Key takeaways

-

Establishing well-defined and prioritized goals can help you avoid the dangers of overreacting to short-term market fluctuations while you grow your business.

-

Defining your goals based on priority and your time horizon allows you to create a clear path towards long-term success.

- Dividing your portfolio into three distinct segments can help you more effectively manage your portfolio as you progress through your business and personal milestones.

Avoiding the dangers of irrational investing

Too often investors buy high and sell low. Unfortunately, many investors allow their emotions to overpower their goals when the markets approach high or low points.

Studies show that the more frequently investors check their portfolio performance, the more they trade, and the worse their performance becomes. In fact, investors in liquid investments such as stocks tend to sell quicker than investors in illiquid investments such as real estate because liquid investment pricing is so readily available.

As a business leader with limited time to devote to personal investment planning, how can you avoid falling into this trap? Should you just buy and hold? Set it and forget it?

Our advice is to focus on defining and prioritizing your investment goals as carefully as your business goals and design a plan that positions you for long-term success. Then, track your progress based on your goals rather than worry about every uptick and downtick of the S&P 500 Index.

Related read: Expanding investment opportunities with legal assets

Retirement planning: The ultimate long-term investment

A long-term goal at the top of most investors’ lists is achieving an ample retirement nest egg. 82% of the current U.S. working population plan on paying for retirement via self-funded savings.1 Retirement plans that avoid short-term market jitters are critical to a properly-funded retirement account.

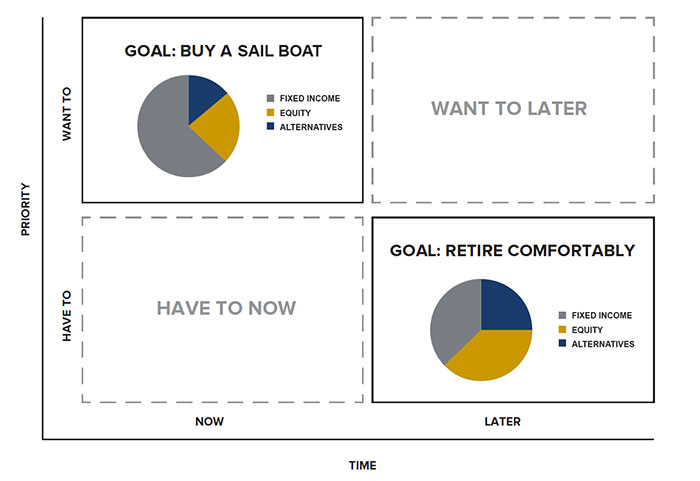

When mulling over your retirement plans, ask yourself these two key questions: What do I need to have? What would be nice to have?

When it comes to retirement, of course, it’s important to have enough money to cover your basic financial expenses – food, housing, clothing, healthcare, etc. It would be nice to have additional funds to enjoy your retirement – travel, entertainment, vacation home, sailboat, etc.

For many investors, the biggest concern is maintaining their lifestyle through retirement. After your lifestyle requirements are met, taking the time to define your other high-priority goals and mapping out a plan to align your remaining assets to meet them may help you live the retirement you’ve envisioned. Answering the following questions can help you begin to solidify your plans:

-

What is the purpose of my wealth?

-

What causes do I want to support?

-

What legacy do I want to leave for my family?

Defining your goals based on their priority and time horizon can help you properly assess your existing financial situation and create an actionable roadmap to achieve your goals.

Embracing the three pillars of an effective investment portfolio

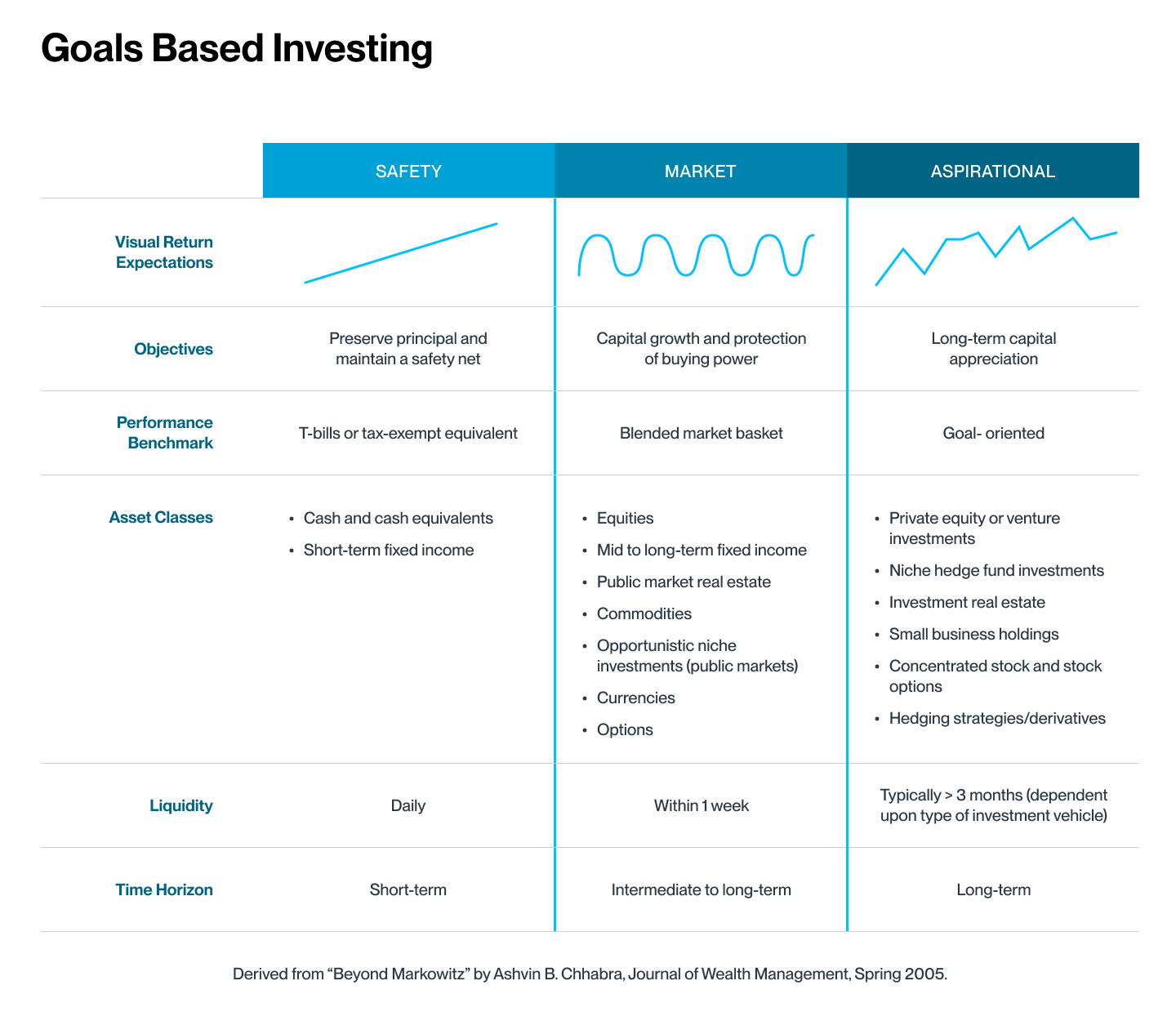

Once you’ve defined your goals, implementing an investment plan that seeks the most efficient risk-return tradeoff for each stated objective is easier to navigate. Consider earmarking your personal funds into safety, market and aspirational segments.

1. Safety. The ‘safety bucket’ is where to keep your low risk, stable funds for daily living expenses, emergency expenses and near-term spending.

2. Market. The ‘market bucket’ is earmarked for your longer-term needs. This is the account used for funding your retirement and is designed to grow over time, hopefully avoiding the full brunt of any market downturns. As you come closer to retirement, you may want to dial down the risk in your portfolio.

3. Aspirational. The ‘aspirational bucket’ is where you take on more risk to achieve your future goals. Significant wealth accumulation often requires investments in assets that require leverage and concentration such as real estate, hedge funds, private equity and business ownership. However, the potential pay-off does come with greater risk. Therefore, you may want to earmark the funds in this bucket for long-term legacy, not your essentials.

The chart below provides a more comprehensive breakdown of the three segments we recommend employing when developing a goals-based investment portfolio. Understanding the resources and corresponding returns that comprise each portion of your portfolio can help you more deftly manage the market fluctuations that may occur as you progress towards your long-term goals.

Structuring your investment portfolio for your long-term financial goals may help you to tune out the noise of short-term market fluctuations. View risk as the probability of permanent loss between now and the date of the goal that your money is working towards. There may be volatility in your investments but understanding that those fluctuations are not going to derail your future provides a less stressful investing experience.

Of course, each investor’s goals, risk tolerance and financial circumstances are different. If you would like assistance aligning your investment portfolio with your long-term goals, contact an SVB Private wealth advisor today.

1Transamerica Center for Retirement Studies. (2021, August 5). Living in the COVID-19 Pandemic: The Health, Finances, and Retirement Prospects of Four Generations. Transamerica Institute. Retrieved from https://transamericacenter.org/docs/default-source/retirement-survey-of-workers/tcrs2021_sr_four-generations-living-in-a-pandemic.pdf