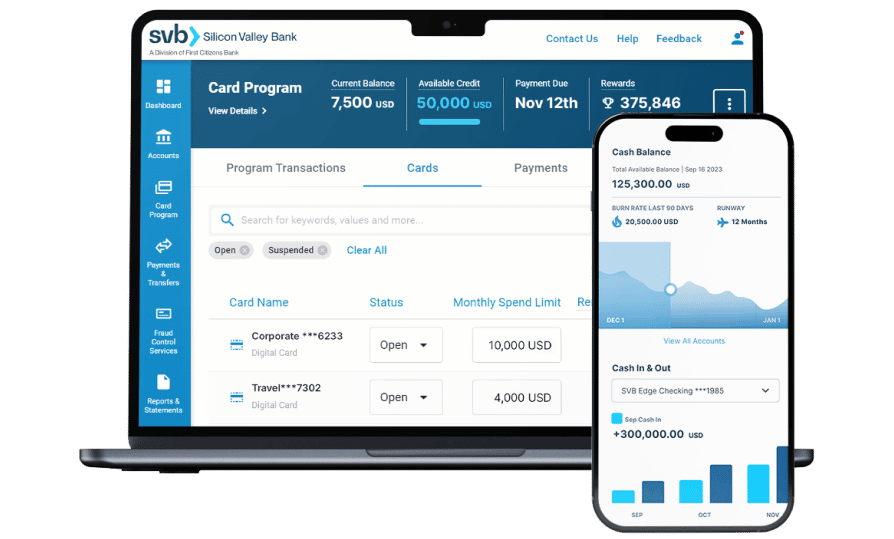

Startup banking products and services for founders

Discounted partner offers

Benefit from exclusive partner discounts on software and services. SVB technology, life science/healthcare & global business clients can save on software and services such as workforce collaboration, infrastructure, talents and more.4

60%

of the companies on the 2025 Forbes Fintech 50 List are SVB clients*

40%

of the Forbes 2025 AI 50 list are SVB clients**