- There are countless third parties eager to help companies with their cash management needs. Yet you need to choose wisely, especially since prudent cash management can potentially make or break an innovative company.

- Take the time to formally prioritize objectives, and then look for a collaborative manager whose philosophy and style are aligned with your company’s goals.

- In the end, consider a Registered Investment Adviser (RIA), who is bound to act as your fiduciary.

This month’s main article, Cash Management—The Paradox of Choice, recognizes that as part of the broader treasury function, investing corporate cash balances is a complex process that can benefit from dedicated expertise and resources in a dynamic investment environment. To meet their investment objectives, stakeholders should consider a few key questions when selecting an external professional investment manager.

Also included are the following themes:

- Credit Vista: Pool party—State of asset-backed securities

- Trading Vista: On to the next worry

Economic Vista: Cash management—The paradox of choice

The global asset management industry is an enormous $126 trillion industry and has doubled in size in the past 10 years. Despite the occasional bouts of turmoil, this strong growth has led to the formation of countless new boutique firms, while at the same time large managers have been acquisitive and become even larger in an effort to combat shrinking margins. While clients have access to a wide array of possible third-party asset managers, their needs have also become more specialized, particularly in corporate cash management and the fixed income space. As a result, finding the right fit has become more important—and more challenging—than ever.

It certainly doesn’t help matters that corporate cash management is often overlooked. As treasury officers are accountable for an expansive list of tasks, investment of excess cash is sometimes on the bottom of their list. Going with the status quo is fine, until it isn’t. Rapid and substantial changes to monetary policy, as well as the growing complexity of fixed income markets, makes it imperative to invest the time to appoint the right fiduciary corporate cash asset manager. With that in mind, below are a few important considerations, and by extension some of the reasons we believe SVB Asset Management fits into the picture.

Prioritization of Objectives and Clientele

For starters, it is important to have clearly defined key objectives for cash management, not just loose ideas. These funds are the lifeblood of your business and while pivotal for the day-to-day aspects like payroll, are also needed for executing broader business strategies, such as expansions or acquisitions. Prudent cash management will influence the ultimate success of any company, especially for pre-revenue and high-cash-burn companies in their formative years. More than one company with a brilliant idea has been undone by mismanaging its cash reserves.

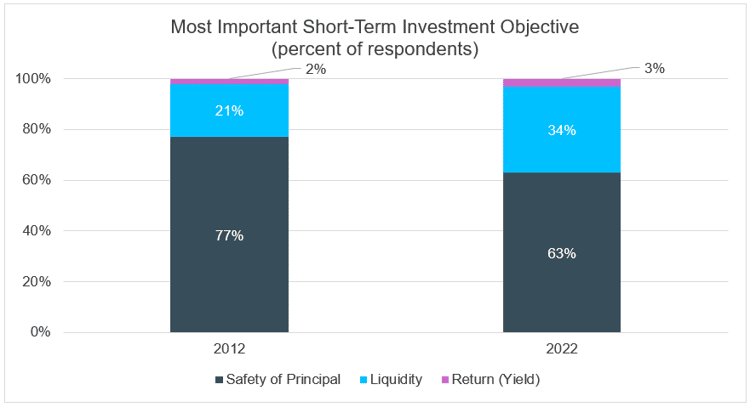

We believe that objectives should be prioritized in order of preservation of capital, liquidity, and yield. As the below chart illustrates, safety of principal should far outweigh the ambition of slightly higher incremental return for short-term strategies. Don’t fall prey to attractive headline yields. If it sounds too good to be true, it probably is. After all, the safety of the portfolio takes precedence in supporting the business, rather than simply trying to grab a few extra basis points to generate a more attractive short-term return.

Source: 2022 AFP (Association for Financial Professionals) Liquidity Survey, Underwritten by Invesco 2022 AFP Liquidity Survey: Short-Term Investing in Turbulent Times (afponline.org)

Source: 2022 AFP (Association for Financial Professionals) Liquidity Survey, Underwritten by Invesco 2022 AFP Liquidity Survey: Short-Term Investing in Turbulent Times (afponline.org)

When selecting an investment manager, it is critical that the manager’s philosophy and style should be clear and aligned with your company’s goals. An overly aggressive approach may not be appropriate for a company with an uncertain runway for future capital raises. Also, the general clientele profile of the investment manager might also be worth considering. For example, SVB Asset Management manages portfolios for the innovation economy, which enables an innovative company to access best practices within its peer group. This industry knowledge should not be overlooked. In contrast, if the asset manager has no clients in your industry or sector, that might be a red flag of sorts.

Risk Management

In addition to aligning interests, risk should be on the forefront of any analysis of investment managers. It is important to acknowledge that eliminating all risk is not a realistic objective. Rather, the goal should be to identify risks and manage them appropriately. As a corporate client, compiling a list of concerns, questions and vulnerabilities is vital, and working collaboratively with the investment manager to address these issues serves as a mechanism to being proactive in tackling risks. When exploring these risks, recognize how the manager responds and if risk management programs are an essential pillar of their business.

We believe that operational transparency is one central component to risk management. For example, does the manager provide an easily accessible accounting system that displays transactions or reports? Effortlessly accessing portfolio data can swiftly address audit requests or board inquiries.

Credit risk is another area that must also be examined. Does the asset manager have a dedicated and experienced team to analyze an issuer’s ability to pay back principal and interest? Is diversification a hallmark of the manager’s investment philosophy? These are important questions to ask.

In addition to assessing transparency and credit risk, a clear investment policy statement can help define parameters, limits and objectives. These investment parameters are intended to protect and provide guardrails for managers. SVB Asset Management has a robust credit research team that is solely dedicated to analyzing and maintaining an approved list of corporate issuers to mitigate the credit risk associated with fixed income investing.

Lastly, understanding where the assets are held is critical. Securities should be held with a bankruptcy-remote, third-party custodian in the name of the client. This protects your funds in the event of insolvency of the bank or asset manager. SVB Asset Management never takes possession or control of client funds. They are always held in custody with a third party.

Service

Service is another critical component in selecting a cash manager. The service team is your gateway to the investment manager and needs to be knowledgeable and responsive to the dynamic needs of your business. A Registered Investment Adviser (RIA) may be an excellent choice to ensure alignment of your cash management with the interests of your business. An RIA registered with the Securities Exchange Commission, such as SVB Asset Management, is a fiduciary and as such is legally bound to act in the best interest of clients.1 Not all broker-dealers, some of whom offer investment products targeting corporate cash management, are fiduciaries.

Remember, the number one goal of effective cash management is maintaining sufficient capital and liquidity to meet current needs, while optimizing potential returns in a risk-appropriate manner. Make sure your investment manager is able to help you develop and implement a strategy that meets the unique liquidity management needs of companies in the innovation economy.

Source: the-great-reset-north-american-asset-management-in-2022.pdf (mckinsey.com)

Credit Vista: Pool party—State of asset-backed securities

Who doesn’t love a pool party? Certainly, investors have enjoyed the performance of these pooled loans that are packaged together into investable securities. The pandemic and subsequent zero interest rate environment created a space where we saw incredible performance across prime structured products, including consumer receivable asset-backed securities, such as credit cards and autos. This reflected, in large part, the benefits of strong labor markets and low borrowing costs. But are the effects of rising rates, or higher-for-longer rates about to spoil the party? Let’s take a closer look to see how structured issuers are positioned as we move into our new environment of tighter lending standards and possibly lower (or maybe even negative) economic growth.

As a quick refresher on asset-backed securities (ABS), these are financial products that can be backed by pools of receivables. They are securitized by sponsors who create special purpose vehicles, giving investors claim to the underlying loans. They are then typically split into tranches where investors can buy different levels of subordination, choosing to match the yield with their risk parameters.

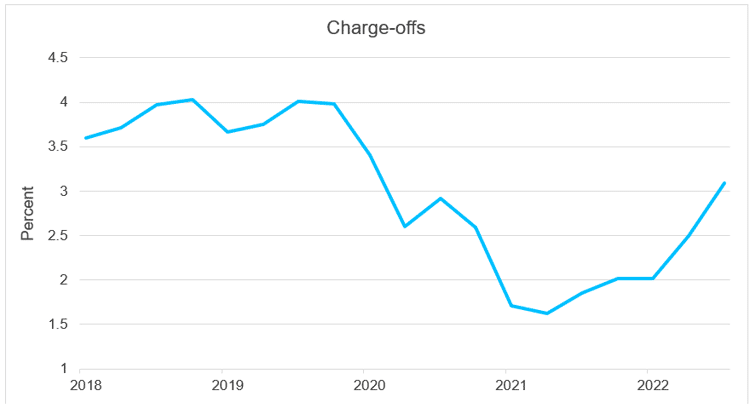

Credit card ABS recorded their best performance in a decade over the last two years. Monthly payment rates hit their highest levels, charge-offs bottomed out, and delinquencies defied even seasonal trends. Card ABS from the Big Six issuers2 boast accounts that have been open more than five years, have geographic diversity across the United States and FICO sores of 600+ on average. Since the 2008 financial crisis, the trusts from where these issue have undergone a noticeable improvement as problem loans have been moved out to keep the trusts cleaner. Strong sponsor support is a notable credit positive, with the majority of issuance in the prime space coming from Global Systemically Important Banks (G-SIBs). Given these dynamics, we feel comfortable in our selection of ABS even in the face of possible contraction in the economy. We may view the last two years of strong performance to be an outlier, but the structure and performance characteristics underlying these investments continue to be constructive even as the new environment could challenge consumers. Source: NY Fed & Equifax

Source: NY Fed & Equifax

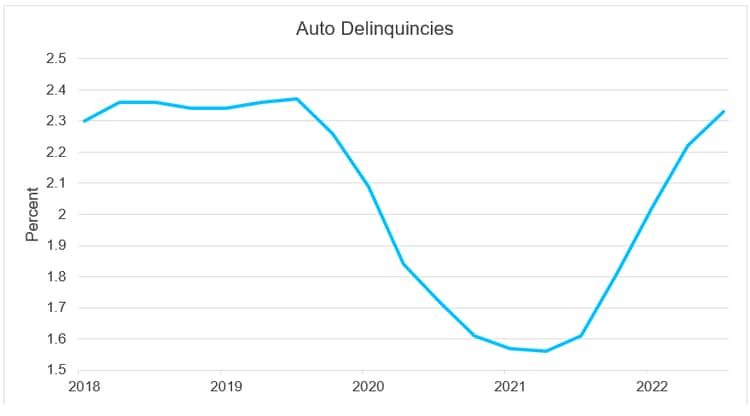

Turning to another large segment of the structured products market, auto ABS (including loan, lease, and floorplan) saw similar robust performance. Key metrics such as delinquencies and losses were at decade lows during the pandemic, though we recently have seen some upticks in the subprime space. The prime space remains well insulated in our opinion, but we are carefully monitoring the lower credit quality sections. We note that the uptick is mostly seasonal trends, which should shake out into lower loss rates as the year goes on. Thus, we feel that prime auto ABS also are well insulated from broader economic concerns, with net loss rates historically well below 2%. Source: NY Fed & Equifax

Source: NY Fed & Equifax

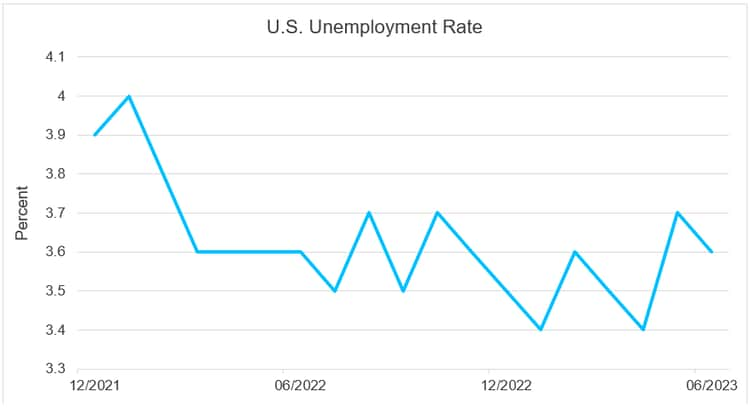

As both asset classes are backed by consumer receivables, the somewhat obvious macro indicator we follow most closely is the U.S. employment rate. Simply put, a low unemployment rate suggests that consumers are making money and will make good on their consumer credit and car payments. But even if the unemployment rate ticks up, we feel that prime ABS are in an excellent position coming off two years of stellar performance and systemic positives. If anything, we view the recent developments as mean reversions, as opposed to suggesting any real trouble is brewing in the prime sector. As far as we can see it, investors can and will continue looking at these pooled loans, even if they will be keeping one eye on the data. Source NY Fed

Source NY Fed

Trading Vista: On to the next worry

Jason Graveley, Senior Manager, Fixed Income Trading

With investors, it’s always something. Sure, Congress resolved the debt ceiling standoff, but now investors have shifted their focus from the potential U.S. default to near-term monetary policy and its impact on the markets. Equities continued to surge during June and into mid-Summer, particularly growth-oriented investment styles. Meanwhile, 2-year Treasury yields surpassed 5.0% in early July, the highest levels seen since 2007. This largely reflects the resilient economic data, which is not only pushing recession expectations out, but also allowing the Federal Reserve to continue with its hawkish stance. After the pause in May, markets have all but penciled in a July rate hike while the likelihood of additional increases has moderated. No doubt about it though—markets have embraced the higher-for-longer mantra that the Fed has been pushing. Nevertheless, the range of possible policy paths is wide open, with rate-hike probabilities and sentiment shifting considerably after each batch of labor market and inflation data. This uncertainty has pushed investors to adopt a somewhat defensive investment approach, which is evidenced by the $530 billion increase in government money market fund balances. Clearly, many investors are content to stay in this wait-and-see mode.

With the debt ceiling debate in the rear-view mirror, the U.S. Treasury has ramped up Treasury bill issuance to replenish its operating account. This account, known as the Treasury General Account, had dipped below $50 billion in June, compared to an approximate $380-billion balance at the start of the year. As a result, new supply is already on the upswing with over $400 billion in issuance since the middle of June, with weekly issuance peaking at over $131 billion during the first week of July. Projections on the total size of this year’s issuance have varied, with some dealer strategists predicting more than $1.4 trillion in net issuance for 2023.

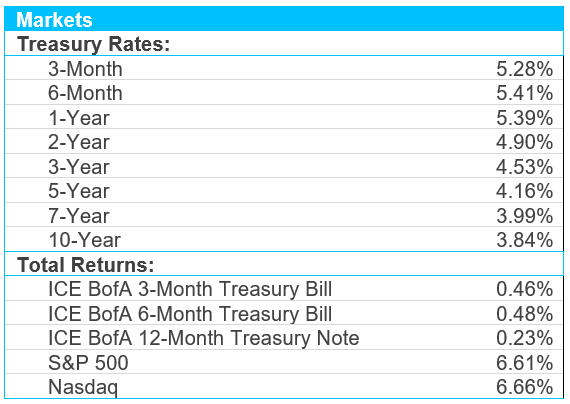

Despite the significant uptick in supply, the net effect on front-end yields is expected to be marginal. This is largely because money market funds can step-in as a primary buyer if yields become attractive enough, using their balances at the Federal Reserve reverse repo (RRP) facility to toggle where the economics are most favorable. Investors have already seen this dynamic play out to some extent, with reverse repo balances dropping from $2.5 trillion at the end of May to $1.8 trillion at the time of this writing. Incidentally, this marks the lowest level of the year for the RRP facility. This outflow of funds should persist as long as the opportunity to capture incremental yields remains. For context, consider that the current 6-month Treasury yield has been hovering near 5.50% while the RRP program currently offered yields of roughly 5.05%. Although these market technicals favor front-end investors through higher money market fund returns and benchmark Treasury yields today, it is important to remember how quickly sentiment can shift: after all, the market is always looking ahead to anticipate the next risk, the next batch of data, or even the next potential Fed pivot.

Sources: U.S. Debt Ceiling 2023: Risks Linger | Morgan Stanley, Announcements, Data & Results — TreasuryDirect

Sources: Bloomberg and Silicon Valley Bank as of 6/30/2023.

Sources: Bloomberg and Silicon Valley Bank as of 6/30/2023.