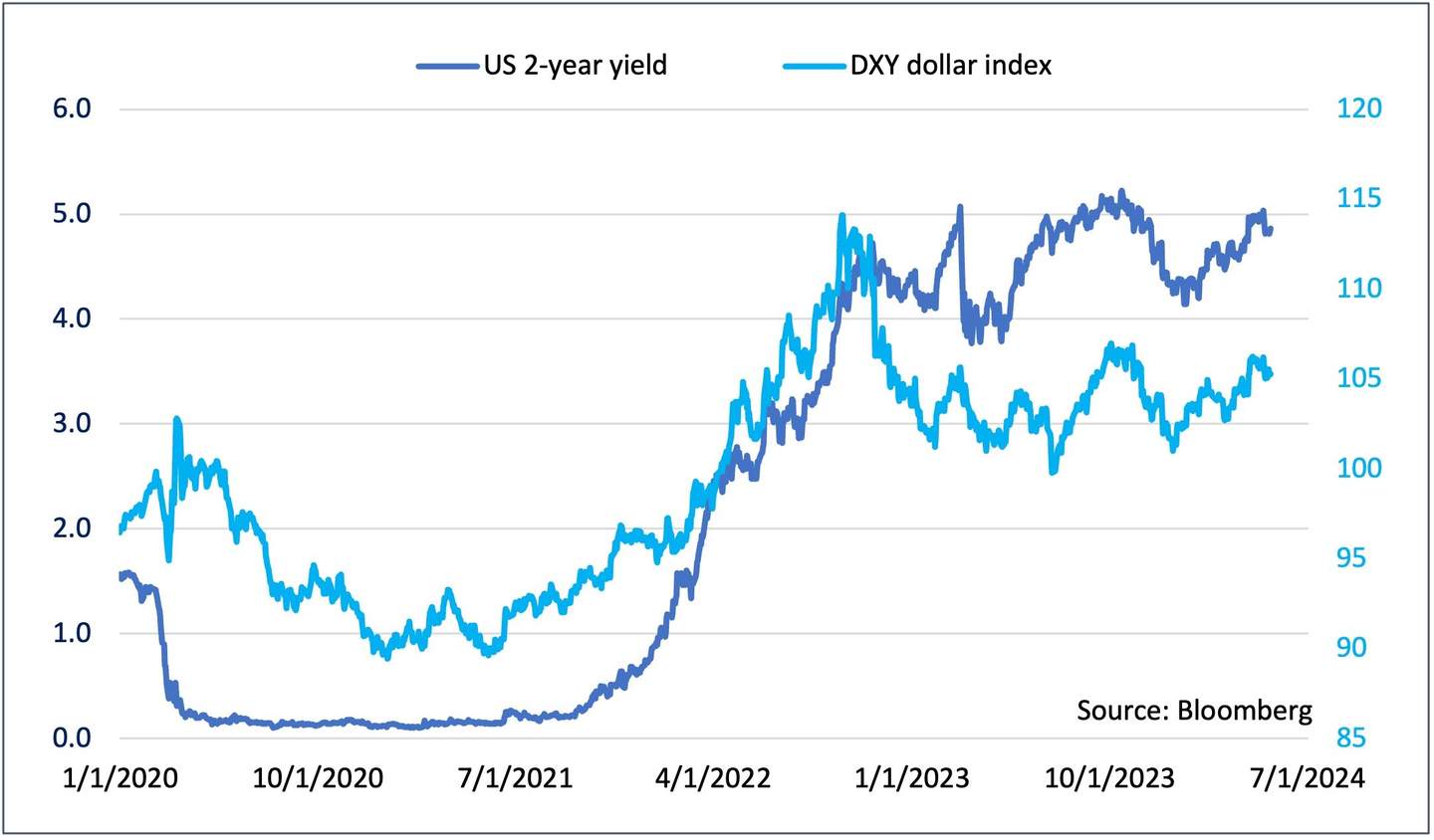

Recently, the stars have aligned for US-based companies as it relates to the management of cash, investments, and foreign exchange (FX). A positive correlation between US interest rates and the US dollar (USD) has provided a dual win: Higher interest rates have generated material income streams, for the first time in a long time, while a strong USD has benefitted companies that price goods and services in USD but have operating expenses in foreign currencies.

Chart 1: Correlation between US interest rates and the USD has benefitted corporate earnings

The windfall has eased cash burn for high-growth technology and life science companies, helping offset the challenges presented by a tougher fundraising environment and higher cost of capital. According to Silicon Valley Bank (SVB) research, for example, enterprise software companies in the SVB client portfolio with a minimum of $50M in revenues had a median 26 months of cash runway as of year-end 20231. A 5% interest rate on that cash, compliments of an inflation-fighting Fed, coupled with a firmer USD would extend the median runway by as much as one quarter if recent market trends were to repeat2.

For global public companies, there have been unexpected FX risk management benefits. Revaluation of foreign assets and liabilities (aka remeasurement) may be destabilizing to earnings presentations if not addressed. Generally, the FX volatility created from such remeasurement activity can be remedied by implementing balance-sheet hedging programs which deploy forward contracts to create synthetic offsets within current income. The new income streams from holding cash and short-term investments, which also run through current income, have worked to smooth earnings, serving as a natural hedge of FX remeasurement volatility.

The dual windfall may be going away

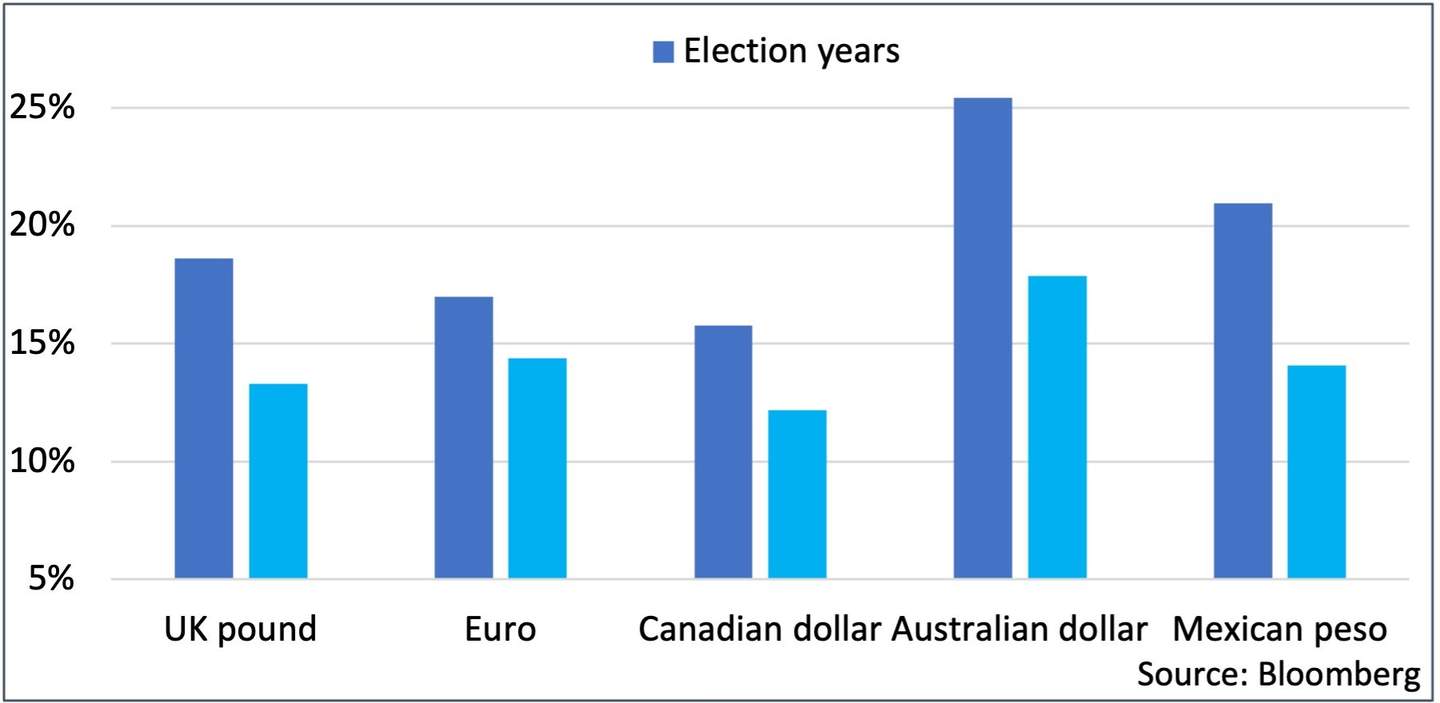

Looking ahead, however, correlation dynamics are poised to change. After raising the policy interest rate 11 times, the Fed has been on hold in 2024 and all signs are pointing for the next move to be a rate cut3. Without the boost of higher interest rates and wider interest rate differentials, the USD will likely struggle to make new highs. A reversal of trends would erode the dual windfall enjoyed recently. Furthermore, looking ahead to a general election in the United States later this year, we can expect greater volatility and uncertainty, if history is a guide.

Chart 2: Average annual currency trading ranges have been materially higher in election years

Since 2000, expressed in % terms

Innovation sector CFO input focused on preserving market tailwinds

Silicon Valley Bank recently collaborated with Bloomberg to host a panel discussion with innovation sector CFOs to discuss how best to navigate financial market trends and position for such changes4. Following are key insights and takeaways from our discussion.

- The market tailwinds from higher interest rates and a stronger dollar are elevating the treasury function, seen today as delivering tangible value to the core mission of the innovation economy.

- In the current environment, there is a real tension between growth and cost control, with neither side necessarily winning out. Companies are still spending in search of growth, but it is more mindful and controlled spending than previously.

- Recession is no longer on corporate radars, C-suite/Board conversations, or investor meetings. The focus is preservation of capital to achieve responsible growth between now and the next round.

- Firms are focused on preserving high cash yields for as long as possible, as well as protecting the value of their USDs earmarked for overseas operations.

- Owners and investors of companies do not want the finance function taking views on financial markets including the future path of interest rate hikes or currency prices. The goal of hedging is to achieve certainty, for the lowest cost possible.

- Picking the right banking partner to work with on hedging pays dividends as risk management is not a one size fits all solution. It is best to work with partners that will tailor strategies that are consistent with an institution’s stage in the life cycle, business objectives, desired accounting presentation, and risk tolerance.

Hedging to preserve gains is an easier proposition than hedging to prevent further losses. With CFOs redirecting their attention to financial market impacts and risk management, now may be the right time to start a hedging program.

If you’d like to discuss your specific situation or for information regarding SVB’s tailored FX risk management services, reach out to your SVB FX contact or GroupFXRiskAdvisory@svb.com

Please click here to view a recording of the SVB/Bloomberg session.