How to dispute an electronic transaction

If you believe your account has been subject to an incorrect, unauthorized, or unrecognized electronic fund transfer, you can ask the bank to investigate. To view frequently asked questions about consumers’ rights and responsibilities regarding electronic transaction disputes, visit our dedicated Fraud Reporting page for more information.

Initiating a dispute in digital banking

Digital Banking now provides the capability for users to dispute certain types of electronic transactions that have posted to their account right from the Account Details page. This feature is enabled for all personal and business users in Digital Banking. Corporate users will need their User Roles Administrator to enable the Transaction Disputes entitlement.

Users have the option of submitting a dispute for either a single transaction or for multiple transactions for each account. After selecting the transaction they wish to dispute, the user must answer questions regarding why they are disputing it. As the dispute is reviewed and processed, updates are provided in Digital Banking for all users who have access to the account to monitor the status of the dispute.

Transactions that are eligible for dispute in Digital Banking include:

- ACH

- ATM

- Card - Point of Sale (POS)

- Zelle

Please note that transactions must be disputed within 90 days of posting to the account.

Submitting the dispute

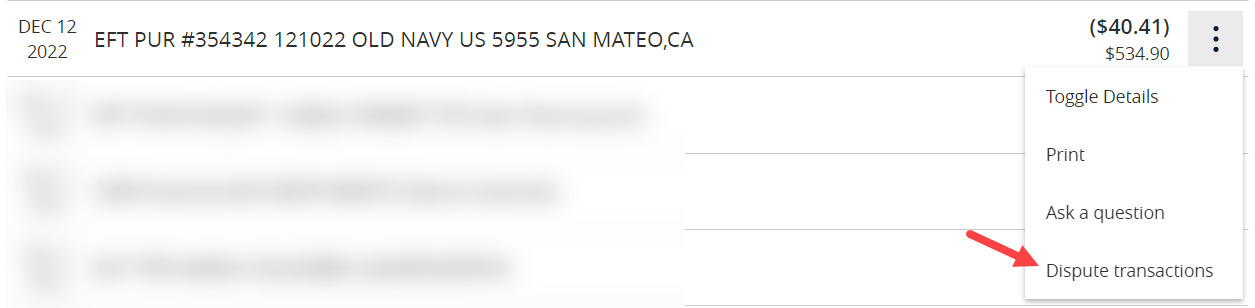

To submit a dispute, navigate to the Account Details page by selecting the account on the Home Screen. Choose the toggle to the right of the transaction you wish to dispute and select “Dispute transactions” from the dropdown menu.

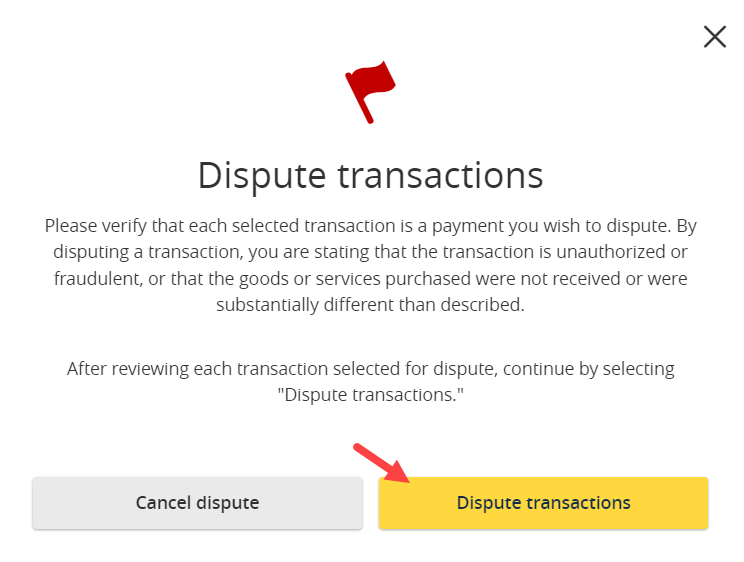

A verification box will display. Select “Dispute transactions” to continue with the dispute.

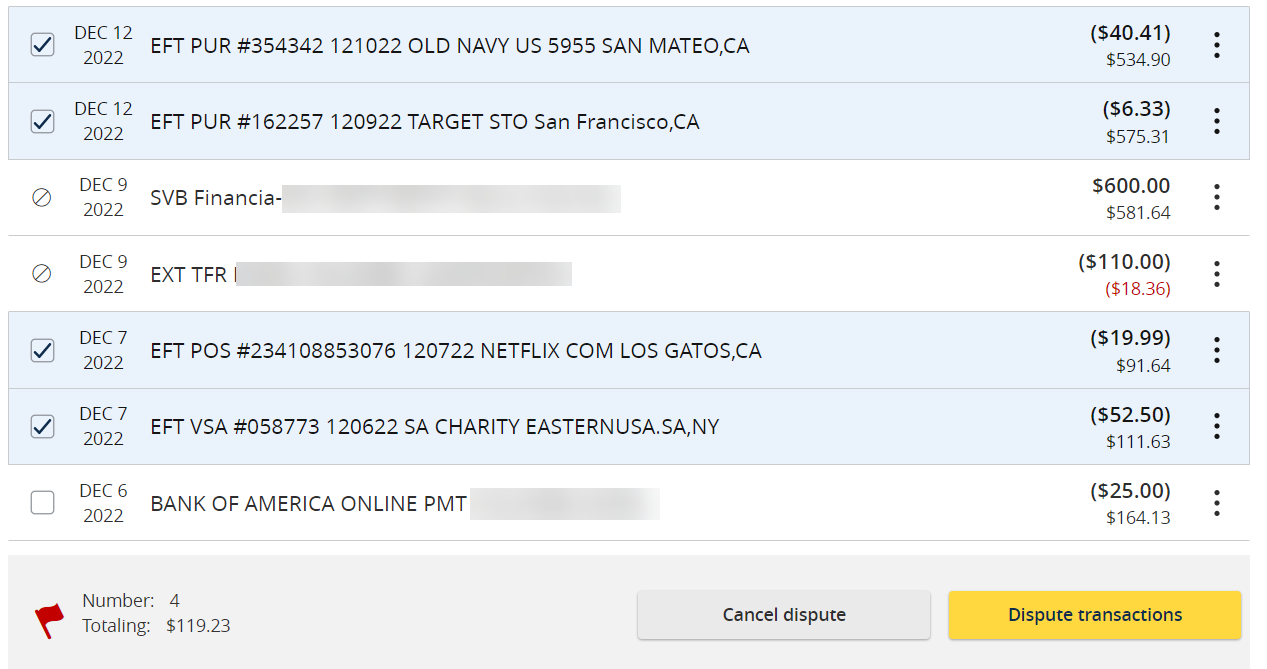

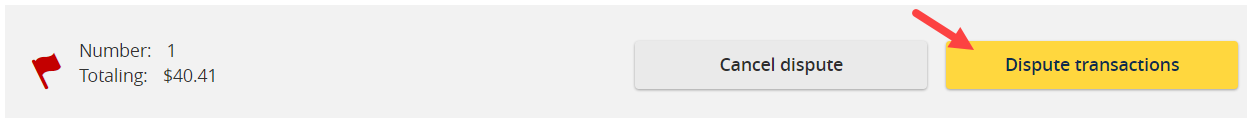

A totals bar will appear at the bottom of the page displaying the total number of transactions being disputed and the total dollar amount. There is the capability to select multiple transactions to dispute by selecting the box to the left of each transaction. When multiple are selected, the bar at the bottom will update the number and amount of transactions.

After all transactions are selected, click Dispute transactions.

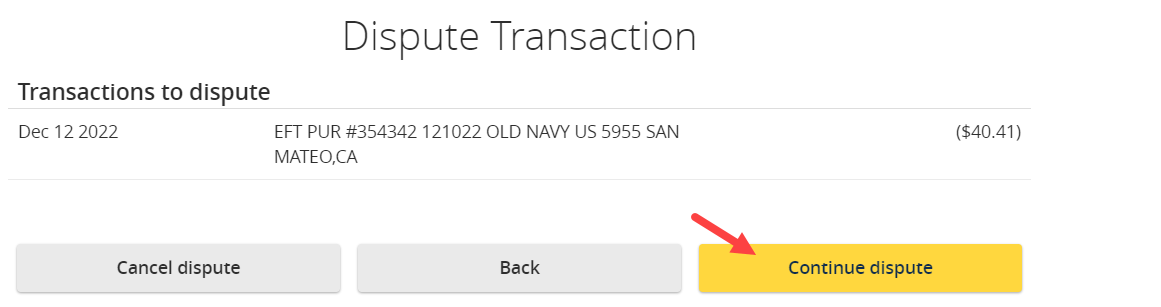

To proceed with the dispute, choose Continue dispute.

Completing the questions

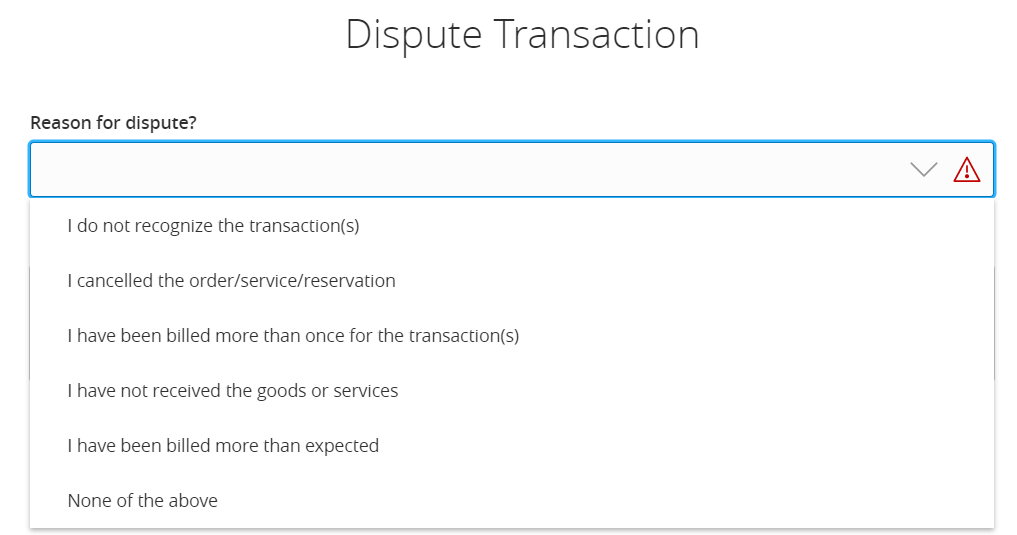

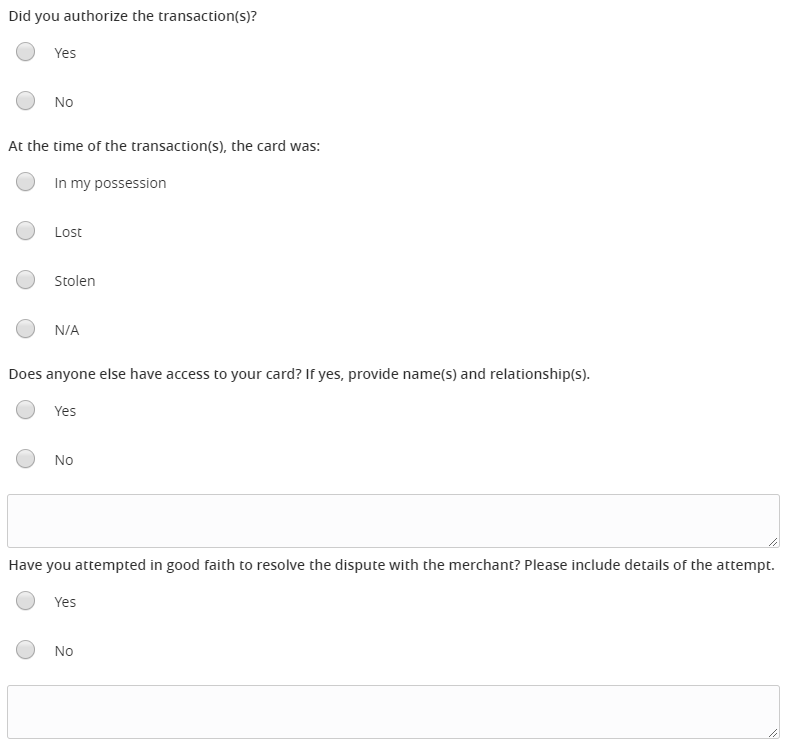

Complete the questions regarding the reason for disputing the transaction.

For question 1, select the reason for the dispute.

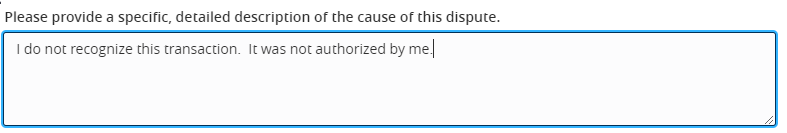

In the next section, provide a specific, detailed description of the cause for the dispute. Example below:

Complete the remaining questions providing details where needed. Then submit the dispute.

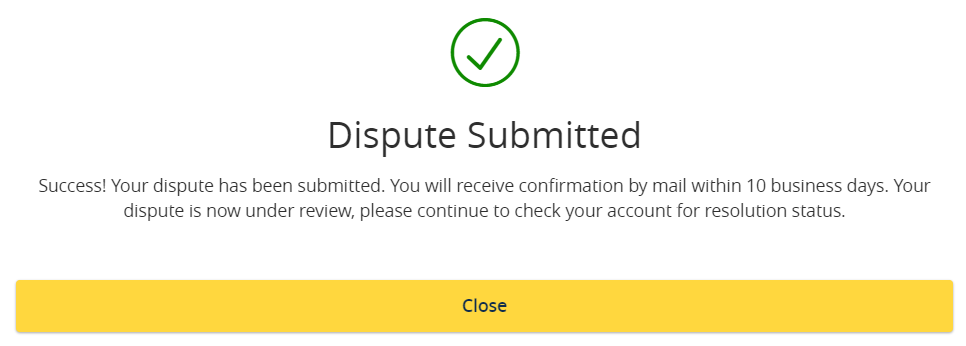

You will receive a confirmation message when the dispute has been submitted.

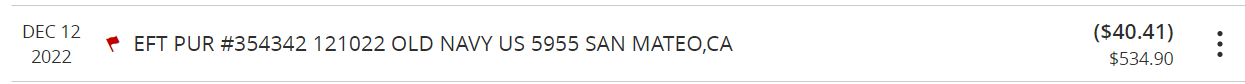

The transaction will be flagged in the account details screen to indicate that a dispute has been submitted on it.

If there are any questions or documents that need to be signed, we will reach out to you via Secure Message within Digital Banking, DocuSign, or you may receive a phone call from your relationship team. It is critical to respond to requests for information via Secure Messaging and requests for signature via Docusign as quickly as possible. The sooner we have the required information, the sooner we can process the dispute and attempt to recover funds.

Status updates

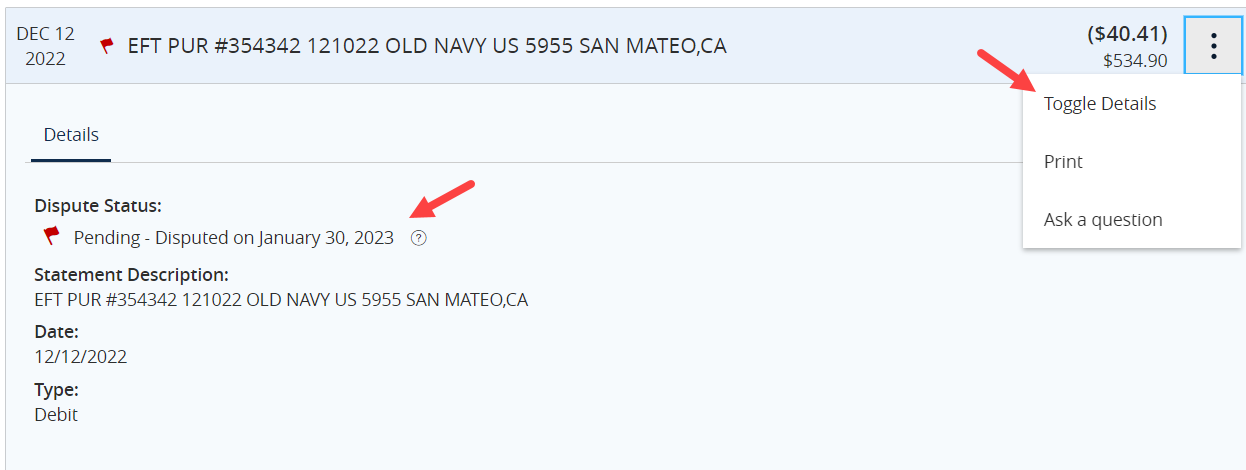

Select the actions menu at the right of the transaction to Toggle Details and view the status of the dispute at any time.

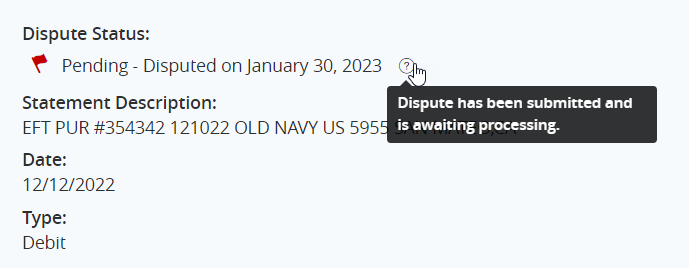

Select the question mark to get further details. When the status is Pending, it has been submitted to the bank and awaiting processing.

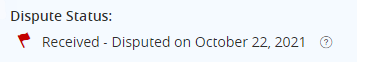

When the dispute is in a Received status, it is being reviewed by the bank.

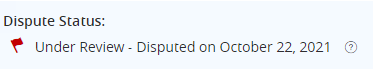

The status updates to Under Review when provisional credit has been given. Depending on when the transaction was submitted and reviewed, the credit should be in the account either after 4:00pm ET same day, or the following day after 4:00pm ET.

The status will update to Accepted (Closed) or Denied when all actions are complete. Note: The red flag will remain on the transaction in Digital Banking.