SVB Merchant Services and Payment Solutions

Accept payments anywhere to help power your growth

Safe, simple, flexible ways to accept payments on your site, app, mobile and more. Next business day funding and streamlined tools give you more power from day one to global enterprise payments.

Get paid fast to help cash flow

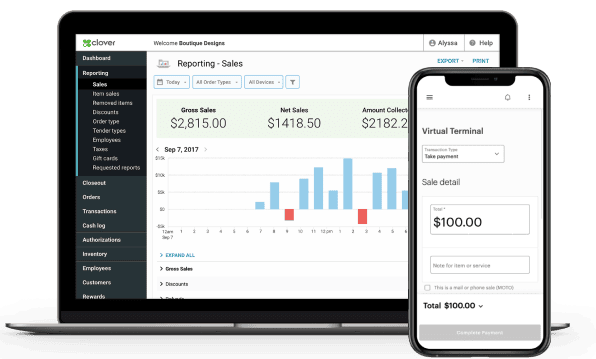

Intuitive reporting and actionable insights

Streamline accounting

Manage transaction types, sales tax, invoicing and customer card-on-file.Help reduce costs & fraud

Minimize fraud losses and chargebacks with data, tools and reporting.

Customized payment solutions for your vertical and business models

Payments-as-a-service

Embed payment acceptance into your platform.Global acceptance

Transact in more than 140 currencies.Scalable

Evolve solution to keep pace with your growth.Ready to talk with our team?

Merchant Services FAQs

Merchant Services enables your business to accept debit and credit cards, digital wallets, gift cards, checks (scanned as digital payment) and other payment types.

Funds can be deposited into your SVB account as soon as the next business day for your processed payments.

Powerful real-time analytics give you fast insights into sales data, trends and performance across your channels and locations. Transactions capture Level 2 and Level 3 business card data for deeper detail.

Yes. You can integrate your merchant services data with QuickBooks and Xero, and add APIs to connect to NetSuite and other enterprise resource planning (ERP) systems. Explore the API Sandbox

With Merchant Services, clients can accept a wide range of digital and in person payments via online platforms, mobile, in-app and more.

A merchant service charge is a fee a business pays when their customer uses a debit card, credit card or digital wallet to purchase services or merchandise.