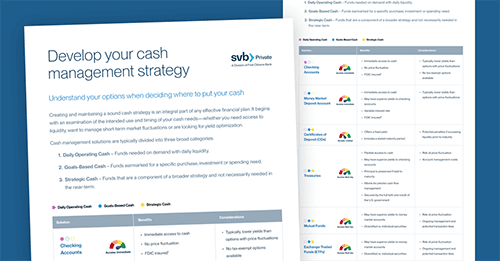

Cash Management Services

Develop your cash management strategy with our holistic approach to personal finances

More insights

Additional ideas from our team of professionals.

Short-term liquidity options: What are your choices?

When you need a cost effective source of cash, be sure to consider these not-so-obvious factors.

Learn more

How can we reach you?

While you’re creating the future, we’re helping your finances move forward.

Keeping pace with change means being prepared. We can help. SVB Private serves wealth clients like you to develop a fresh, holistic approach to your financial life and legacy.

Learn more

We’re here to build a collaborative partnership.

Communication and connectivity are at the heart of everything we’ll accomplish together.

Get to know usIndividuals and families are different

We collaborate to arrive at a deep understanding of what drives you. With a holistic approach, we can help you grow and protect your wealth and legacy at every stage of your journey by considering your complete picture.

More ways we help

1Banking, lending, and trust products or services are offered by Silicon Valley Bank, a Division of First-Citizens Bank. Silicon Valley Bank, a Division of First Citizens Bank is a member of the FDIC and of the Federal Reserve System. Loans are subject to underwriting, credit and collateral approval. NMLSR ID 503941.

Money Market Accounts (MMAs) and CDs: (CDs) Rates are subject to change at any time, and are not guaranteed until the CD has been opened. Minimum opening deposit amount may be required depending on term. Fees could reduce the earning on the account. Early withdrawal(s) are subject to early withdrawal penalties. (MMA’s) Rates are subject to change before or after account opening. Fees could reduce earnings on account.

2Placement of your funds through the ICS service is subject to the terms, conditions and disclosures set forth in the agreements that you enter into with us, including the ICS Deposit Placement Agreement. Limits and customer eligibility criteria apply. Program withdrawals are limited to six per month when using the ICS savings option. ICS, Insured Cash Sweep, and Bank Safe, Bank Smart are registered service marks of IntraFi Network LLC. For more information, please visit intrafinetworkdeposits.com.

3Wealth management and investment advisory services are offered through SVB Wealth LLC, an SEC-registered investment adviser.

4Brokerage products and services are offered through SVB Investment Services, Inc, a registered broker-dealer, Member FINRA and SIPC.