We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

Market fluctuations are normal and to be expected. But, when volatility strikes—as a result of political developments, economic downturns, war, health crises, or natural disasters—it can be tempting to react, make educated guesses on what to do, or fear that you are missing out on an opportunity.

When anxiety is high, that’s the time to keep things in perspective by focusing on your long-term plan and goals. In our opinion, the best response may be to do nothing, especially if you already have a sound, long-term plan for pursuing your financial goals.

To help you take volatility in stride, remember

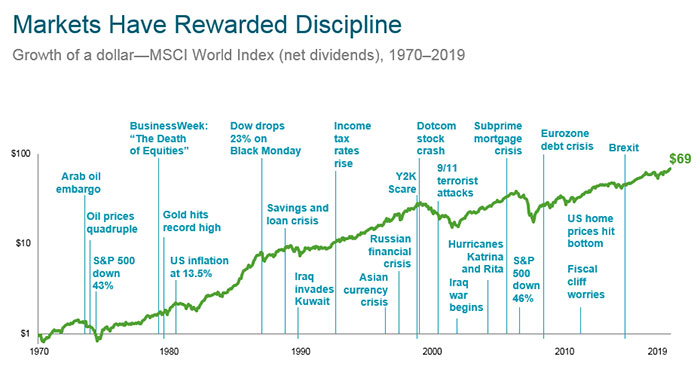

We’ve been here before; volatility is nothing new.

From the Arab oil embargo and Y2K, to Hurricane Katrina and Brexit, below are the global events that impacted the market over the past three decades. The chart underscores that, historically, markets reward discipline.

Market declines create opportunity for long-term investors.

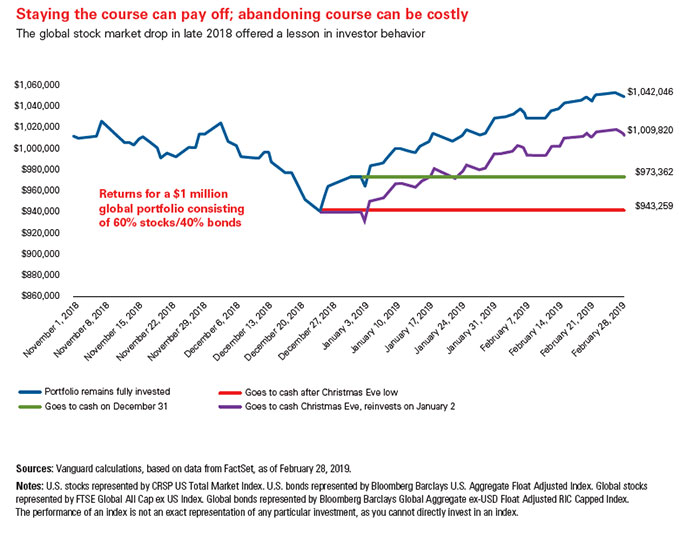

As the global market drop of 2018 illustrates, staying the course can pay off, while abandoning it can be costly.

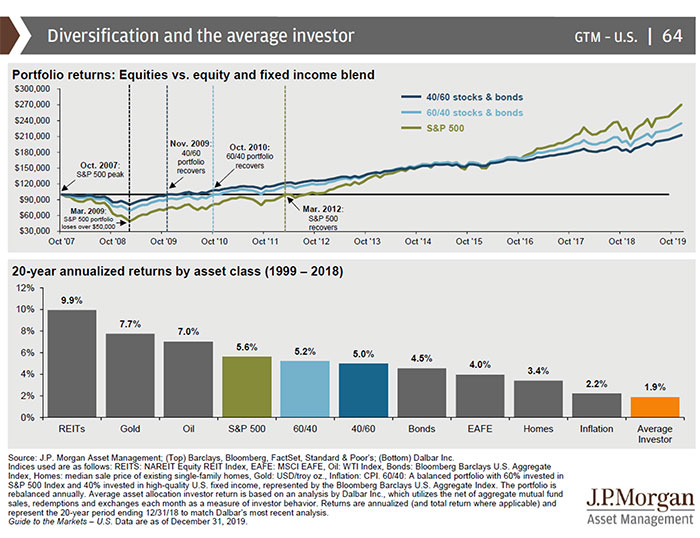

Diversification helps your portfolio weather market turbulence.

The goal of a diversified portfolio is to participate in the best performing asset classes each year. History has proven that it is nearly impossible to accurately predict which asset class will outperform in any given day, month, year, cycle, etc. The chart below shows how a diversified portfolio, made up of stocks and bonds, fares against individualized stocks and depending on their allocation how fast investors recovered after the 2008-2009 crisis.

Focus on the right time horizon

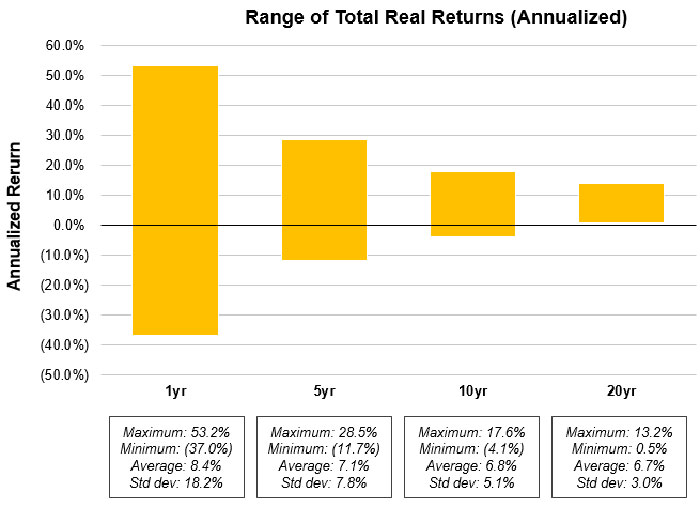

Research on investor psychology has shown that as market volatility increases, your time horizon tends to shorten. Combining easy access to information on the daily swings in markets/your portfolio and no shortage of alarming headlines is a recipe for bad investment decisions.

The key is to focus on the right time horizon. If you have 20 years before retirement, the daily/weekly fluctuations mean very little to your long term results. Don’t let short term phenomena drive long term decision making. In other words, maintain a long term mindset.

The chart below provides a great data driven illustration confirming how a focus on the long term may produce a positive outcome. Returns over the short term vary widely and are relatively unpredictable, but over the long-term, the range of potential outcomes is much narrower. It’s also more likely your returns will be positive.

While nothing is certain, market volatility is inevitable

Try to remain calm. Stay focused on your financial goals, and build a long-term plan with one of our expert advisors to help alleviate worry, preserve your wealth, and position yourself to take advantage of the next bull market.

Our approach

Focus on what you can control

Your SVB Private Advisor will work with you to:

- Create an investment plan – informed by financial science and tailored to your needs, goals, and tolerance for risk.

- Structure a portfolio along the dimensions of expected returns, within your risk tolerance parameters.

- Manage the impact of taxes.

- Add investment value, manage expenses, and monitor turnover, while maintaining broad diversification.

- Stay disciplined through market dips and swings.

We understand you can never have enough time and that your life may be complex. Our partnership – built on transparency and communication -- is grounded in our commitment to providing exceptional service. We provide a uniquely customized experience through execution of a plan developed with technical wealth planning expertise that fully integrates every part of your life.

Your dedicated advisor combines technical expertise, professional experience, and judgment to be your single point of contact, consulting on all your personal financial decisions. This advisor is backed by a team of technical experts who can provide deeper knowledge and advice on specialized financial matters that might arise.

SVB PRIVATE is a leading provider of integrated wealth management, trust and private banking services to individuals, families, businesses and nonprofits. Over the last 30 years, SVB Private has provided clients with conflict-free, comprehensive advice and deep technical expertise that spans every aspect of their lives to simplify their path to financial success. The firm provides the capabilities of larger institutions yet delivers the superior service of a boutique firm to clients across the United States.