We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

For a gift of family real estate, consider the value of an IDGT

If you own real estate—perhaps a vacation home or income property that has increased substantially in value over the years—and you want to keep it in the family, there are a number of planning strategies you can use to help minimize the estate and gift tax consequences of the transfer.

“In today’s real estate market, particularly in California, Massachusetts, and New York, it’s not unusual to see people with a large percentage of their assets in real estate properties that have increased 10- to 20-fold in value from their original purchase price many years ago,” says Alyssa Do, Managing Director and Wealth Strategist at Boston Private. Even though the new estate tax exemption is now at $11.18 million1, owning just a few of these highly appreciated real estate assets can easily push someone’s total estate over that threshold and trigger estate taxes as high as 40%, she says.

That’s why it’s important to be careful about how and when you transfer these properties to the next generation, says Do. “Taking the right steps now could save you and your heirs a significant amount in income and estate taxes in the future.”

Creating an ‘intentionally defective’ trust for estate and gift tax benefits

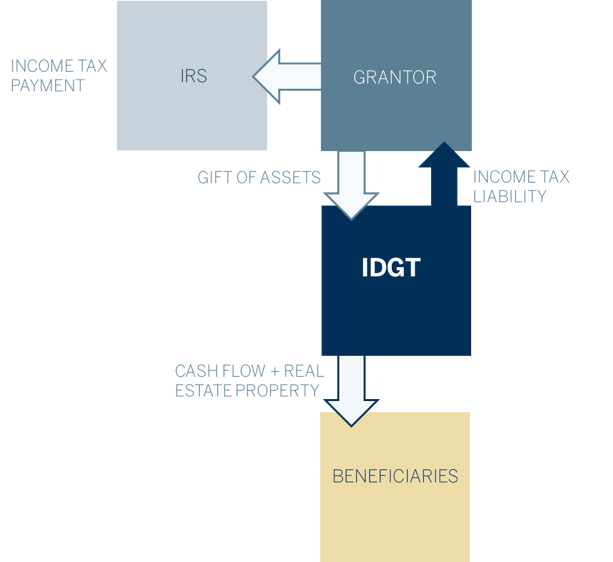

One strategy that an increasing number of property owners are using is the Intentionally Defective Grantor Trust (IDGT). The unique design of this type of irrevocable trust can create important benefits for both you as the grantor of the trust and your children as the beneficiaries of the trust. “While the transfer to an IDGT is complete in terms of removing taxable assets from your estate for estate tax purposes, it is purposely incomplete (or defective) for income tax purposes,” Do says.

“For estate tax purposes, once the transfer of property to this irrevocable trust is complete that asset is removed from your (the grantor’s) taxable estate, and so is any future appreciation of that asset,” she explains. When structured properly, the IDGT will receive the net income generated from the trust’s income-producing assets, which will be held for the benefit of or to distribute to the beneficiaries of the trust. This does not account for the transfer as a taxable gift during your lifetime which will count towards your lifetime gifting exemption.

However, for income tax purposes, you will still be responsible for paying any taxes generated by the gift of assets. Because those tax payments won’t be subject to any estate or gift taxes, you can think of the income tax payments as additional, tax-free “gifts” to your children as well. There are several ways to establish the trust as a defective trust for income tax purposes. Under one common technique, the grantor retains the power to substitute assets. This retained power offers the grantor the opportunity to preserve potential losses from depreciated assets, which otherwise would disappear at his/her death.

A great strategy for income-producing real estate property

Because of the potential significant tax savings, you might consider using an IDGT for properties that:

- have appreciated – and will continue to appreciate – substantially in value over time so you can remove their appreciation from your estate, and

- have the potential to generate high level of income that will benefit your children in the future.

Using an IDGT for properties held in an LLC adds a valuation discount

If the real estate you intend to transfer is not held by a business entity such as a limited liability company (LLC), you can make a gift of the property directly to the IDGT. That gift can be any fractional share of the property or the entire property.

However, if your income property is owned by an LLC – and many income-producing properties are, says Do – then you will need to make a gift of a percentage of your LLC interest to the IDGT. This may give you (as the grantor of the trust) the benefit of valuation discounts for lack of control and/or lack of marketability.

Do explains: “Let’s say that the building that the LLC owns is worth $1 million dollars and you are the single member of the LLC. If you make a gift of your entire LLC interest to the IDGT, the gift amount would be $1 million dollars. However, if you make a gift of 40% of your membership interest in the LLC to the trust (while retaining 60% of the LLC interest), nobody is going to buy that smaller portion for its full value because they would have no control over operations of the LLC. So essentially, the portion of the LLC that the IDGT owns has less value – perhaps $300,000 due to the valuation discount of $100,000. Hence, you’re making a bigger gift for a smaller taxable gift amount.”

In addition, because you still own 60% of the LLC, you retain control of the LLC/property, while also taking advantage of the estate tax benefits that the transfer of the other 40% at a discounted amount to the IDGT offers.

Variation on the theme: Leveraging the transfer with an installment sale

Another way to transfer highly appreciated real estate to your family is to use an installment sale approach. This method allows you to take advantage of the current low interest rate environment.

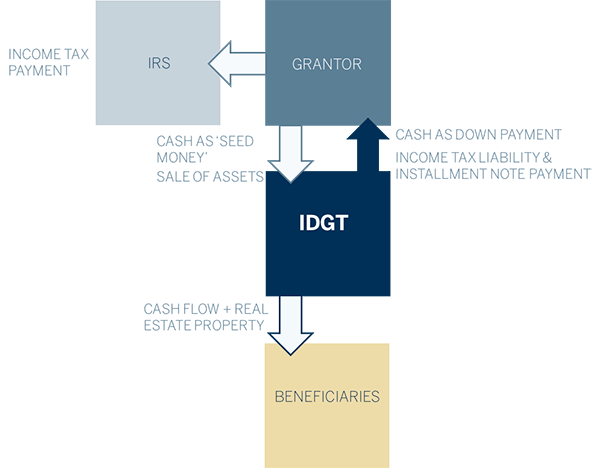

Here’s how an installment sale works with an IDGT:

- As the grantor of the trust, you make a cash gift (called “seed money”) to the IDGT, which counts toward your lifetime gift tax exemption. (The use of seed money ensures that the subsequent sale of the property will be considered a bona fide sale by the IRS, rather than a gift.)

- The trust uses this cash as down payment to purchase the real estate then finances the balance via an installment note/loan payable to the grantor of the IDGT.

NOTE: Since this transaction is considered a sale, the cost basis of the property gets a step-up, thereby reducing the amount of capital gains to be paid in the future as well. - The grantor charges at least the minimum interest rate required by the IRS for an intra-family loan, called the Applicable Federal Rate or AFR. This is typically much lower than prevailing interest rates. (For current AFR rates go to https://apps.irs.gov/app/picklist/list/federalRates.html)

- Over time, the appreciation in the value of the property purchased through the installment sale should exceed the interest payable on the note. Again, any growth in value of the trust above the AFR rate is free from gift and estate taxes.

For example, assume the asset annually produces $500,000 of rental income, the expenses on the asset are $150,000 and the payments on the promissory note from the IDGT to you are $150,000 per year. The IDGT receives the $500,000 in rent, pays the $150,000 in expenses and pays you $150,000 on the note. The IDGT keeps the $200,000 of net income for the benefit of your children. Because you are treated as continuing to own the asset, you will include the $200,000 of net rental income in your income and you will pay the income tax on that amount. If you are in a 40% income tax bracket, you will pay $80,000 in income taxes. You can use the $150,000 the trust paid you on the promissory note, and you will not have to spend money out of your pocket.

One additional benefit of the installment note approach is that every year, as grantor, you can use your annual exclusion amount to forgive a portion of the note. You can also write into the loan agreement that the note is forgivable upon your (the grantor’s) death.

Do recalls one client in his 90s who used the installment sale strategy to transfer his property in Beverly Hills into an IDGT to benefit his heirs: “This was a property in a prime location – worth $5 million when the gift and estate tax exemption was only $3.5 million. So we structured an installment sale for his children and grandchildren. When he died a year later, most of the installment note was forgiven.”

If he had not used the defective trust with an installment sale, the result would have been far different, she says. "The family would have paid 40% in estate taxes on the $1.5 million that exceeded the exemption. That’s $600,000 lost to taxes."

Instead, the property was transferred to his daughter, who is in her early 60s, and to her children, who are in their 20s, with virtually no tax impact. The daughter, in turn, is now doing the same thing again with her other properties – setting up an installment sale with the assets in the IDGT ultimately going to her children. "As long as you don’t sell the property," concludes Do, "You can keep pushing off the capital gains."

1- Adjusted annually for inflation. Current exemption amount expires in 2025 unless extended.