Find anything about our product, search our documentation, and more. Enter a query in the search input above, and results will be displayed as you type.

Searching...

Investment Trends Driving Private Equity and Venture Capital Markets

Key takeaways

Firms continue to adapt to a “higher for longer” interest rate environment.

01

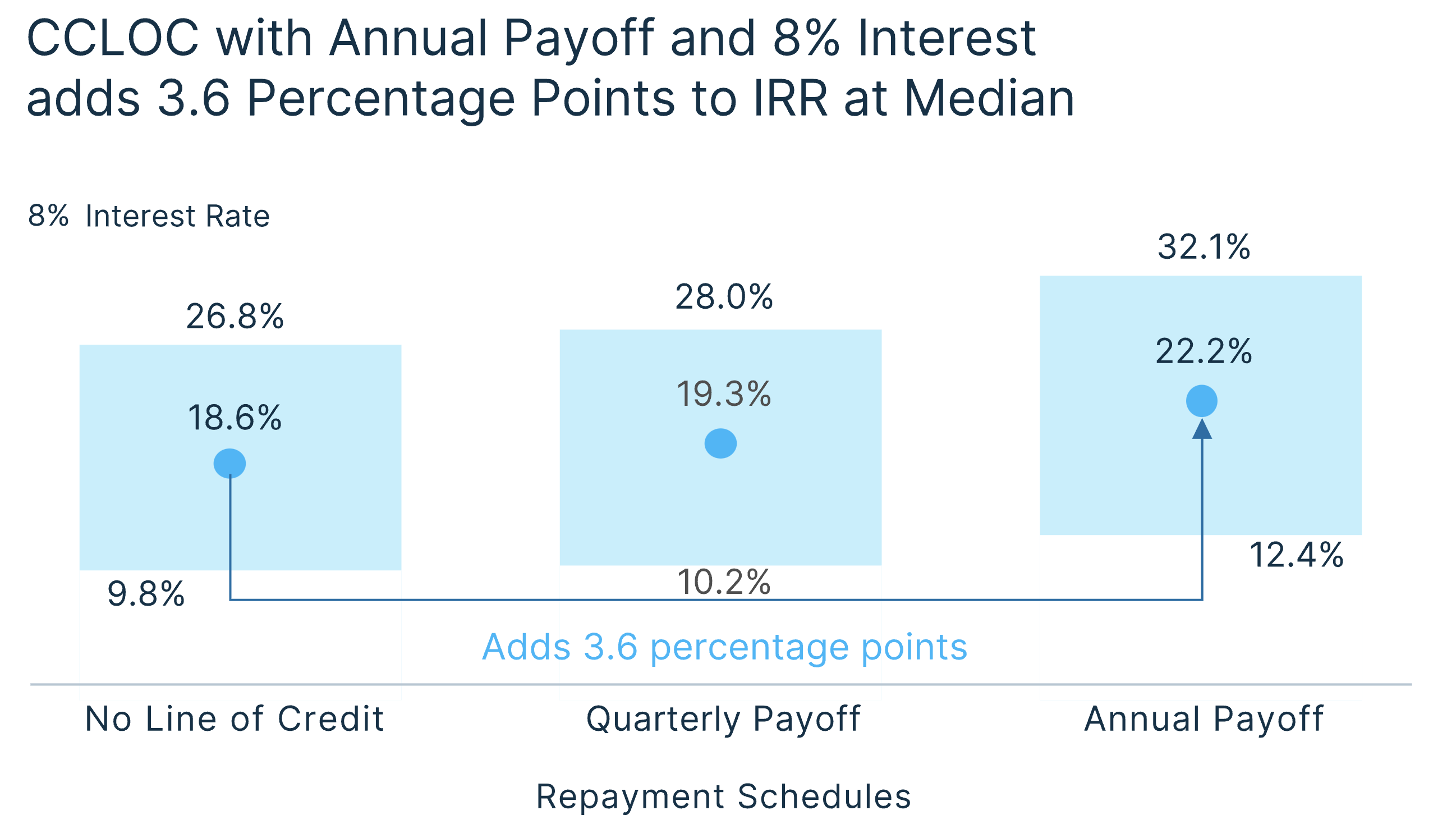

Interest rates affect debt usage.

Capital call lines of credit continue to offer enhanced internal rates of return (IRR) despite rising interest rates.

02

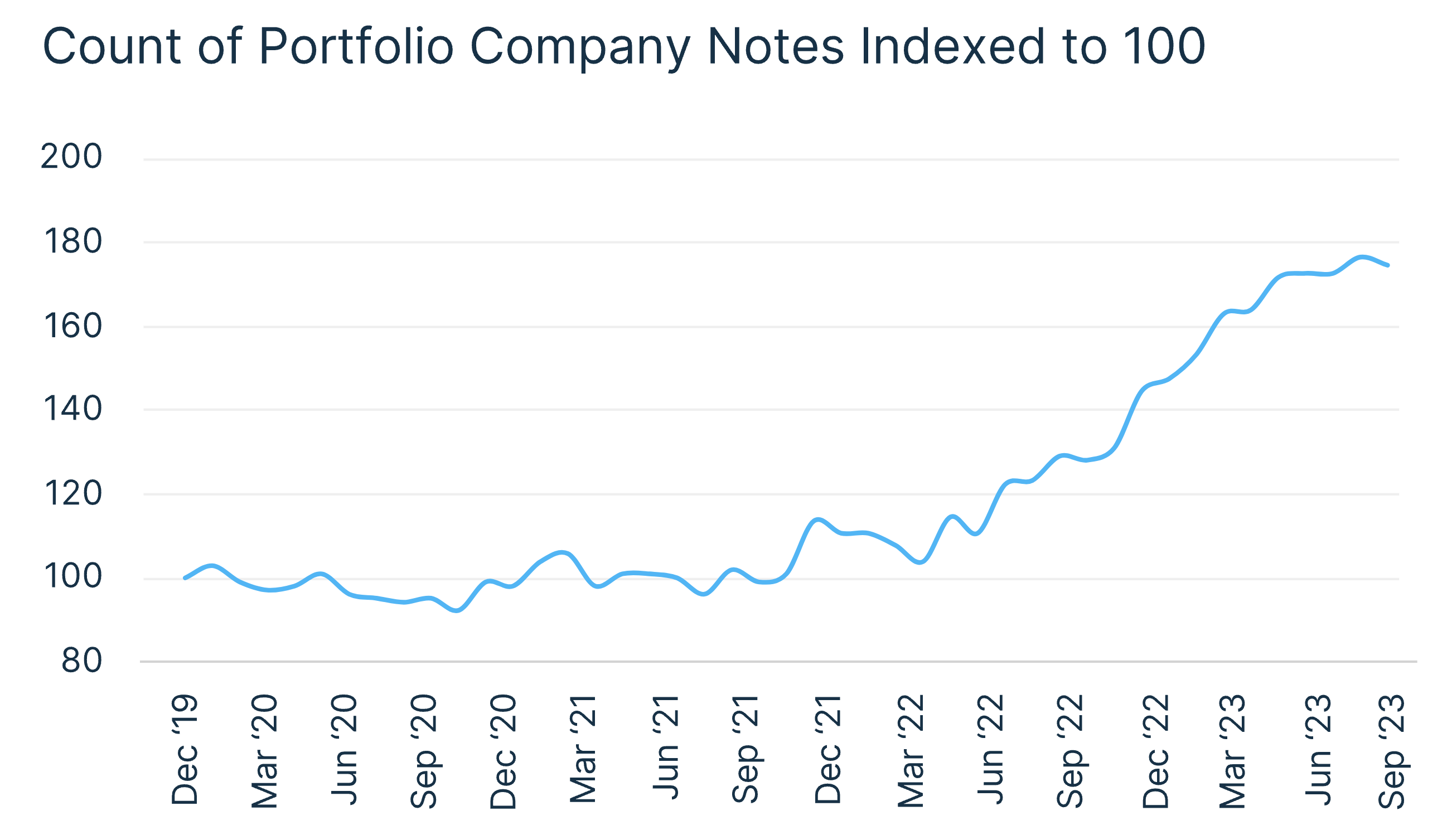

Focus on alternative liquidity solutions.

Firms have responded to a tighter liquidity environment by increasing their use of portfolio company notes to support their holdings.

03

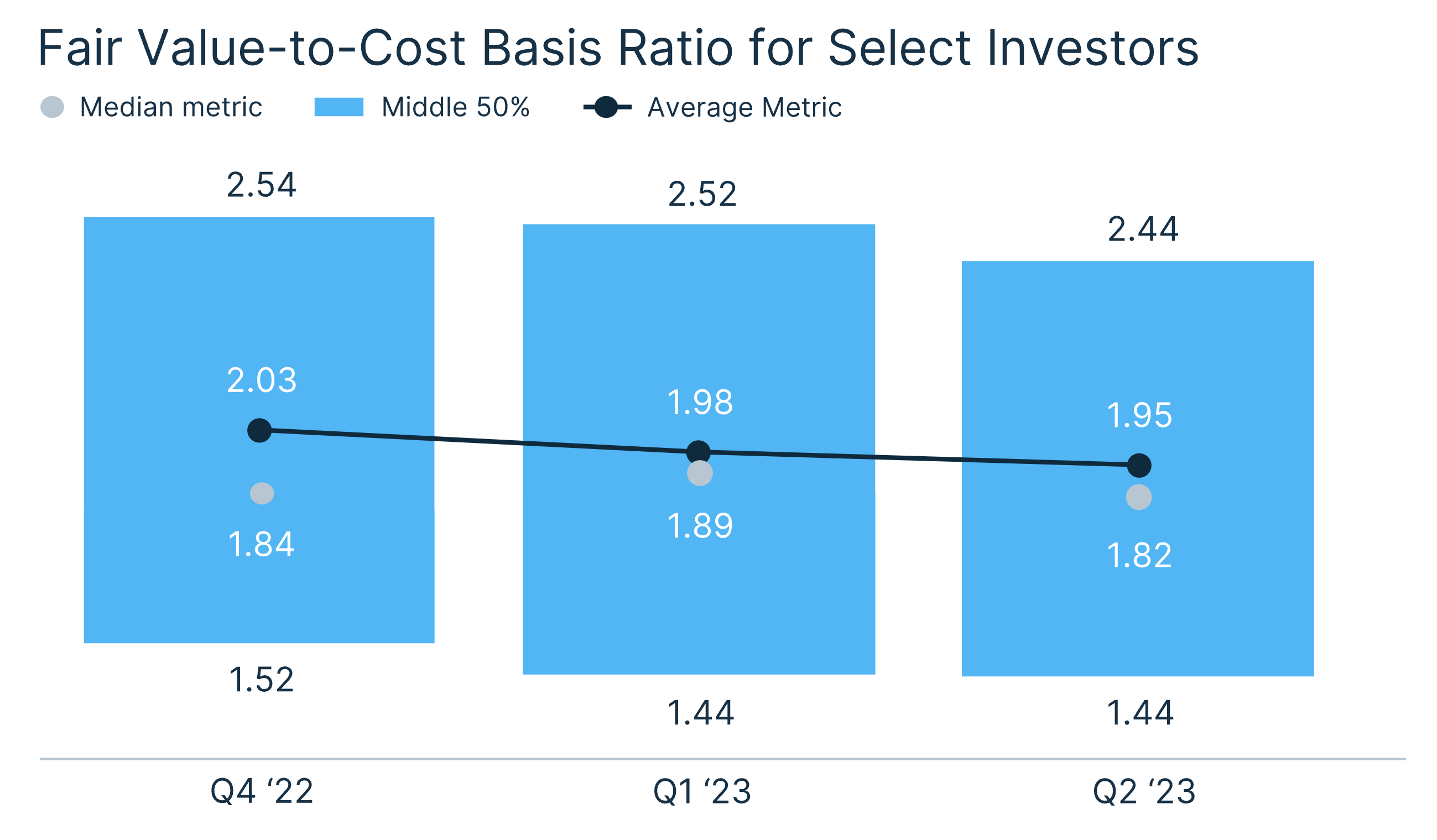

Valuations come down.

Many venture capital funds have marked down the fair value of their portfolios this year.