2018 Startup Outlook

China Report

Chinese startups are buoyed by growing tech ecosystem

The outlook for the tech sector is strong, with a large number of startups saying they expect more M&A opportunities. Access to talent and raising capital remain challenging. Compared to the US and UK, a higher percentage of Chinese startups have women in senior company roles and at least one woman on the founding team.

Jump to Business Conditions | Funding | Hiring & Talent | Public Policy

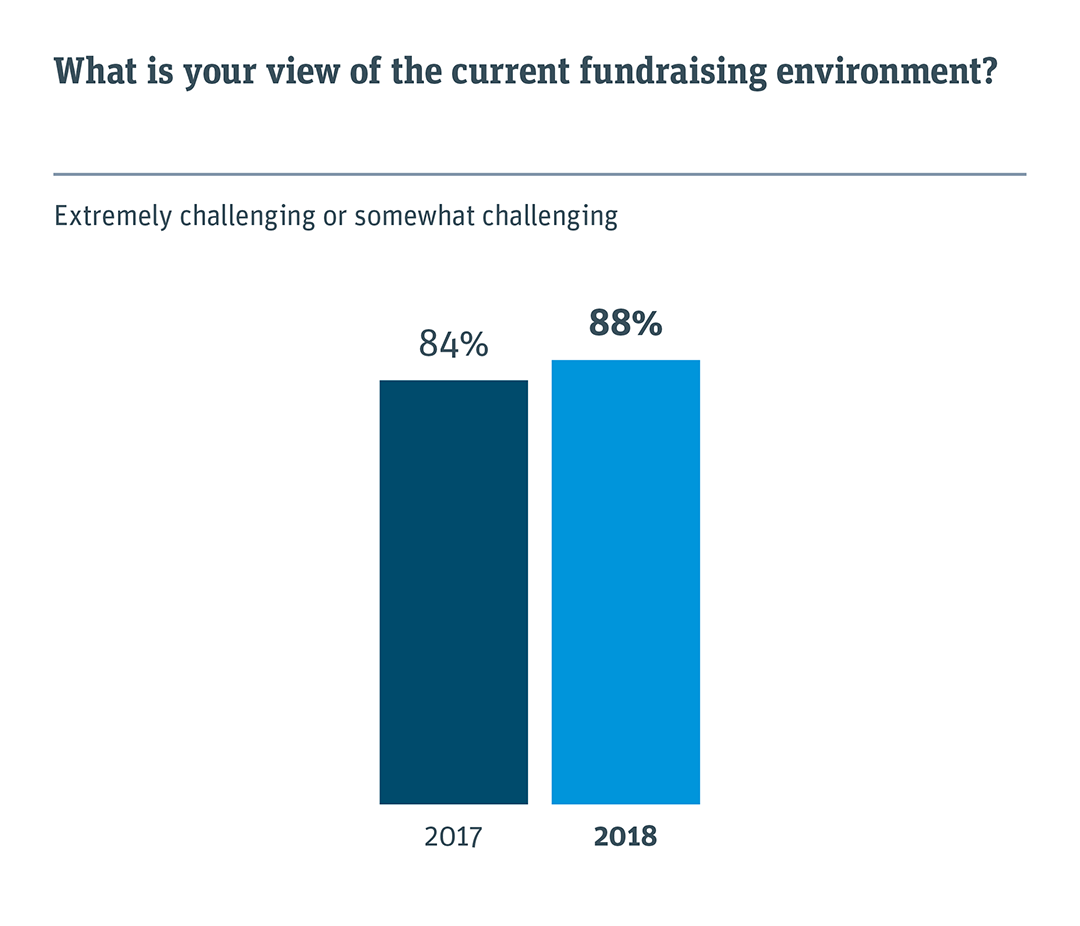

Fundraising remains difficult

More Chinese startups (88 percent) say the fundraising environment is extremely challenging or somewhat challenging compared with peers in the US and the UK.

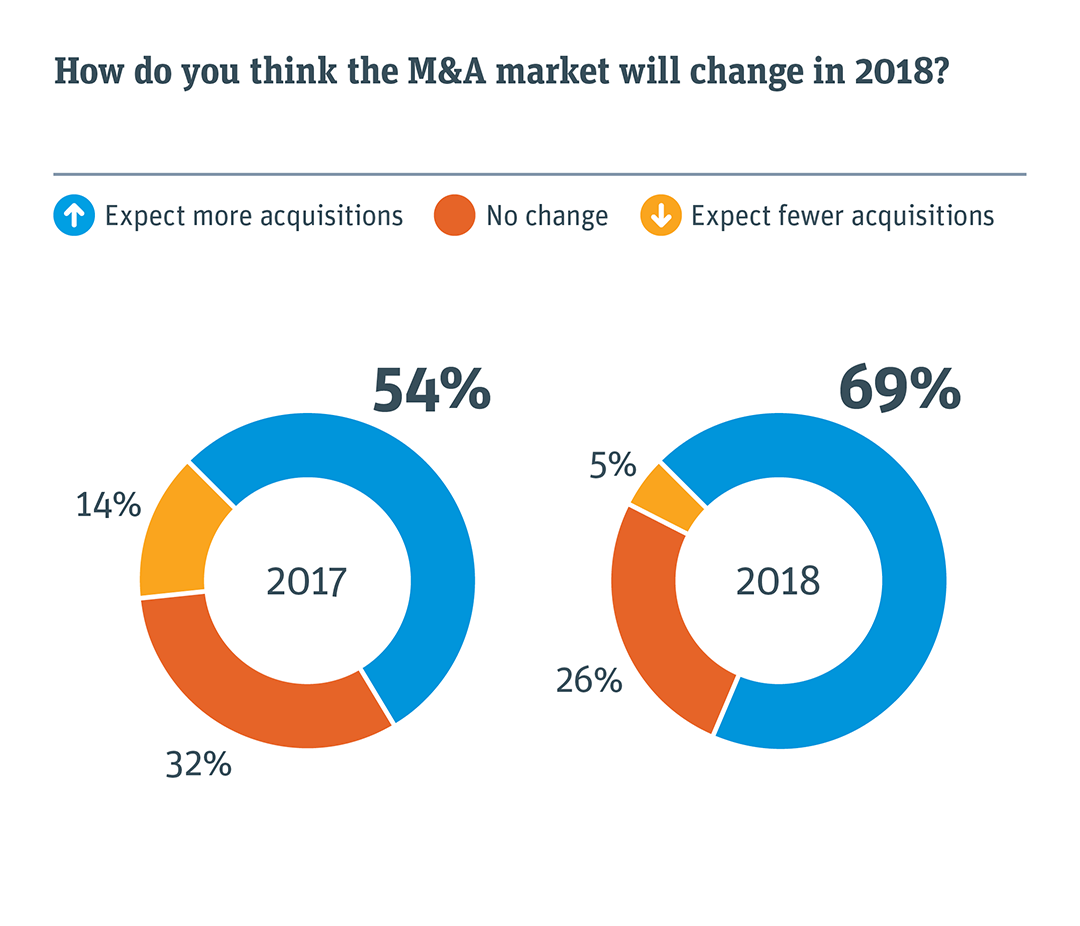

Most startups say M&A will increase

More than two-thirds (69 percent) of Chinese startups believe that acquisitions will increase in 2018. The percentage is up significantly from a year ago. In September 2017, the China Securities Regulatory Commission (CSRC) revised rules to encourage more domestic M&A activity, and large, successful tech companies such as Tencent and Alibaba are making acquisitions. Additionally, large companies themselves have merged to dominate certain sectors.

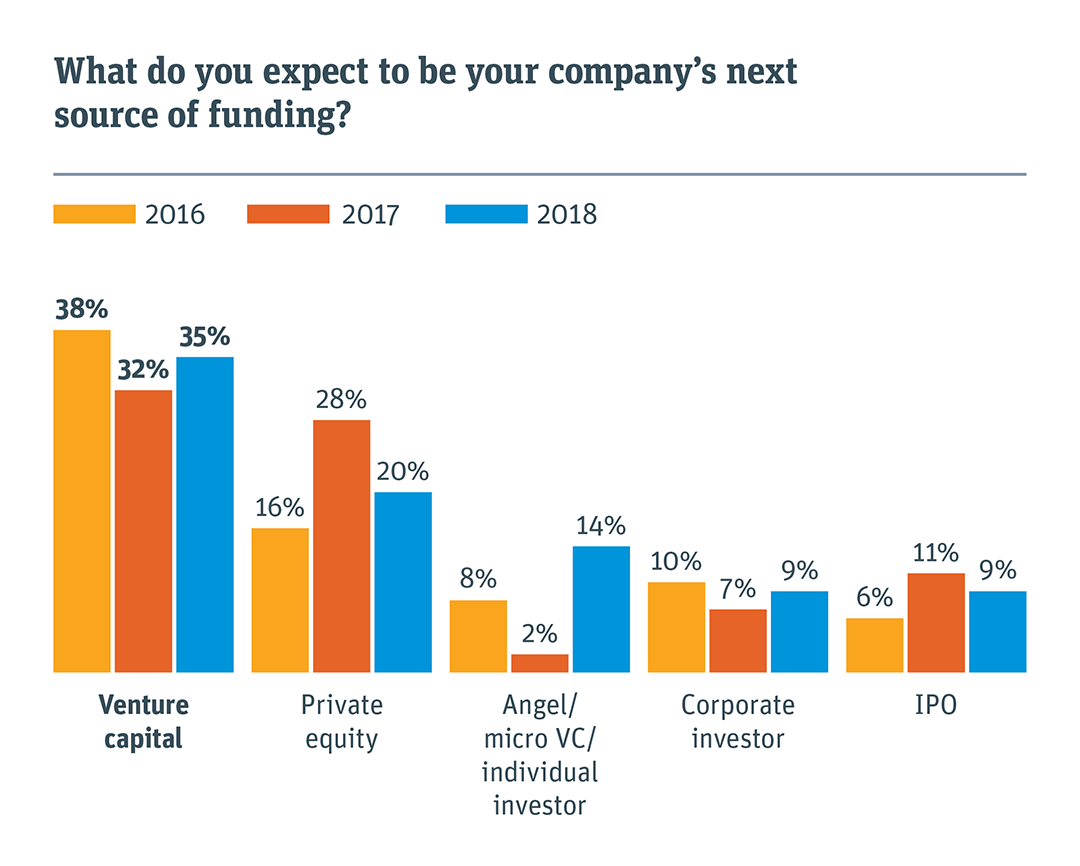

VC and private equity are top sources of capital

Looking ahead, 55 percent of Chinese startups expect their next source of funding to come from either venture capital or private equity. Those saying angel/micro VC/individual sources increased substantially in the past year, from 2 percent to 14 percent, signaling that companies hope to raise money earlier in their life stage.

Note: Asked of private companies that successfully raised capital. Other sources of funding include bank debt, IPO, merger, government grants and crowd funding and represented 22% in 2016, 20% in 2017 and 13% in 2018.

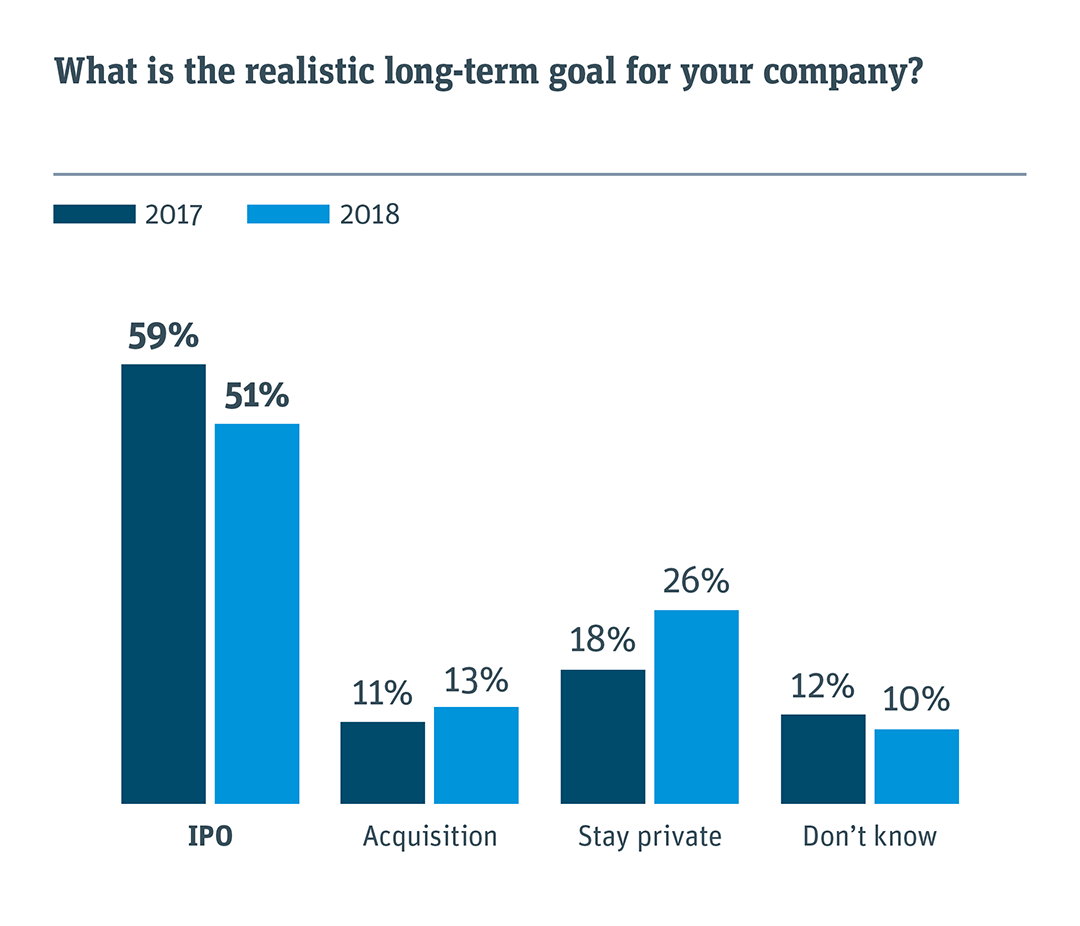

Fewer startups say IPO is their long-term goal

Although IPOs hit a record high in 2017, looking ahead fewer entrepreneurs expect to go public and more expect to stay private.

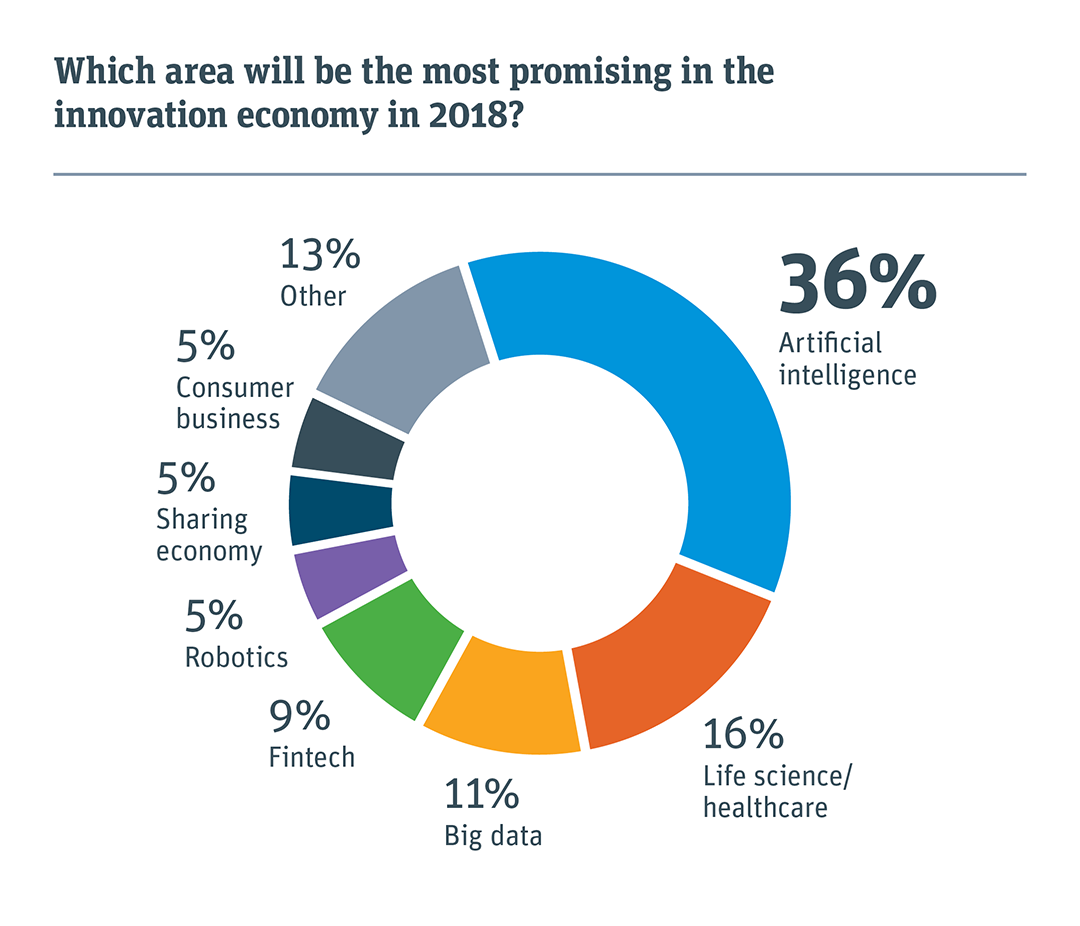

The most promising sector is AI

Artificial intelligence and life science/healthcare are the top two areas that Chinese entrepreneurs say have the most promise.

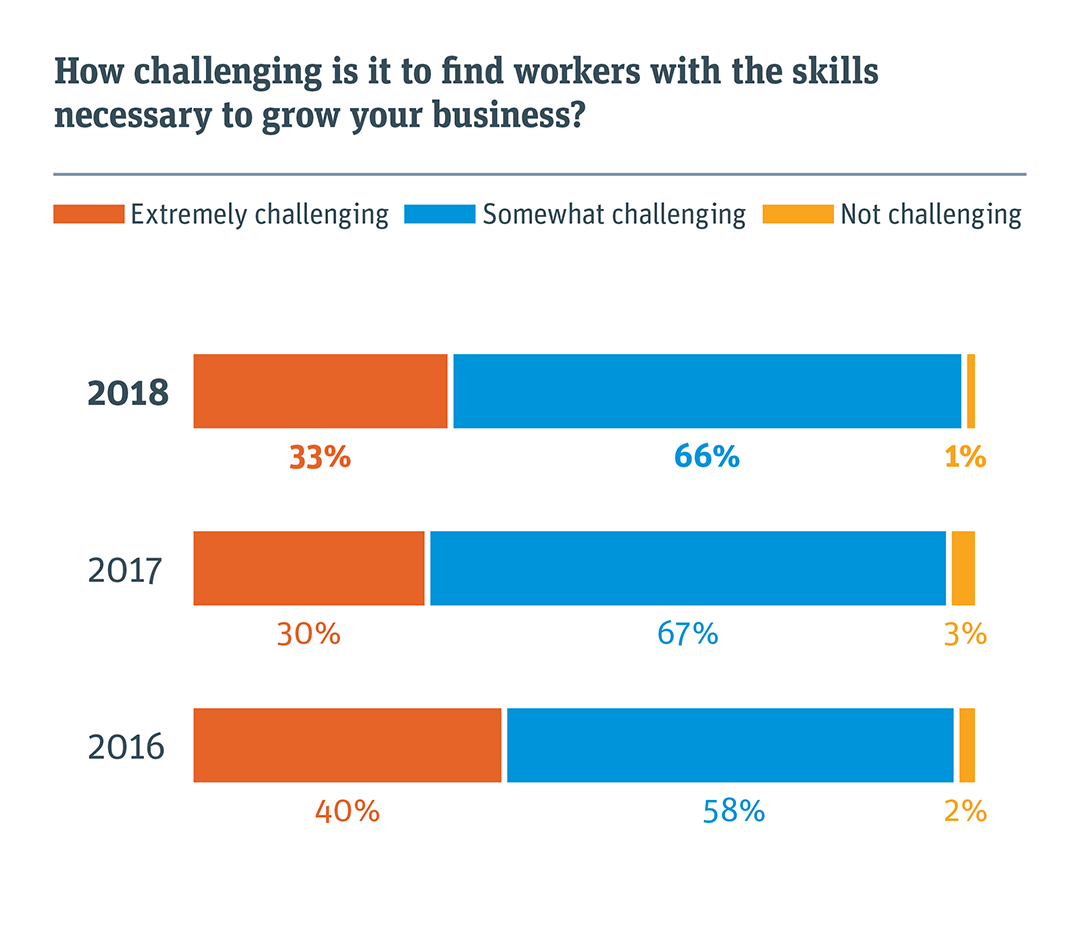

Finding tech talent is challenging

Reflecting China’s expanding tech ecosystem, Chinese startups, like their US and UK peers, say it is challenging to hire talent with the skills needed to grow their businesses.

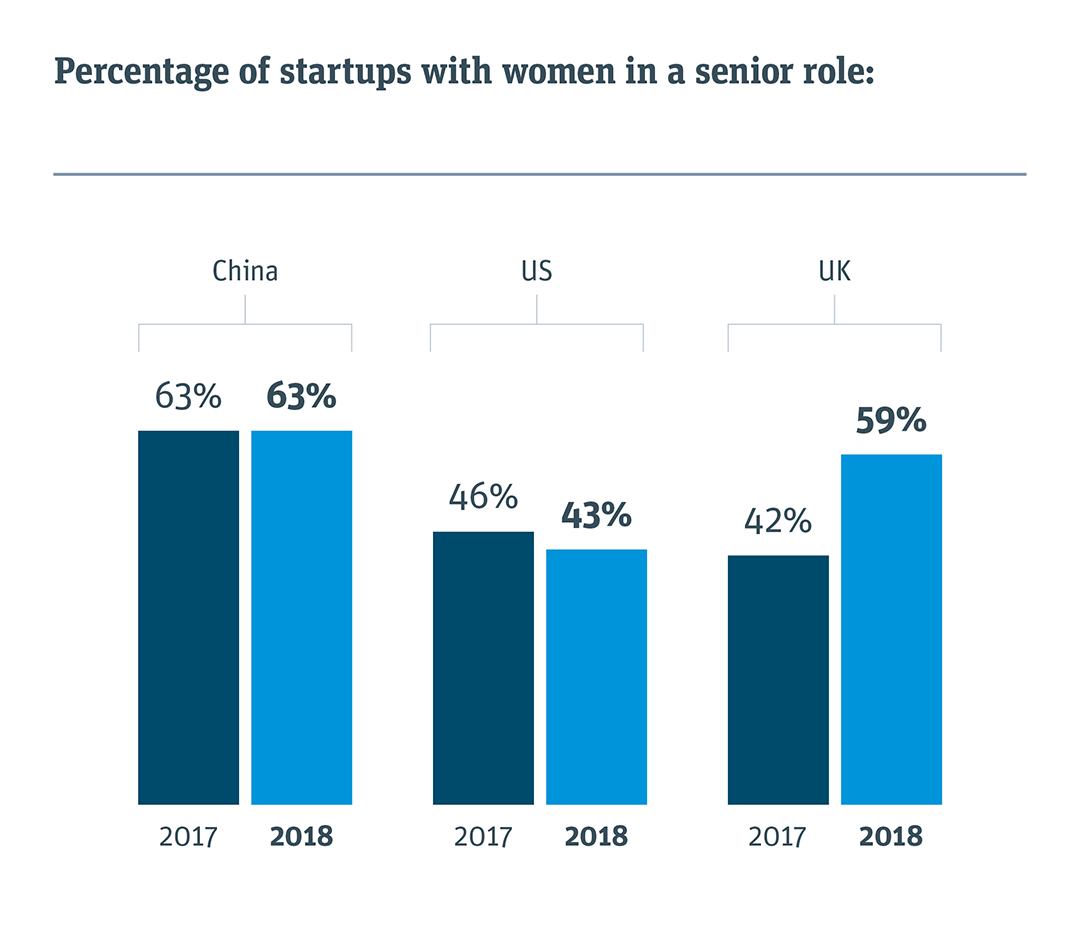

The majority of startups have women in leadership

About two-thirds of Chinese startups (63 percent) have at least one woman in a senior role, a considerably higher percentage than in the US. Half of Chinese startups say they have programs in place to increase the number of women in leadership roles.

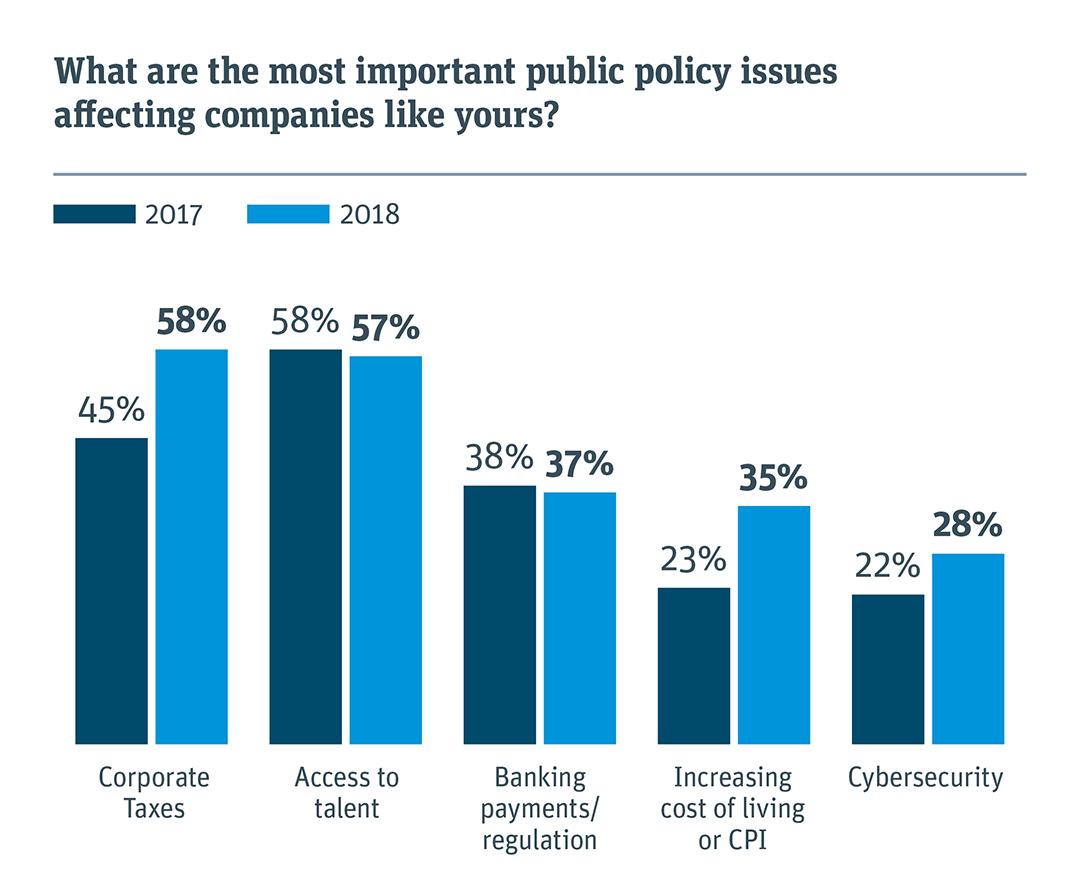

Taxes and access to talent are top policy concerns

Corporate taxes and access to talent are the top two public policy issues that Chinese startups say have the most impact on companies like theirs.

“Reducing corporate taxes would help R&D-intensive companies spend less on operations and focus more on research and development.”

—Biotechnology executive, China

Note: Respondents could choose up to three responses.

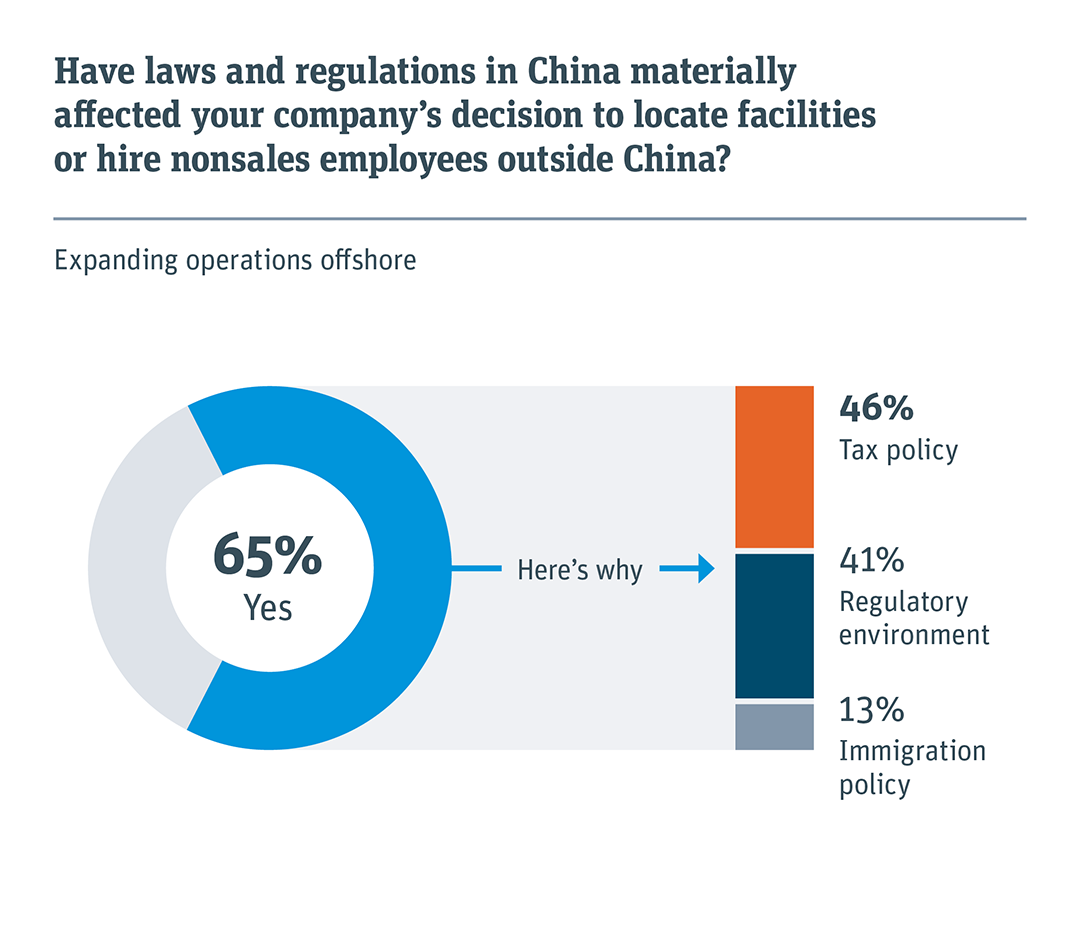

Startups plan to expand offshore

Seeking to expand their opportunities and access to resources, two in three Chinese startups say they are locating nonsales jobs and operations outside China. In part, local laws and regulations have affected these decisions. Respondents cite tax policy and the regulatory environment as leading factors.

“We need more flexible tax policies to reduce operations costs and simplify the process for technology, media and telecom (TMT) companies like us.”

—TMT executive, Beijing

COMPID-1146