We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

Even during times when rates are low

Buying a bond is akin to lending money to a counter party, be it a corporation, government, or municipality. In exchange for the use of your funds, the bond issuer agrees to pay you (the bondholder) a coupon payment at regular intervals (usually semi-annually) and then return the principal value to you at maturity. The rate of interest received/paid depends on the perceived credit quality of the bond issuer. Lending money to a riskier counter party generally requires a higher interest rate be paid in order to compensate for the increased risk of default or impairment. An example of a high quality corporate bond is shown below

Source: Bloomberg

Market interest rates have been on a steady decline since the 4th quarter of 2018 as a result of slowing global growth and economic uncertainty. While existing bonds in portfolios have generated exceptional returns year-to-date, investing new money into the bond market may seem unappealing. We think it is worth revisiting the reasons to own bonds as the overall net yield to the bondholder is just one of the many reasons.

Principal preservation

Unlike stocks and other equity investments, bonds have specific maturity dates when bondholders are contractually required to receive back their principal investment. The exception, is a default by the bond issuer, but these are rare for high-quality bonds. The characteristic of principal preservation increases stability in client portfolios.

A consistent stream of income

Coupon payments are made to bondholders at regular, predetermined dates (usually semi-annually). Depending on the specific bond, the coupon is set at a fixed level for the term, and is in reference to a percentage of principal par value (1%, 3%, 7%, etc.). Whether the coupon is high or low depends on the quality of the issuer and the interest rate environment at issuance. Coupons lead to flexibility in client portfolios since these cash flows can be used at a client's discretion, whether it is reinvested or used to pay living expenses. Coupons also help to stabilize returns since they accrue over the lifetime of the bond, instead of realizing returns at a single point in time.

Mitigation of portfolio risk

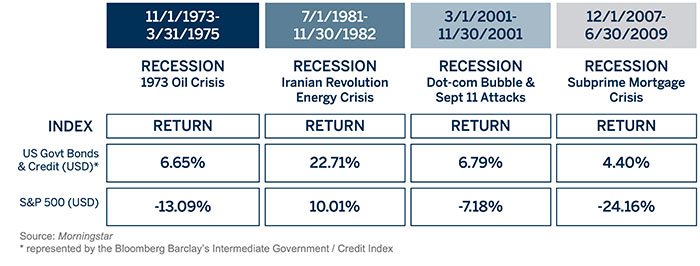

Because they are a different kind of investment, fixed income securities usually react differently than stocks to changing market and economic conditions. That makes them an excellent choice for diversifying your portfolio. When stocks and other equity investments lag, bonds often contribute positively to portfolio returns. They can also help reduce portfolio volatility over time. In fact, although the prices of fixed income securities in the U.S. do fluctuate with interest rates and economic cycles, they haven't seen the extreme volatility that stock/equity investments have experienced. As the chart below shows, fixed income investments (as represented by the Bloomberg Barclays U.S. Intermediate Government/Credit Index) helped smooth out volatile returns by outperforming the stock market, (represented by the S&P 500®, ) in each of the four recessions since 1973.

A hedge against deflation

Oftentimes investors are concerned about inflation or the possibility that future purchasing power could decline due to the increased price of goods over time. This is an inherent risk in bonds, since, on the bond's purchase date, the cash flows are set for the lifetime of the security. Conversely, deflation makes having fixed cash flows and a set maturity schedule more valuable as the purchasing power of those cash flows increases over time. Thus, bonds are a good hedge in deflationary environments.

Active management return versus a benchmark

While there are many other qualities that make bonds attractive, investors also want excess return versus a benchmark. The over-the-counter, less liquid nature of many bonds can offer opportunities for active managers to take advantage of dislocations that occur in the bond market. Nuances in sectors, credit quality, and bond structure offer opportunities for investors to add excess return versus their respective benchmarks.

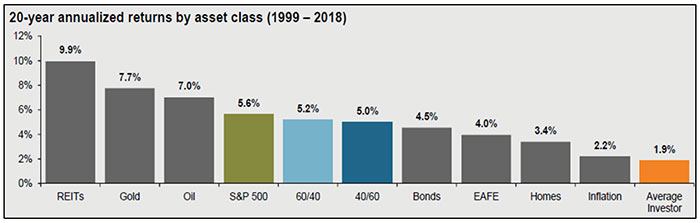

Shown below are different asset returns over a twenty year period. A blended portfolio has exhibited similar returns to the S&P 500, and inherently has less volatility.

Source: J.P. Morgan Asset Management; (Top) Barclays, Bloomberg, FactSet, Standard & Poor's; (Bottom) Dalbar Inc.

Indices used are as follows: REITS: NAREIT Equity REIT Index, EAFE: MSCI EAFE, Oil: WTI Index, Bonds: Bloomberg Barclays U.S. Aggregate Index, Homes: median sale price of existing single-family homes, Gold: USD/troy oz., Inflation: CPI. 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high-quality U.S. fixed income, represented by the Bloomberg Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/18 to match Dalbar’s most recent analysis. Guide to the Markets – U.S. Data are as of June 30, 2019.

For any portfolio allocation considerations you may have, reach out to your SVB Private advisor.