Phishing is the practice of impersonating a legitimate company through emails, text messages or phone calls in order to trick individuals into disclosing sensitive personal information and/or account details. For example, you may receive a text purporting to be from SVB Private. If you respond, you may receive a follow-up call in which a fraudster asks you to provide your social security number or online banking credentials.

Phishing attempts often include an immediate call to action, trying to get you to quickly give up your information before you have the chance to think. A phishing text or email may ask you to click on a link or respond immediately with personal information. Once the information is obtained from you, it may be used to access your account, steal your identity and withdraw your funds.

Remember, if you are ever unsure about an email, text, or phone call from SVB Private, please call the Concierge Desk at 1-888-322-2120 (option #2), visit our Fraud Prevention center, or contact your relationship manager.

Types of Phishing

- SMS/text messaging (Smishing)

- Phone calls (Vishing)

Phishing Red Flags

Scammers can be quite convincing and relentless in their pursuit of your personal/banking information.

Knowing the following red flags will help you be better prepared and less susceptible to a phishing scam:

1. You receive a message from an unknown sender

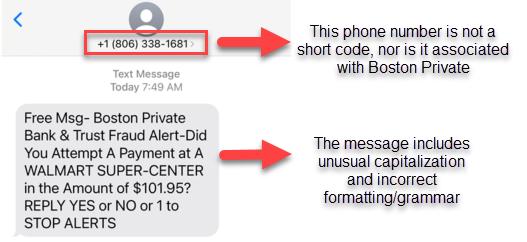

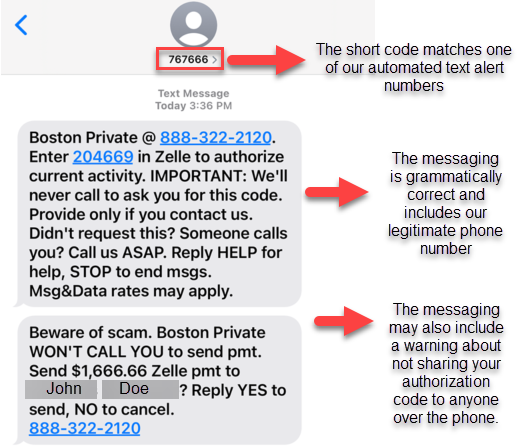

Always confirm incoming text messages or emails you receive are coming from a legitimate SVB Private phone number or email address. Legitimate SVB Private SMS alerts and notifications will be received from the following phone numbers/short codes*: 767666, 86434, 20733, 37268, 33072.

*Short codes are 5 or 6 digit phone numbers used by many companies and financial institutions, including SVB Private, for the purpose of sending and receiving text messages.

When receiving an email, always be sure that the message is coming from SVB or from a genuine SVB Private email domain that ends with “@svb.com.”

2. You notice a message contains grammatical errors

Phishing messages are more likely to contain strange formatting, unusual capitalization, incorrect spelling and/or grammatical mistakes. Keep an eye out for wording that appears improperly formatted or unprofessional.

Below is a fraudulent SMS/text message (a.k.a. Smishing) that was sent by a scammer :

Compare the Smishing message above to a legitimate SMS alert from one of SVB Private’s short codes:

3. You receive an unexpected, urgent or immediate call to action

Phishing emails or texts may warn you that immediate action is required to:

Authorize a charge, login to your account, update information or change your password. The urgency of the message is intended to rush you into sharing sensitive information that may compromise your account.

Remember to take your time and consider whether the message you are receiving is reasonable and makes logical sense. Do not click on any URLs or links before you have confirmed that the message is legitimately from SVB Private.

4. You are asked to share sensitive account information over the phone (a.k.a. Vishing)

SVB Private only asks for your account details when you call us. This is done to authenticate our callers to ensure we are speaking with a genuine client/customer. If you receive a call from SVB Private we will never ask for your personal or account information. However, a scammer will!

Scammers do have the ability to spoof our phone number. Even if the call appears to be coming from a SVB Private phone number, if you are asked to provide sensitive information, then you may be speaking with a scammer. If this is the case, or at any point you feel uncomfortable about the information you are asked to provide, then immediately disconnect the call and contact SVB Private at 1-888-322-2120.

Spoofing

Scammers use phone and email spoofing technology that can mimic a legitimate call from SVB Private. Therefore, the number that appears on your phone’s caller ID may not always be accurate.

Please keep the following in mind when you are contacted by SVB Private:

- SVB Private will never ask for private or sensitive account information when we call you. Do not share your password, ATM/debit card numbers, one time passcodes, PIN, address, or Social Security number with anyone who calls.

- Read your incoming messages carefully. If you receive a text message containing a one-time passcode, you should never share that number or read it aloud to anyone over the phone. Sharing a one-time passcode or mobile ID verification code with a scammer allows them to access your online banking account and initiate an unauthorized payment.

- If at any point you ever feel uncomfortable, we urge you to disconnect the call immediately and dial 1-888-322-2120 for our Concierge Desk. Because of phone spoofing, caller ID is not always reliable.

If you received a suspicious phone, text or email message and provided personal or financial information, contact us immediately at 1-888-322-2120 (option #2) or visit our Fraud Prevention center.

It’s our goal to protect your personal and financial information from fraud. Please be vigilant when responding to calls or texts and never click on suspicious email links.