If you’re considering changing your legal domicile from one state to another, the checklist below can help illustrate the various factors involved. As you weigh your options, please note that the criteria for legal domicile can vary significantly from state to state.

Since California has some of the most stringent residency stipulations in the U.S., the information below is derived primarily from California state law. As you consider your options, it’s important to consult with tax professionals during the decision-making process.

Properly defining your residency

The underlying theory of residency in each state is that you are a resident of the place where you have the closest connections. With this in mind, you should begin by comparing your ties in your state with your ties elsewhere.

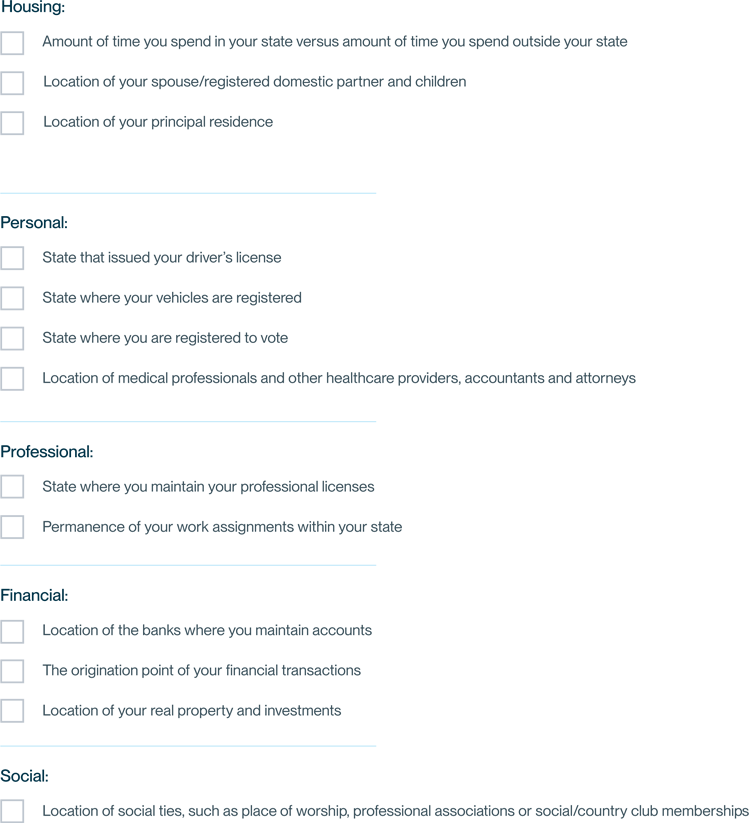

When using these criteria, it is the strength of your ties, not just the number of ties that ultimately determines your residency. The list below catalogs many of the pertinent factors. However, it’s important to understand that no single factor is determinative. Consider all the facts of your situation to properly determine your residency status.

Factors involved when moving your primary residence to a tax-advantaged state

As we have discussed in a companion tax law article, there are several criteria to consider when moving from one to state to another. To help you get started, here are the common factors involved when changing your domicile:

State tax law in practice

To offer a more practical view of state tax implications on residency, two examples from the State of California Franchise Tax Board Guidelines are illustrated below.

Example – You are a medical device company founder and reside in New York with your family. Several times a year you travel to other states for business. Your average stay is one or two weeks and the entire time spent in California for any taxable year does not exceed six weeks. Your family usually remains in New York when you are traveling for business purposes.

Determination: Under these circumstances, you are not a California resident because your stays in California are temporary or transitory in nature. As a nonresident, you are taxed only on your income from California sources, including your income for services performed in California.

Example – In December 2019, you moved to California on an indefinite job assignment. You rented an apartment in California and continued to live in the apartment. You retained your home and bank account in Illinois until April 2020, at which time you sold your home and transferred your bank account to California.

Determination: Your assignment in California was for an indefinite period; therefore, your stay in California was not of a temporary or transitory nature. Although you kept ties in Illinois until April 2020, you became a California resident upon entering the state in December 2019. As a California resident, you are taxed on your income from all sources.

The examples above are included to offer a pragmatic view of the laws that govern state residency status. Our team of advisors can help you develop a tax strategy that factors in your personal circumstances, financial goals and the latest legislation. We’ll ensure you’re aware of the critical financial considerations to factor in when deciding on your current and future living arrangements.

Plan a tax strategy with a team of experts at your side

Of course, planning and implementing a tax-efficient strategy will take time. Contact your SVB Private Advisor to get started. As your primary contact, your Advisor can help guide and connect you with the additional professionals needed. We recommend that you seek counsel from your tax and estate plan professionals, to partner with us to design the very best wealth strategy for you and your family.

Source: State of California Franchise Tax Board Guidelines for Determining Resident Status, FTB Publication 1031.