Bank with us. We'll bank on you.

You’re part of the Techstars community – well done! As you build your startup, we invite you to join the SVB community as well. We’ve helped many Techstars startups accelerate their growth.

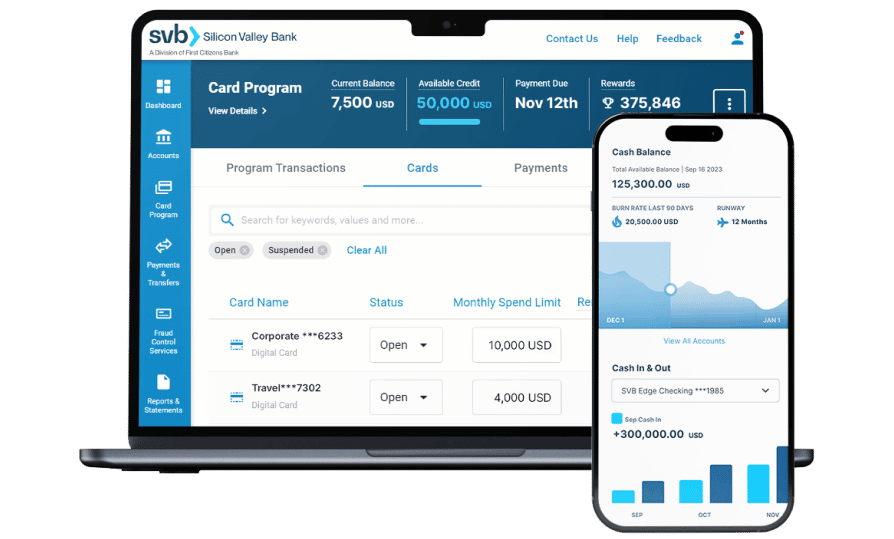

Startup banking products and services for founders

Discounted partner offers

Benefit from exclusive partner discounts on software and services. SVB technology, life science/healthcare & global business clients can save on software and services such as workforce collaboration, infrastructure, talents and more.4

60%

of the companies on the 2025 Forbes Fintech 50 List are SVB clients*

40%

of the Forbes 2025 AI 50 list are SVB clients**