- Credit spreads represent the additional yield compensation that investors receive for taking on added risk above and beyond benchmark fixed income yields, such as Treasuries.

- Although today’s credit spreads are relatively tight by historical comparisons, we think that all-in yields for high quality corporate bonds remain attractive.

- Fundamental research is key when selecting quality corporate bonds, which we believe can continue to enhance diversified fixed income portfolios.

Economic vista: Look at that spread

Steve Johnson, CFA, Portfolio Manager

It goes without saying that fixed income investors are always hungry for incremental yield. But as we head toward Thanksgiving and into year-end, we wonder if the table is set for investors to achieve that goal. Let’s look at the current environment and, specifically, the credit spreads available to investors today. Is it still worth it?

Credit spreads represent the additional yield that credit investors receive above and beyond benchmark fixed income yields, such as those on Treasury securities. Put simply, this additional yield spread, which is often expressed in basis points (bps), is needed to compensate investors for the additional risk they are taking versus simply buying typically low-risk government bonds. After all, a corporate bond buyer is simply lending funds to the issuer and should be paid based on the credit worthiness (or lack thereof) of the borrower. The higher the perceived risk, the greater the compensation and wider the spread.

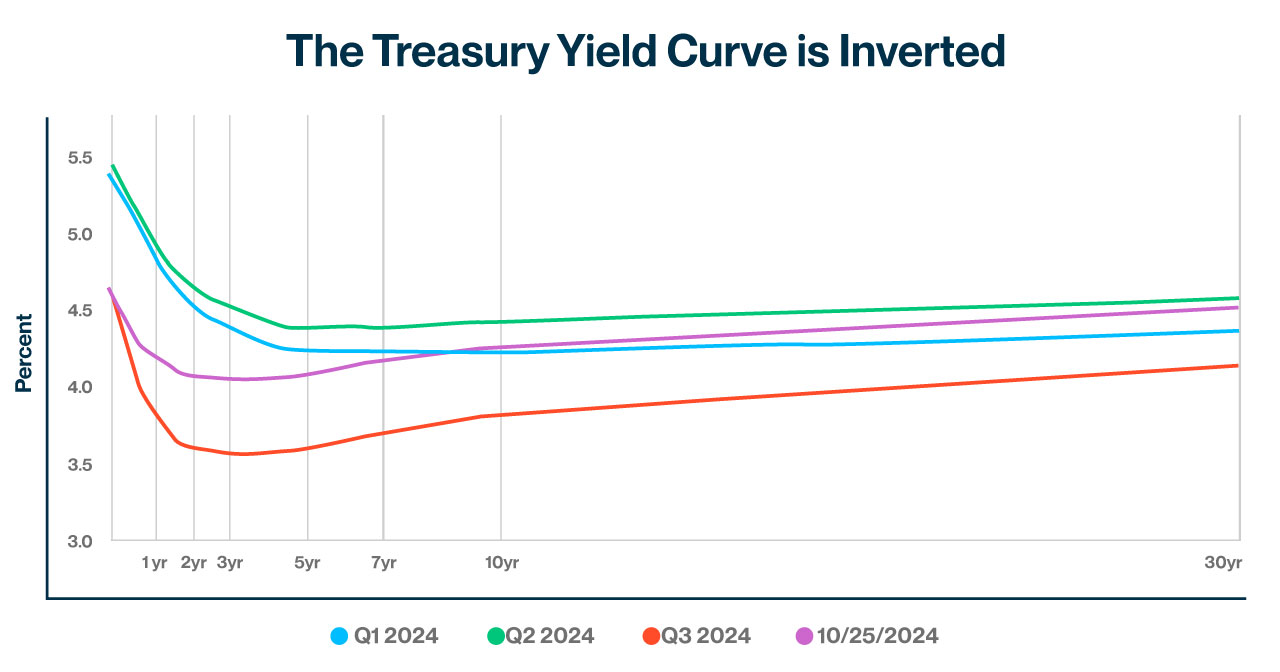

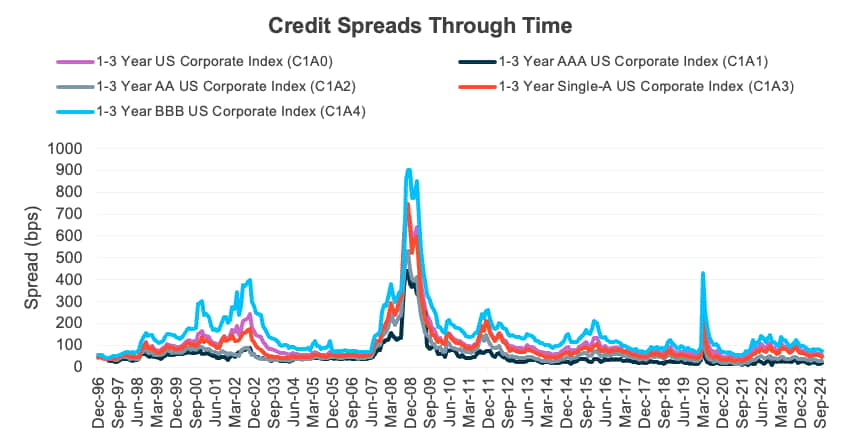

Both macro and micro factors can impact credit spreads. Recently, given the strong financial position of many well-run companies and the resiliency of the U.S. economy, investment-grade (IG) credit spreads have narrowed significantly. In addition, with the Federal Reserve having taken their policy rate to a 23-year high (before the most recent rate cuts), the market dynamics were fueling an elevated interest in short duration fixed income as an asset class. In turn, this was further increasing demand and compressing credit spreads. So, what does all this mean, and how should investors adjust, if at all?

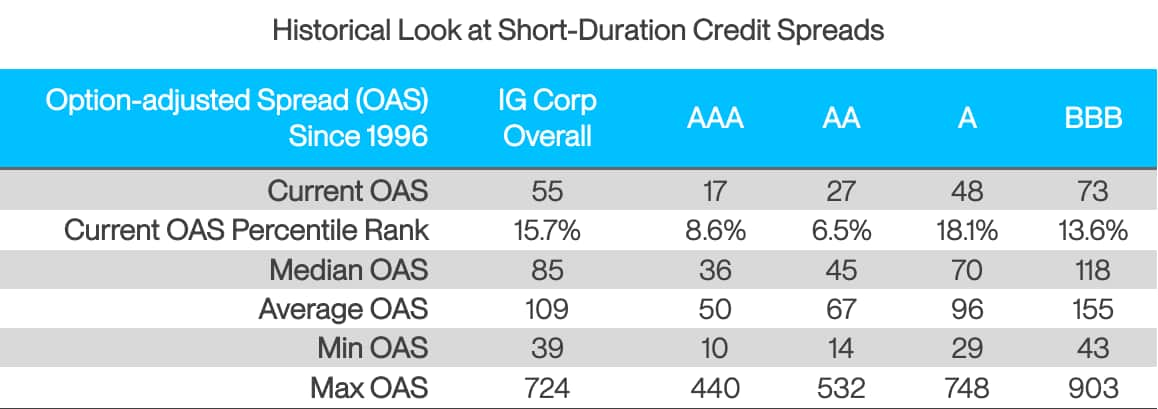

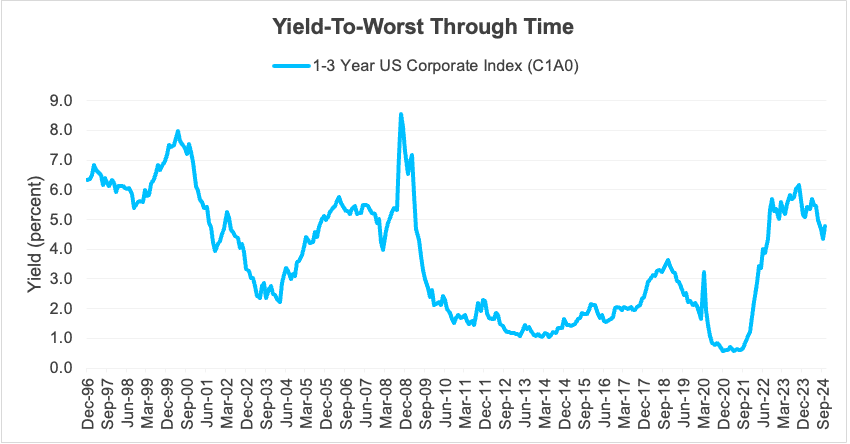

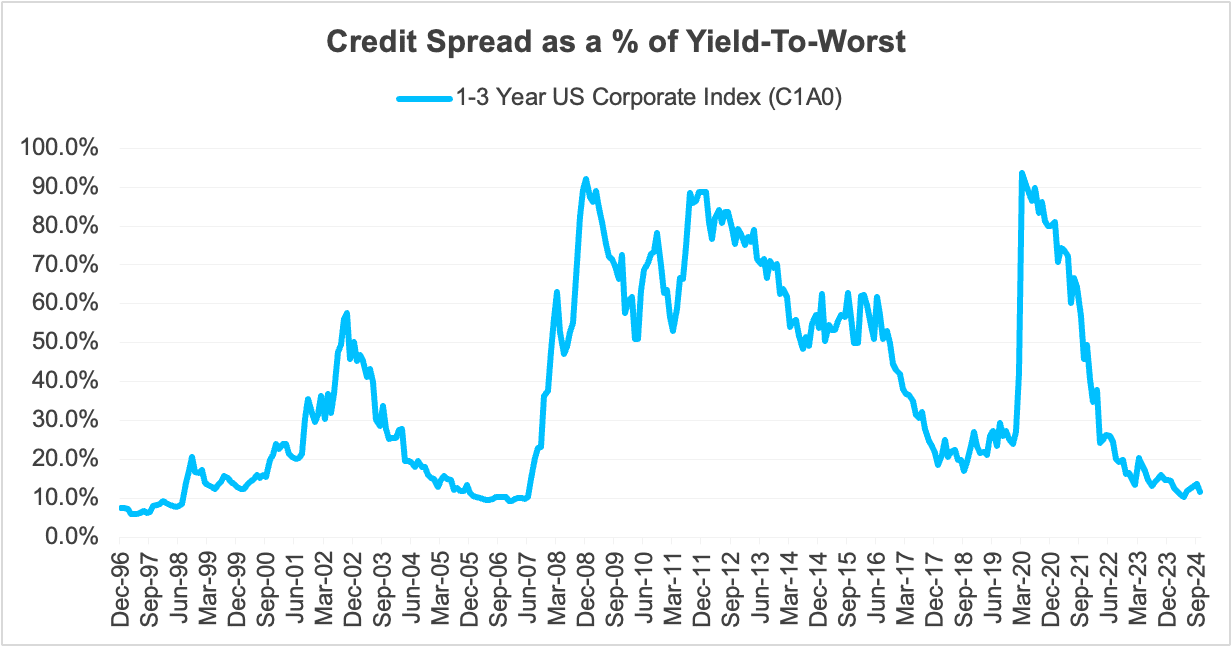

First, let’s look at the current situation. Short duration IG credit spreads sit at the tightest level since December 2021[1]. While history shows spreads could tighten further, current option-adjusted spreads are in the bottom quintile or decile, depending on the credit rating spectrum, and spreads remain firmly below median ranges since the mid-1990s.

Source: ICE, Bloomberg; data from 12/31/1996 to 10/31/2024.

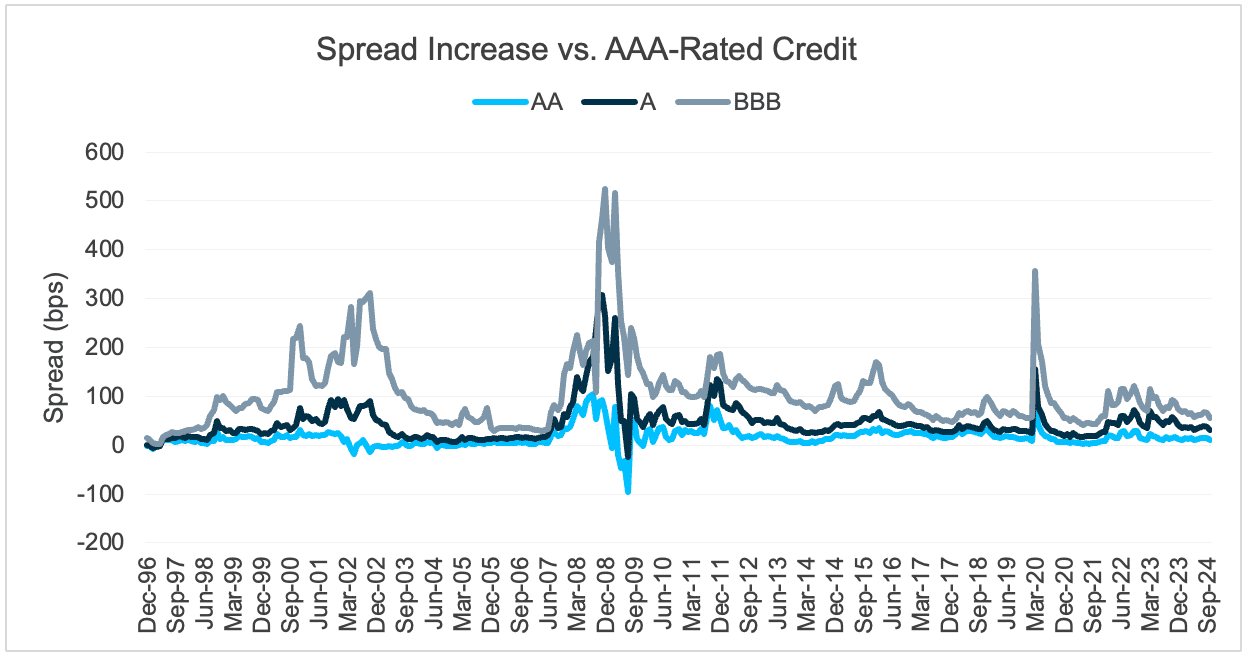

As further evidence of strong macro and micro fundamentals, along with robust demand, the spread compression between corporate securities rated AAA and those of lower quality has narrowed. Clearly, the market feels pretty good about the economy and corporate profits.

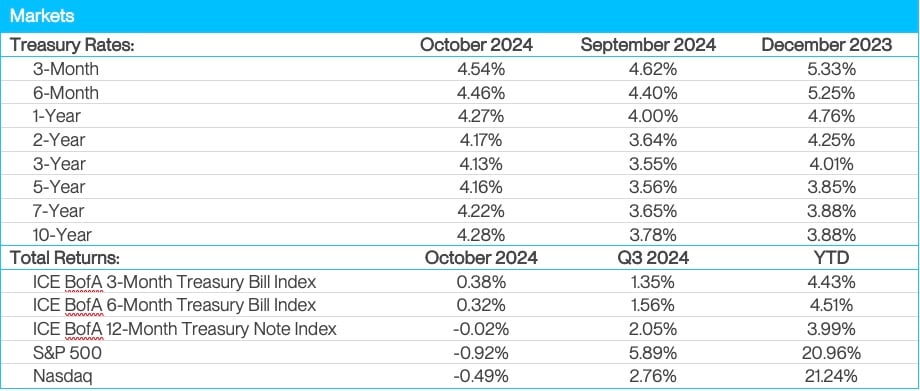

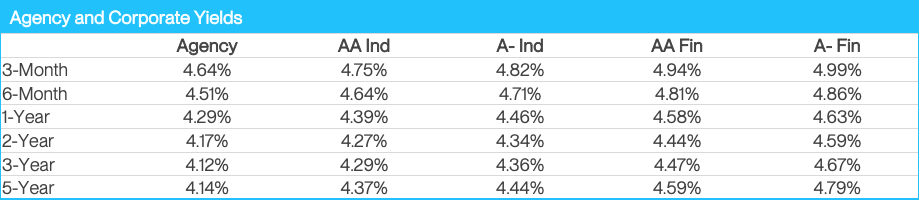

Of course, bond investors also care about all-in yields for corporate securities, which represent the total yield earned when combining both the credit spread and the benchmark yield. On that front, investors have enjoyed multi-decade highs for front-end yields in recent years. Despite the kick-off of the Fed’s new rate-cutting campaign, all-in corporate yields sit at levels not seen since the aftermath of the global financial crisis.

Source: ICE, Bloomberg; data as of 10/31/2024.

However, the key difference today is the narrowness of credit spreads and their proportion of all-in yields. For example, today the IG Corporate Index all-in yield is approximately 4.78%. To find a higher all-in yield in the pre-COVID era, we must look all the way back to April of 2009, when the index yielded 5.86%. Unlike today, that 5.86% yield was inclusive of a 496-bps credit spread, nearly 85% of the total yield. Today’s 4.78% index yield in comparison, was inclusive of a 55-bps credit spread, only 11.5% of the total yield. Credit spreads are a much smaller part of the total yield compensation that IG investors are receiving today. In fact, it’s as small of a yield proportion since just prior to the global financial crisis.

So where does all this leave us, and why does it matter for fixed income investors? Clearly, the overall corporate bond yield picture is much improved versus the near-zero interest rates of the 2010s. That said, the compensation required by IG corporate bond investors has been reduced significantly, as measured by both overall credit spreads and the proportion of total corporate bond yield that credit spreads represent.

We certainly don’t think investors should give up on corporate credit, even in this tight-spread environment. However, we do believe that investors should be patient and selective when it comes to corporate bond opportunities. While strong macro and micro fundamentals underpin IG corporate bonds, yield spreads and compression of yield spreads among different ratings tiers sit near the bottom end of historical ranges. Thus, keen security selection, patience, and cross-sector comparison with other spread products, including asset-backed securities, take on continued importance.

Trading vista: Tough talk ahead

Jason Graveley, Senior Manager, Fixed Income Trading

Two days after the presidential election, the November Federal Open Market Committee (FOMC) meeting concluded with a 25-bps rate cut. It had been an eventful couple of days, and fixed income investors had been paying close attention. The move was widely anticipated and priced into markets, but the expectations of monetary policy and the pace at which the Federal Reserve moves to neutral will be debated post-election. After all, markets still remember the contentious rhetoric surrounding monetary policy during the previous Trump Presidency, and that’s likely to shape the yield curve to some degree going forward. One post from Trump in 2019 summarizes his view at the time: “Jay Powell and the Federal Reserve Fail Again. No guts, no sense, no vision!” (Note: Trump nominated Chairman Powell to replace Janet Yellen in 2017.)

There is some irony in the fact that the election and November FOMC happened almost simultaneously. Is it foreshadowing for how linked these entities might become, particularly since President-elect Trump continues to believe he should have influence over Fed policy? No doubt the independence of the Fed will remain a headline topic, as the president-elect has asserted that he has “better instincts” than many members of the FOMC (in his opinion, of course). President Trump’s prior attacks on the Fed during his first term broke with decades of precedent in which the president avoided direct criticism of the central bank. Given that history, it’s worth taking a look at the market’s base case for how this is expected to evolve or devolve.

Central bank independence is considered a bedrock of modern economics, a necessary separation of powers between the branches of government. In April, The Wall Street Journal reported that a group of Trump allies were drafting proposals in which the president “… should be consulted on interest-rate decisions, and the draft document recommends subjecting Fed regulations to White House review and more forcefully using the Treasury Department as a check on the central bank.” Markets haven’t bought into much of this premise, and it would be a difficult conflict of interest to navigate, given the link between Trump’s businesses, interest rates and short-term politics.

That said, President-elect Trump is likely to push for lower interest rates to spur growth, juice market returns and reinvigorate a lackluster real estate market. However, the Fed’s likely preference for a more gradual path to changing monetary policy will likely spark criticism from the executive branch, which is why Chairman Powell was asked point-blank if he would resign if asked by President Trump. He replied with a resounding “No.”

What’s the key takeaway? We believe the most likely outcome is that President-elect Trump will pressure the Fed to cut interest rates aggressively, similar to his first term. For the moment, this isn’t likely to have an immediate effect on the trajectory of interest rates since the market still expects rates to move lower over the short term. Of course, this is subject to change as expectations can and do shift. It’s also notable that the Fed chairman’s term ends May 2026, so we know this union has an expiration date. Stay tuned to see if tough talk from the president-elect can move the needle on interest rate policy.

Additional resources: : Trump Allies Draw Up Plans to Blunt Fed’s Independence - WSJ; Trump rails against Powell a day after Fed cuts rates again

Source: Bloomberg and Silicon Valley Bank as of 10/31/2024.

Source: Bloomberg and Silicon Valley Bank as of 10/25/2024.