We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

More details emerge regarding the structure of the American families plan.

A part of the Washington Policy series

The Biden Administration is advancing its “American Families Plan” through Congress this fall. The $3.5 trillion spending and tax bill includes federal programs that support lower-income families, the elderly via Medicare and tackle climate change. While passage of the legislation in 2021 is not guaranteed, the Biden Administration has expressed its commitment to moving the legislation across the goal line by year-end.

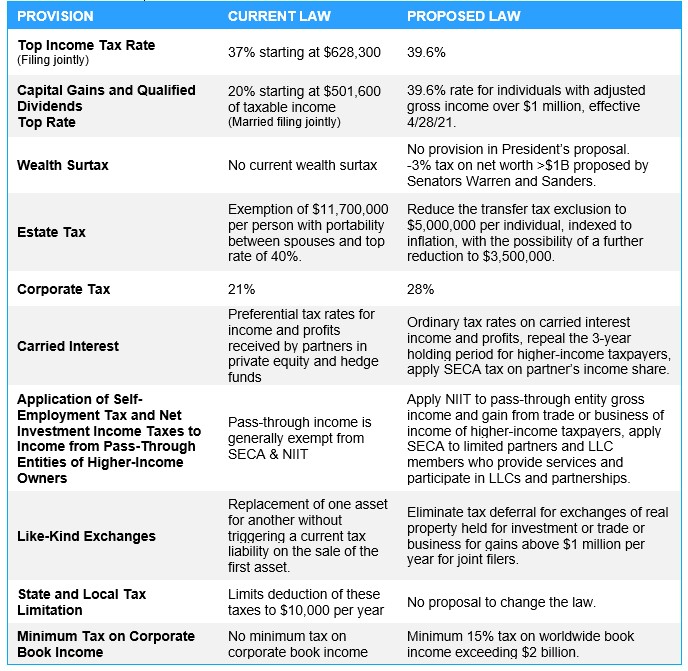

To help you assess the impact the new tax plan may have on your financial situation, we developed the chart below to summarize the proposed tax changes. At this stage, it is difficult to predict the details of the final deal with any certainty.

Because these policies and effective dates may change, it is important to consult with your advisors regarding the best course of action for your situation. The chart below is designed to illustrate the prospective legislative impacts based on the information available at the time of publication. As the year progresses, we will continue to monitor the effective dates of the proposed tax increases and will reach out to you to discuss options as the details of plan are solidified.

SECA: Self-employment tax, NIIT: Net investment income tax

Contact your wealth advisor for more information

Now is a good time to reach out to your wealth advisor and discuss how the potential changes may impact your financial situation and determine if any action is needed on your part. We will continue to monitor the situation and provide updates as the legislation advances. As always, please reach out to your advisor if you would like to discuss your plans.