Key Takeaways

- Outlook for enterprise software companies looks strong, amidst considerable uncertainty.

- Developer Ops startups will continue to thrive, fueled by big data and AI.

- Demand for debt will grow as companies look to increase runway.

The devil is in the details

Last year, 2019, was a record breaker for venture investment and fundraising in Silicon Valley. The historical tenure and strength of the economic boom and the flood of capital into the tech ecosystem resulted in record levels of investment across sectors, life stages and regions. The old saying that a rising tide lifts all boats has certainly held true in recent years for the tech industry. However, as the cycle grows later in stage and tides prepare to recede, the industry’s undercurrent of trends becomes more important for anticipating the future of the tech economy. As we have seen most recently with the Coronavirus, which has highlighted the world’s dependence on China’s manufacturing plants, one trend can have global impacts.

SVB has the unique vantage point of banking roughly half of all venture capital–backed tech and life science companies in the US, which gives us unparalleled insight into startup experiences and a powerhouse of client data. For this post, SVB’s NorCal Enterprise team put their heads together and leveraged internal data to identify specific trends and predict which will be most influential across the venture sector this year.

Sectors to watch in 2020

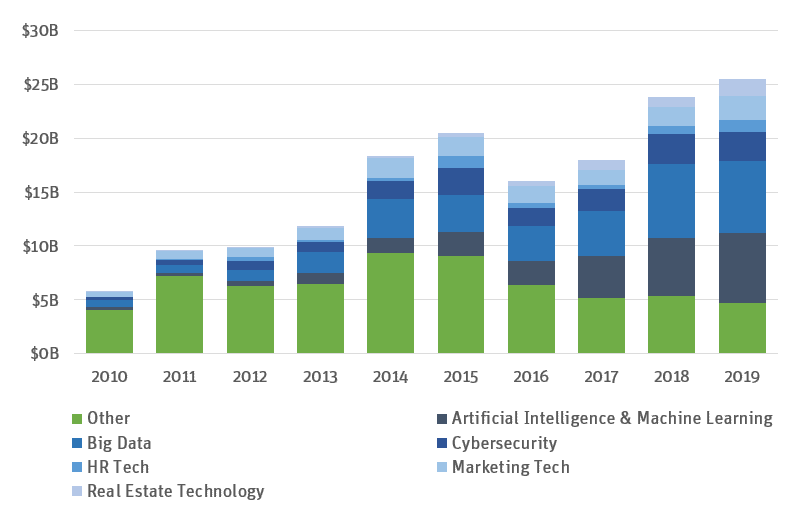

The NorCal Enterprise team believes that developer operations (DevOps) and Big Data will continue receiving strong investment, as they did in 2019. The DevOps space will continue to grow due to overriding trends in software development, including prioritizing seamless software update rollouts, efficient development and reducing bugs in code. In particular, the sector will focus on serving open source projects (vs. closed proprietary solutions), which have grown in popularity in recent years largely because open source code can significantly increase flexibility and lower the cost of software development. In addition, Big Data companies will remain front of mind going into 2020 and continue building off the sentiment that data is king. Over recent years, many companies have accumulated and stored data, but very few can effectively harness its value. Investors have recognized this market need and as a result Big Data was the second fastest growing subsector in enterprise software over the past decade. Only artificial intelligence and machine learning grew more quickly and notably, this subsector requires the clean, organized data that Big Data can provide.

Alternatively, while it doesn’t feel like any space will fall in hype, the general consensus across the team is that human resources (HR) tech will see the biggest drop in interest. The team has seen a noticeable drop in deal flow for HR tech companies, already a smaller sector in the enterprise software space, which indicates a reduced level of new venture capital investment.

Source: PitchBook. Enterprise software is represented by PitchBook’s SaaS vertical classification.

Breaking down fundraising trends

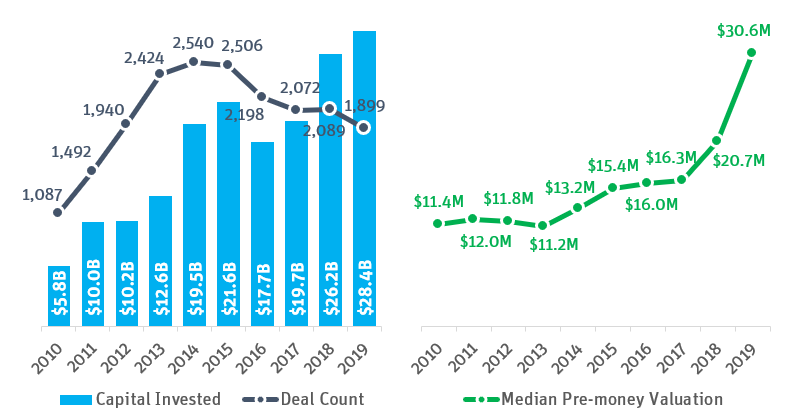

SVB’s NorCal Enterprise team predicts that strong interest from investors will continue in 2020, with investment levels across the sectors and life stages remaining at or above 2019 levels. A record $28.4B was invested in the enterprise software space in 2019, and outside a large macroeconomic shift, the team believes venture capital spend will remain strong.

Series A and B deal interest will remain at a record high, with deal count and size remaining at 2019 levels ($8.2M median investment for Series A and $18M for Series B). In contrast, the team predicts that Series C+ rounds ($28M in 2019) will see accelerated interest, with both deal count and size increasing in 2020. The SVB NorCal team drew this conclusion based on conversations with venture capitalists, who across the board have stated that doubling down on late-stage successful investments is a priority. This conclusion is backed by 2019 data, which shows that the amount invested in enterprise software continued to rise while deal count dipped as investors poured more capital into a smaller number of late-stage companies.

Source: PitchBook. Enterprise software is represented by PitchBook’s SaaS vertical classification.

Debt to bridge the gap

The abundance of equity capital will continue to fuel growth sectors. As companies reach scale and turn their attention to profitability, bridge financing in the form of debt or equity will play an increasingly important role. Through 2019, SVB NorCal team saw a 50% increase in bridge-financing from 2018, and we see no reason for this to slow. Increasing valuations have raised investor expectations in terms of business traction and progress, which means startups need additional time and support from existing investors to achieve these milestones. Bridge financing provides startups, typically between their Series A and C rounds, the extra runway they need to achieve their milestones and confidently raise their next round of financing at a strong valuation.

Reduced IPO activity will lead to increased M&A

We anticipate reduced IPO activity in 2020 largely as a result of two main factors: the lukewarm performance of IPOs in 2019 and macroeconomic uncertainty. The economy remained strong in 2019, yet according to Renaissance Capital’s annual US IPO Market Review, the 42 tech companies that went public saw their listing price increase by an average of 20% (with the top 10 performing companies carrying a lot of this weight), whereas the Nasdaq increased 35% through 2019. This mixed performance combined with uncertainty surrounding the political climate will cause executives of late-stage companies to postpone or reconsider their IPO plans. As a result, companies that may have previously been focusing on an IPO will turn to strategic finance or private equity firms for an exit. We expect increased M&A activity in 2020 but at a lower price point given the increased supply of companies looking to be acquired.

Corporate venture capital will play a greater role in venture

In 2019, there was a slight dip in corporate venture capital (CVC) activity despite its rapid growth throughout the decade (10% CAGR in deal count since 2010). Even with the slight slowdown, we believe that CVC activity will return strong in 2020, assuming that the macroenvironment doesn’t cause corporates to reconsider their strategies. Interestingly, 2019 showed that CVC participation varies greatly by a company’s industry, geography and life stage. Enterprise and Fintech had the most traction, with CVCs participating in 18% of deals. This phenomenon is something SVB’s NorCal Enterprise team has witnessed firsthand, as we see more deals with investors from well-known CVCs like M12 (Microsoft’s venture arm) and Google Ventures. Global corporates such as Alibaba and Tencent continue to invest directly from their balance sheets, and new CVCs will emerge, not just in Silicon Valley but also in Europe and Israel. It will be interesting to see how an increase in CVC activity will affect the venture ecosystem and how corporate venture capitalists would behave in an economic downturn.

Optimism despite uncertainty

Sentiment going into 2020 remains strong and optimistic, despite a shared feeling that a market correction is on the horizon. This is reinforced by the market’s volatile reaction to the Coronavirus, which saw the Nasdaq drop 7% in one day and the Fed cut rates. As a result of the perceived macroeconomic risk, SVB as a whole has seen an increase in debt requests from startups that intend to use the debt in the event of an economic correction and resulting fundraising delays. While the NorCal Enterprise team believes that the economy will continue to volatile through 2020, it does not believe that a full market correction will happen in the tech industry in 2020 given the significant amounts of dry powder remaining in the market; the team thinks that 2021 is when the tech industry will see the market turn.

The team believes that growth will continue through 2020. We want to ensure that this great progress continues. If you are a startup in the San Francisco Bay Area looking for advice on how to finance growth, please send us a note.