US Treasuries, these investments have significantly outperformed money market funds in all of the recent fed funds rate cutting cycles. As always, your SVB Asset Management representatives are available to help you dial in the right strategy and portfolio mix that is suitable for your company’s goals.

Trading Vista: Fewer Jobs, Lower Yields

Jason Graveley, Senior Manager, Fixed Income Trading

Just a short month ago we wrote that probabilities were favoring a rate cut in September and Treasuries were gradually recalibrating from recent highs. In retrospect, perhaps gradually was the wrong word?

Looking back, the 2-year Treasury yield closed at over 5% in May, and investors undoubtedly miss those lofty rates and calm days. July and August offered a divergence and more shock therapy for market participants. Yields retreated quickly as the summer progressed and the narrative shifted amid greater economic uncertainty and a more turbulent undertone. This created several potential monetary policy paths, and the subsequent speculation and uncertainty fueled large market swings and volatility.

For some time now, September had been identified as the most likely month for the first rate cut, with probabilities firmly set on a modest 25-basis point (bps) move. The market was also suggesting that further rate cuts of 25 bps were under consideration at each of the November and December FOMC meetings. But as July ended, there was suddenly more chatter about an “emergency” reduction in the fed funds rate before the next meeting. Such cuts are extremely rare and even considered extreme, and the mere fact that it became a point of discussion is noteworthy. What happened to change the narrative?

This time, inflation was not the culprit. In fact, there has been growing confidence that inflation will continue to trend toward the Fed’s 2% target, which has left an outsized focus on the other side of the Fed’s dual mandate: the labor market. Although Chairman Powell’s press conference after the July FOMC meeting stoked widespread Treasury buying (incidentally the same week where some of his other comments also moved the market), it was the July payroll report that stunned the market and proved to be the catalyst for the swift rate repricing.

New job creation vastly underwhelmed the market, although the details of the report were widely considered less worrisome than the headline number. Regardless, sentiment shifted immediately as investors suddenly debated whether the Fed had left rates higher-for-too-long, and there was an immediate rush into the safe haven of Treasuries and out of the perceived riskier equities. The VIX index, a key measure of the expected volatility in the stock market, jumped to its highest level since the start of the Covid-19 pandemic in 2020.

Of course, it’s impossible to draw any definitive economic conclusions from one unemployment report, but the latest reading was enough to spark widespread anxiety. The 2-year Treasury note, the point considered most sensitive to changes in monetary policy, has moved lower throughout July. After starting the month at 4.75%, yields on the 2-year Treasury note closed at a yearly low of 3.88% in the first week of August. Moreover, the market has moved to price in more than four rate cuts through the remainder of 2024, while probabilities show that expectations are now set for a 50-bps cut in September.

Where to from here? Nobody truly knows, but remember, one soft jobs report does not make a trend. Although the data points to a deceleration in economic activity, it isn’t suggesting imminent disaster. There’s much more data coming soon, and we’ll be watching closely for clues on how best to position.