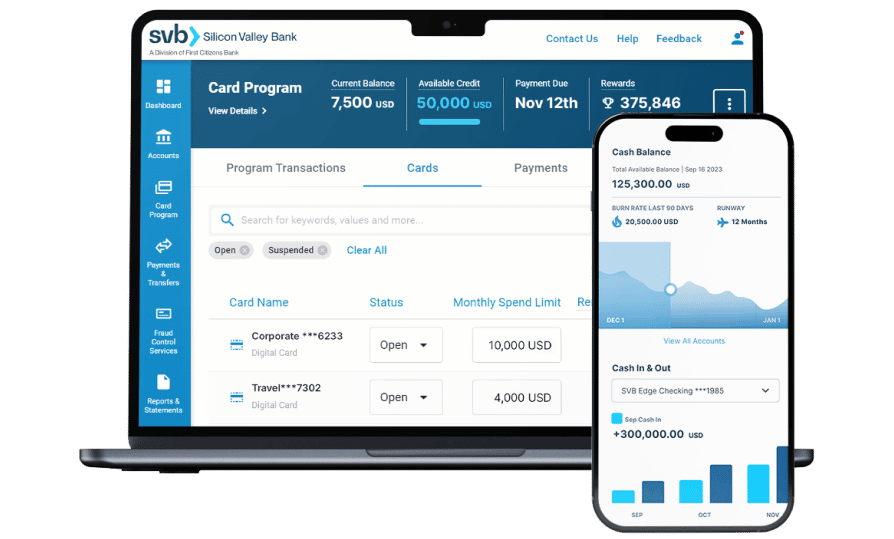

SVB Startup Banking for Primary Ventures game changers

Primary Ventures founders choose Silicon Valley Bank because we champion startups at every stage — from seed and venture raising to IPO and beyond — to accelerate growth. And to change the game.

Startup banking products and services for founders

60%

of the 2024 CNBC Disruptor 50 list are SVB clients*

~50%

of the Forbes’ Next Billion Dollar Startups 2024 are SVB clients**