SVB Startup Banking for Greycroft game changers

Greycroft founders choose Silicon Valley Bank because we champion startups at every stage — from seed and venture raising to IPO and beyond — to accelerate growth. And to change the game.

Startup banking products and services for founders

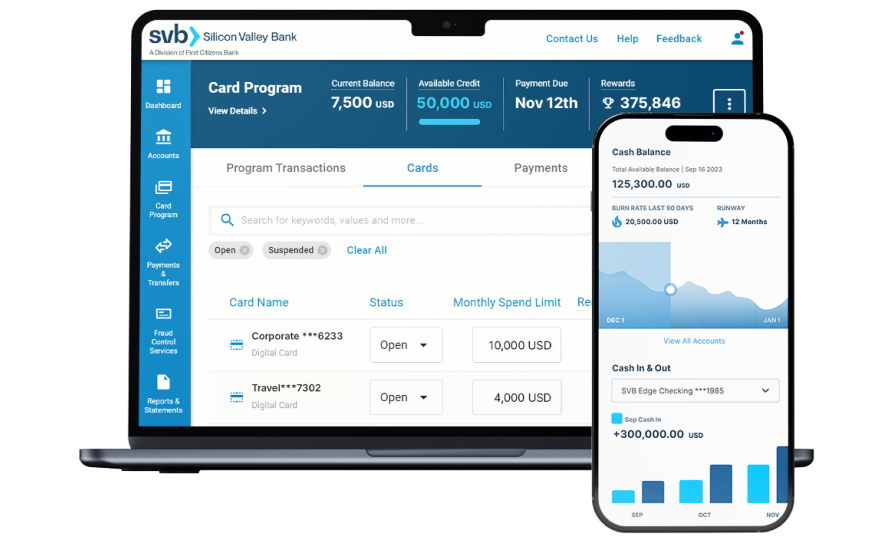

Free checking for 3 years

Enjoy free unlimited wires, bill payments and mobile deposits. There are no monthly maintenance and transaction fees. See terms and conditions for requirements.1

Up to 5.10% annual percentage yield on qualifying balances

Help make your money last longer with our Startup Money Market Account. Like with a savings account, eligible clients earn up to 5.10% APY on deposits of $4 million or less — so you gain a longer runway. Certain limitations and restrictions apply.2

Earn up to 3,000,000 rewards points

You could earn up to 3X rewards3 on all purchases made on the SVB Innovator Card for the next $1M you spend, or the next 6 months, whichever comes first after you enroll. Plus venture-friendly benefits such as no personal liability or annual fee, robust spend controls, automated workflows and more.

Accepting payments

Increase cashflow by accepting payments for sales, invoices, subscriptions and recurring billing with our Merchant Services offerings. Manage orders and create an integrated checkout experience on your website or in your app with flexible APIs. And keep the cash flowing with next-day funding.

Global growth services

Our team is here to support your global growth ambitions with market entry advice and networking across Europe, Latin America, India, MENA, Asia, Israel, Australia and New Zealand.

Discounted partner offers

SVB Technology, Life Science/Healthcare & Global Business clients gain access to deals on partner software and services that startups need such as workforce collaboration, infrastructure, talent and more.4

76%

of the 2023 CNBC Disruptor 50 list are SVB clients*

64%

of the Forbes’ Next Billion Dollar Startups 2023 are SVB clients**