Key takeaways: Proactively manage FX risk to help get ahead of the pack

Plans to expand your operations outside the United States may be far off, but there is a good chance you already are facing foreign exchange (FX) risks. Have you ever signed a contract with an overseas manufacturer, sold a product abroad directly from the U.S., or hired a sales person across the border? Just because you may be doing business all in U.S. dollars doesn’t mean you’ve eliminated FX risk. FX risk exposure happens the moment you have an international customer, partner, or competitor.

Managing currency risk doesn’t have to be a defensive exercise. Protect and grow your company's value by proactively deploying FX strategies that may help:

-

Provide more clarity and certainty in your financial forecasts

-

Give you tools to increase competitiveness overseas

-

Lead to new operational, tax, or accounting efficiencies

Tips for establishing a competitive advantage

-

Operating only in U.S. dollars overseas does not make FX risks disappear, it only transfers the risk to partners and customers, and may reduce your negotiating power. In some countries, notably China, if you transact in U.S. dollars, your vendors and partners may greatly inflate their prices to compensate for conversion fees and taking on the risk.

-

Use FX planning to develop competitive pricing strategies, attract new customers and boost your overseas sales.

-

If you are hiring overseas, top talent will be more likely to join your team if compensation isn’t tied to the ups and downs of international currencies.

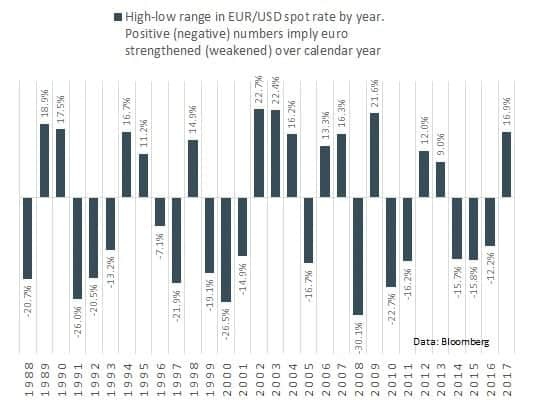

Consider this: Currency volatility leads to business uncertainty. It is hard to predict the short-term direction, and history shows that individual value swings can be significant. For example, the value of the euro versus the U.S. dollar (the EUR/USD spot rate) has risen in 14 out of the last 30 years, roughly a 50-50 proposition. However, over a given year, the spot rate has moved considerably: high-low range has averaged 15 percent, and has been as high as 30 percent.1

Tips for managing currency volatility risk

-

If exposure to foreign currencies is impacting key business performance metrics (revenues, margins, OpEx budgets, cash burn rates), managing FX risk should be a priority. As growth happens quickly, the impact increase may be exponential. It’s better to plan risk mitigation far ahead.

-

Often sitting on the sidelines is just as speculative as doing something. Hedging strategies are not a guarantee you won’t lose money, but they can provide some measure of risk mitigation and predictability for business forecasting.

-

Consider hedging solutions to insulate your business. Strategies may or may not involve derivatives, depending on business needs, objectives, and constraints.

Going overseas can be complex. Having a strategy and timetable in place for addressing FX risk management and accounting decisions can make implementation easier, and help bring focus back to the core business.

Bottom line: We live in a time of great global business uncertainty, so understanding FX risks and the tools you may have in your arsenal makes good business sense.

Checklist of Decisions to consider about going global

-

How do I know the time is right?

If exposure to foreign currencies is materially impacting key business performance metrics, make managing FX risk a priority. Materiality varies by organization, as does prioritization of performance metrics.2 -

Should I operate in U.S. dollars only?

Assuming you have the flexibility to do so, usually the answer is still no. You’ll be giving up negotiating power to in-country competitors. -

What other strategies should I consider?

As you grow international revenues, consider using FX gains within your core non-USD pricing strategy as a way to capture market share.3

Learn more

-

For specific strategies and tools to help manage FX and global expansion risk, watch the SVB Tips for Global Expansion webcast replay on SVB.com.

-

See all SVB's foreign exchange services

-

Source: Bloomberg 2018

-

Example: Suppose 25 percent of OpEx occurs outside the U.S. We can assign a 10% probability that an adverse move in exchange rates will result in a $1mio rise in OpEx costs measured in U.S. dollars. Both the size of the exposure, and the projected impact are important metrics to consider.

-

See SVB FX Risk Advisory piece “Incorporating FX into corporate pricing strategy”, forthcoming.

© SVB Financial Group. All rights reserved. Silicon Valley Bank is a member of the Federal Reserve System. Silicon Valley Bank is the California bank subsidiary of SVB Financial Group (Nasdaq: SIVB). SVB, SVB FINANCIAL GROUP, SILICON VALLEY BANK, MAKE NEXT HAPPEN NOW and the chevron device are trademarks of SVB Financial Group, used under license.

This article is intended for US audiences only.

The views expressed in this article are solely those of the author and do not reflect the views of SVB Financial Group, or Silicon Valley Bank, or any of its affiliates. This material, including without limitation the statistical information herein, is provided for informational purposes only. The material is based in part upon information from third-party sources that we believe to be reliable, but which has not been independently verified by us and, as such, we do not represent that the information is accurate or complete. The information should not be viewed as tax, investment, legal or other advice nor is it to be relied on in making an investment or other decisions. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors, as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal and other advisors, and only make investment decisions on the basis of your own objectives, experience and resources.