When you need a cost-effective source of cash, be sure to consider these not-so-obvious factors.

Key takeaways

- When deciding on your course of action, examine the three critical liquidity factors: How much money you’ll need, how quickly you’ll need it and how much you are willing to pay to get it.

- As you review your options, carefully consider the repayment terms, tax implications and the potential impact on your other financial goals.

- Employing multiple sources of funds may be the most effective solution.

When you need cash—to seal a real estate deal, manage one of life’s “not-so-little” emergencies, or pay for a wedding or a once-in-a-lifetime vacation—what’s the best course of action? If you’re tempted to reach for a credit card to get the cash you need, you may want to reconsider. There may be other ways you can address your personal liquidity needs.

Look first at the amount, speed, and cost

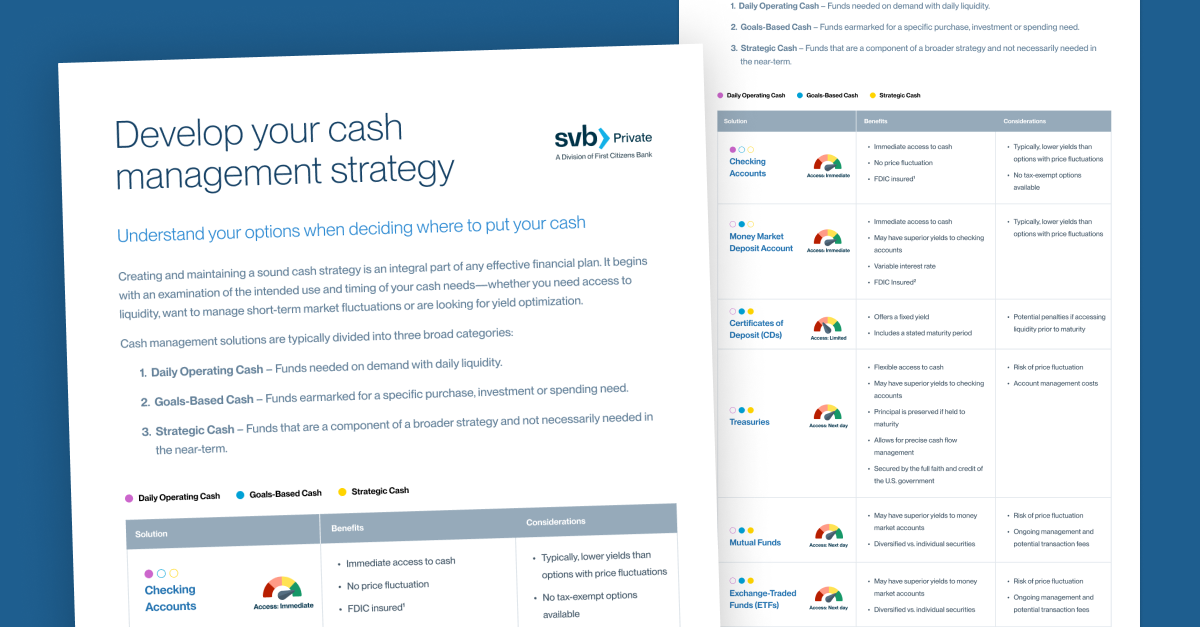

How much money you need (amount), how quickly you need it (speed), and how much you’re willing to pay to get it (cost) are the three factors that can help you identify the right source of cash for your situation, according to Charles Nilsen, Senior Managing Director, SVB Private. As the table below illustrates, these factors vary greatly among the choices you can make.

Short-term liquidity options

| Source | Amount Available | Speed of access | Cost (interest rate) | Length / repayment | Tax impact | Other Considerations |

| Cash on hand in bank or money market fund | $ Usually smaller |

Immediate | NA but possible transaction fees | None | Little or none | Effect on other goals |

| Selling securities | $$$ Medium to Large |

Immediate | NA but possible brokerage fees | Flexible | Paying capital gains or incurring financial losses | Forfeiting potential asset growth |

| Securities-based loans | $$$$$ Largest |

1-2 Weeks | $ Low |

Flexible | None | If the value of the underlying securities decreases significantly, borrower may be required to provide additional collateral or repay the loan immediately. This event may also evoke a margin call. |

| Home equity line of credit (HELOC) | $$$ Medium to Large |

30+ Days | $$ Medium |

10-year draw period | Interest may be tax deductible if used for home improvement | Debt secured by home. Lots of paperwork. |

| Mortgage refinance with cash out | $$$$$ Large to Largest |

45+ Days | $ Low |

15-30 years | Interest may be tax deductible | Lots of paperwork. Debt secured by home. |

| Unsecured loan | $$ Medium |

2-3 Weeks | $$ Medium |

Per lender | None | Availability and repayment terms |

Please Note: There are additional lines of credit available that can be secured with various asset types. Please reach out to your SVB Private banker for more details.

Unsecured lending may be an effective solution for you.

Reach out to your SVB Private banker to discover your options.

If the amount you need is small and you need it quickly—to replace a faulty air conditioning system or to pay for a summer-long rental at the beach, for example—the fast, easy solution is to tap into the cash in your checking, non-retirement savings accounts or money market funds. Or this might be the right time to use some of the cash you’ve been accumulating in your emergency or rainy day fund.

On the other hand, you could use a credit card cash advance. Just remember, while this is another easy way to get cash fast, the interest rates for borrowing from a card tend to be extremely high, often at usury rates of 18% or higher.

“The cheapest, easiest source of liquidity will always be your cash on hand,” says Nilsen. “But most people don't keep a significant amount of money just lying around. They prefer to keep those assets invested.” That’s why you may want to explore other options, he says.

Check the impact on your goals and taxes

When you look at all of your cash options—and their speed, cost, and amounts available—don’t forget to consider the paperwork involved, the payback terms (and any penalties for early repayment), tax consequences and how using a particular cash source might affect your other financial goals too.

Borrowing against assets you already own through:

- Securities-based loans

- A home equity line of credit (HELOC)

- A margin account

- Mortgage refinance with cash out

These solutions may provide you with a much larger amount of cash, at a reasonable borrowing cost, without reducing the long-term value of those assets or compromising your other financial goals.

One drawback: Most of these asset-based options are not particularly speedy solutions. "However, if you are approved for a secured line of credit, you'll have immediate accessibility to that cash in the future, so that’s a consideration too," says Nilsen.

Also important to remember: Margin loans and other securities-based loans offer fast access to cash at reasonable rates (so you can avoid having to sell securities outright), it is based on the value of your investments. So if the market tumbles, you may need to pay your money back more quickly due to a “margin call.”

Combining cash sources may offer a solution

Depending on the reason you need the money, a combination of cash sources might work well too.

Nilsen offers a hypothetical example to show how using two cash sources could help a young couple purchase real estate in a highly competitive real estate market like San Francisco, Boston, or Los Angeles. “With so much competition in these areas, they're apt to have a better shot at getting the house they want, if they pay cash for the property and close quickly,” he explains.

In a scenario like this, the steps might be as follows:

- The couple’s parents agree to help them make a cash offer for the home so they can seal the deal with the seller.

- Once the offer is accepted (and because the cash payment might be substantial) the parents access the cash the couple needs at the closing by using a line of credit secured by their investment portfolio.

- When the sale is done, the young couple, if qualified, may take the final step to repay their parents by completing an “all cash-out refinance.” With this type of financing, the cash proceeds from the new mortgage would go to the new owners to use as repayment.

How SVB Private can help

Clearly, there are many sources of cash to meet short-term liquidity needs and many combinations of sources that might be used to create timely, cost-effective solutions. To zero-in on the best ones for your situation:

Focus first on the three key considerations for accessing that cash—amount, speed and cost.

Then look at other factors, like goals, payback terms and taxes that can influence your choice.

We can have a private banker contact you, take you through this decision-making process and review the cash/liquidity options that are available to you from SVB Private and your other financial partners. If you would like to discuss your liquidity options, simply complete the contact form on our custom lending solutions webpage and we will contact you shortly.