We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

A part of the Raising Financially Responsible Children series

Building wealth over the long term takes hard work and careful planning. But wealth creators often need help to teach their children how to use money responsibly.

The toughest part may be getting the conversation started.

A 2015 survey found that nearly 70 percent of parents said they were very or extremely concerned about setting a good financial example for their kids, but 41 percent said they sometimes avoided talking to their kids about money.1

Many of those who were reluctant to raise the subject said they didn’t want their kids to worry about it. Other parents worried that their children will lose the motivation to pursue career ambitions. Some believe the kids aren’t old enough to handle the news.

That means there are a staggering number of people who are struggling to convey important life lessons to their children. And it’s coming at a critical time. Boston College’s Center on Wealth and Philanthropy estimates that some $39 trillion of wealth will be transferred from one generation to the next as an inheritance over the next four decades. At SVB Private, we frequently hear from clients on the issue of money and kids, and how best to educate children to be financially savvy in a way that enables them to be active participants rather than passive listeners.

What's the best age to start?

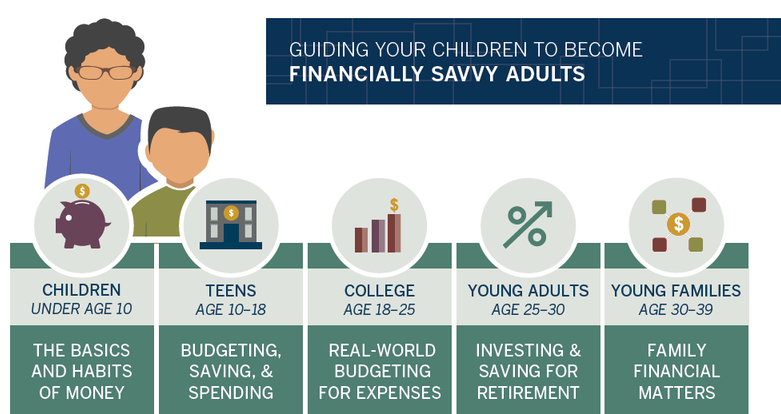

While we believe that it’s never too early to begin educating children about money, talking about the family’s wealth is a step beyond the basic information a parent would teach a child about saving birthday money and babysitting wages in a piggy bank or savings account. It is about a much bigger picture and a parent’s desires and expectations for how the next generation handles wealth.

At SVB Private, we think the ideal time to begin those more complex family wealth discussions is when the adult children in the family have entered their mid-20s, a time when they are graduating from school and setting out to establish their own identities, careers, and families. At this age, major financial decisions have to be made, often for the first time. And unlike much younger people, adults at this age have an understanding of money and its power (and curse).

At this point, they should already understand how to budget and spend wisely, and they might have some idea how to invest money and handle a credit card. But they may not grasp on how to save for retirement, harness an entrepreneurial idea, or choose charitable projects that will change the world for the better.

In addition, they are about to make major financial and life decisions for the first time, such as going into business, starting a family, and buying a home. They will need guidance on credit, protecting their assets, establishing a financial plan, investing for the future, and setting their own goals.

How can I start the conversation?

Try a family investment club.

For some families, getting started is as simple as getting together to participate in an activity. Gerald Graves, the head of SVB Private Wealth’s West Coast operations, says one of his clients has an investment club for its members ages 8 to 27, linked to an account.

The family meets periodically to talk about the investment portfolio, and each child is expected to research ideas and make recommendations, with the youngest pairing up with an older family member for assistance.

But it doesn’t have to be that elaborate, either. Parents can start the conversation by talking about their experiences getting started in business, and share what values they would like to pass along.

Try writing a family Mission Statement

Sometimes it’s helpful to put this information in writing in a family mission statement. This document describes the parents’ goals and wishes for how the family money is to be used, as well as the goals and desires of the children, giving them a stake and a voice in a successful outcome.

The statement can detail the ownership of the family business, if there is one, and how it is to be owned in the future.

It can set clear and specific goals about the family’s education goals and charitable giving activities, including the family’s preferences for the types of issues or institutions to support and in what amounts.

It can also describe how the family members plan to communicate about the family money, whether that will be in formal annual or semiannual gatherings or in periodic phone calls.

Financial education is just one aspect of creating collaboration between the generations. This collaboration helps solidify shared goals and makes sure everyone is working toward the same vision. Open and frequent discussion of the family mission statement also demystifies the family’s wealth and helps the younger generations understand that there is more at stake than simple money.

Make sure adult children have a voice.

Adult children should be left with a sense that they have a place at the table and that they are being trusted to act wisely. Whether they are joining the family business or participating in the family’s philanthropic activities, now is the time to help them decide which role they want to fill.

Younger children can also play a role, but the conversations obviously need to be tailored to their ages.

Parents can start by teaching their elementary school children to divide birthday and holiday money into three buckets:

- one for saving

- one for giving

- one for spending

The giving bucket will be a way to get the children involved in the family’s charitable giving, enabling them to research charities they want to add to the family’s list.

Older children heading off to high school and college should already have a command of basic banking activities, such as savings and checking accounts and mobile payment services. They can also take their first spin at investing.

It isn't just going to be one big talk, either.

This step is the first in a lifetime of conversations, sharing ideas, and setting common goals. For some families, these conversations have already begun, while others are just setting out on this path.

Either way, we are ready to guide the conversations. Not sure how to start talking to your children about money? Please contact a SVB Private Advisor.

1. T. Rowe Price, “7th Annual Parents, Kids & Money Survey, 2016"