Key takeaways

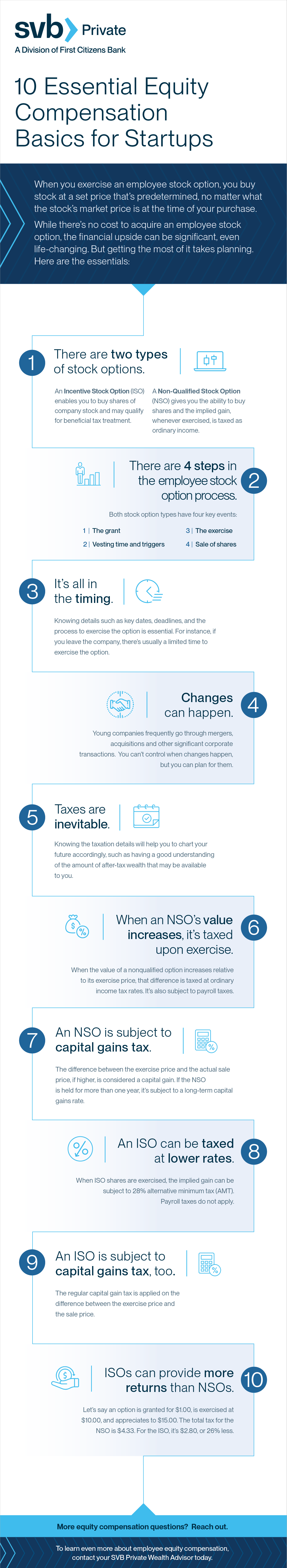

- There are two types of equity compensation that are usually offered to employees: the Incentive Stock Option and the Non-Qualified Stock Option.

- Each employee stock option has unique tax obligations that must be followed, so be aware of the specific regulations to be fully prepared.

- Very often, the financial upside of an employee stock option can be significant if you know the optimal time to take full advantage of it.