We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

As a business leader, it can be difficult to carve out time for your taxes each year. To help you get a jump on this year’s tax season, my colleagues and I have prepared the following guidelines. The tactics below can help you have more productive discussions when speaking with your financial and tax advisors prior to the December 31 deadline.

1. Rebalance your portfolio/harvest losses

If this year’s volatile stock market has thrown your investment portfolio out of alignment, now is a good time to review your asset allocation with your advisor and decide what might need trimming and what should be beefed up. Getting back to your target allocation may involve selling stocks with significant gains. You may be able to offset those gains and reduce your tax bill through tax loss harvesting, meaning selling investments that have lost value and using those capital losses to offset capital gains (or, in the absence of gains, up to $3,000 a year in income).

2. Make annual gifts

This year you can gift up to $16,000 per person to any recipient without incurring gift taxes. For example, if you and your spouse each take advantage of the gift tax exclusion, together you can give a total of $32,000 to each child and grandchild without paying gift taxes, while reducing the size of your taxable estate. As long as each gift doesn’t exceed the $16,000 limit, it will not count against your lifetime estate tax exclusion.

Related read: Three ways to streamline tax preparation this year

3. Make charitable/philanthropic gifts

Charitable giving is always an effective way to support causes that are important to you and the organizations you lead as well an effective way to reduce your income taxes. However, you may want to take a closer look at your giving strategy this year. If you need to sell some highly appreciated securities in your portfolio to correct an imbalance, now may be a good time to consider donating the securities instead (rather than making a cash donation) as you may not need to pay taxes on the gains if the securities are given to a qualified charity.

4. Contribute to a donor-advised fund

If you decide to accelerate your charitable giving, creating and contributing to a Donor-Advised Fund (DAF) for 2022 is another effective strategy. Because a DAF allows you to make a single large contribution each year that can be paid out later to the charities of your choice, you’re not forced to select the charities immediately.

If you donate appreciated securities to a DAF, you may receive an income tax deduction (in the current year) based on the fair market value of the securities while avoiding the capital gains tax impact of selling the securities outright.

5. Take your required minimum distribution (RMD)

If you are 72 or older, you must take your required minimum distribution (RMD), based on the total value of your traditional IRAs and 401(k)s, by December 31. Be careful. If you miss the deadline, the penalty is 50% of the amount that should have been withdrawn. If you turned 72 this year, there is an exception; you can delay taking your RMD until April 1, 2023.

If you don’t need the funds and want to avoid paying income taxes on them, you can make a Qualified Charitable Distribution of up to $100,000 directly from your IRA to a qualified charity. The distribution counts toward your RMD and is income tax-free; however, it is not eligible to be a charitable deduction.

6. Maximize your contributions to tax-advantaged retirement accounts

If you work for an organization that offers retirement benefits, make sure you’re taking full advantage of your company-sponsored retirement plans. In addition to contributing enough to capture any company match, if you’re 50 or older, consider contributing the $20,500 maximum for 2022, plus the $6,500 catch up amount. In addition to maximizing your retirement account contributions, talk to your financial and tax advisors regarding the potential benefits of converting an existing IRA into a Roth IRA. You may also contribute up to $245,000 to a Defined Benefit Plan.

7. Review any employer-provided benefits available to you, including FSAs and HSAs

When working for an employer that offers health and welfare plans, take advantage of open enrollment, typically taking place in the fall. It is also the time to use this "window of opportunity" to compare plans and coverage to be sure the plan you select still meets your needs, especially if your personal or family situation has recently changed.

During open enrollment you may change to a different medical or dental plan to increase coverage or lower your costs. You may also choose to enroll in a high deductible health plan and Health Savings Account (HSA), if that is offered. Any money left in these plans at year end has the potential to grow tax-deferred and will not be taxed when it’s withdrawn in the future to pay for qualified medical expenses.

By contrast, a Flexible Savings Account (FSA) may require you to use the money contributed to it by the end of the calendar year or lose it. Some employers may provide a two-and-a-half-month grace period to spend the money or let you carry over up to $570 of your unused balance to 2023. Be sure to check your plan to see what flexibility you have and what expenses your FSA covers.

8. Prepay expenses to increase tax deductions

Prepaying property taxes, mortgage payments, medical bills or estimated state/local income taxes may give you additional itemized deductions that can reduce your taxable income. In addition, the Tax Cuts and Jobs Act provides reduced tax rates for small businesses (earning less than $340,100 for joint filers in 2022) organized as pass through entities (partnerships, S corporations, LLCs, LLPs and sole proprietorships). Prepaying or accelerating business deductions may help you reduce your taxable income and qualify you for lower tax rates.

9. Distribute trust assets to beneficiaries

Trusts reach the top tax brackets more quickly than individuals do. If you’re a trustee for a trust that gives you discretion regarding the timing of income distribution to beneficiaries, consider making beneficiary distributions before year-end, rather than having the trust taxed at the higher trust-level tax rate. Consult your financial advisor, trust officer, trust administrator or tax preparer for guidance.

10. Manage changes if you're recently married

If you got married this year, don’t forget to check in with your tax advisor. While some changes will be necessary, such as notifying the IRS and Social Security regarding a new name or address are just "good housekeeping" practices, other changes may affect the amount of taxes you’ll pay.

For example, while you may have been able to deduct up to $3,000 of capital losses on your tax return when filing as individuals in the past, a married couple filing jointly is now limited to a total $3,000 loss. A married couple filing separately is now limited to a $1,500 loss. Conversely, filing jointly with a new, non-working spouse may be an opportunity to reduce your withholding or estimated tax payments.

Please Note: Since your tax filing status is determined on the last day of the tax year, you and your new spouse will be treated as "married" for the entire year, and can no longer claim "individual" filing status, regardless of when you got married. Instead, your filing choices for this year’s return will be "married, filing jointly" (where incomes and deductions are combined) or "married, filing separately," which can be more complicated in community property states. If you have a prenuptial agreement, the terms of your agreement may also affect your filing choice.

11. (Re)Evaluate 529 plans for college savings

Review asset allocation and explore possibility of front-loading gifting (up to 5 years), which would allow for a $80,000 contribution per donee ($160,000 contribution per donee for married couples). A 529 plan may also be used for qualified K-12 education expenses up to $10,000 per year.

Related read: Educational gifts that make for wise investment strategies.

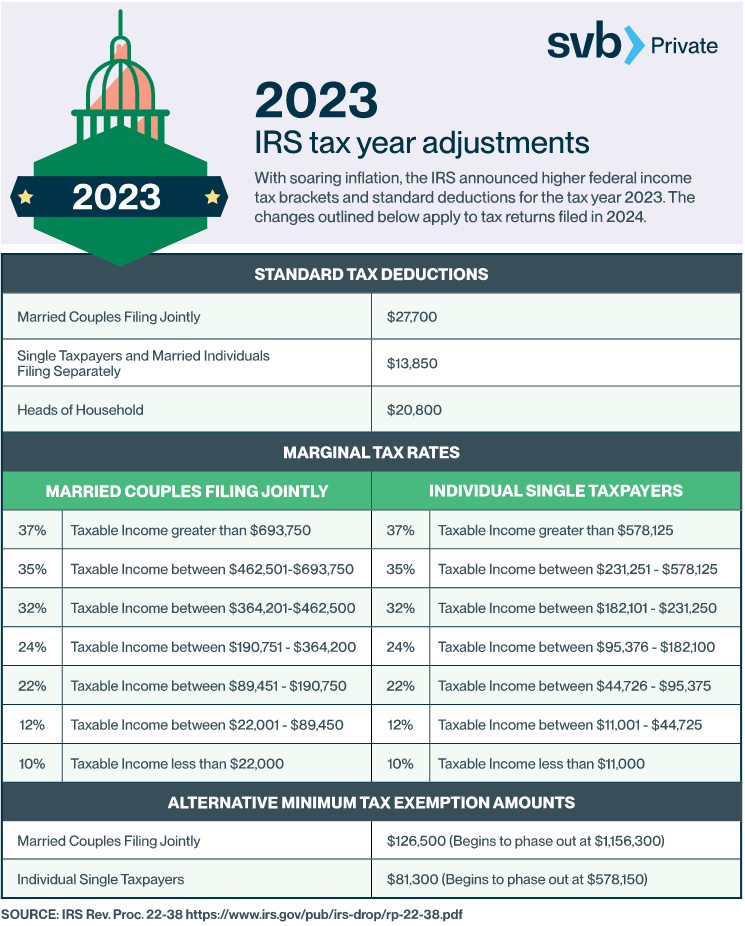

Looking ahead – 2023 IRS tax year adjustments

Additional changes to the tax code have been announced by the IRS. For additional information regarding how this may affect your tax status as a founder, entrepreneur or investor, please reach out to your SVB Private Wealth Advisor.