The global transition away from LIBOR

What's happening?

Regulators called for the global financial industry to transition away from the London Interbank Offered Rate, also known as LIBOR to new alternative reference rates (ARRs).

LIBOR is a set of benchmark interest rates that major global banks use to price a wide range of products, including corporate loans, derivatives, residential mortgages, student loans, corporate bonds, and other securities.

SVB is committed to helping you understand the new rates and how these changes may impact your loan or other products in the future.

SVB will continue to navigate through the industry cessation of LIBOR and on to the new ARRs, and will focus on migrating all remaining LIBOR-based deals.

Please refer to the FAQs below for more information about the transition away from LIBOR. For further detail on how the transition away from LIBOR may impact you specifically, please discuss with your financial and legal advisors.

Background

These announcements serve to cease publication of the following LIBOR tenors:

Cessation of LIBOR rates

(i) all GBP, EUR, CHF and JPY LIBOR settings, and the 1 Week and 2 Month USD LIBOR settings immediately following the LIBOR publication on December 31, 2021; and

(ii) the Overnight and 1, 3, 6 and 12 Month USD LIBOR settings immediately following the LIBOR publication on June 30, 2023.

Where can I find additional information?

We will continue to update this page as new information is received. SVB clients may submit questions to the email address on this page and/or reach out to your relationship manager with any questions you may have.

FAQs

What is LIBOR?

Why is LIBOR going away?

What does this transition mean for SVB clients?

What is SVB doing to prepare?

SVB has established a transition team to manage the transition for SVB clients and provide oversight. SVB also has representation in the ARRC, and our transition team is taking action to meet planned milestones. As the transition continues, we have developed guidelines and protocols for contracts and product offerings; and we’ll continue to update our clients.

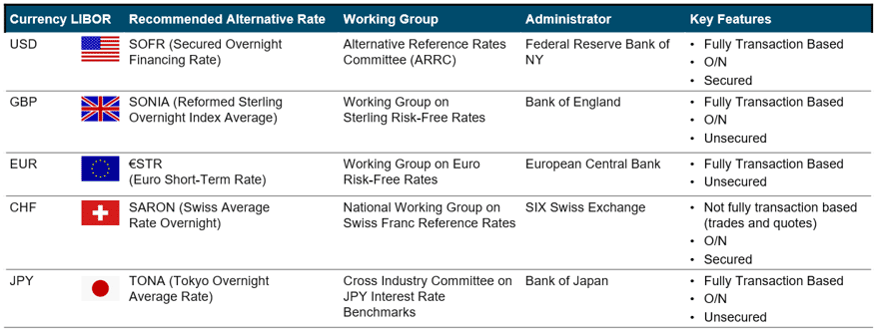

What alternative rates were recommended to replace LIBOR?

How are SOFR/SONIA different from LIBOR?

SONIA, the recommended replacement rate for GBP LIBOR, measures the rate paid by banks on overnight funds. It is calculated as a trimmed means of rates paid on overnight unsecured wholesale funds. Per the Sterling RFR Working Group, SONIA is robust because it is anchored in active, liquid underlying markets. For more information on SONIA, click here.

Who are the relevant industry bodies, or Working Groups, providing guidance related to the transition?

Different industry bodies, or industry working groups were established under the sponsorship of the relevant regulatory bodies to recommend Alternative Reference Rates (ARRs) to replace the different existing forms of LIBOR and provide guidance on the transition away from LIBOR. Several of the working groups relevant to SVB clients are as follows:

What does the ARRC do?

What does the Working Group on Sterling Risk-Free Reference Rates do?

What is fallback language?

Other resources

The below resource links are not affiliated with SVB and are provided for information and educational purposes only. Any opinions and/or views expressed do not necessarily reflect the opinions and/or views of SVB.

Central Banks &

Working Groups:

US:

Federal Reserve Bank of New York (FRBNY) Alternative Reference Rate Committee (ARRC)

UK:

Bank of England Working Group on Sterling Risk Free Rates

EU:

European Central Bank (ECB) Working Group on Euro Risk Free Rates

SWITZERLAND:

Swiss National Bank National Working Group on Swiss Franc Reference Rates

JAPAN:

Bank of Japan (BOJ) Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks