- Asset-backed commercial paper (ABCP) is an intriguing, fixed income niche that, under the right circumstances, may merit inclusion in a diversified short-duration portfolio.

- As with other nuanced collateralized securities, the risks must be closely examined. But ABCP has evolved with many safeguards, including credit enhancement and liquidity features.

- Under the right circumstances, ABCP has the potential to enhance yields while at the same time, reduce overall portfolio risk.

Also included are the following themes:

- Credit Vista: Spicing up short-term portfolios with ABCP

- Trading Vista: Staring at the ceiling

Economic Vista: Going deep on ABCP

Rohan Ashar, Former Portfolio Manager

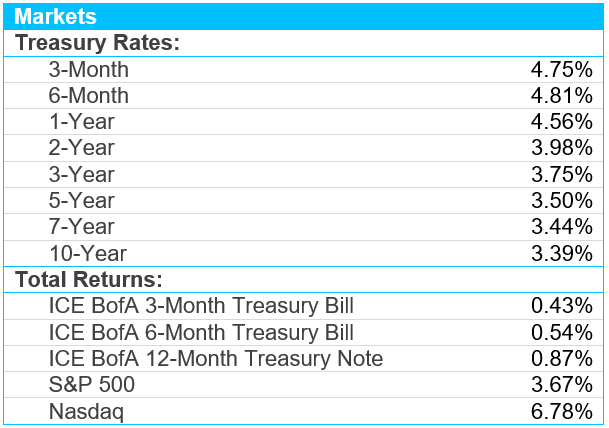

For more than a year now, the Federal Reserve has been aggressively raising rates in its fight against inflation, so it’s no surprise that corresponding yields have been trending higher across the spectrum of fixed income products. Still, every basis point counts, and it’s always worth exploring ways to enhance yields. We think that asset-backed commercial paper (ABCP), which is a short-term debt product collateralized by a package of loans, could be a prudent investment type in a portfolio for boosting yield while managing—even mitigating—overall portfolio risk.

Too good to be true? Maybe not. Take a deeper look into why we like ABCP in the current environment.

Structure & Collateral

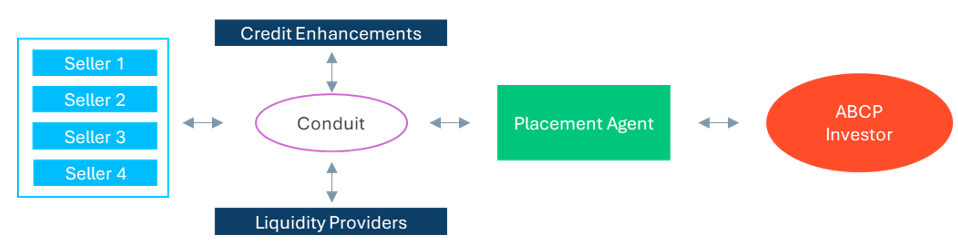

Asset-backed commercial paper (ABCP) is a bankruptcy-remote special purpose vehicle (SPV) or conduit with typical maturities of 397 days or less. Banks or financial institutions sponsor these programs backed by collateral. As ever, it’s imperative to understand the structure and collateral associated with these short-term money market instruments.

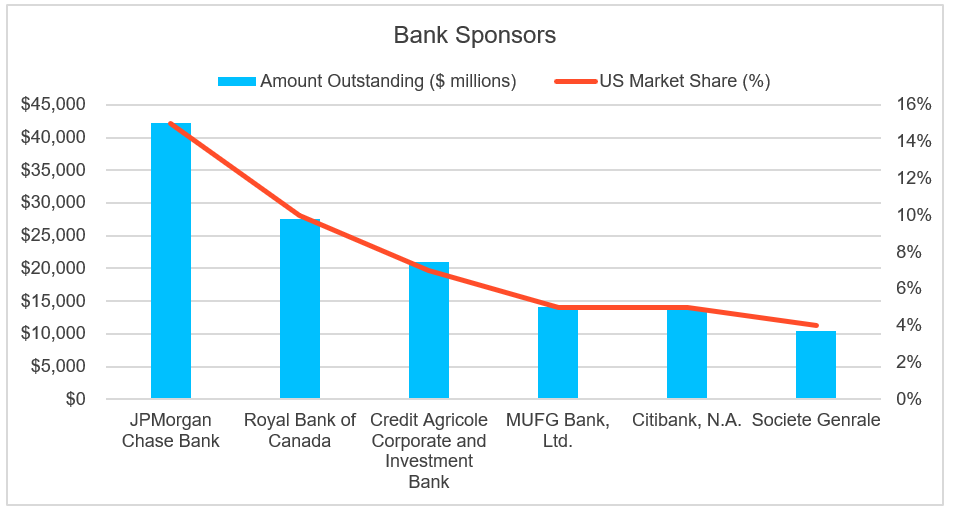

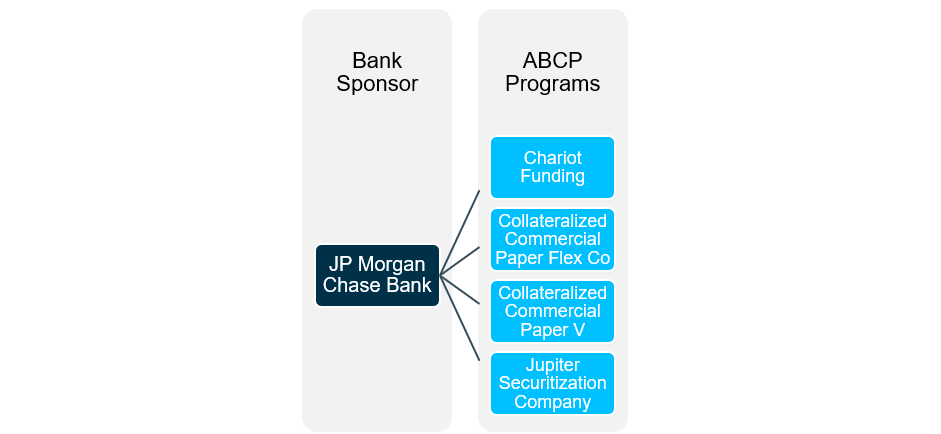

Firstly, an SPV is a legally separate entity established by a sponsor to isolate financial and credit risk. The sponsor securitizes assets into a distinct entity (program) and is maintained off the balance sheet. In the event of a sponsor’s bankruptcy, the ABCP is legally secured, and vice versa. It is pivotal to note that a sponsor may provide credit enhancements if an ABCP faces difficulty. Thus, the strength of the sponsor must be considered when purchasing these securities. JP Morgan is one of the largest sponsors with $42 billion outstanding through four different ABCP programs, which account for 15% of the U.S. ABCP market. While the sponsor controls the credit and collateral, the administrator manages the day-to-day operation.

Source: Moody’s. Data as of 6/30/2022.

Source: Bloomberg and SVB Asset Management.

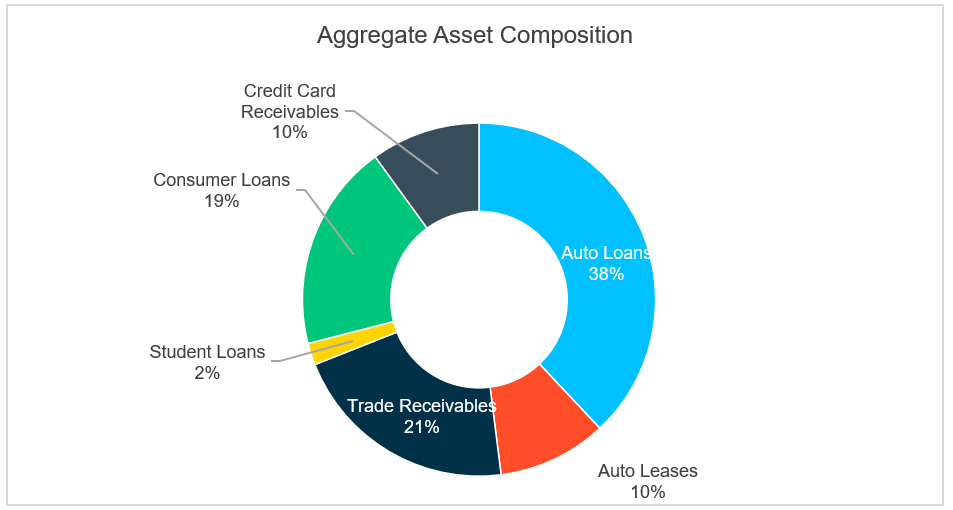

ABCP plays an important role in financing businesses and even consumers. The collateral for ABCP usually consists of expected future payments or receivables (i.e., trade receivables, auto loans, credit card debt, student loans). Well capitalized financial institutions (sponsors) securitize these assets with an objective to lend high-quality assets. This provides investors, who purchase through broker-dealers' counterparties, an attractive cost of funds and elevated liquidity. When analyzing asset composition of aggregate ABCP programs, auto loans, trade receivables, and consumer loans comprise 78% of the assets. Since these programs are collateralized by a variety of assets, they are referred to as “multi-seller programs”. Source: Moody’s. Data as of 12/31/2022.

Source: Moody’s. Data as of 12/31/2022.Risk Analysis

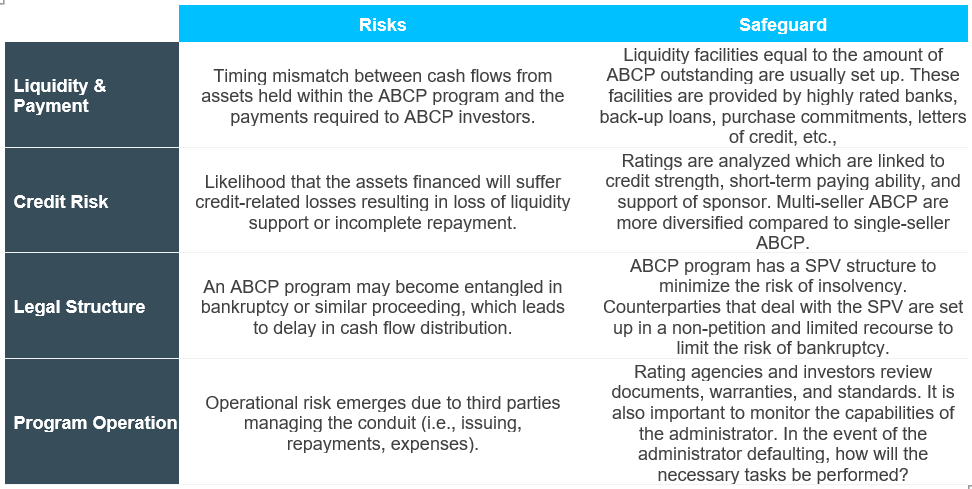

Like other collateralized securities, risks must be examined. That said, it’s important to understand that ABCP has evolved with many safeguards now in place that help mitigate risk, including credit enhancements and liquidity features. These are intended to protect principal.

Credit enhancements: A sponsor or administrator may provide a multitude of credit enhancement features to make the investment more attractive. For example, overcollateralization of the underlying assets and third-party credit support (i.e., LOC, guarantee) are established. Generally, overcollateralization is defined as having excess assets held over the ABCP program’s face value. Rating agencies evaluate these enhancements, which ultimately impact the program’s credit rating. These features help protect investors from obligor default risk, servicer risk, and receivables dilution risk.

Liquidity providers: Liquidity risk is defined as the sponsor’s inability to refinance a maturity or inability to produce the cash flows required for a maturing note. This likely occurs when there is a mismatch between liability and asset cash flows. A facility is provided by the sponsor bank and can come in many forms. For example, a liquidity loan agreement (LLA) enables the ABCP to borrow without reducing assets, which allows for flexibility in volatile markets.

Source: SVB Asset Management. For illustrative purposes only.

Source: SVB Asset Management. For illustrative purposes only.The table below summarizes the high-level risks and safeguards involved with investing in ABCP.

Source: SVB Asset Management

Source: SVB Asset ManagementA Burgeoning Opportunity

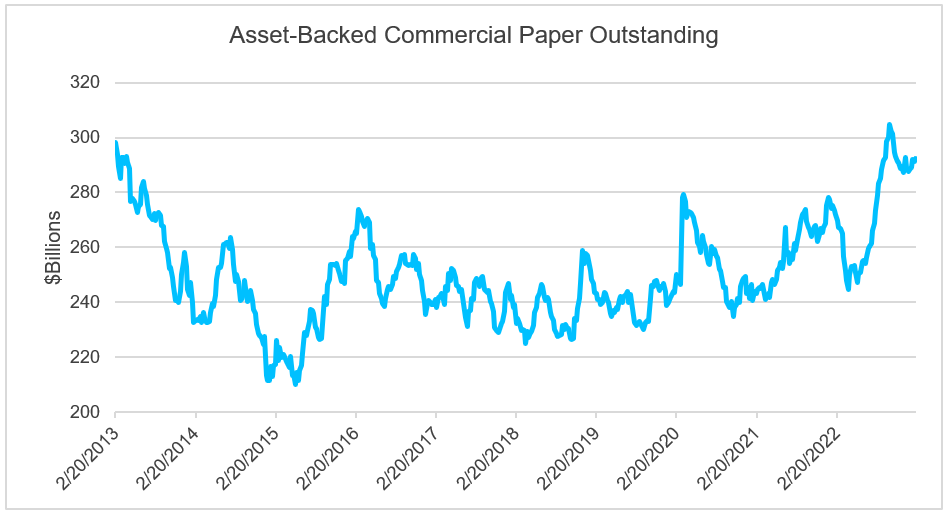

ABCP is a large segment of the overall short-term debt market. In fact, ABCP accounts for about 25% of the total commercial paper outstanding, and at the end of 2022, ABCP had $292 billion outstanding. Since 2021, nine new programs have launched and have met with robust investor demand. Demand has remained elevated due to supply constraints in the broader short-term CP market. Today, we see ABCP as a favorable alternative to unsecured CP, which has seen a 35% decline in issuance since the 2020 peak.

Source: https://fred.stlouisfed.org/series/ABCOMP

Source: https://fred.stlouisfed.org/series/ABCOMPABCP Advantages

Given the robust market and ample safeguards associated with many of these investments, we believe that ABCP has the potential to enhance portfolio yields while simultaneously reducing overall portfolio risk. Consider these three advantages:

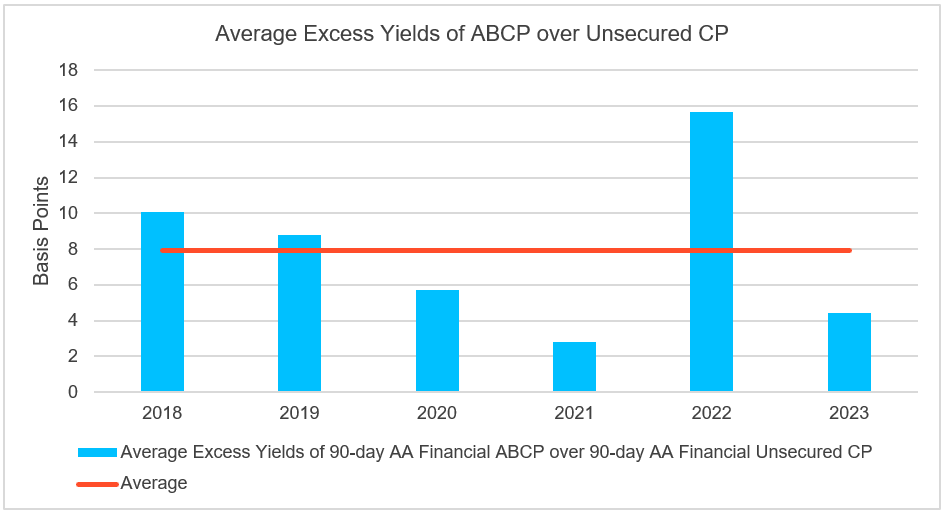

Attractive Yields: ABCP is far more intricate than unsecured commercial paper, but due to its complexity and research requirements, investors are usually compensated two to 15 basis points (bps) or an average of eight bps (2018-2023) over unsecured top-tier financial commercial paper. As the below figure highlights, these spreads were dramatically elevated in 2022 for a variety of reasons. One major driver of elevated spreads was that prime funds were the main buyers of ABCP. Prime funds were kept short due to an active federal reserve, which often avoided longer dated commercial paper. This resulted in higher spreads to entice investors.

Source: St. Louis Fed Economic data. Updated 03/03/2023. https://fred.stlouisfed.org/series/RIFSPPFAAD90NB and https://fred.stlouisfed.org/series/RIFSPPAAAD90NB

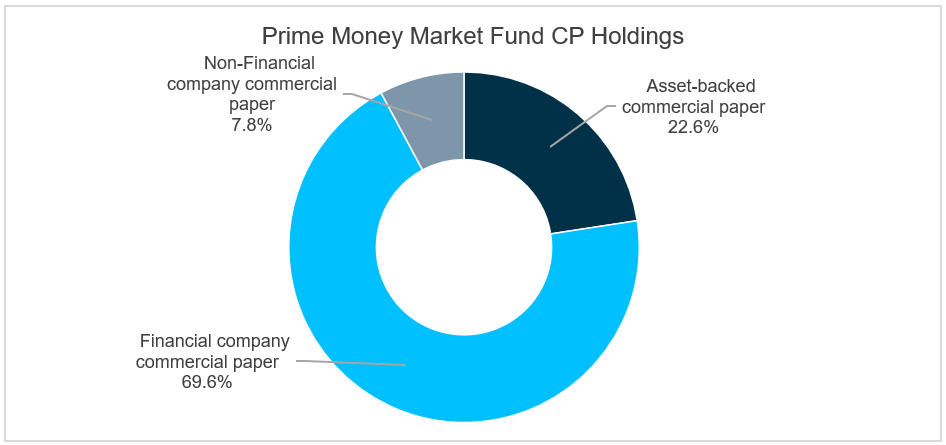

Source: St. Louis Fed Economic data. Updated 03/03/2023. https://fred.stlouisfed.org/series/RIFSPPFAAD90NB and https://fred.stlouisfed.org/series/RIFSPPAAAD90NBAmple Liquidity: The great financial crisis in 2008-2009 has led many investors to scrutinize—even shun—asset backed securities. However, strong regulatory framework and healthy balance sheets have enabled ABCP to remain stable, and ABCP remains prevalent in many short duration portfolios and prime money market funds. As of the end of January 2023, 23% of CP holdings were ABCP in prime money market funds. The strong investor demand illustrates the ample liquidity.

Source: ICI Money Market Fund Portfolio Data https://www.ici.org/research/stats/mmfsummary, Table 7. Data as of 1/31/2023.

Source: ICI Money Market Fund Portfolio Data https://www.ici.org/research/stats/mmfsummary, Table 7. Data as of 1/31/2023.Diversification: Including ABCP in a portfolio may boost diversification benefits. Consider how utilizing multi-seller ABCP programs reduces single issuer concentration. For example, purchasing JP Morgan-issued unsecured commercial paper would expose a portfolio to the credit worthiness of JP Morgan itself. However, purchasing Chariot Funding LLC sponsored by JP Morgan reduces issuer specific credit risk as the ABCP is secured with various loans, receivables, etc. This limits JP Morgan exposure but adds a layer of protection because of JP Morgan’s support.

The Verdict

With vigorous credit analysis and risk mitigation measures, we believe that ABCP may offer enhanced yield potential, liquidity, diversification, and flexibly in short-duration fixed income portfolios. At first, these securities may be intimidating and complex; however, with diligent asset selection, cash managers can build more holistic portfolios. With improved regulatory measures and a proven track record using these effective safeguards, investors may see for themselves that the mechanism of ABCP is investor friendly.

Credit Vista: Spicing up short-term portfolios with ABCP

Timothy Lee, CFA, Senior Credit Analyst

Some savvy short-term fixed income investors may have found some secret sauce. Asset-backed commercial paper, commonly referred to as ABCP, has the potential to spice up a portfolio without unnecessarily ratcheting up the risk profile. In fact, when compared to its unsecured counterpart, commercial paper, ABCP not only offers attractive yields, but also the security of being backed by dedicated collateral. ABCP looks like a sweet deal in the current environment.

Many major global financial institutions issue two types of commercial paper to investors: commercial paper and ABCP. The difference? General commercial paper (CP) is also known as “unsecured commercial paper,” meaning there is no specific collateral assigned to the debt. Repayment is dependent on the general credit of the issuer. In the case of a default, investors in unsecured commercial paper would become unsecured creditors if the issuer were to become bankrupt. That adds a bit of risk into the equation.

Comparatively, ABCP is a commercial paper that is assigned specific collateral to back the debt. Repayment is also dependent on the general credit of the sponsor. When an ABCP program is fully supported, in addition to the collateral provided, the principal amount of the debt is 100% guaranteed by the sponsor. For an ABCP program that is partially supported, investors will have a portion of the principal guaranteed by the sponsor, but (generally speaking) it will be assigned collateral that is in excess of the principal amount in a form of credit enhancement known as “overcollateralization.” In case of a default, ABCP investors will have a pool of assets to claim for recovery, in addition to an unsecured claim from the guarantee provided by the sponsor. This offers ABCP a distinct advantage over unsecured commercial paper investors, who will not have specific claims to such assets in the effect of a default.

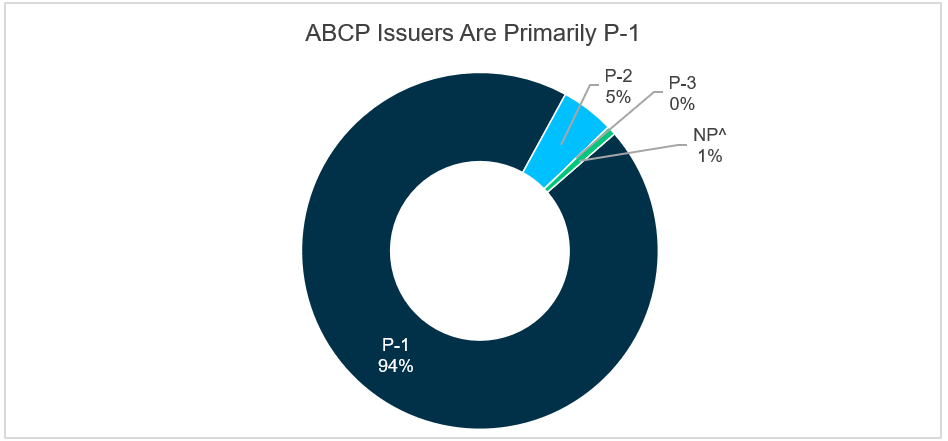

The secured nature of ABCP means the vast majority of issuance receives the highest short-term rating from rating agencies. As of September 30, 2022, 94% of active ABCP issuers globally rated by Moody’s carried the P-1 rating (i.e., they were deemed the safest), while 5% carried the mid-prime rating of P-2. Only 1% of ABCP issuers were rated not-prime.

^Not Prime.

Source: Moody’s Investor Service. As of 9/30/2022.

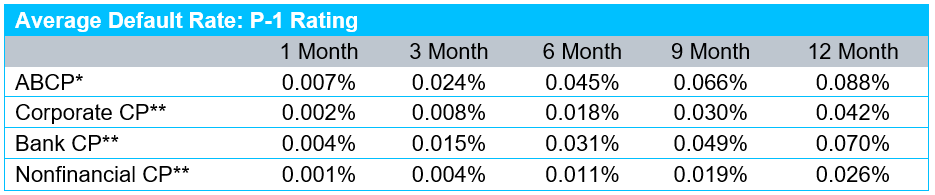

Historical data reveals default incident rates for corporate commercial paper and ABCP are both low and not materially different. According to Moody’s data, at the P-1 rating level and over a 6-month period, corporate commercial paper has a default probability of 0.018%, while ABCP has a default probability of 0.045%. Bank-issued commercial paper has a default probability of 0.015%. The difference in default probabilities does not diverge meaningfully out to nine or 12 months, with default probabilities across both ABCP and corporate CP below 0.1%.

Source: Moody’s Investor Service.

*For the period 1983-2021. Data as of March 23, 2022.

**For the period 1972-2017H1. Data as of April 23, 2018.

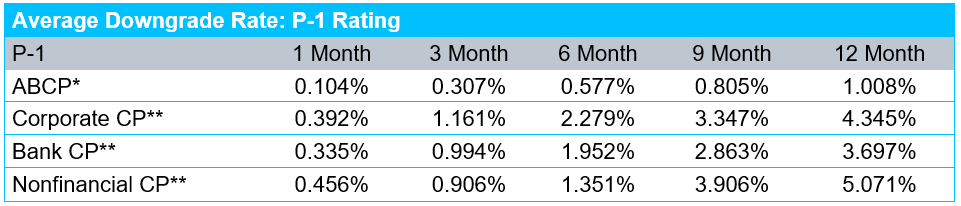

While default probabilities are similar between commercial paper and ABCP, the latter is significantly more stable. The probability of a P-1 issuer being downgraded over a six-month period is much lower for ABCP at 0.57%, versus 2.28% for all corporate CP and 1.61% for bank issuer CP. The difference becomes slightly more material out to nine and 12 months, with the downgrade probability for ABCP over a 9-month period standing at 0.81% versus 3.35% for corporate CP and 2.86% for bank issuer CP. A downgrade probability for CP issued by a nonfinancial company is nearly five times higher than ABCP at 3.91%.

Source: Moody’s Investor Service and SVB Asset Management. Excludes withdrawn ratings.

*For the period 1983-2021. Data as of March 23, 2022.

**For the period 1972-2017H1. Data as of April 23, 2018.

So, what’s the key takeaway? ABCP offers a similar default risk profile to unsecured commercial paper, yet it offers investors more stability and a meaningful advantage with dedicated collateral in the unlikely case there is a default. Interestingly, the benefits of receiving more stability and a better chance of principal recovery in a default scenario when compared with unsecured commercial paper does not come with a hefty price. In fact, savvy investors have observed that ABCP has provided better yield in recent years than their unsecured counterpart (see chart “Average Excess Yields of ABCP over Unsecured CP” in Economic Vista). Thus, in the current environment, we see ABCP as a key ingredient in a variety of short-term, fixed income strategies.

Trading Vista: Staring at the ceiling¹

Hiroshi Ikemoto, Senior Fixed Income Trader

Investors continue trying to sort out whether the Federal Reserve will need to keep rates higher for longer, or if weakening economic conditions will lead to another pivot. And now to complicate matters, they’re starting to stare at the ceiling—the debt ceiling, that is. Yields on three to six-month Treasuries continue to rise as the next debt ceiling deadline approaches and an ultimate resolution remains unclear. Some analysts are projecting that the U.S. Treasury will deplete its borrowing authority by the end of June, while the bill curve is currently at its cheapest in the July/August maturities. This uncertainty, along with the general banking turmoil of this spring, has prompted many investors and depositors to seek assets that may not be as vulnerable to a potential U.S. government default. The three biggest benefactors of this shift have been money market mutual funds (MMMFs), agency debt, and the Fed’s reverse repo facility (RRP).

The two highest-liquidity options for investors are MMMFs and the Fed’s RRP. Both are yielding greater than 4.7% and still provide investors either immediate or overnight access to their cash. Demand for MMMFs, in particular, is booming. By the end of March, balances in MMMFs reached an all-time high of $5.5 trillion, an inflow of $400 billion for the month alone. Portfolio managers of these funds typically shy away from large positions in the most volatile points of the Treasury curve, instead placing a preference on liquidity and more strategic positioning. Separately, the Fed’s RRP remains comfortably above $2 trillion where balances have set a floor throughout this year. After peaking at yearend over $2.5 trillion, the most recent prints encompass more than $2.25 trillion across more than 100 counterparties.

For those investors that do want to invest into the curve and also maintain high relative portfolio credit quality, government-sponsored agency debt has become a larger allocation to portfolios. Generally, this government-sponsored agency debt trades in line with the Treasury market, although it traditionally yields a handful of basis points lower given the implicit government guarantee of the bonds. While these spreads can widen as their issuance fluctuates, spreads have been declining after peaking in March. And while issuance has been declining, the stalemate in Congress on a near-term resolution to the debt ceiling has sparked additional interest in the space. This jump in demand, coupled with a decreasing issuance slate, means that investors are now paying more for agencies than they do for Treasuries. Apparently, investors are deciding that a higher-yielding Treasury is just not worth the discount (i.e., the risk) in the short-term.

Brinkmanship is likely to take the negotiations down to the wire, which is why investors expect these dynamics to remain in the market over the short-term. With all this said, it’s important to remember that the U.S. has never defaulted on its debt. Analysts agree that the question is more about “when” Congress raises the debt ceiling and not “if.” Thus, while there will be headlines around these discussions, we do not believe that portfolio liquidity will be a concern.