Key Takeaways

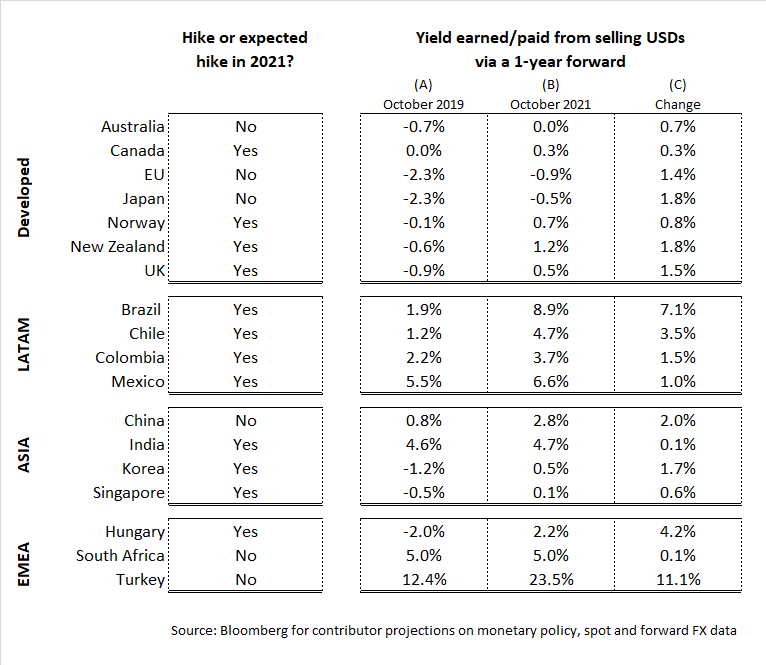

- Over a dozen central banks globally have hiked interest rates post-COVID in response to higher inflation, prioritizing it over supporting domestic growth.

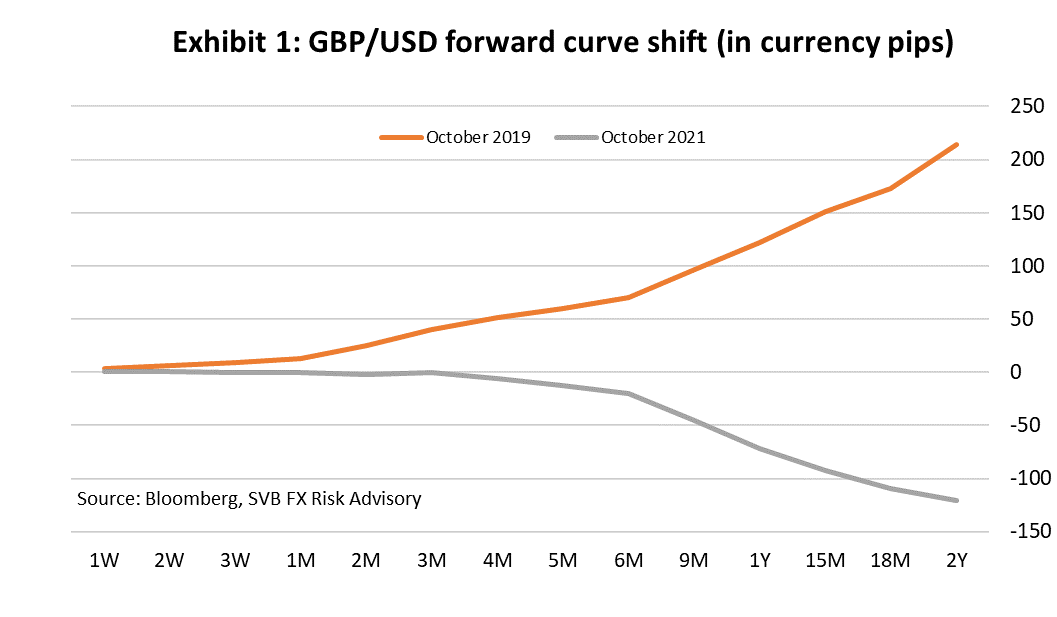

- Fed liftoff is still a way away, thereby resulting in widening divergences in interest rates from the vantage point of US institutions. Divergences manifest themselves in sizeable shifts in FX forward curves.

- SVB clients are net buyers of currency (sellers of USD) by a margin of 3-to-1 and can now earn interest income from FX hedging of most future currency purchases.

Inflation anxiety is no longer reserved for trips to the grocery store or gas station.

Over a dozen central banks globally have hiked interest rates post-COVID in response to higher inflation, prioritizing it over supporting domestic growth. This trend began earlier in the year. Emerging Market central banks struck first (Brazil, Korea, Hungary, etc.), and now developed economies have started to act. Norway lifted rates off the zero-lower bound last month, and now it is expected that the UK will hike rates before year-end. Market prices assign an 92% probability of the BoE going through with this1.

Noticeably lagging from interest rate lift-off excitement is the Fed, a situation that is resulting in steep interest rate divergence from the vantage point of US- based institutions. In FX markets, this manifests itself in shifts in FX forward curves, such as the one pictured in Exhibit 1 involving the Pound sterling (GBP) versus US dollar (USD)2. The curve has flipped from positive to negative since 2019, and the shift in forward points over the last several weeks would certainly constitute a black-swan event3.

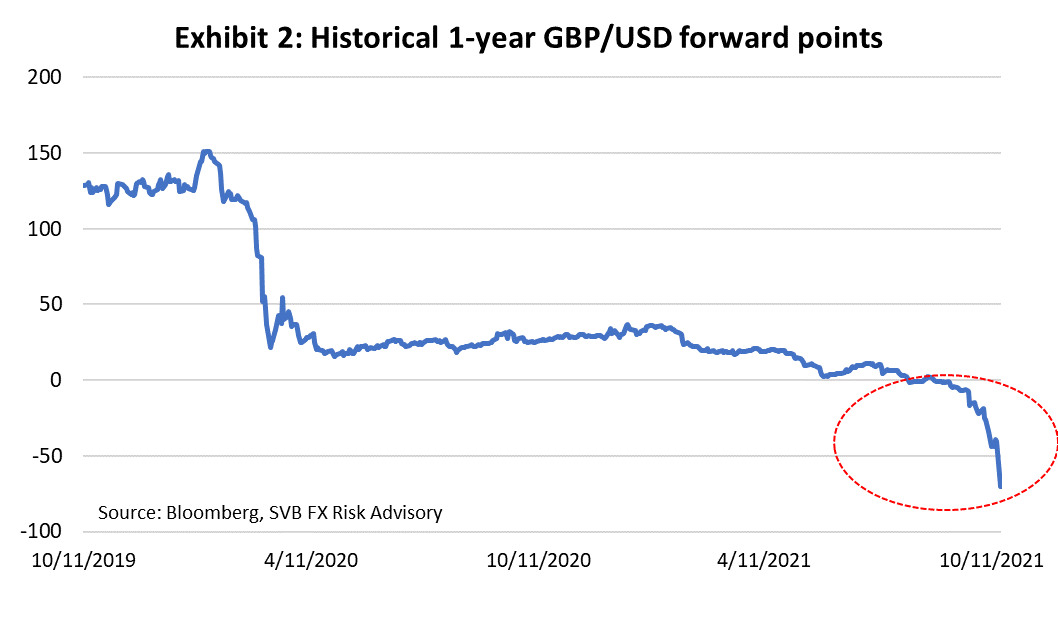

Exhibit 2 illustrates the speed and severity of the move for a 1-year forward contract tenor, fueled by a change in monetary policy expectations in the UK.

Why does this matter to SVB FX clients?

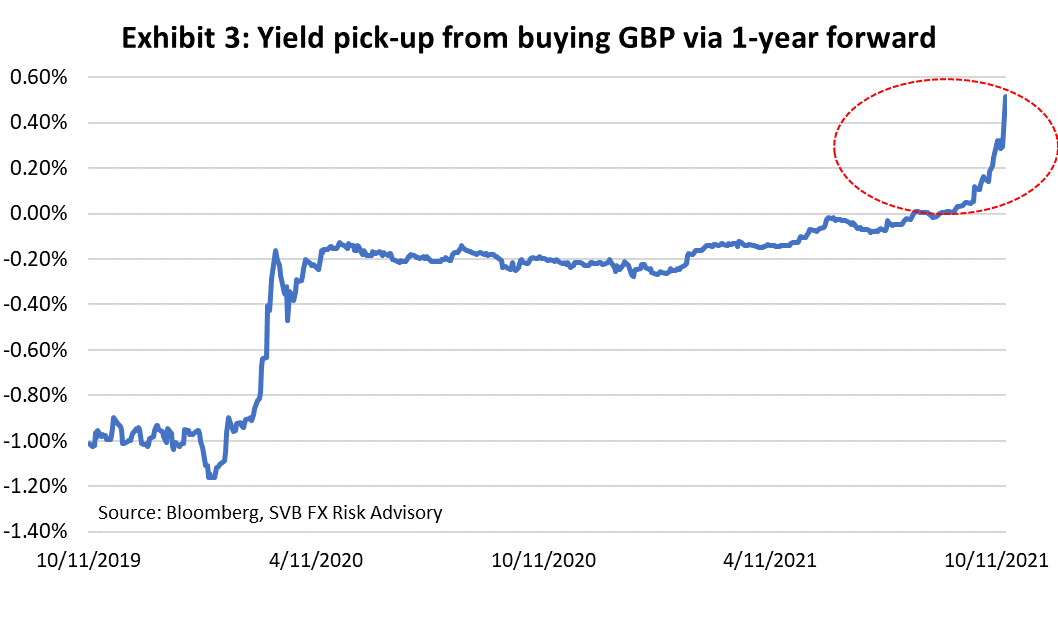

SVB FX clients are net buyers of foreign currency, and thus sellers of USDs, by a margin of about 3-to-1. In other words, there are three net sellers of USDs for every net buyer of USDs. The recent divergence between interest rates, in which interest rates rises abroad are outpacing those of the US, results in an opportunity to earn interest income from the forward hedging of future currency purchases.

Returning to the example involving GBP, locking into a 1-year forward for future GBP expenditures today generates approximately +0.50% yield per annum. This yield is generated from receiving a better price to purchase GBP on the forward market, versus spot. As illustrated in the chart, a year ago, this trade would have incurred a cost around -0.25%, and pre-COVID, the cost was around -1.00%.

Bottom-line

This yield opportunity is ideally suited to high-growth companies who are regularly sending USD to fund foreign operations, and who may not have access to a sizeable yield benefit of pre-funding overseas accounts and holding the currency in advance of spending it (versus holding USD). Table shows the approximate yield per annum that can be earned for locking into a 1-year forward contract for currency purchases headed for the most common destinations in the innovation-sector4. In all but two cases, the yield is non-negative (see Column B), and in all cases the yield position is better today and pre-COVID in October 2019 (Column C).

Similarly, global PE/VC funds who engage in balance-sheet hedging programs may be able to earn some FX carry now due to the curve shift. Generally speaking, longer tenors provide the largest yield boost and better bang-for-buck.

In closing, the yield opportunity discussed in this paper coupled with the general strength in the USD we have seen in 2021 year-to-date, could present a dual-win for 2022 budgets.

Learn more:

SVB Perspectives provide a unique vantage point on the industries and issues forging innovation.

Corporates

https://www.svb.com/trends-insights/foreign-exchange-advisory/fx-risk-advisory-for-corporates

If you have questions or for assistance discussing your specific risk management situation, contact your SVB FX Advisor directly, or the SVB FX Risk Advisory Team at GroupFXRiskAdvisory@svb.com