- Some investors question if they need to develop a formal Investment Policy Statement (IPS), but in our experience it’s an invaluable document with many benefits.

- Safety of principal and liquidity should be the top two objectives of any IPS, and those should always be emphasized over total returns.

- An IPS is not a static document. It should be revisited periodically, and evolving company needs may dictate adjustments.

Economic Vista: The ABCs of an IPS

Christi Fletcher, Senior Portfolio Manager

Just think how much the investment landscape has changed over the past several years. We’ve gone from an era of cheap money punctuated by zero-bound interest rates to a fed funds rate hovering at a range of 5.25% to 5.50%. Along the way we’ve experienced bouts of extreme volatility, an inverted yield curve, and numerous other “unusual” challenges. It certainly hasn’t been an easy time for treasury departments, and it’s unlikely to get much easier going forward. Fortunately, a well-crafted Investment Policy Statement (IPS) can be an invaluable document that provides guardrails in changing times. With that in mind, we wanted to share some tips on creating this important document.

What’s the point?

Some investors may wonder if they should invest the time to develop a formal IPS. The unequivocal answer, in our opinion, is YES! The purpose of an IPS is to set general guidelines and define the investment objectives for a company’s short-term cash reserves. The policy can be used as a reference tool by Treasury, the internal audit committee, and investment managers. A well written IPS is typically organized in sections that cover three key topics: Objectives, Roles & Responsibilities, and Investment Guidelines. Let’s look at these three components in more detail:

- Objectives: The IPS should clearly list the company’s primary objectives when investing excess cash, and it should cover three distinct categories:

- Safety: Safety of principal should be the foremost objective of the investment program. Although there is no such thing as zero risk, investments should be selected to ensure the preservation of capital above all else. Stretching for incremental yield has been the undoing of many.

- Liquidity: When developing an investment program for short-term reserves, the portfolio must remain liquid enough to meet anticipated cash needs. Thus, allocations should be managed in a way that investment cash flows meet or exceed near-term projected liquidity requirements.

- Return: The investment portfolio should be designed with a goal of attaining a reasonable market rate of return throughout the economic cycle, though we emphasize that safety and liquidity are always priorities over yield/return.

- Roles and Responsibilities: The company’s Board of Directors, CEO, CFO, or an appropriate designated individual should be responsible for reviewing and documenting the company’s near-term cash flow requirements. This will subsequently determine the amount of liquidity necessary for working capital, and ultimately the choice of investments. Any excess funds can be invested in a managed portfolio of fixed income securities, but within a carefully defined set of risk parameters. The IPS should also define which individual(s) will maintain oversight of the investment program. Someone must be responsible for compliance with the IPS.

- Investment Guidelines: In addition to overall objectives and responsibilities, the IPS should provide more granular details on how the company’s investment portfolio may be invested. An Investment Officer might impose additional requirements and restrictions to ensure that safety and liquidity parameters are maintained at all times. Among other items, an IPS may cover the following criteria:

- Authorized Instruments: Include a list of permitted investment types, likely restricted to those denominated in USD, along with a brief definition of each eligible asset type.

- Credit Quality: What is the minimum credit rating allowed for securities rated by the NRSRO’s (Moody’s, S&P and Fitch). You may want to consider distinguishing between short- and long-term ratings.

- Liquidity and Diversification: The funds should be diversified to avoid incurring unreasonable risks from overinvesting in specific instruments or maturities. This could include stated maximum percentages of funds allocated to any single security (or asset type), based on the AUM in the portfolio.

- Maturity and Portfolio Duration: Typically, a portfolio’s maximum maturity will be based on the company’s liquidity requirements and asset types. Stating a maximum maturity will also help dictate the duration of the portfolio, which is the average tenor of all holdings. Having maturity and duration guardrails can help structure the portfolio in an appropriate manner that still ensures sufficient cash is available to meet anticipated liquidity needs.

- Security Downgrade: In the event a security held in the portfolio is downgraded below the minimum required credit rating, what is the appropriate action? You may want to mandate that the company be notified with a recommended action for the security in question within two business days of the downgrade event.

- Reporting and Performance Measurement: Finally, the Investment Manager should be required to provide the complete list of securities held, amortized book value, maturity date, current market value, credit ratings, and other features deemed relevant on a monthly basis. It is also wise to stipulate regular meetings with the Investment Manager to review the performance of the portfolio versus an appropriate benchmark.

We understand that developing an IPS is no small task, but it’s an important tool with many uses and benefits. This policy document can and should be modified as the company evolves or becomes more complex. For example, expanding the eligible asset types or shifting to a longer average duration are things that may make sense under the right circumstances. And if history has taught us anything, circumstances can and do change, sometimes unexpectedly.

Trading Vista: Changing Expectations

Jason Graveley, Senior Manager, Fixed Income Trading

Think back to the many pivots the Federal Reserve has made over the last two years. Remember when committee members were suggesting that inflation was “transitory?”’ That was a miss, and so were numerous other interest rate projections from market pundits. In fact, it seems like the market has regularly been off target when trying to anticipate changes in monetary policy and the path of future rates. Did history just repeat?

Despite assertions by the Fed that it was taking a wait-and-see approach and that any future moves would be subject to the longer-run effects of the recent tightening cycle, markets were intent on pricing in more than six rate cuts for 2024, according to the fed funds futures earlier this year. Meanwhile, some individual investment firms were even more aggressive, publishing forecasts with an upward bound of 11 rate cuts this year.

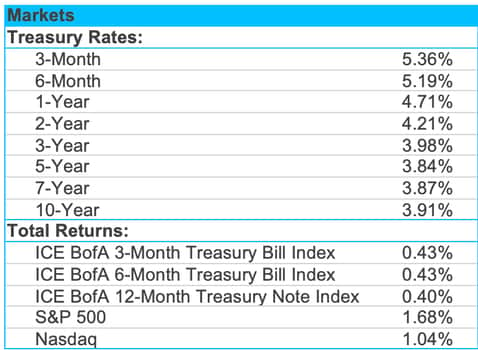

Nevertheless, expectations shifted quickly in early February after employment data surprised to the upside and Chairman Powell made a rare prime time TV appearance to emphasize the unlikelihood of a March rate cut. In the interview, Chairman Powell stressed prudence and noted that the Federal Reserve wanted to see the “data confirm that inflation is moving down to 2% in a sustainable way.” In response to these comments and the recent robust employment data, yields have been moving higher, with the 2-year Treasury note rising 25 basis points in the last week. This effectively removed the March rate cut out of its pricing. With a March cut now off the table, expectations have shifted to May and June, where futures probabilities are currently showing an almost 50/50 split in rate cut expectations. Indeed, it appears that the market had gotten a bit ahead of itself.

While the Treasury curve remains volatile, investor demand for credit is not waning. Using the Bloomberg US Corporate 1-3 Year Index as an example, credit spreads have continued an unrelenting march tighter to begin the year. In fact, spreads have tightened to the within the multi-year lows seen before the regional banking crisis of last March. Meanwhile, money market fund assets under management continue to grow and balances there remain over $6 trillion. A common expectation is that a portion of this money will rotate into other asset classes when the Fed's timeline for rate cuts becomes clearer. Many are expecting dividend-paying equities or other fixed income asset classes to benefit, and this could serve as a catalyst for additional tightening bias.

New credit supply is doing its best to keep up, but even record issuance hasn’t been enough meet such robust demand. January saw the largest monthly volume in investment-grade issuance since 2017, with more than $188 billion coming to market. And while it’s all types of issuers that are finding liquidity depth, non-financial deals tend to attract the most interest given the smaller deal sizes. Generally, it is cheaper to buy directly from a company issuing since they historically need to attract direct investment in large sizes, but that concession is shrinking as more investors line up for such opportunities. Is it any surprise why more buyers looking to lock-in yields? The forward Treasury curve currently shows that at this time next year, the 2-year Treasury is expected to be below 4%. Of course, the data and the Fed may have something to say about that, but for now putting money to work seems like a good plan.