Choosing the best charitable giving option

Other than direct contributions, Donor-Advised Funds and Private Foundations are two of the most common charitable giving vehicles. However, each option approaches giving differently; and each provides a unique set of benefits to the giver as well as the charitable organizations receiving the gifts.

Defining a Donor-Advised Fund (DAF)

A DAF is an investment account that allows a donor to make tax deductible donations which are then invested until the donor requests that a grant be made to an IRS-qualified charity of their choice. DAFs allow the donor to place cash, stocks and other assets within the account and receive a tax deduction during the tax year the contributions are made. The donor can then make a recommendation to distribute the assets within the DAF to benefit charitable organizations in the future.

Defining a Private Foundation

A private foundation is a charitable organization that makes donations that are managed by its trustees or directors. A private foundation gives more control to the donor regarding grants and there is no requirement to give directly to IRS-qualified charities. For example, grants from a private foundation may be made directly to individuals as well as to qualifying charitable organizations. Private foundations also help to instill a legacy of philanthropy for families by having family members actively participate in establishing a charitable mission, selection of charitable recipients and day to day management of the foundation. However, private foundations are significantly more costly to establish and maintain.

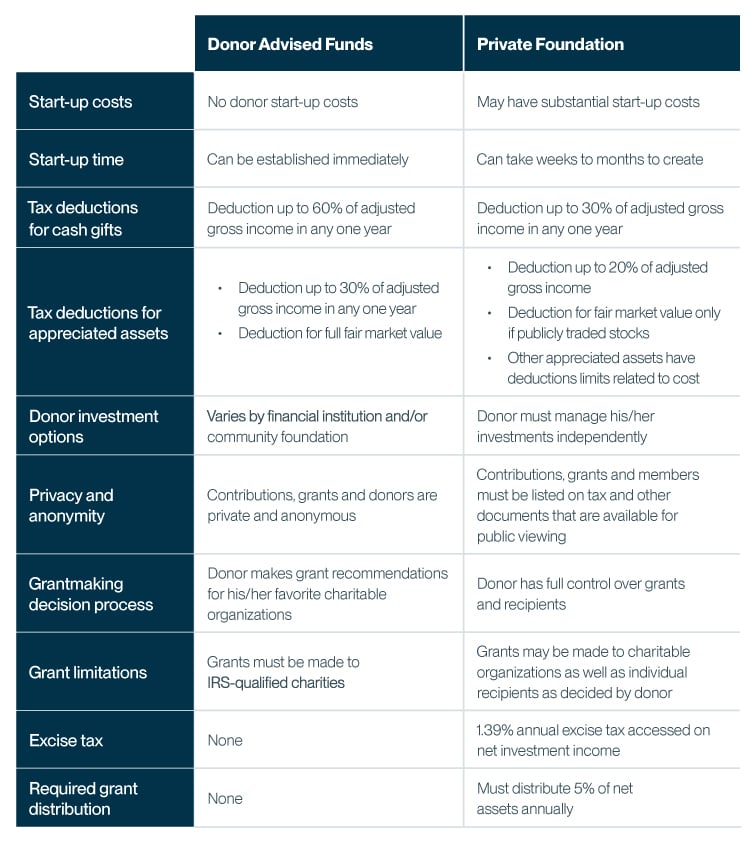

Choosing between a DAF and Private Foundation

The table below can help you quickly compare the characteristics of these two giving options. After reviewing the information below, we recommend that you consult with your advisor to determine which approach is the most effective charitable vehicle for your giving plan.

For additional help with your charitable giving

If the idea of a charitable vehicle that can enhance your giving strategy appeals to you, we recommend talking with your advisor regarding an appropriate solution for you and your family. Your advisor will consider your total financial picture, including your long-term estate and legacy goals, to help you decide on the most effective approach.